I need help filling these three part question?

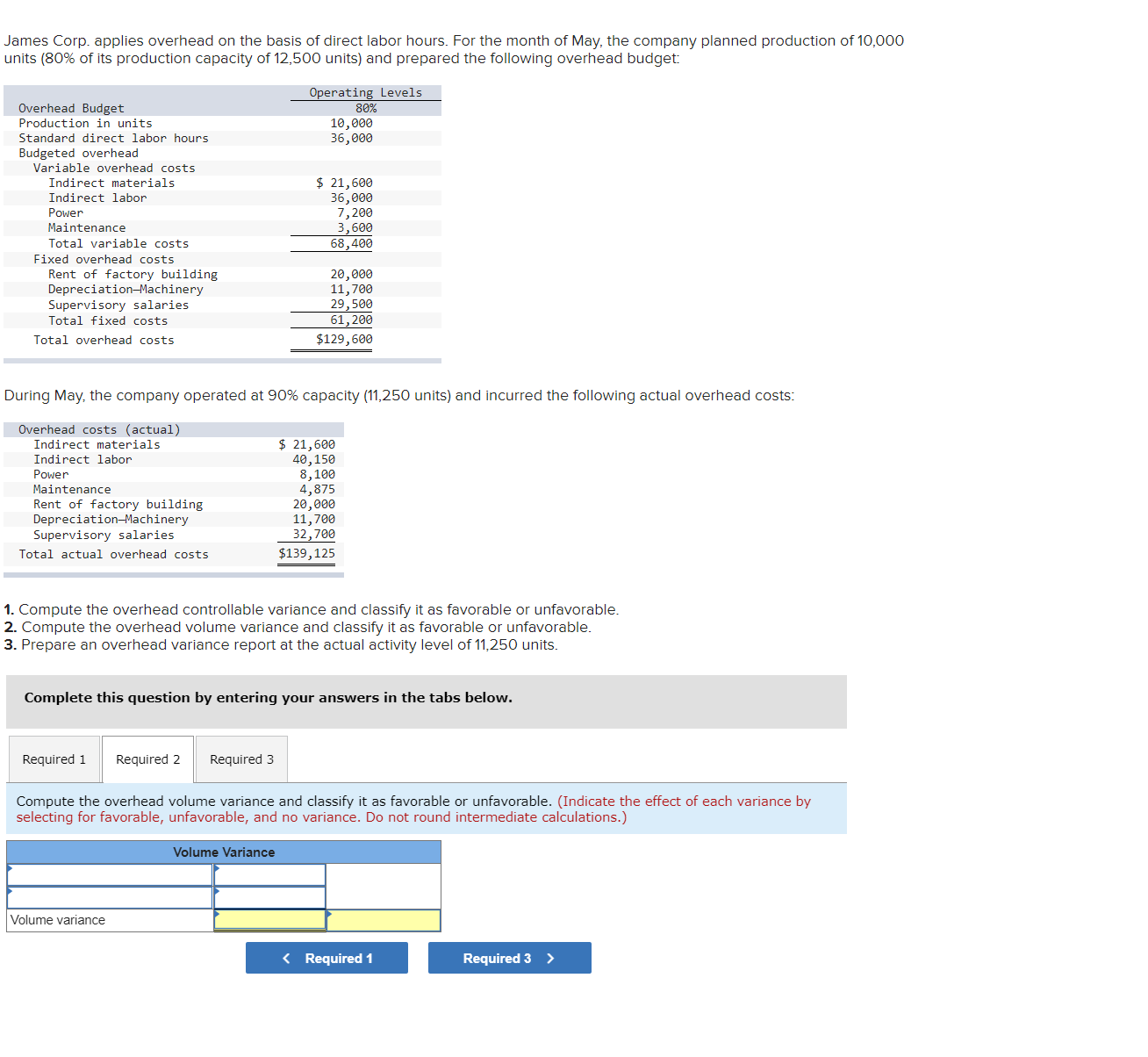

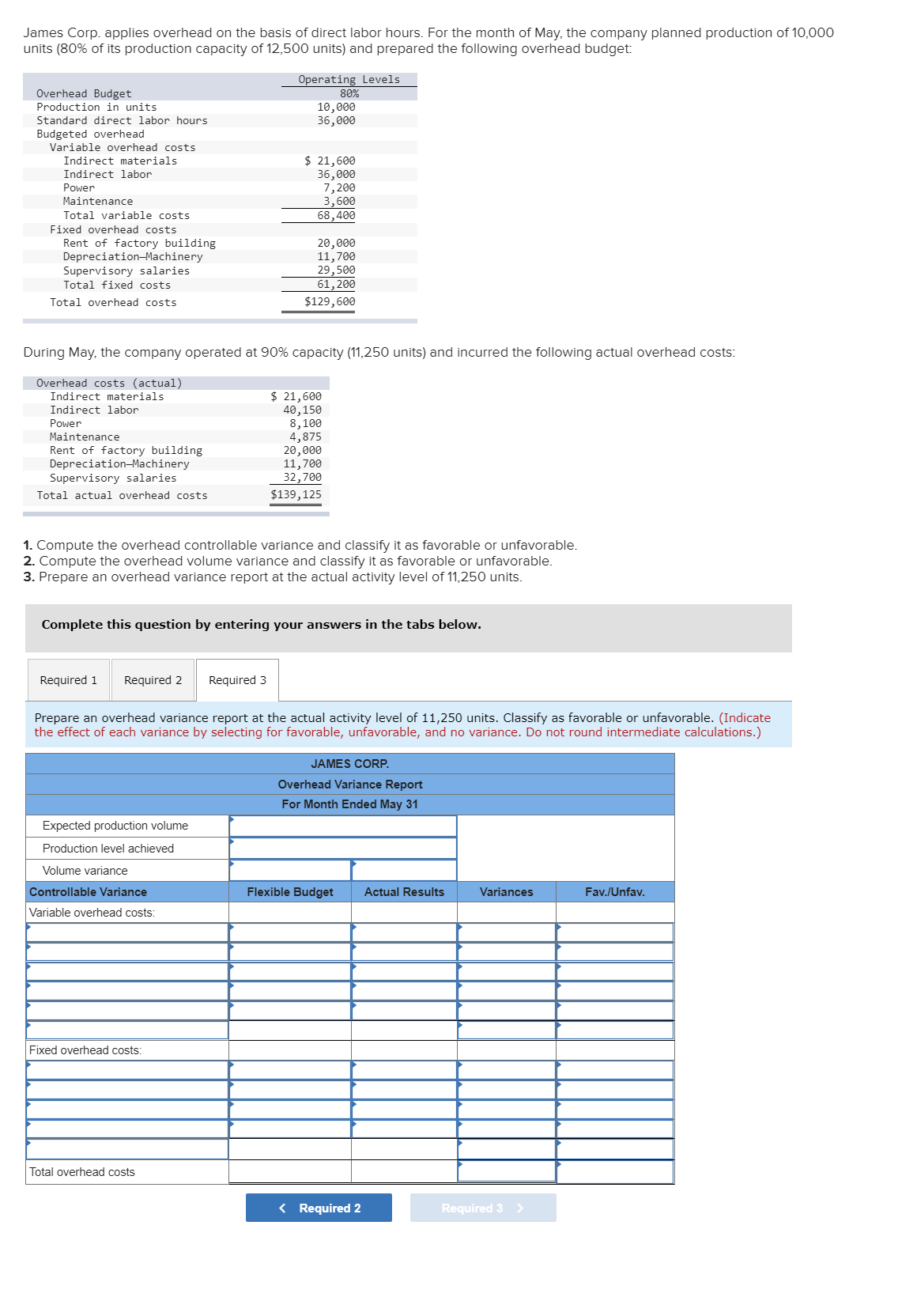

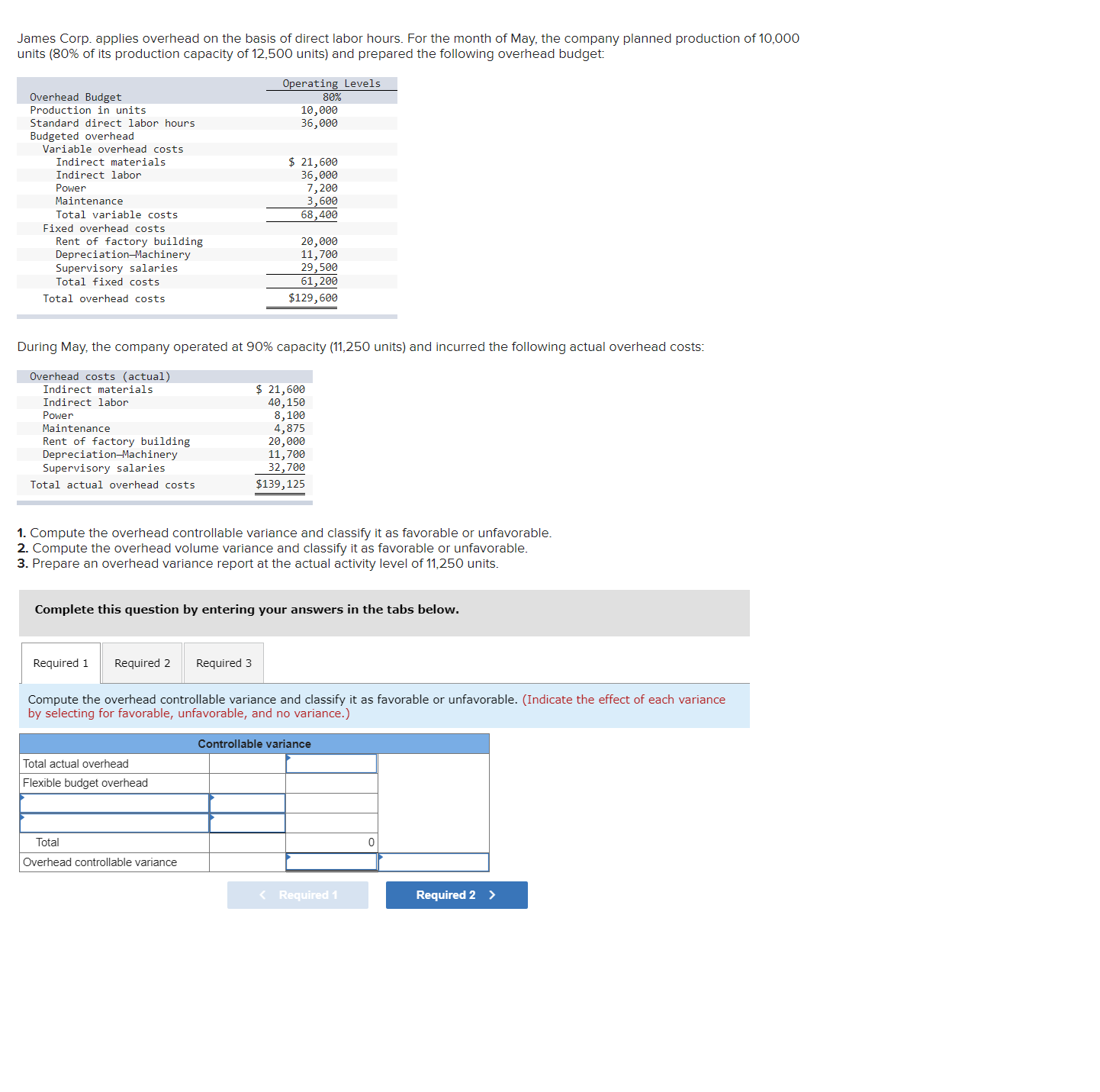

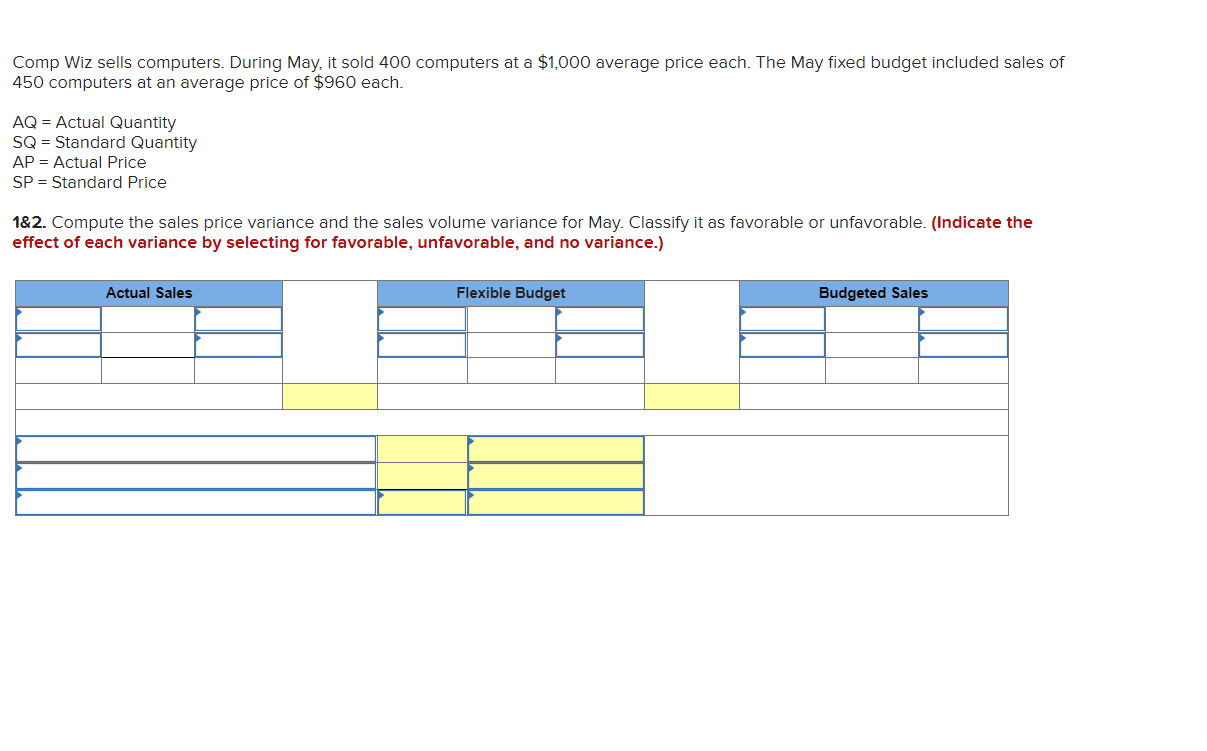

James Corp. applies overhead on the basis ofdirect labor hours, For the month ofMay, the company planned production of 10,000 units (80% of its production capacity of12,500 units) and prepared the following overhead budget Operating Levels Overhead Budget 399: Production in units 19,999 Standard direct labor hours 36,999 Budgeted overhead Variable overhead costs Indirect materials 5 21,699 Indirect labor 36,999 Power 7,299 Maintenance 3,589 Total variable costs 68,489 Fixed overhead costs Rent of factory building 29,999 DepreciationMachinery 11,799 Supervisory salaries 29,599 Total fixed costs 61,299 Total overhead costs $129,699 During May the company operated at 90% capacity (11,250 units) and incurred the following actual overhead costs: Overhead costs (actual) Indirect materials $ 21,688 Indirect labor 49,159 Power 8,199 Maintenance 4,875 Rent of Factory building 29,988 DepreciationMachinery 11,799 Supervisory salaries 32,799 Total actual overhead costs $139,125 1. Compute the overhead controllable variance and classify it as favorable or unfavorable. 