Answered step by step

Verified Expert Solution

Question

1 Approved Answer

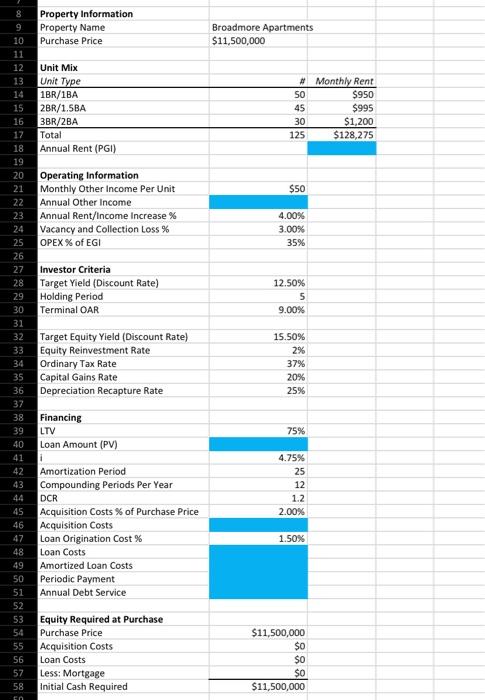

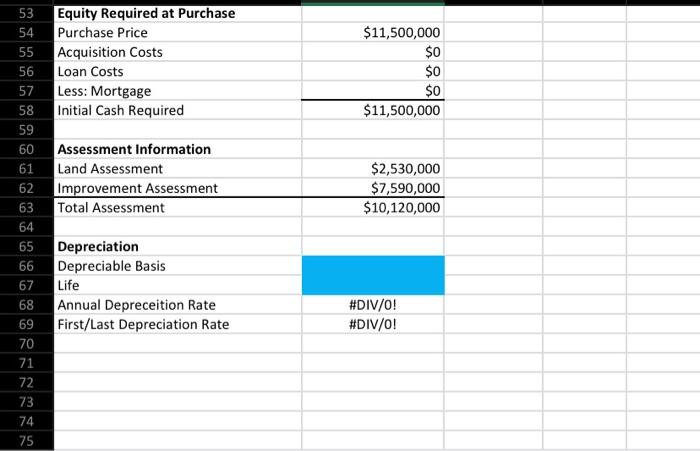

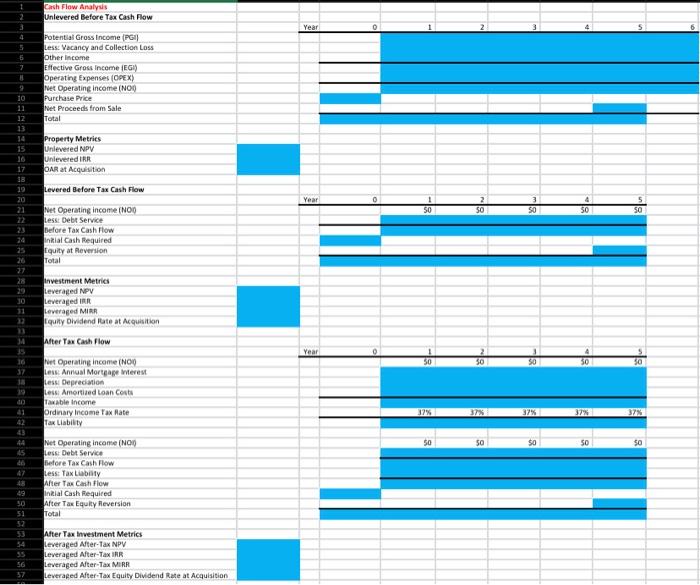

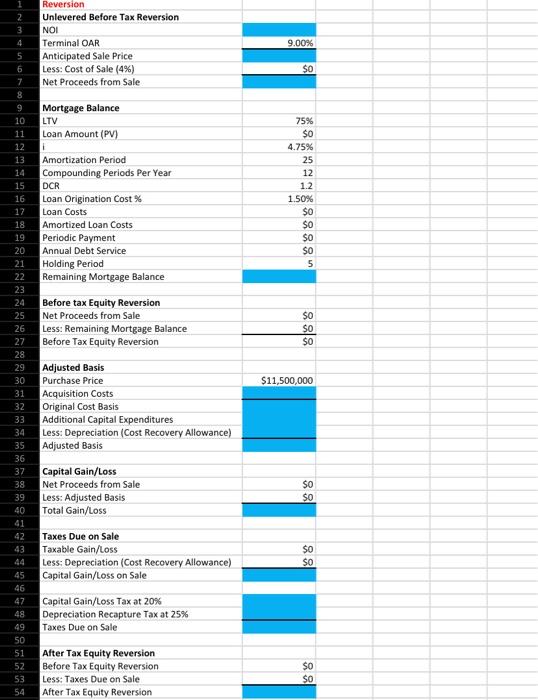

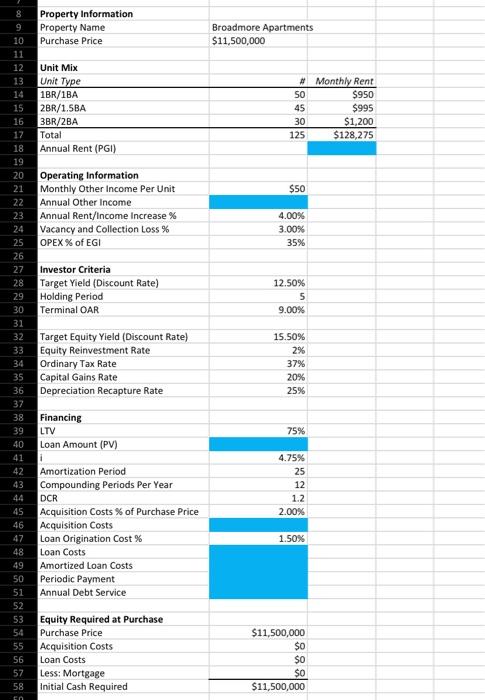

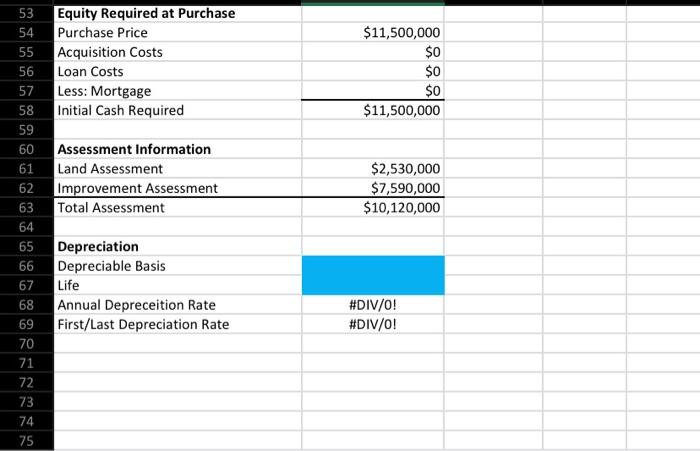

