Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i need help find answers for that. NOTE: ALL DOCUMENTATION TO SUPPORT YOUR ANSWERS MUST COME FROM THE FINANCIAL STATEMENTS AND/OR THE NOTES TO THE

i need help find answers for that.

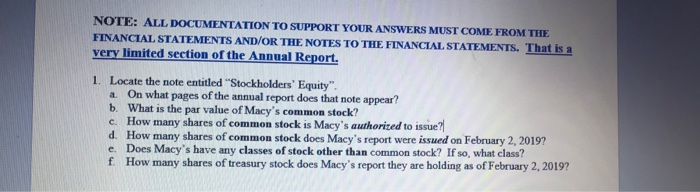

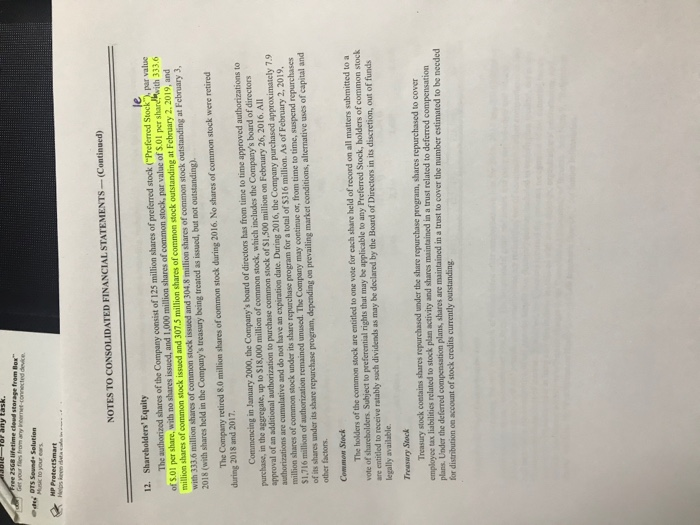

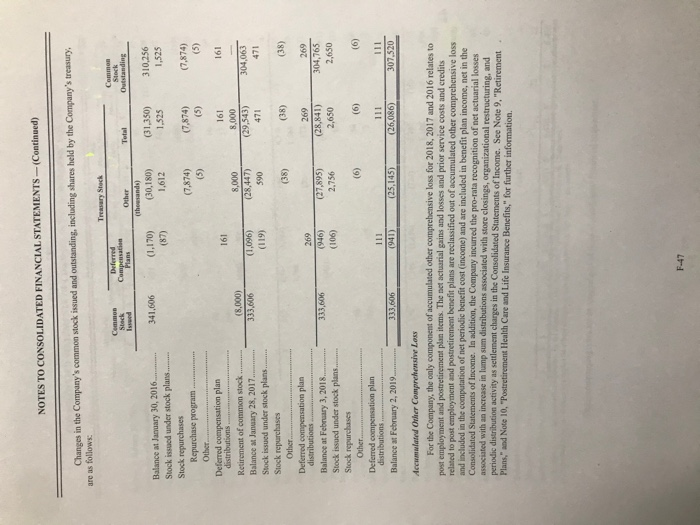

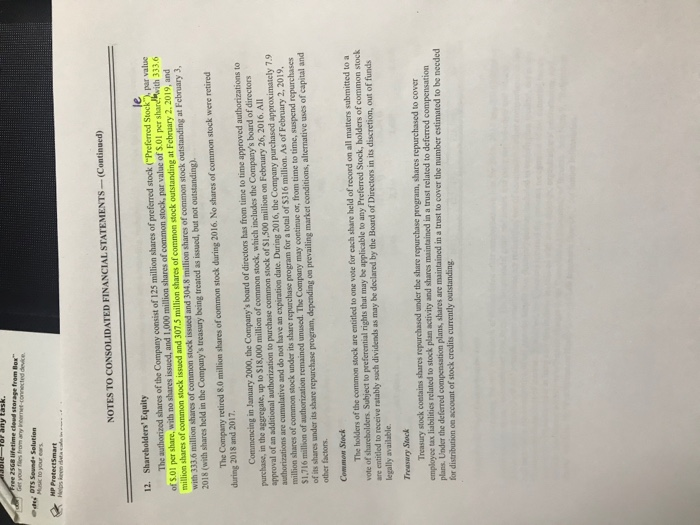

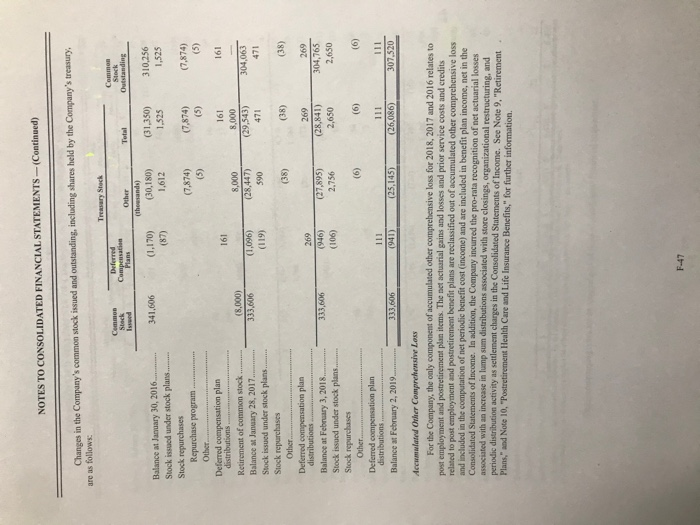

NOTE: ALL DOCUMENTATION TO SUPPORT YOUR ANSWERS MUST COME FROM THE FINANCIAL STATEMENTS AND/OR THE NOTES TO THE FINANCIAL STATEMENTS. That is a very limited section of the Annual Report. 1. Locate the note entitled "Stockholders' Equity". a. On what pages of the annual report does that note appear? b. What is the par value of Macy's common stock? c. How many shares of common stock is Macy's authorized to issue? d. How many shares of common stock does Macy's report were issued on February 2, 2019? e Does Macy's have any classes of stock other than common stock? If so, what class? f. How many shares of treasury stock does Macy's report they are holding as of February 2, 2019? Por any task. Free 2568 Lifetime cloud storage from Box Get your files from any warnet connected device. der DTS Sound Solution Music to your cars HP Protect Smart * Melo NOTES TO CONSOLIDATED FINANCIAL STATEMENTS -- (Continued) le 12. Shareholders' Equity The authorized shares of the Company consist of 125 million shares of preferred stock ("Preferred Stock par value of s.1 per share with no shares issued, and 1,000 million shares of common stock, par value of S.Ol per shard With 333.6 million shares of common stock issued and 307.5 million shares of common stock outstanding at February 2, 2019, and with 333.6 million shares of common stock issued and 304.8 million shares of common stock outstanding at February 3, 2018 (with shares held in the Company's treasury being treated as issued, but not outstanding). The Company retired 8.0 million shares of common stock during 2016. No shares of common stock were retired during 2018 and 2017. Commencing in January 2000, the Company's board of directors has from time to time approved authorizations to purchase, in the aggregate, up to $18,000 million of common stock, which includes the Company's board of directors approval of an additional authorization to purchase common stock of $1.500 million on February 26, 2016. All authorizations are cumulative and do not have an expiration date. During 2016, the Company purchased approximately 7.9 million shares of common stock under its share repurchase program for a total of S316 million. As of February 2, 2019. $1,716 million of authorization remained unused. The Company may continue or from time to time, suspend repurchases of its shares under its share repurchase program, depending on prevailing market conditions, alternative uses of capital and other factors. Common Stock