I need Help

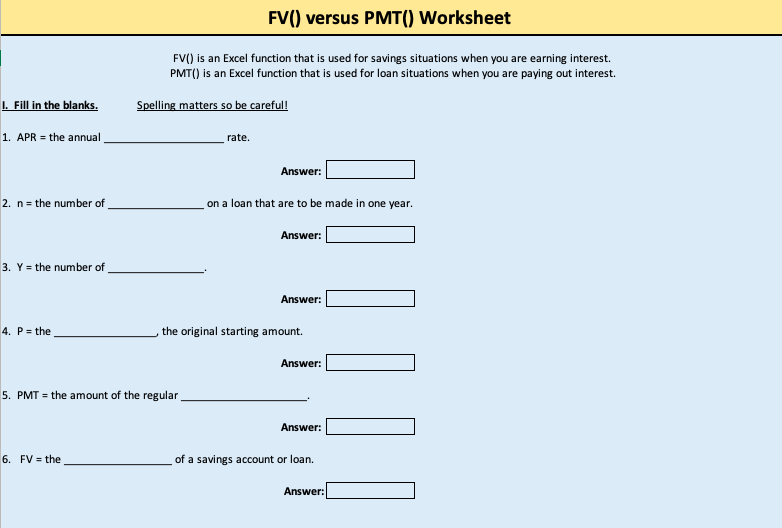

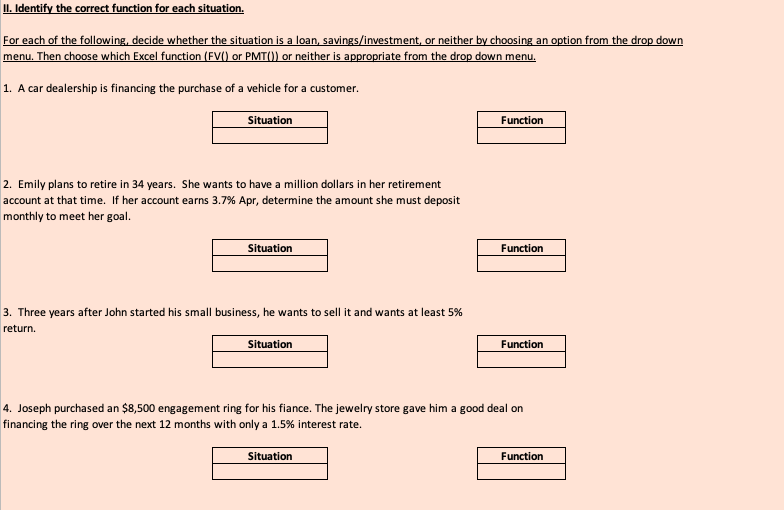

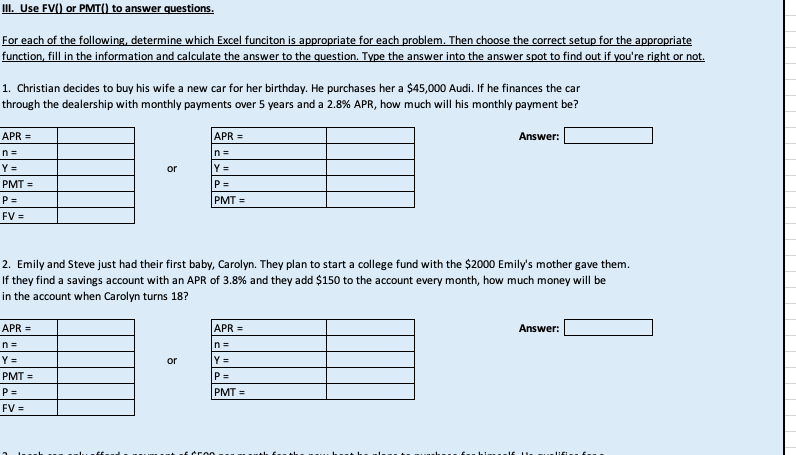

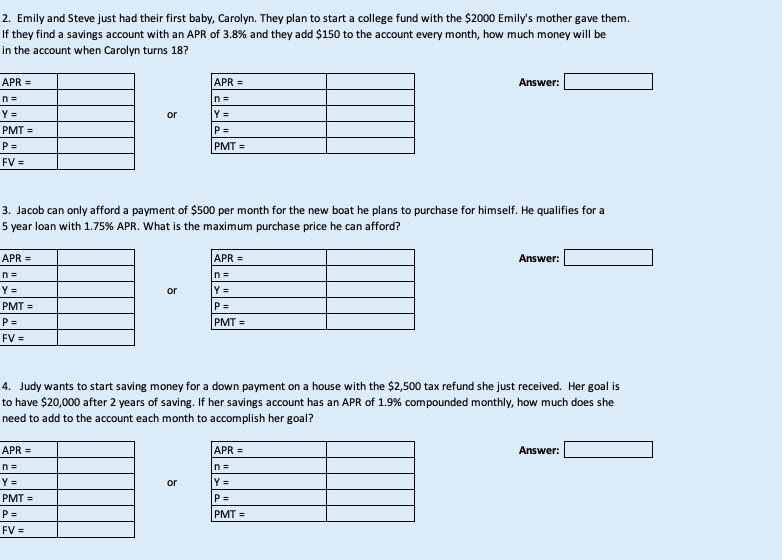

FV() versus PMT() Worksheet FV() is an Excel function that is used for savings situations when you are earning interest. PMT() is an Excel function that is used for loan situations when you are paying out interest. 1. Fill in the blanks. Spelling matters so be careful! 1. APR = the annual rate. Answer: 2. n = the number of on a loan that are to be made in one year. Answer: 3. Y = the number of Answer: 4. P = the the original starting amount. Answer: 5. PMT = the amount of the regular Answer: 6. FV = the of a savings account or loan. Answer:Il. Identify the correct function for each situation. For each of the following, decide whether the situation is a loan, savings/investment, or neither by choosing an option from the drop down menu. Then choose which Excel function (FV() or PMT() or neither is appropriate from the drop down menu. 1. A car dealership is financing the purchase of a vehicle for a customer. Situation Function 2. Emily plans to retire in 34 years. She wants to have a million dollars in her retirement account at that time. If her account earns 3.7% Apr, determine the amount she must deposit monthly to meet her goal. Situation Function 3. Three years after John started his small business, he wants to sell it and wants at least 5% return. Situation Function 4. Joseph purchased an $8,500 engagement ring for his fiance. The jewelry store gave him a good deal on financing the ring over the next 12 months with only a 1.5% interest rate. Situation FunctionIll. Use FV() or PMT() to answer questions. For each of the following, determine which Excel funciton is appropriate for each problem. Then choose