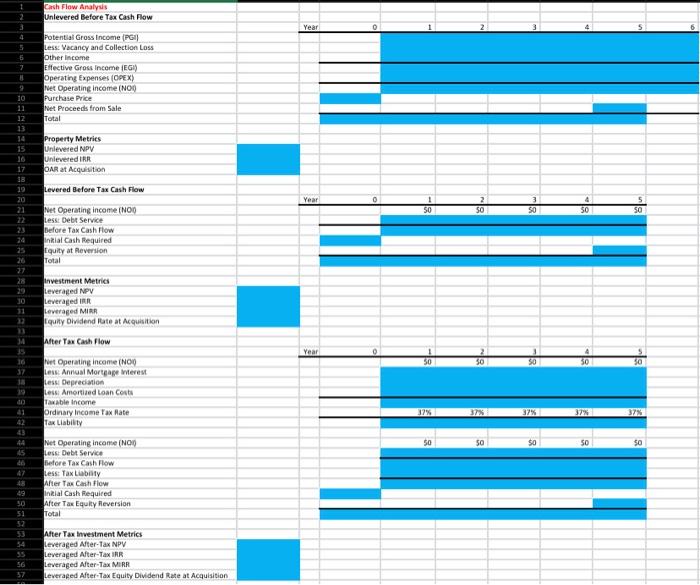

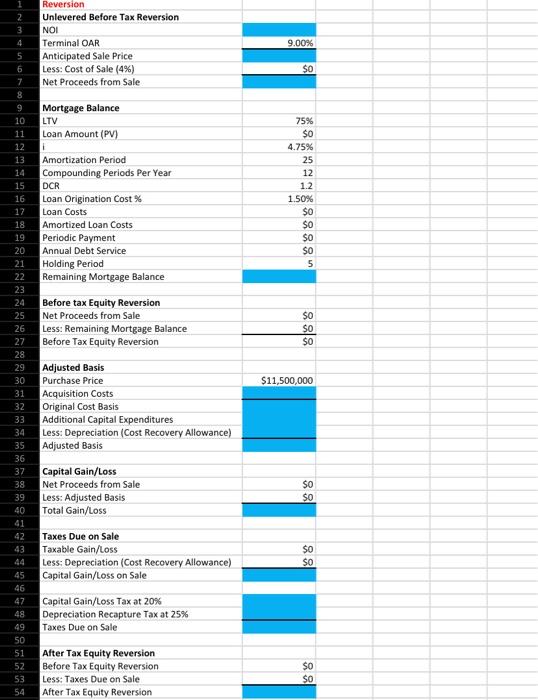

I need help finding everything in the blue boxes, if possible could you also show how to get the answers? Property Information Property Name Purchase

I need help finding everything in the blue boxes, if possible could you also show how to get the answers?

