Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help i need some assistance. Looking at Alibaba (BABA) on the NYSE. Choose one of the financial ratios and use it to assess

I need help

i need some assistance.

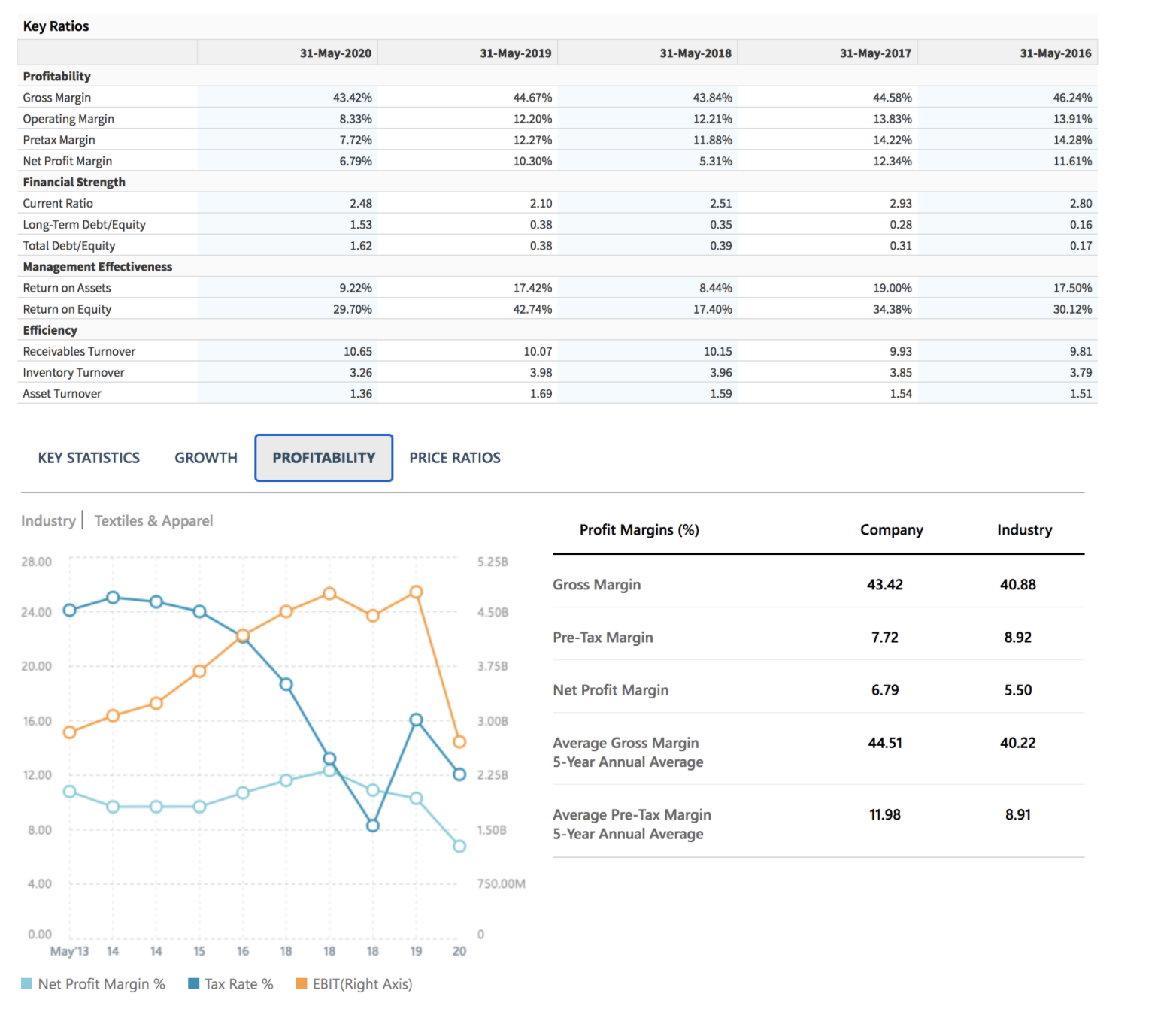

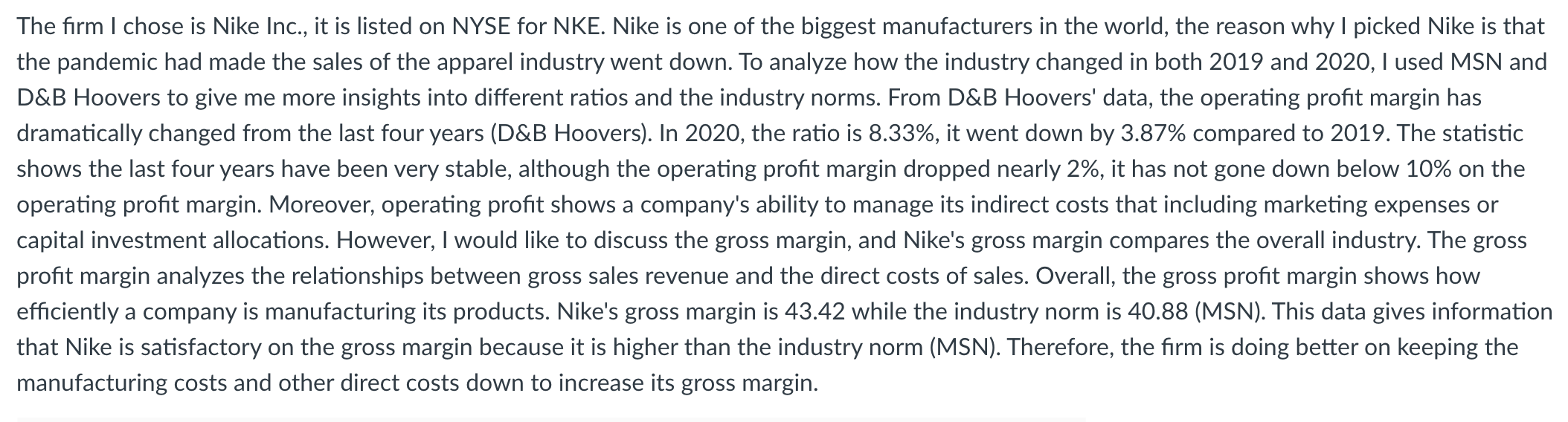

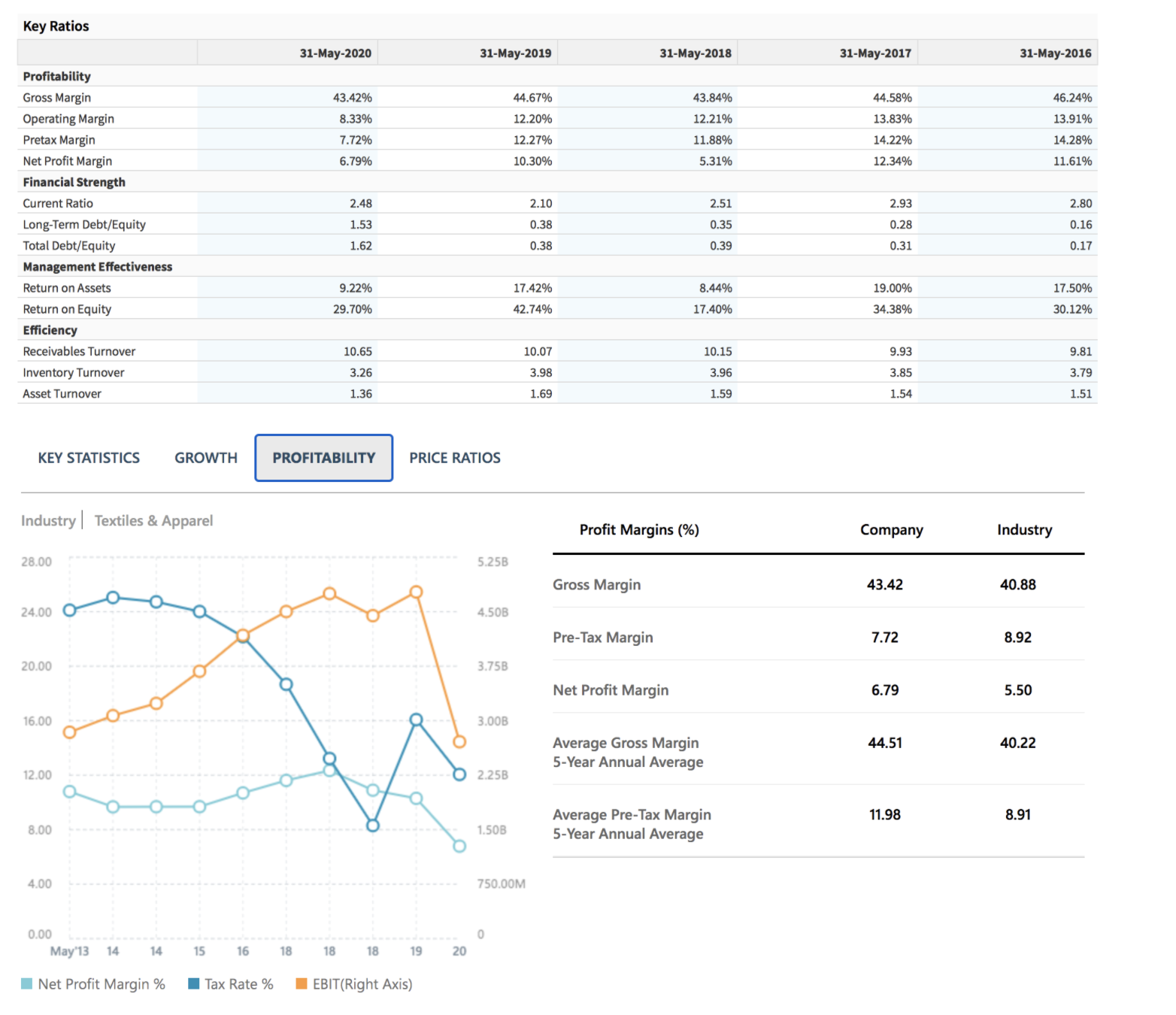

- Looking at Alibaba (BABA) on the NYSE. Choose one of the financial ratios and use it to assess the financial health of the company; 2019 & 2020 (keep in mind that each ratio conveys a particular financial information, which needs to be included in your response). Whether the ratio is favorable or unfavorable, defend the use of that ratio to analyze the financial health of the company.

- Then, discuss how the company's ratio compares with the overall industry.

Usehttps://www.msn.com/en-us/money(Links to an external site.)

to make the industry comparison. If you use a different website, include a screenshot or the link to that site.

example:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started