Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help fulfilling the Excel spreadsheet using the directions above. The Owens Chocolatier Company is a midsized company operating in Virginia Beach, VA. The

I need help fulfilling the Excel spreadsheet using the directions above.

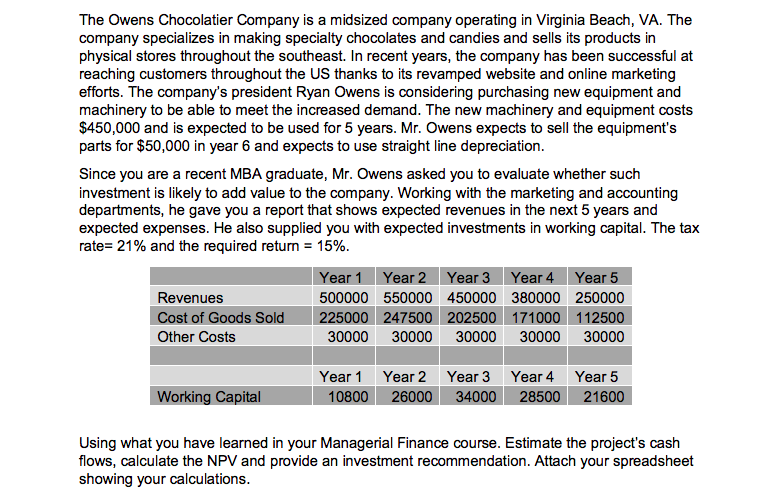

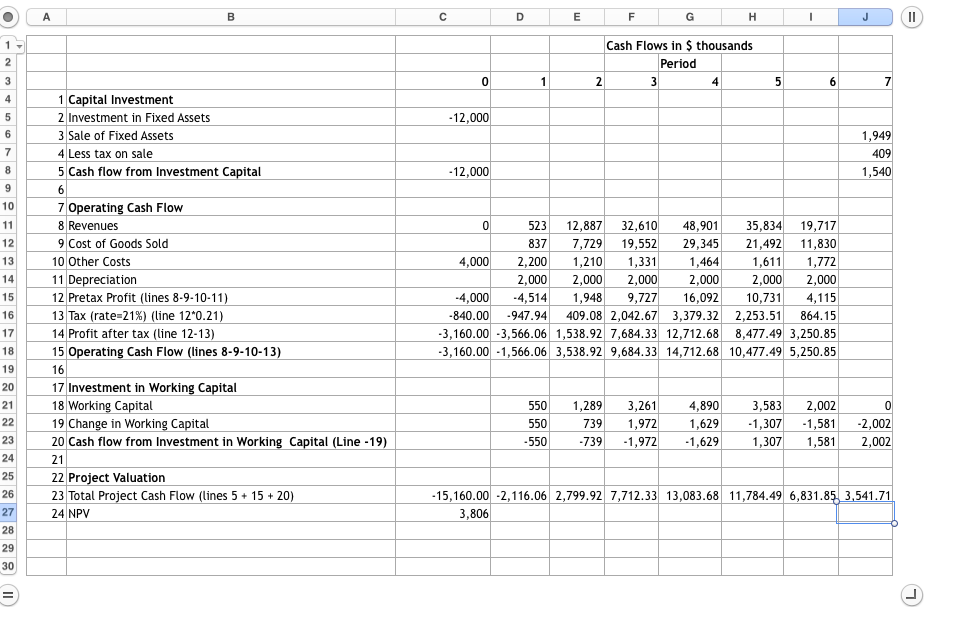

The Owens Chocolatier Company is a midsized company operating in Virginia Beach, VA. The company specializes in making specialty chocolates and candies and sells its products in physical stores throughout the southeast. In recent years, the company has been successful at reaching customers throughout the US thanks to its revamped website and online marketing efforts. The company's president Ryan Owens is considering purchasing new equipment and machinery to be able to meet the increased demand. The new machinery and equipment costs $450,000 and is expected to be used for 5 years. Mr. Owens expects to sell the equipment's parts for $50,000 in year 6 and expects to use straight line depreciation. Since you are a recent MBA graduate, Mr. Owens asked you to evaluate whether such investment is likely to add value to the company. Working with the marketing and accounting departments, he gave you a report that shows expected revenues in the next 5 years and expected expenses. He also supplied you with expected investments in working capital. The tax rate=21% and the required return = 15%. Year 1 Year 2 Year 3 Year 4 Year 5 Revenues 500000 550000 450000 380000 250000 Cost of Goods Sold 225000 247500 202500 171000 112500 Other Costs 30000 30000 30000 30000 30000 Working Capital Year 1 Year 2 Year 3 Year 4 Year 5 10800 26000 34000 28500 21600 Using what you have learned in your Managerial Finance course. Estimate the project's cash flows, calculate the NPV and provide an investment recommendation. Attach your spreadsheet showing your calculations. A B D E F H . J Il 1- 2 Cash Flows in $ thousands Period 2 3 4 0 1 5 6 7 - 12,000 1,949 409 1,540 8 -12,000 9 10 11 12 13 14 1 Capital Investment 2 Investment in Fixed Assets 3 Sale of Fixed Assets 4 Less tax on sale 5 Cash flow from Investment Capital 6 7 Operating Cash Flow 8 Revenues 9 Cost of Goods Sold 10 Other Costs 11 Depreciation 12 Pretax Profit (lines 8-9-10-11) 13 Tax (rate-21%) (line 12*0.21) 14 Profit after tax (line 12-13) 15 Operating Cash Flow (lines 8-9-10-13) 16 17 Investment in Working Capital 18 Working Capital 19 Change in Working Capital 20 Cash flow from Investment in Working Capital (Line -19) 21 22 Project Valuation 23 Total Project Cash Flow (lines 5 + 15 + 20) 24 NPV 0 523 12,887 32,610 48,901 35,834 19,717 837 7,729 19,552 29,345 21,492 11,830 4,000 2,200 1,210 1,331 1,464 1,611 1,772 2,000 2,000 2,000 2,000 2,000 2,000 -4,000 -4,514 1,948 9,727 16,092 10,731 4,115 -840.00 -947.94 409.08 2,042.67 3,379.32 2,253.51 864.15 -3,160.00 -3,566.06 1,538.92 7,684.33 12,712.68 8,477.49 3,250.85 -3,160.00 -1,566.06 3,538.92 9,684.33 14,712.68 10,477.49 5,250.85 15 16 17 18 19 20 21 22 23 24 550 550 -550 1,289 739 -739 3,261 1,972 -1,972 4,890 1,629 -1,629 3,583 -1,307 1,307 2,002 -1,581 1,581 0 -2,002 2,002 25 26 -15,160.00 -2,116.06 2,799.92 7,712.33 13,083.68 11,784.49 6,831.85 3,541.71 3,806 27 28 29 30Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started