Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help for verification of the first part of the exercise(general journal). I completed it how I thought it was correct but I need

I need help for verification of the first part of the exercise(general journal). I completed it how I thought it was correct but I need to be 100% good to keep going and Im not sure.

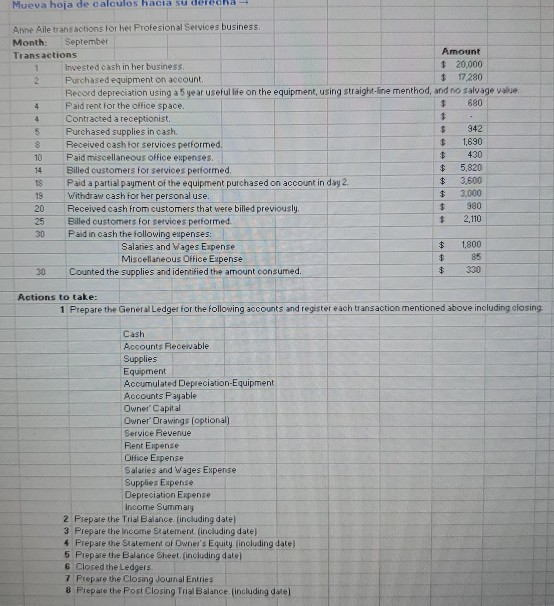

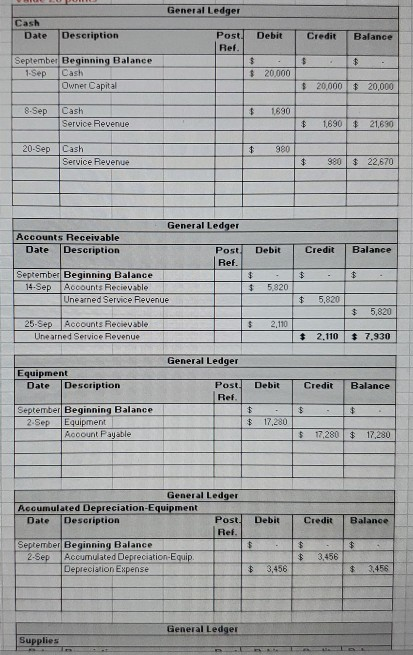

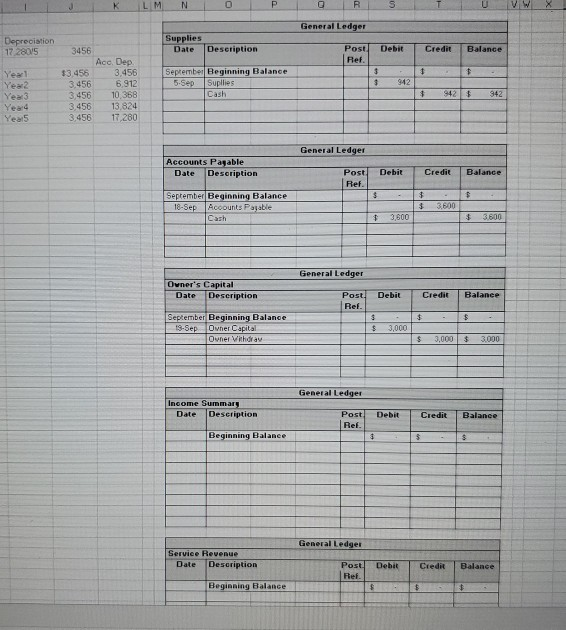

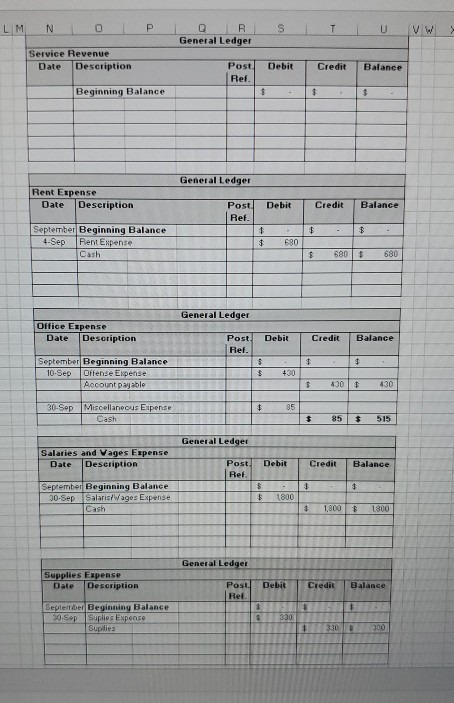

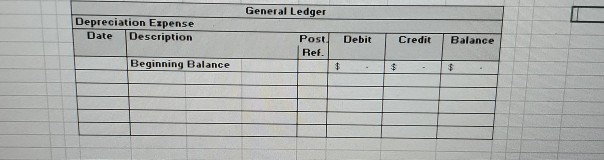

Mueva hoja de calculos hacia su derecha Anne Aile transactions for her Profesional Services business Month September Transactions Amount Invested cash in her business, $ 20,000 2 Purchased equipment on account 17,280 Record depreciation using a 5 year useful life on the equipment, using straight-line menthod, and no salvage value 4 Paid rent for the office space. 880 4 Contracted a receptionist. $ 5 Purchased supplies in cash. $ 942 8 Received cash for services performed $ 1,690 10 Paid miscellaneous office expenses $ 430 14 Billed oustomers for services performed $ 5,820 18 Paid a partial payment of the equipment purchased on account in day 2. $ 3,600 19 Withdraw cash for her personal use. $ 3.000 20 Received cash from customers that were billed previously. $ 980 25 Billed oustomers for services performed $ 2.110 30 Paid in cash the following expenses: Salaries and Wages Expense $ 1,800 Miscellaneous Office Expense 85 30 Counted the supplies and identified the amount consumed. $ 330 Actions to take: 1 Prepare the General Ledger for the following accounts and register each transaction mentioned above including closing. Cash Accounts Receivable Supplies Equipment Accumulated Depreciation-Equipment Accounts Payable Ownet' Capital Owner' Drawings (optional) Service Revenue Rent Expense Office Expense Salaries and Wages Expense Supplies Expense Depreciation Expense Income Summary 2 Prepare the Trial Balance (including date) 3 Prepare the income Statement (including date) Prepare the Statement of Owner's Equity, including date) 5 Prepare the Balance Sheet (including date) 6 Closed the Ledgers 7 Prepare the Closing Journal Entries 8 Prepare the Post Closing Trial Balance (including del General Ledger Cash Date Description Debit Post. Ref. Credit Balance $ - $ September Beginning Balance 1-Sep Owner Capital Cash $ $ 20,000 $ 20,000 $20,000 8-Sep $ 1690 Cash Service Revenue $ 1,690 $ 21,690 $ 980 20-Sep Cash Service