I need help from Q8 to Q12 in filling the template and solving the questions

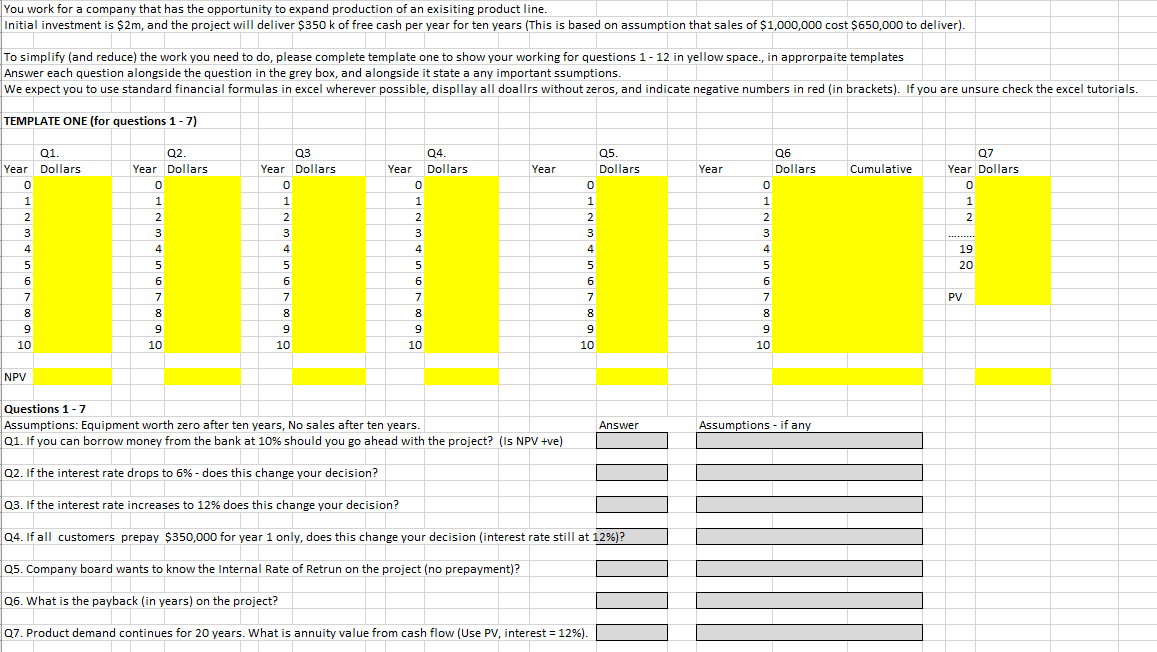

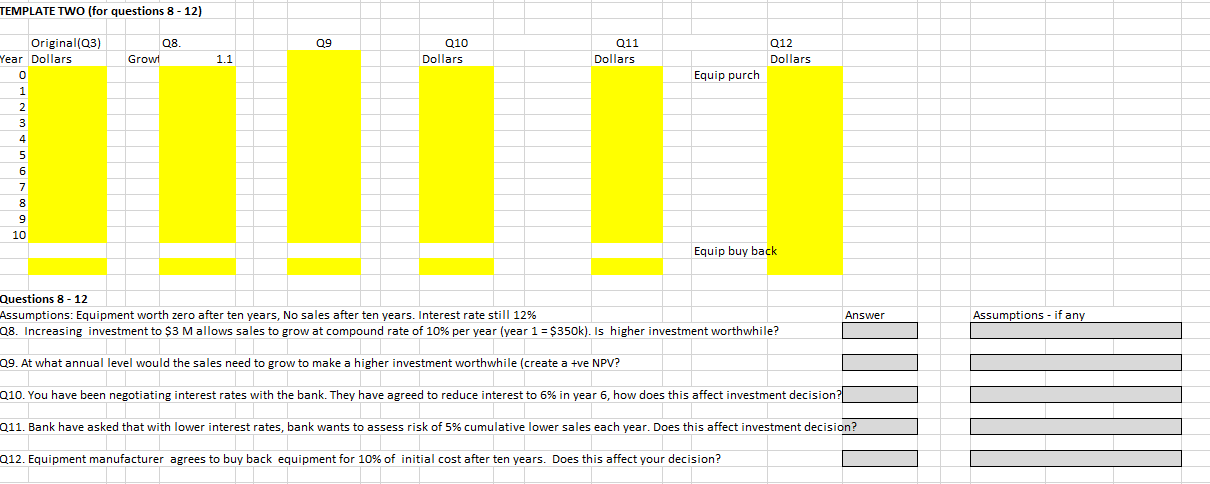

You work for a company that has the opportunity to expand production of an exisiting product line. Initial investment is $2m, and the project will deliver $350 k of free cash per year for ten years (This is based on assumption that sales of $1,000,000 cost $650,000 to deliver). To simplify (and reduce) the work you need to do, please complete template one to show your working for questions 1 - 12 in yellow space., in approrpaite templates Answer each question alongside the question in the grey box, and alongside it state a any important ssumptions. We expect you to use standard financial formulas in excel wherever possible, display all doallrs without zeros, and indicate negative numbers in red (in brackets). If you are unsure check the excel tutorials. TEMPLATE ONE (for questions 1 - 7) Year Q5. Dollars 0 Year Cumulative Q6 Dollars 0 1 Q7 Year Dollars 0 1 2 Q1. Year Dollars 0 1 1 2 2 2 3 3 4 7 5 2 5 6 7 8 9 10 Q2. Year Dollars 0 1 2 4 3 4 5 6 O 7 7 8 9 10 Q3 Year Dollars 0 1 2 4 3 4 5 2 6 7 7 8 9 10 Q4. Year Dollars 0 1 2 3 4 5 6 6 7 8 9 10 19 20 1 2 3 4 4 5 6 6 7 1 8 9 10 2 3 3 4 4 5 6 6 7 7 8 9 9 10 PV NPV Questions 1-7 Assumptions: Equipment worth zero after ten years, No sales after ten years. Q1. If you can borrow money from the bank at 10% should you go ahead with the project? (Is NPV +ve) Answer Assumptions - if any Q2. If the interest rate drops to 6%- does this change your decision? Q3. If the interest rate increases to 12% does this change your decision? Q4. If all customers prepay $350,000 for year 1 only, does this change your decision (interest rate still at 12%)? Q5. Company board wants to know the Internal Rate of Retrun on the project (no prepayment)? Q6. What is the payback (in years) on the project? Q7. Product demand continues for 20 years. What is annuity value from cash flow (Use PV, interest = 12%). TEMPLATE TWO (for questions 8-12) 09 Original(23) Year Dollars 0 08. Growt Q10 Dollars Q11 Dollars Q12 Dollars 1.1 Equip purch 10 Equip buy back Questions 8 - 12 Assumptions: Equipment worth zero after ten years, No sales after ten years. Interest rate still 12% 08. Increasing investment to $3 M allows sales to grow at compound rate of 10% per year (year 1 = $350k). Is higher investment worthwhile? Answer Assumptions - if any 09. At what annual level would the sales need to grow to make a higher investment worthwhile (create a tve NPV? Q10. You have been negotiating interest rates with the bank. They have agreed to reduce interest to 6% in year 6, how does this affect investment decision? 011. Bank have asked that with lower interest rates, bank wants to assess risk of 5% cumulative lower sales each year. Does this affect investment decision? 