2. Compute the overhead volume variance and classify it as favorable or unfavorable. 3. Prepare an overhead variance report atthe actual activity level of11,250 units, Complete this qustion by entering your answers in the tabs below. Required 1 Required 2 Required 3 Compute the overhead volume variance and classify it as favorable or unfavorable. (Indicate the effect of each variance by selecting for favorable, unfavorable, and no variance. Do not round intermediate calculations.) Volume variance James Corp. applies overhead on the basis ofdirect labor hours Forthe month of May, the company planned production of10,000 units (80% of its production capacity of 12,500 units) and prepared the following overhead budget Operating levels Overhead Budget 86% Production in units 16,666 Standard direct labor hours 36,666 Budgeted overhead Variable overhead costs Indirect materials $ 21,666 Indirect labor 36,666 Power 7,233 Maintenance 3,666 Total variable costs 68,466 Fixed overhead costs Rent of factory building 26,666 DepreciationMachinery 11,766 Supervisory salaries 29,566 Total fixed costs 61,266 Total overhead costs $129,666 During May, the company operated at 90% capacity (11.250 units] and incurred the following actual overhead costs: Overhead (use; (actual) Indirect materials $ 21,666 Indirect labor 46,156 Power 8,166 Maintenance 4,875 Rent of factory building 26,666 DepreciationMachinery 11,766 Supervisory salaries 32,766 Total actual overhead costs $139,125 1. Compute the overhead controllable variance and classify it as favorable or unfavorable. 2. Compute the overhead volume variance and classify it as favorable or unfavorable. 3. Prepare an overhead variance report atthe actual activity level of11,250 units. Complete this qution by entering your answers in the tabs below. Required 1 Required 2 Required 3 Prepare an overhead variance report at the actual activity level of 11,250 units. Classify as favolable or unfavorable. (Indicate the effect of each variance by selecting for favorable, unfavolable, and no variance. Do not round intem'lediate