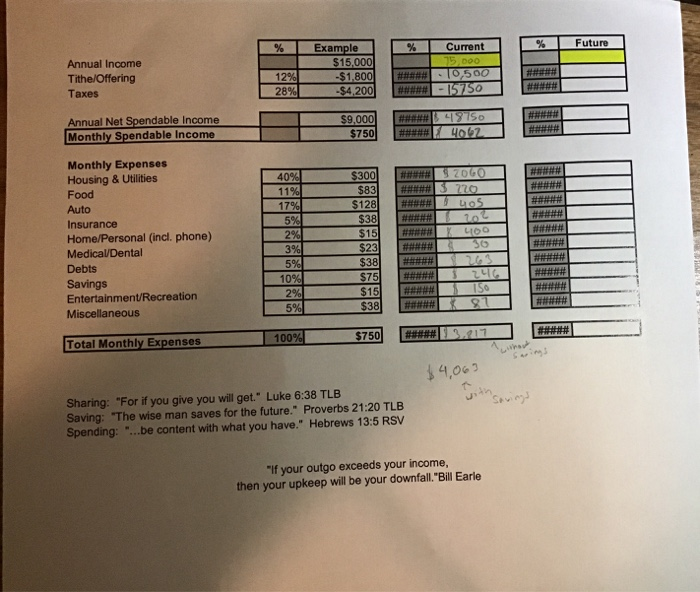

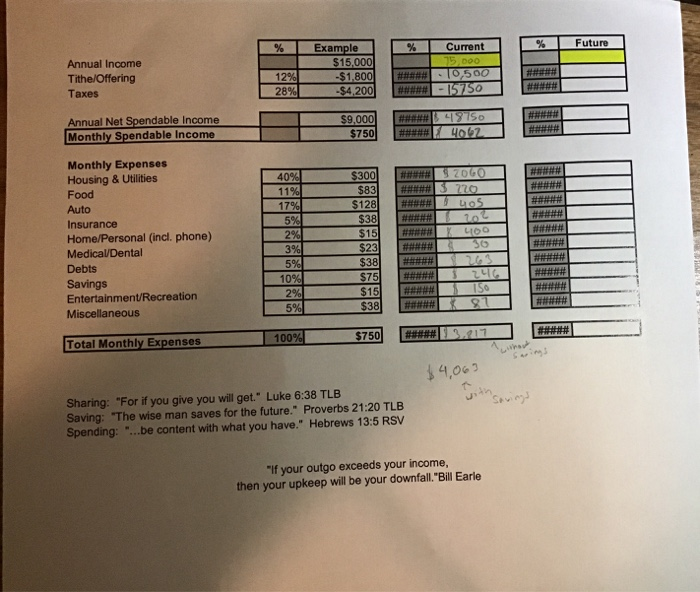

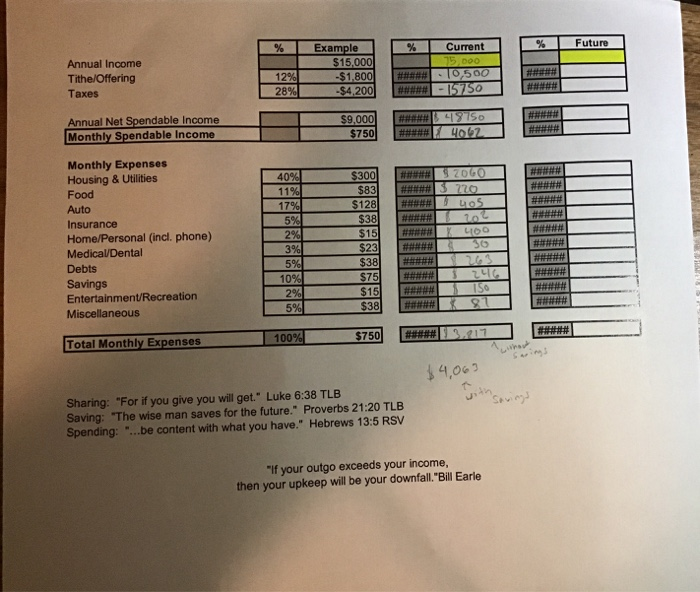

i need help finding the future column of Marthas budget

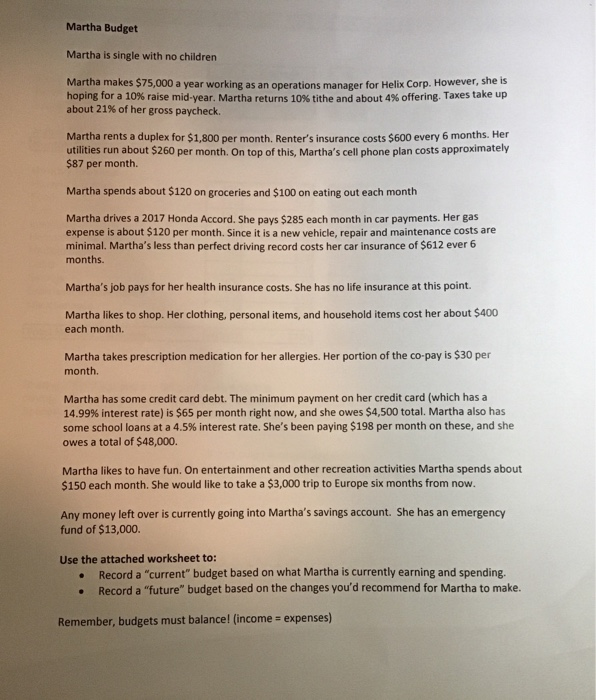

Future Current % % Example $15,000 $1,800 -$4,200 75, Doo To500 #**- 15750 Annual Income ### ##### 12 % 28% Tithe/Offering ##### Taxes ##* # #### Annual Net Spendable Income Monthly Spendable Income $9,000 $750 Monthly Expenses Housing & Utilities Food #au* $300 40% 11% 17% 5% 2% 3% 5% 10% 2% 5% # #### # #### # #### ### # # #####3 22o ##### 4o5 $83 $128 $38 $15 $23 Auto ##### Insurance ##### Home/Personal (incl. phone) Medical/Dental 36 # ##0 ##### $38 Debts ##### $75 $15 $38 ##### Savings Entertainment/Recreation ##### #### Miscellaneous # #### # .211 100% $750 Total Monthly Expenses $4,063 Sharing: "For if you give you will get." Luke 6:38 TLB Saving: "The wise man saves for the future." Proverbs 21:20 TLB Spending: ...be content with what you have." Hebrews 13:5 RSV "If your outgo exceeds your income, then your upkeep will be your downfall."Bill Earle Martha Budget Martha is single with no children Martha makes $75,000 a year working as an operations manager for Helix Corp. However, she is hoping for a 10 % raise mid-year. Martha returns 109% tithe and about 4 % offering. Taxes take up about 21 % of her gross paycheck. Martha rents a duplex for $1,800 per month, Renter's insurance costs $600 every 6 months. Her utilities run about $260 per month. On top of this, Martha's cell phone plan costs approximately $87 per month. Martha spends about $120 on groceries and $100 on eating out each month Martha drives a 2017 Honda Accord. She pays $285 each month in car payments. Her gas expense is about $120 per month. Since it is a new vehicle, repair and maintenance costs are minimal. Martha's less than perfect driving record costs her car insurance of $612 ever 6 months. Martha's job pays for her health insurance costs. She has no life insurance at this point. Martha likes to shop. Her clothing, personal items, and household items cost her about $400 each month. Martha takes prescription medication for her allergies. Her portion of the co-pay is $30 per month. Martha has some credit card debt. The minimum payment on her credit card (which has a 14.99 % interest rate) is $65 per month right now, and she owes $4,500 total. Martha also has some school loans at a 4.5 % interest rate. She's been paying $198 per month on these, and she owes a total of $48,000. Martha likes to have fun. On entertainment and other recreation activities Martha spends about $150 each month. She would like to take a $3,000 trip to Europe six months from now. Any money left over is currently going into Martha's savings account. She has an emergency fund of $13,000 Use the attached worksheet to: Record a "current" budget based on what Martha is currently earning and spending Record a "future" budget based on the changes you'd recommend for Martha to make. Remember, budgets must balance! (income expenses)