Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help how to do all the steps included in the problem and explaination too. Also if anything is it possible if excel can

I need help how to do all the steps included in the problem and explaination too. Also if anything is it possible if excel can be used too.

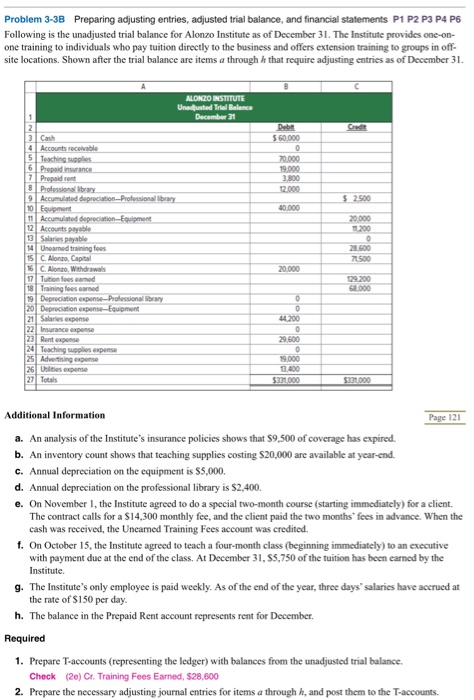

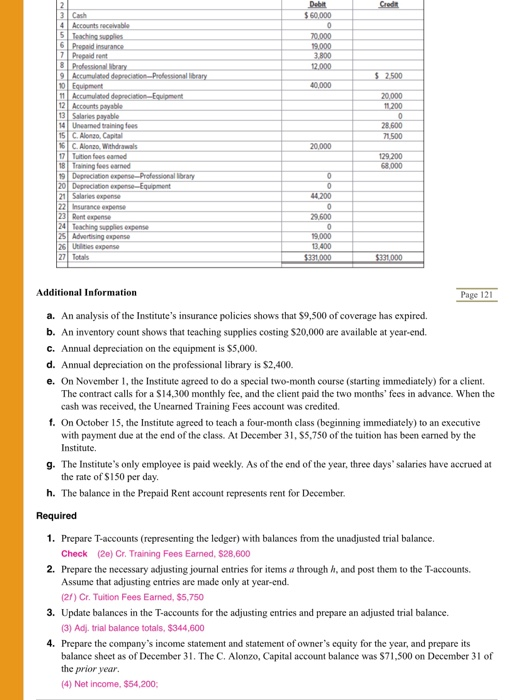

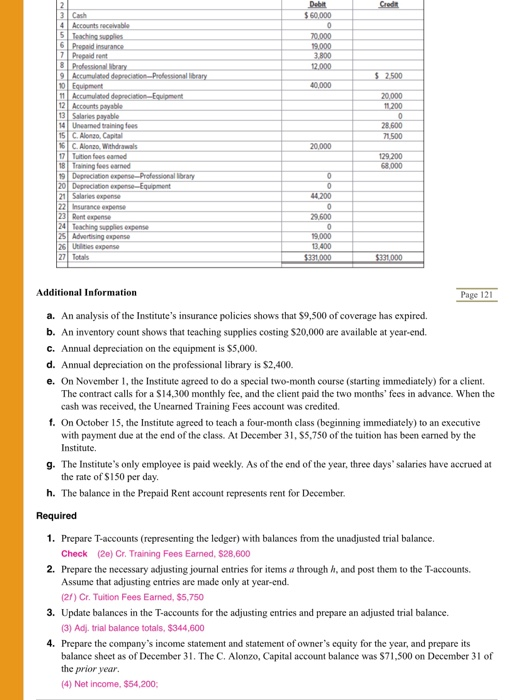

Problem 3-3B Preparing adjusting entries, adjusted trial balance, and financial statements P1 P2 P3 P4 P5 Following is the unadjusted trial balance for Alonzo Institute as of December 31. The Institute provides one-on- one training to individuals who pay tuition directly to the business and offers extension training to groups in off- site locations. Shown after the trial balance are items a through that require adjusting entries as of December 31. ALORZO INSTITUTE Traiyaala thal talam) December 4 Account st GP 2 P Professional 9 Accum depreciation Professional beary Foun Acum deprecation Equipment 12 Accounts payable Sare payable Umegfos 151 Alonga Capital Wews Tuonos med 18 Traming samed 19 Depreciation expense Professional library 20 Depreciation expense-Equipment Scenes 22surance expense . 44.200 24 Teaching sus swing pense 19000 3.400 Additional Information Page 121 a. An analysis of the Institute's insurance policies shows that $9.500 of coverage has expired. b. An inventory count shows that teaching supplies costing $20,000 are available at year-end C. Annual depreciation on the equipment is $5,000. d. Annual depreciation on the professional library is $2,400 e. On November 1, the Institute agreed to do a special two-month course (starting immediately) for a client The contract calls for a $14,300 monthly fee, and the client paid the two months' fees in advance. When the cash was received, the Uneamed Training Fees account was credited f. On October 15, the Institute agreed to teach a four-month class (beginning immediately) to an executive with payment due at the end of the class. At December 31, 55,750 of the tuition has been carned by the Institute 9. The Institute's only employee is paid weekly. As of the end of the year, three days'salaries have accrued at the rate of $150 per day h. The balance in the Prepaid Rent account represents rent for December Required 1. Prepare T-accounts (representing the ledger) with balances from the unadjusted trial balance. Check (20) Ct. Training Fees Earned, $28,600 2. Prepare the necessary adjusting journal entries for items a through h, and post them to the T-accounts. Debat $60.000 79.000 1000 3.800 12.000 0 000 4 Accounta ble S Teaching supplies Produce 7 Pro Powy 9Accuero Pala Equipment Ro c o Equi copy Salpable 14 Uoming fees Along Along with To samed 28600 71_500 20.000 Deco DE 44.200 29600 25 Advertising expense 19.000 137400 $221000 Additional Information Page 121 a. An analysis of the Institute's insurance policies shows that $9,500 of coverage has expired. b. An inventory count shows that teaching supplies costing $20,000 are available at year-end. c. Annual depreciation on the equipment is $5,000. d. Annual depreciation on the professional library is $2,400. e. On November 1, the Institute agreed to do a special two-month course (starting immediately) for a client. The contract calls for a S14,300 monthly fee, and the client paid the two months' fees in advance. When the cash was received, the Unearned Training Fees account was credited. 1. On October 15, the Institute agreed to teach a four-month class (beginning immediately) to an executive with payment due at the end of the class. At December 31, 55,750 of the tuition has been earned by the Institute g. The Institute's only employee is paid weekly. As of the end of the year, three days' salaries have accrued at the rate of $150 per day h. The balance in the Prepaid Rent account represents rent for December Required 1. Prepare T-accounts (representing the ledger) with balances from the unadjusted trial balance. Check (20) Cr. Training Fees Earned, 528,600 2. Prepare the necessary adjusting journal entries for items a through h, and post them to the T-accounts Assume that adjusting entries are made only at year-end. (21) Cr. Tuition Fees Eamed. $5.750 3. Update balances in the T-accounts for the adjusting entries and prepare an adjusted trial balance (3) Adj, trial balance totals $344,600 4. Prepare the company's income statement and statement of owner's equity for the year, and prepare its balance sheet as of December 31. The C. Alonzo, Capital account balance was $71,500 on December 31 of the prior year. (4) Net income, $54,200 thank you

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started