the correct setup for the appropriate function, fill in the information and calculate the answer to the question. Type the answer into the answer spot to find out if you're right or not. 1. Christian decides to buy his wife a new car for her birthday. He purchases her a $45,000 Audi. If he finances the car through the dealership with monthly payments over 5 years and a 2.8%% APR, how much will his monthly payment be? APR = APR = Answer: n = Y = or V = PMT = P = P = PMT = FV = 2. Emily and Steve just had their first baby, Carolyn. They plan to start a college fund with the $2000 Emily's mother gave them. If they find a savings account with an APR of 3.8% and they add $150 to the account every month, how much money will be in the account when Carolyn turns 18? APR = APR = Answer: n = Y = or Y = PMT = P = P = PMT = FV =2. Emily and Steve just had their first baby, Carolyn. They plan to start a college fund with the $2000 Emily's mother gave them. If they find a savings account with an APR of 3.8% and they add $150 to the account every month, how much money will be in the account when Carolyn turns 18? APR = APR = Answer: n= n = Y = or Y = PMT = P = P = PMT = FV = 3. Jacob can only afford a payment of $500 per month for the new boat he plans to purchase for himself. He qualifies for a 5 year loan with 1.75% APR. What is the maximum purchase price he can afford? APR = APR = Answer: n= n = Y = or Y = PMT = P = P = PMT = FV = 4. Judy wants to start saving money for a down payment on a house with the $2,500 tax refund she just received. Her goal is to have $20,000 after 2 years of saving. If her savings account has an APR of 1.9% compounded monthly, how much does she need to add to the account each month to accomplish her goal? APR = APR = Answer: n= n = Y = or Y = PMT = P = P = PMT = FV =