mlculations.) Expected production volume Production level achieved Volume vanance Variable overhead mats L Fixed overhead costs: Total overhead costs James Corp. applies overhead on the basis ofdlrect labor hours. For the month ofMay, the company planned production of10,000 units (80% of its production capacity of12,500 units) and prepared the following overhead budget Operating Levels Overhead Budget 39% Production in units 16,666 Standard direct labor hours 36,666 Budgeted overhead Variable overhead costs Indirect materials 3: 21,666 Indirect labor 36,666 Power 7,266 Maintenance 3,533 Total variable costs 68,466 Fixed overhead costs Rent of factory building 26,666 DepreciationMachinery 11,766 Supervisory salaries 29,566 Total fixed costs 61,266 Total overhead costs $129,666 During May the company operated at 90% capaCIty (11,250 units) and incurred the following actual overhead costs: Overhead costs (actual) Indirect materials 3 21,696 Indirect labor 46,156 Power 8,196 Maintenance 4,875 Rent of factory building 26,696 DepreciationMachinery 11,796 Supervisory salaries 32,796 Total actual overhead cost; $139,125 1. Compute the overhead controllable variance and classify it as favorable or unfavorable. 2. Compute the overhead volume variance and classify it as favorable or unfavorable. 3. Prepare an overhead variance report atthe actual activity level of11,250 units. Complete lis qu$un by entering your answers in the tabs below. Required 1 Required 2 Required 3 Compute the overhead controllable variamr and classify it as favorable or unfavolable. (Indicate the effect of each variance by selecting for favorable, unfavorable, and no variance.) Total actual overhead Flexible budget overhead Total Overhead controllable variance Requ ed2 ) Comp Wiz sells computers. During May, it sold 400 computers at a $1,000 average price each. The May xed budget included sales of 450 computers at an average price of $960 each. A0 = Actual Quantity SQ : Standard Quantity AP : Actual Price SP = Standard Price 1&2. Compute the sales price variance and the sales volume variance for May. Classify it as favorable or unfavorable. [Indicate the effect of each variance by selecting for favorable, unfavorable, and no variance.)