Property Information Property Name Purchase Price Unit Mix Unit Type 1BR/1BA 15 2BR/1.5BA 16 3BR/2BA 17 Total 18 Annual Rent (PGI) 19 20 Operating Information Monthly Other Income Per Unit Annual Other Income 21 Annual Rent/Income Increase % Vacancy and Collection Loss % OPEX % of EGI Investor Criteria Target Yield (Discount Rate) 29 Holding Period Terminal OAR 30 31 32 Target Equity Yield (Discount Rate) Equity Reinvestment Rate 33 34 Ordinary Tax Rate 35 Capital Gains Rate 36 Depreciation Recapture Rate 37 38 Financing 39 LTV 40 Loan Amount (PV) 41 i 42 Amortization Period 43 Compounding Periods Per Year 44 DCR 45 Acquisition Costs % of Purchase Price 46 Acquisition Costs 47 Loan Origination Cost % 48 Loan Costs 49 Amortized Loan Costs 50 Periodic Payment 51 Annual Debt Service 52 53 Equity Required at Purchase 54 Purchase Price 55 Acquisition Costs 56 Loan Costs 57 Less: Mortgage 58 Initial Cash Required FO 8 ORHEENSS982222 10 11 12 13 14 23 24 25 26 27 Broadmore Apartments $11,500,000 #Monthly Rent 50 $950 45 $995 30 $1,200 125 $128,275 $50 4.00% 3.00% 35% 12.50% 5 9.00% 15.50% 2% 37% 20% 25% 75% 4.75% 25 12 1.2 2.00% 1.50% $11,500,000 $0 $0 $0 $11,500,000 $11,500,000 $0 Equity Required at Purchase Purchase Price Acquisition Costs Loan Costs Less: Mortgage Initial Cash Required $0 $0 $11,500,000 Assessment Information Land Assessment Improvement Assessment Total Assessment $2,530,000 $7,590,000 $10,120,000 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 Depreciation Depreciable Basis Life Annual Depreceition Rate First/Last Depreciation Rate #DIV/0! #DIV/0! Cash Flow Analysis Unlevered Before Tex Cash Flow Year O 4 5 6 7 Potential Gross Income (PGI) Less: Vacancy and Collection Loss Other Income Effective Gross Income IEGI) Operating Expenses (OPEX) Net Operating Income (NOO Purchase Price Net Proceeds from Sale Total 10 11 12 13 14 15 Property Metries Unlevered NPV Unlevered IRR DAR at Acquisition Levered Before Tax Cash Flow Year 50 SO SO 50 SO 17 18 19 20 21 22 23 24 25 2 27 28 29 30 11 Net Operating income INOO Less Debt Service Before Tax Cash Flow Intial Cash Required Equity at Reversion Total Investment Metries Leveraged NPV Leveraged IRR Leveraged MIRR Iquity Dividend late at Acquisition After Tax Cash Flow Year 50 50 18 $0 37 18 ut Operating income (NO Less Annual Mortgage Were Less Depreciation Less: Amortised Loan Costa Taxable income Ordinary Income Tax Rate Tax Liability 32% 39% 37% 37% 41 42 43 4 15 do 50 50 $0 50 $0 Net Operating Income INOO Less: Debt Service Before Tax Cash Flow Less: Tax liably After Tax Cash Flow Intial Cash Required After Tax Equity Reversion Total 49 SO 51 52 53 34 After Tax Investment