Revenue $ 980 $ 22,670 General Ledger Accounts Receivable Date Description Credit Balance Post. Debit Ref. $ $ 5,820 $ - $ September Beginning Balance 14-Sep Accounts Recievable Unearned Service Revenue $ 5,820 $ 5,820 $ 2.110 25-Sep Accounts Recievable Unearned Service Revenue $ 2.110 $ 7.930 General Ledger Equipment Date Description Debit Credit Balance Post Ref $ - $ September Beginning Balance 2-Sep Equipment Account Payable $ $ 17,280 $ 17.280 $ 17,280 Credit Balance General Ledger Accumulated Depreciation-Equipment Date Description Post. Debit Ref. September Beginning Balance $ 2-Sep Accumulated Depreciation Equip Depreciation Expense $ 3,456 - $ $ $ 3,456 $ 3,456 General Ledger Supplies K LM N 0 R S General Ledger Depreciation 1728075 Supplies Date Description 3456 Debit Credit Balance Post Ref. $ $ 3 942 $3,456 3,456 3,456 3,456 3,456 Septembe Beginning Balance 5-Sep Supllies Cash acc Dep 3,456 6.912 10.368 13 824 17,280 Yeal Year 2 Yew 3 Year4 Years $ 942 $ 942 General Ledger Accounts Payable Date Description Debit Credit Balance Post Ref. $ - September Beginning Balance 18-Sep Accounts Payable Cash $ $ 3,600 $ 3,600 $ 3.600 General Ledger Owner's Capital Date Description Debit Credit Balance Post. Ref. $ $ September Beginning Balance Ovher Capital Owner Vithday 3-Sep $ 3,000 $ 3,000 $ 3.000 General Ledger Income Summary Date Description Post Rel. Debit Credit Balance Beginning Balance 3 $ General Ledger Service Revenue Date Description Debit Credit Post Rel Balance Beginning Balance $ $ $ LM N S T VW R General Ledger Service Revenue Date Description Debit Credit Balance Post Ref. Beginning Balance $ $ $ General Ledger Rent Expense Date Description Debit Credit Balance Post Ref. $ $ September Beginning Balance 4-Sep Fent Expense Cash + $ 680 $ 680 $ 680 General Ledger Office Expense Date Description Debit Credit Balance Post Ref. $ $ September Beginning Balance 10-Sep Offense Expense Account payable $ $ 430 $ 430 $ 430 $ 35 30-Sep Miscellaneous Expense Cash $ 85 515 General Ledger Salaries and Vages Expense Date Description Debit Post Ret Credit Balance $ $ September Beginning Balance 30-Sep Salaris/Wages Expense Cash $ $ 1800 $ 1,800 $ 1800 General Ledger Supplies Expense Date Description Credit Balance Post Debit Ref. $ $ 330 99 $ September Beginning Balance 30. sep Suplies Expense Supilies # 3.30 $ 330 General Ledger Depreciation Expense Date Description Debit Credit Balance Post Ref. Beginning Balance $ $Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started