Answered step by step

Verified Expert Solution

Question

1 Approved Answer

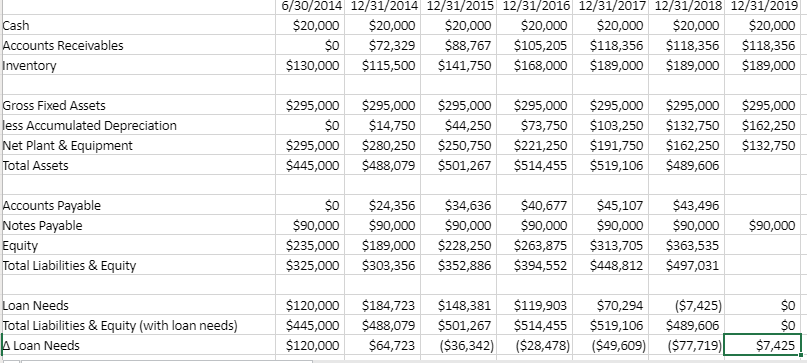

I need help filling out the last column. I am lost with the calculations because I am not getting the correct number for total assets

I need help filling out the last column. I am lost with the calculations because I am not getting the correct number for total assets when i try to see what formula was used to calculate it in the prior columns. I'm off by a few thousands. I also do not know how to calculate the accounts payable and equity.

Cash 6/30/2014 12/31/2014 12/31/2015 12/31/2016 12/31/2017 12/31/2018 12/31/2019 $20,000 $20,000 $20,000 $20,000 $20,000 $20,000 $20,000 $0 $72,329 $88,767 $105,205 $118,356 $118,356 $118,356 $130,000 $115,500 $141,750 $168,000 $189,000 $189,000 $189,000 Accounts Receivables Inventory Gross Fixed Assets less Accumulated Depreciation Net Plant & Equipment Total Assets $295,000 $0 $295,000 $445,000 $295,000 $14,750 $280,250 $488,079 $295,000 $44,250 $250,750 $501,267 $295,000 $73,750 $221,250 $514,455 $295,000 $103,250 $191,750 $519,106 $295,000 $132,750 $162,250 $489,606 $295,000 $162,250 $132,750 $90,000 Accounts Payable Notes Payable Equity Total Liabilities & Equity $0 $90,000 $235,000 $325,000 $24,356 $90,000 $189,000 $303,356 $34,636 $90,000 $228,250 $352,886 $40,677 $90,000 $263,875 $394,552 $45,107 $90,000 $313,705 $448,812 $43,496 $90,000 $363,535 $497,031 Loan Needs Total Liabilities & Equity (with loan needs) Loan Needs $120,000 $445,000 $120,000 $184,723 $488,079 $64,723 $148,381 $501,267 ($36,342) $119,903 $514,455 ($28,478) $70,294 $519,106 ($49,609) ($7,425) $489,606 ($77,719) SO $7,425 Cash 6/30/2014 12/31/2014 12/31/2015 12/31/2016 12/31/2017 12/31/2018 12/31/2019 $20,000 $20,000 $20,000 $20,000 $20,000 $20,000 $20,000 $0 $72,329 $88,767 $105,205 $118,356 $118,356 $118,356 $130,000 $115,500 $141,750 $168,000 $189,000 $189,000 $189,000 Accounts Receivables Inventory Gross Fixed Assets less Accumulated Depreciation Net Plant & Equipment Total Assets $295,000 $0 $295,000 $445,000 $295,000 $14,750 $280,250 $488,079 $295,000 $44,250 $250,750 $501,267 $295,000 $73,750 $221,250 $514,455 $295,000 $103,250 $191,750 $519,106 $295,000 $132,750 $162,250 $489,606 $295,000 $162,250 $132,750 $90,000 Accounts Payable Notes Payable Equity Total Liabilities & Equity $0 $90,000 $235,000 $325,000 $24,356 $90,000 $189,000 $303,356 $34,636 $90,000 $228,250 $352,886 $40,677 $90,000 $263,875 $394,552 $45,107 $90,000 $313,705 $448,812 $43,496 $90,000 $363,535 $497,031 Loan Needs Total Liabilities & Equity (with loan needs) Loan Needs $120,000 $445,000 $120,000 $184,723 $488,079 $64,723 $148,381 $501,267 ($36,342) $119,903 $514,455 ($28,478) $70,294 $519,106 ($49,609) ($7,425) $489,606 ($77,719) SO $7,425Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started