Metrics Leveraged After Tax NPV Leveraged Alter-Tax RR Leveraged Alter-Tax MRR Leveraged After Tax Equity Dividend Rate at Acquisition 56 57 2 3 4 5 6 Reversion Unlevered Before Tax Reversion NOI Terminal OAR Anticipated Sale Price Less: Cost of Sale (4%) Net Proceeds from Sale 9.00% $0 8 Mortgage Balance LTV Loan Amount (PV) $ 4.75% Amortization Period Compounding Periods Per Year DCR Loan Origination Cost % Loan Costs Amortized Loan Costs Periodic Payment Annual Debt Service Holding Period Remaining Mortgage Balance # * 8 88 8 1.50% 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 Before tax Equity Reversion Net Proceeds from Sale Less: Remaining Mortgage Balance Before Tax Equity Reversion $0 SO $0 $11,500,000 Adjusted Basis Purchase Price Acquisition Costs Original Cost Basis Additional Capital Expenditures Less: Depreciation (Cost Recovery Allowance) Adjusted Basis Capital Gain/Loss Net Proceeds from Sale Less: Adjusted Basis Total Gain/Loss $0 $o $0 $ 42 43 44 45 46 47 48 49 50 51 52 53 54 Taxes Due on Sale Taxable Gain/Loss Less: Depreciation (Cost Recovery Allowance) Capital Gain/Loss on Sale Capital Gain/Loss Tax at 20% Depreciation Recapture Tax at 25% Taxes Due on Sale After Tax Equity Reversion Before Tax Equity Reversion Less: Taxes Due on Sale After Tax Equity Reversion $0 $0 Property Information Property Name Purchase Price Unit Mix Unit Type 1BR/1BA 15 2BR/1.5BA 16 3BR/2BA 17 Total 18 Annual Rent (PGI) 19 20 Operating Information Monthly Other Income Per Unit Annual Other Income 21 Annual Rent/Income Increase % Vacancy and Collection Loss % OPEX % of EGI Investor Criteria Target Yield (Discount Rate) 29 Holding Period Terminal OAR 30 31 32 Target Equity Yield (Discount Rate) Equity Reinvestment Rate 33 34 Ordinary Tax Rate 35 Capital Gains Rate 36 Depreciation Recapture Rate 37 38 Financing 39 LTV 40 Loan Amount (PV) 41 i 42 Amortization Period 43 Compounding Periods Per Year 44 DCR 45 Acquisition Costs % of Purchase Price 46 Acquisition Costs 47 Loan Origination Cost % 48 Loan Costs 49 Amortized Loan Costs 50 Periodic Payment 51 Annual Debt Service 52 53 Equity Required at Purchase 54 Purchase Price 55 Acquisition Costs 56 Loan Costs 57 Less: Mortgage 58 Initial Cash Required FO 8 ORHEENSS982222 10 11 12 13 14 23 24 25 26 27 Broadmore Apartments $11,500,000 #Monthly Rent 50 $950 45 $995 30 $1,200 125 $128,275 $50 4.00% 3.00% 35% 12.50% 5 9.00% 15.50% 2% 37% 20% 25% 75% 4.75% 25 12 1.2 2.00% 1.50% $11,500,000 $0 $0 $0 $11,500,000 $11,500,000 $0 Equity Required at Purchase Purchase Price Acquisition Costs Loan Costs Less: Mortgage Initial Cash Required $0 $0 $11,500,000 Assessment Information Land Assessment Improvement