Answered step by step

Verified Expert Solution

Question

1 Approved Answer

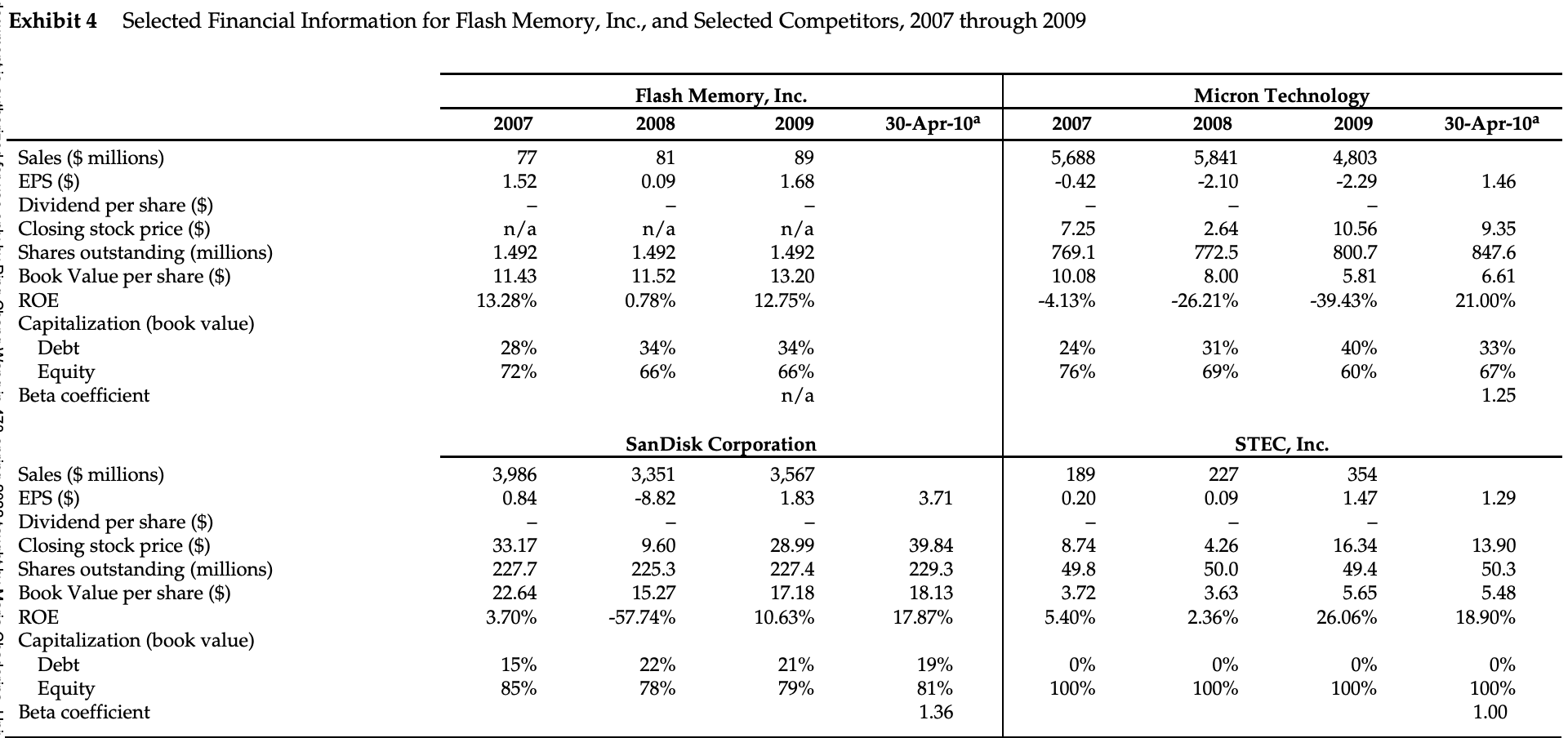

I need help finding the debt. From my teacher, in order to find the debt first find the total BOOK value of assets, then you

I need help finding the debt. From my teacher, in order to find the debt first find the total BOOK value of assets, then you can multiply that number by the 40% and get the book value of debt.

