i need help finding these two work through problems

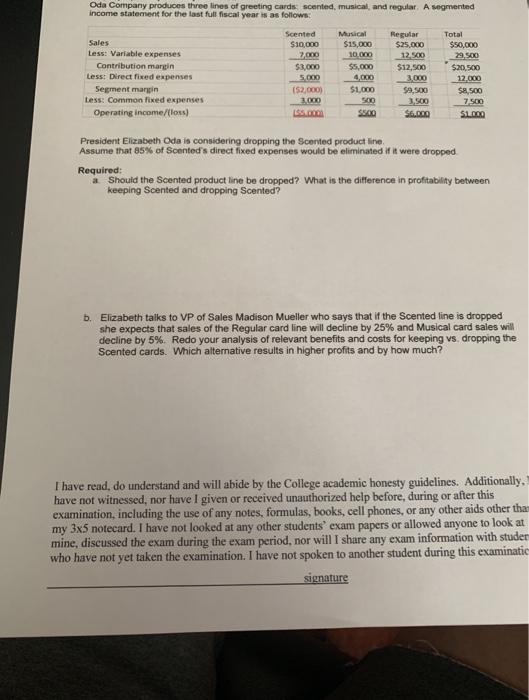

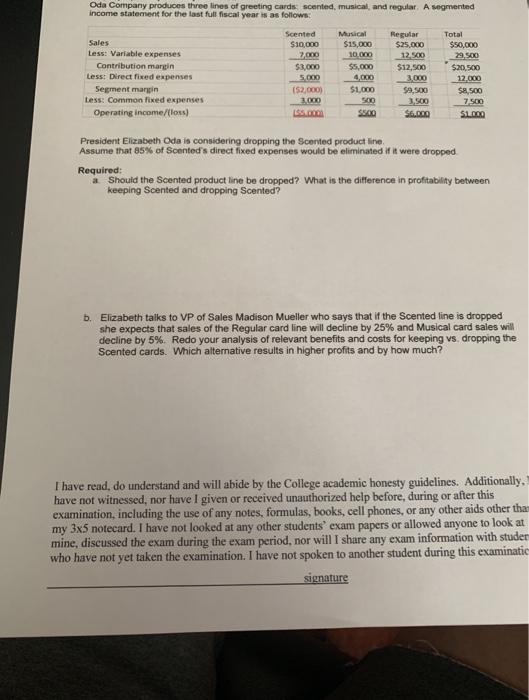

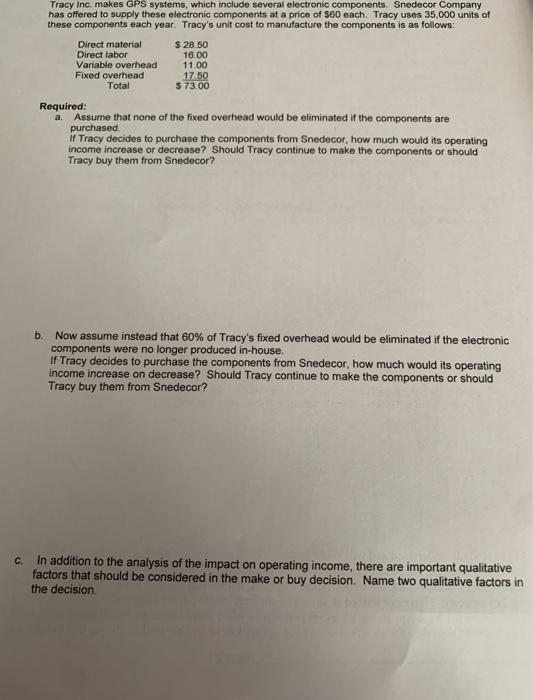

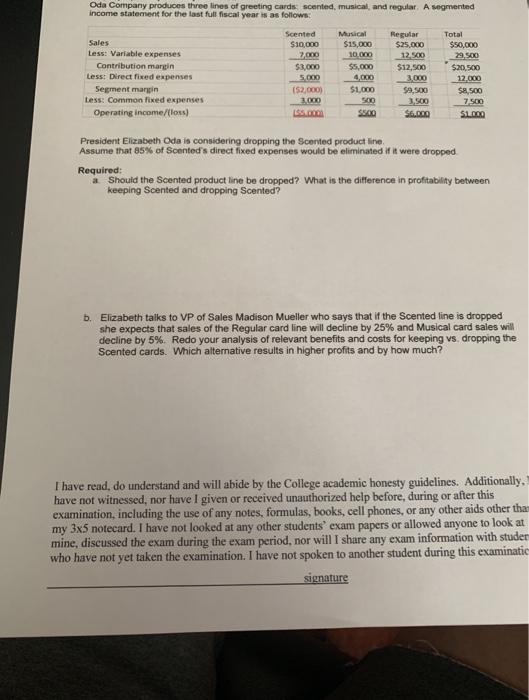

Oda Company produces three lines of greeting cards scented, musical and regular. A segmented income statement for the last full fiscal year is as follows: Sales Less: Variable expenses Contribution margin Less: Direct fixed expenses Segment margin Less: Common fixed expenses Operating income/loss) Scented $10,000 2,000 $2.000 5.000 152.000) 3.000 Musical $15,000 10.000 $5,000 4,000 $1,000 500 SO Regular $25.000 12.500 $12,500 3.000 59,500 3,500 $6.000 Total $50,000 29,500 $20,500 12.000 SR 500 7.500 S1000 President Elizabeth Oda is considering dropping the Scented product line Assume that 85% of Scented's direct fixed expenses would be eliminated if it were dropped Required: Should the Scented product line be dropped? What is the difference in profitability between keeping Scented and dropping Scented? b. Elizabeth talks to VP of Sales Madison Mueller who says that if the Scented line is dropped she expects that sales of the Regular card line will decline by 25% and Musical card sales will decline by 5%. Redo your analysis of relevant benefits and costs for keeping vs dropping the Scented cards. Which alternative results in higher profits and by how much? I have read, do understand and will abide by the College academic honesty guidelines. Additionally, have not witnessed, nor have I given or received unauthorized help before, during or after this examination, including the use of any notes, formulas, books, cell phones, or any other aids other tha my 3x5 notecard. I have not looked at any other students' exam papers or allowed anyone to look at mine, discussed the exam during the exam period, nor will I share any exam information with studer who have not yet taken the examination. I have not spoken to another student during this examinatic signature Tracy Inc makes GPS systems, which include several electronic components. Snedecor Company has offered to supply these electronic components at a price of $60 each. Tracy uses 35,000 units of these components each year. Tracy's unit cost to manufacture the components is as follows: Direct material $ 28.50 Direct labor 16.00 Variable overhead 11.00 Fixed overhead 17.50 Total $ 73.00 Required: Assume that none of the fixed overhead would be eliminated if the components are purchased if Tracy decides to purchase the components from Snedecor, how much would its operating income increase or decrease? Should Tracy continue to make the components or should Tracy buy them from Snedecor? a b. Now assume instead that 60% of Tracy's fixed overhead would be eliminated if the electronic components were no longer produced in-house. If Tracy decides to purchase the components from Snedecor, how much would its operating income increase on decrease? Should Tracy continue to make the components or should Tracy buy them from Snedecor? In addition to the analysis of the impact on operating income, there are important qualitative