Assessment Total Assessment $2,530,000 $7,590,000 $10,120,000 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 Depreciation Depreciable Basis Life Annual Depreceition Rate First/Last Depreciation Rate #DIV/0! #DIV/0! Cash Flow Analysis Unlevered Before Tex Cash Flow Year O 4 5 6 7 Potential Gross Income (PGI) Less: Vacancy and Collection Loss Other Income Effective Gross Income IEGI) Operating Expenses (OPEX) Net Operating Income (NOO Purchase Price Net Proceeds from Sale Total 10 11 12 13 14 15 Property Metries Unlevered NPV Unlevered IRR DAR at Acquisition Levered Before Tax Cash Flow Year 50 SO SO 50 SO 17 18 19 20 21 22 23 24 25 2 27 28 29 30 11 Net Operating income INOO Less Debt Service Before Tax Cash Flow Intial Cash Required Equity at Reversion Total Investment Metries Leveraged NPV Leveraged IRR Leveraged MIRR Iquity Dividend late at Acquisition After Tax Cash Flow Year 50 50 18 $0 37 18 ut Operating income (NO Less Annual Mortgage Were Less Depreciation Less: Amortised Loan Costa Taxable income Ordinary Income Tax Rate Tax Liability 32% 39% 37% 37% 41 42 43 4 15 do 50 50 $0 50 $0 Net Operating Income INOO Less: Debt Service Before Tax Cash Flow Less: Tax liably After Tax Cash Flow Intial Cash Required After Tax Equity Reversion Total 49 SO 51 52 53 34 After Tax Investment Metrics Leveraged After Tax NPV Leveraged Alter-Tax RR Leveraged Alter-Tax MRR Leveraged After Tax Equity Dividend Rate at Acquisition 56 57 2 3 4 5 6 Reversion Unlevered Before Tax Reversion NOI Terminal OAR Anticipated Sale Price Less: Cost of Sale (4%) Net Proceeds from Sale 9.00% $0 8 Mortgage Balance LTV Loan Amount (PV) $ 4.75% Amortization Period Compounding Periods Per Year DCR Loan Origination Cost % Loan Costs Amortized Loan Costs Periodic Payment Annual Debt Service Holding Period Remaining Mortgage Balance # * 8 88 8 1.50% 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 Before tax Equity Reversion Net Proceeds from Sale Less: Remaining Mortgage Balance Before Tax Equity Reversion $0 SO $0 $11,500,000 Adjusted Basis Purchase Price Acquisition Costs Original Cost Basis Additional Capital Expenditures Less: Depreciation (Cost Recovery Allowance) Adjusted Basis Capital Gain/Loss Net Proceeds from Sale Less: Adjusted Basis Total Gain/Loss $0 $o $0 $ 42 43 44 45 46 47 48 49 50 51 52 53 54 Taxes Due on Sale Taxable Gain/Loss Less: Depreciation (Cost Recovery Allowance) Capital Gain/Loss on Sale Capital Gain/Loss Tax at 20% Depreciation Recapture Tax at 25% Taxes Due on Sale After Tax Equity Reversion Before Tax Equity Reversion Less: Taxes Due on Sale After Tax Equity Reversion $0 $0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started