012. Equipment manufacturer agrees to buy back equipment for 10% of initial cost after ten years. Does this affect your decision? You work for a company that has the opportunity to expand production of an exisiting product line. Initial investment is $2m, and the project will deliver $350 k of free cash per year for ten years (This is based on assumption that sales of $1,000,000 cost $650,000 to deliver). To simplify (and reduce) the work you need to do, please complete template one to show your working for questions 1 - 12 in yellow space., in approrpaite templates Answer each question alongside the question in the grey box, and alongside it state a any important ssumptions. We expect you to use standard financial formulas in excel wherever possible, display all doallrs without zeros, and indicate negative numbers in red (in brackets). If you are unsure check the excel tutorials. TEMPLATE ONE (for questions 1 - 7) Year Q5. Dollars 0 Year Cumulative Q6 Dollars 0 1 Q7 Year Dollars 0 1 2 Q1. Year Dollars 0 1 1 2 2 2 3 3 4 7 5 2 5 6 7 8 9 10 Q2. Year Dollars 0 1 2 4 3 4 5 6 O 7 7 8 9 10 Q3 Year Dollars 0 1 2 4 3 4 5 2 6 7 7 8 9 10 Q4. Year Dollars 0 1 2 3 4 5 6 6 7 8 9 10 19 20 1 2 3 4 4 5 6 6 7 1 8 9 10 2 3 3 4 4 5 6 6 7 7 8 9 9 10 PV NPV Questions 1-7 Assumptions: Equipment worth zero after ten years, No sales after ten years. Q1. If you can borrow money from the bank at 10% should you go ahead with the project? (Is NPV +ve) Answer Assumptions - if any Q2. If the interest rate drops to 6%- does this change your decision? Q3. If the interest rate increases to 12% does this change your decision? Q4. If all customers prepay $350,000 for year 1 only, does this change your decision (interest rate still at 12%)? Q5. Company board wants to know the Internal Rate of Retrun on the project (no prepayment)? Q6. What is the payback (in years) on the project? Q7. Product demand continues for 20 years. What is annuity value from cash flow (Use PV, interest = 12%). TEMPLATE TWO (for questions 8-12) 09 Original(23) Year Dollars 0 08. Growt Q10 Dollars Q11 Dollars Q12 Dollars 1.1 Equip purch 10 Equip buy back Questions 8 - 12 Assumptions: Equipment worth zero after ten years, No sales after ten years. Interest rate still 12% 08. Increasing investment to $3 M allows sales to grow at compound rate of 10% per year (year 1 = $350k). Is higher investment worthwhile? Answer Assumptions - if any 09. At what annual level would the sales need to grow to make a higher investment worthwhile (create a tve NPV? Q10. You have been negotiating interest rates with the bank. They have agreed to reduce interest to 6% in year 6, how does this affect investment decision? 011. Bank have asked that with lower interest rates, bank wants to assess risk of 5% cumulative lower sales each year. Does this affect investment decision? 012. Equipment manufacturer agrees to buy back equipment for 10% of initial cost after ten years. Does this affect your decision