The holders of the common stock are entitled to one vote for each share held of record on all matters submitted to a vote of shareholders. Subject to preferential rights that may be applicable to any Preferred Stock, holders of common stock are entitled to receive ratably such dividends as may be declared by the Board of Directors in its discretion, out of funds legally available. Treasury Stock Treasury stock contains shares repurchased under the share repurchase program, shares repurchased to cover employee tax liabilities related to stock plan activity and shares maintained in a trust related to deferred compensation plans. Under the deferred compensation plans, shares are maintained in a trust to cover the number estimated to be needed for distribution on account of stock credits currently outstanding. NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued) Changes in the Company's common stock issued and outstanding, including shares held by the Company's treasury, are as follows: Treasury Stock Common Com Deferred Compensation Total Outstanding 341,606 (1,170) (87) (thousands) (30,180) 1,612 (31,350) 1,525 310,256 1,525 (7,874) (7,874) (7,874) (5) (5) 161 161 (8,000) 333,606 161 8,000 (29,543) 471 8.000 (28,447) 590 (1,096) (119) 304,063 471 Balance at January 30, 2016...... Stock issued under stock plans... Stock repurchases Repurchase program... Other Deferred compensation plan distributions. Retirement of common stock Balance at January 28, 2017 Stock issued under stock plans..... Stock repurchases Other.. Deferred compensation plan distributions Balance at February 3, 2018... Stock issued under stock plans... Stock repurchases Other.. Deferred compensation plan distributions ....... Balance at February 2, 2019 (38) (38) (38) 269 333,606 (946) (106) (27,895) 2.756 269 (28,841) 2,650 304,765 2,650 (6) 333,606 (941) (25.145) (26,086) 307,520 Accumwand Other Comprehensive Less For the Company, the only component of accumulated other comprehensive loss for 2018, 2017 and 2016 relates to post employment and postretirement plan items. The met actuarial gains and losses and prior service costs and credits related to post employment and postretirement benefit plans are reclassified out of accumulated other comprehensive loss and included in the computation of net periodic benefit cost (income) and are included in benefit plan income, net in the Consolidated Statements of Income. In addition, the Company incurred the pro-rata recognition of net actuarial losses associated with an increase in lump sum distributions associated with store closings, organizational restructuring, and periodic distribution activity as settlement charges in the Consolidated Statements of Income. See Note 9, "Retirement Plans," and Note 10,"Postretirement Health Care and Life Insurance Benefits," for further information F-47

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started