factors that should be considered in the make or buy decision. Name two qualitative factors in the decision Oda Company produces three lines of greeting cards scented, musical and regular. A segmented income statement for the last full fiscal year is as follows: Sales Less: Variable expenses Contribution margin Less: Direct fixed expenses Segment margin Less: Common fixed expenses Operating income/loss) Scented $10,000 2,000 $2.000 5.000 152.000) 3.000 Musical $15,000 10.000 $5,000 4,000 $1,000 500 SO Regular $25.000 12.500 $12,500 3.000 59,500 3,500 $6.000 Total $50,000 29,500 $20,500 12.000 SR 500 7.500 S1000 President Elizabeth Oda is considering dropping the Scented product line Assume that 85% of Scented's direct fixed expenses would be eliminated if it were dropped Required: Should the Scented product line be dropped? What is the difference in profitability between keeping Scented and dropping Scented? b. Elizabeth talks to VP of Sales Madison Mueller who says that if the Scented line is dropped she expects that sales of the Regular card line will decline by 25% and Musical card sales will decline by 5%. Redo your analysis of relevant benefits and costs for keeping vs dropping the Scented cards. Which alternative results in higher profits and by how much? I have read, do understand and will abide by the College academic honesty guidelines. Additionally, have not witnessed, nor have I given or received unauthorized help before, during or after this examination, including the use of any notes, formulas, books, cell phones, or any other aids other tha my 3x5 notecard. I have not looked at any other students' exam papers or allowed anyone to look at mine, discussed the exam during the exam period, nor will I share any exam information with studer who have not yet taken the examination. I have not spoken to another student during this examinatic signature Tracy Inc makes GPS systems, which include several electronic components. Snedecor Company has offered to supply these electronic components at a price of $60 each. Tracy uses 35,000 units of these components each year. Tracy's unit cost to manufacture the components is as follows: Direct material $ 28.50 Direct labor 16.00 Variable overhead 11.00 Fixed overhead 17.50 Total $ 73.00 Required: Assume that none of the fixed overhead would be eliminated if the components are purchased if Tracy decides to purchase the components from Snedecor, how much would its operating income increase or decrease? Should Tracy continue to make the components or should Tracy buy them from Snedecor? a b. Now assume instead that 60% of Tracy's fixed overhead would be eliminated if the electronic components were no longer produced in-house. If Tracy decides to purchase the components from Snedecor, how much would its operating income increase on decrease? Should Tracy continue to make the components or should Tracy buy them from Snedecor? In addition to the analysis of the impact on operating income, there are important qualitative factors that should be considered in the make or buy decision. Name two qualitative factors in the decision