The equation: book value of assets = book value of equity + Book value of debt

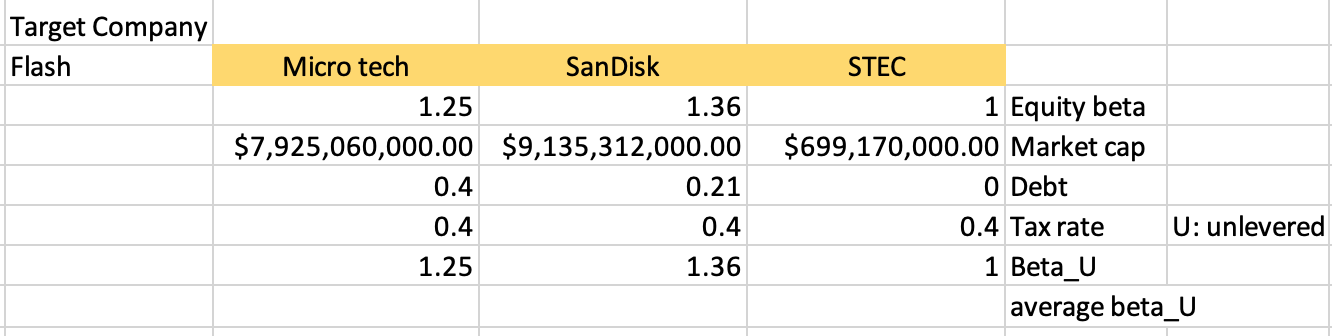

Exhibit 4 Selected Financial Information for Flash Memory, Inc., and Selected Competitors, 2007 through 2009 Flash Memory, Inc. 2008 2007 2009 30-Apr-10a 2007 77 81 89 5,688 Sales ($ millions) EPS ($) 1.52 0.09 1.68 -0.42 Dividend per share ($) Closing stock price ($) n/a n/a n/a 7.25 1.492 1.492 769.1 Shares outstanding (millions) Book Value per share ($) ROE 11.52 13.20 10.08 0.78% 12.75% -4.13% Capitalization (book value) Debt 34% 34% 24% Equity 66% 66% 76% Beta coefficient n/a SanDisk Corporation 3,351 3,567 189 Sales ($ millions) EPS ($) -8.82 1.83 0.20 Dividend per share ($) Closing stock price ($) 9.60 28.99 8.74 Shares outstanding (millions) 225.3 227.4 49.8 Book Value per share ($) 15.27 17.18 3.72 E. ROE -57.74% 10.63% 5.40% 2 Capitalization (book value) Debt 22% 21% 0% Equity 78% 79% 100% Beta coefficient 1.492 11.43 13.28% 28% 72% 3,986 0.84 33.17 227.7 22.64 3.70% 15% 85% 3.71 39.84 229.3 18.13 17.87% 19% 81% 1.36 Micron Technology 2008 2009 5,841 4,803 -2.10 -2.29 2.64 10.56 772.5 800.7 8.00 5.81 -26.21% -39.43% 31% 40% 69% 60% 354 1.47 16.34 49.4 5.65 26.06% 0% 100% STEC, Inc. 227 0.09 4.26 50.0 3.63 2.36% 0% 100% 30-Apr-10 1.46 9.35 847.6 6.61 21.00% 33% 67% 1.25 1.29 13.90 50.3 5.48 18.90% 0% 100% 1.00 Target Company Flash Micro tech SanDisk 1.25 1.36 $7,925,060,000.00 $9,135,312,000.00 0.4 0.21 0.4 0.4 1.25 1.36 STEC 1 Equity beta $699,170,000.00 Market cap 0 Debt 0.4 Tax rate 1 Beta_U U: unlevered average beta_U Exhibit 4 Selected Financial Information for Flash Memory, Inc., and Selected Competitors, 2007 through 2009 Flash Memory, Inc. 2008 2007 2009 30-Apr-10a 2007 77 81 89 5,688 Sales ($ millions) EPS ($) 1.52 0.09 1.68 -0.42 Dividend per share ($) Closing stock price ($) n/a n/a n/a 7.25 1.492 1.492 769.1 Shares outstanding (millions) Book Value per share ($) ROE 11.52 13.20 10.08 0.78% 12.75% -4.13% Capitalization (book value) Debt 34% 34% 24% Equity 66% 66% 76% Beta coefficient n/a SanDisk Corporation 3,351 3,567 189 Sales ($ millions) EPS ($) -8.82 1.83 0.20 Dividend per share ($) Closing stock price ($) 9.60 28.99 8.74 Shares outstanding (millions) 225.3 227.4 49.8 Book Value per share ($) 15.27 17.18 3.72 E. ROE -57.74% 10.63% 5.40% 2 Capitalization (book value) Debt 22% 21% 0% Equity 78% 79% 100% Beta coefficient 1.492 11.43 13.28% 28% 72% 3,986 0.84 33.17 227.7 22.64 3.70% 15% 85% 3.71 39.84 229.3 18.13 17.87% 19% 81% 1.36 Micron Technology 2008 2009 5,841 4,803 -2.10 -2.29 2.64 10.56 772.5 800.7 8.00 5.81 -26.21% -39.43% 31% 40% 69% 60% 354 1.47 16.34 49.4 5.65 26.06% 0% 100% STEC, Inc. 227 0.09 4.26 50.0 3.63 2.36% 0% 100% 30-Apr-10 1.46 9.35 847.6 6.61 21.00% 33% 67% 1.25 1.29 13.90 50.3 5.48 18.90% 0% 100% 1.00 Target Company Flash Micro tech SanDisk 1.25 1.36 $7,925,060,000.00 $9,135,312,000.00 0.4 0.21 0.4 0.4 1.25 1.36 STEC 1 Equity beta $699,170,000.00 Market cap 0 Debt 0.4 Tax rate 1 Beta_U U: unlevered average beta_UStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started