Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help i need the corrections in this format please Complete this question by entering your answers in the tabs below. Prepare closing entries

I need help i need the corrections in this format please

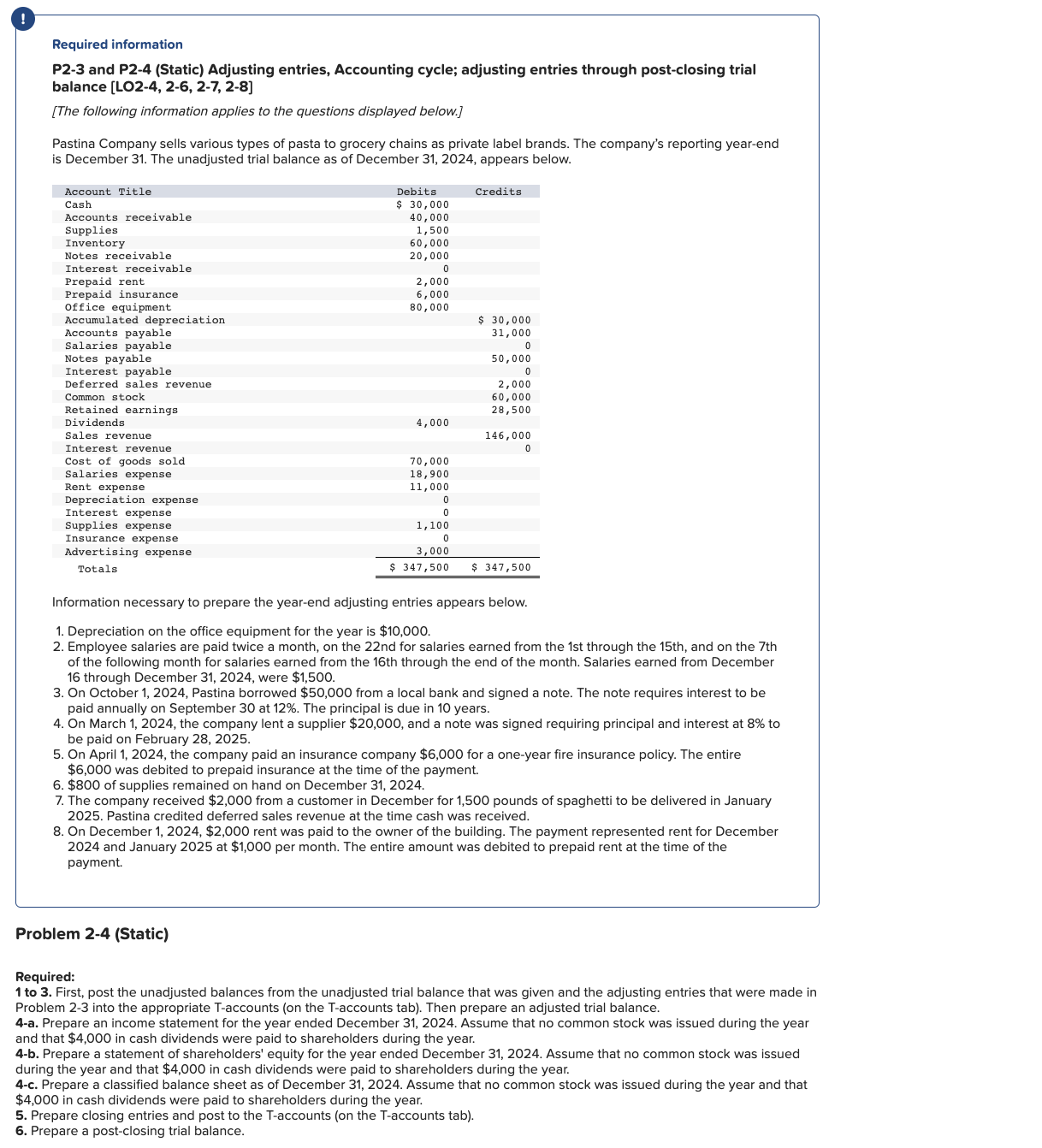

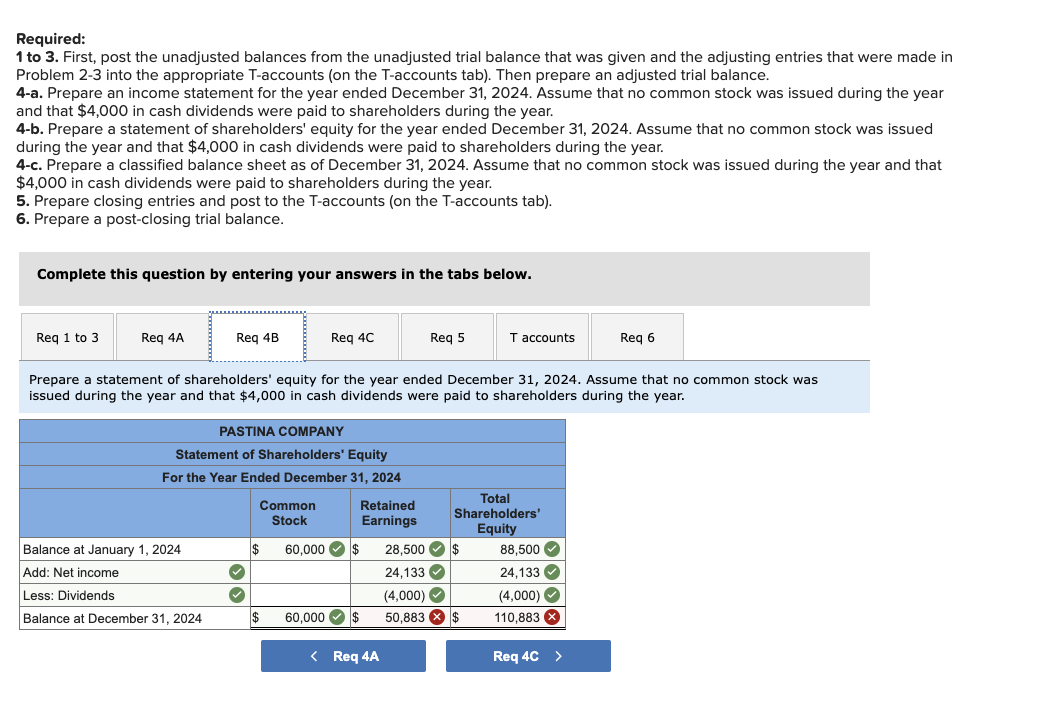

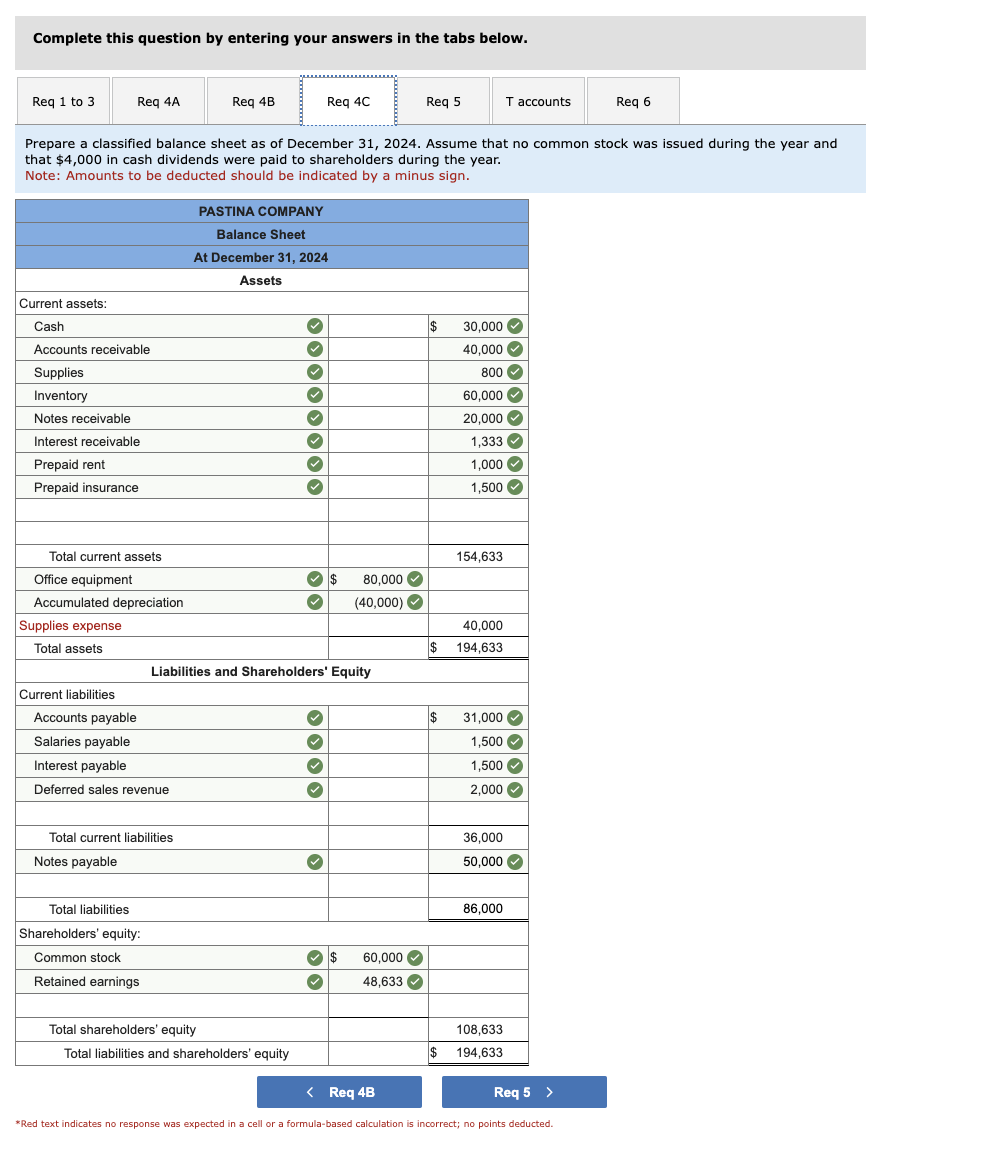

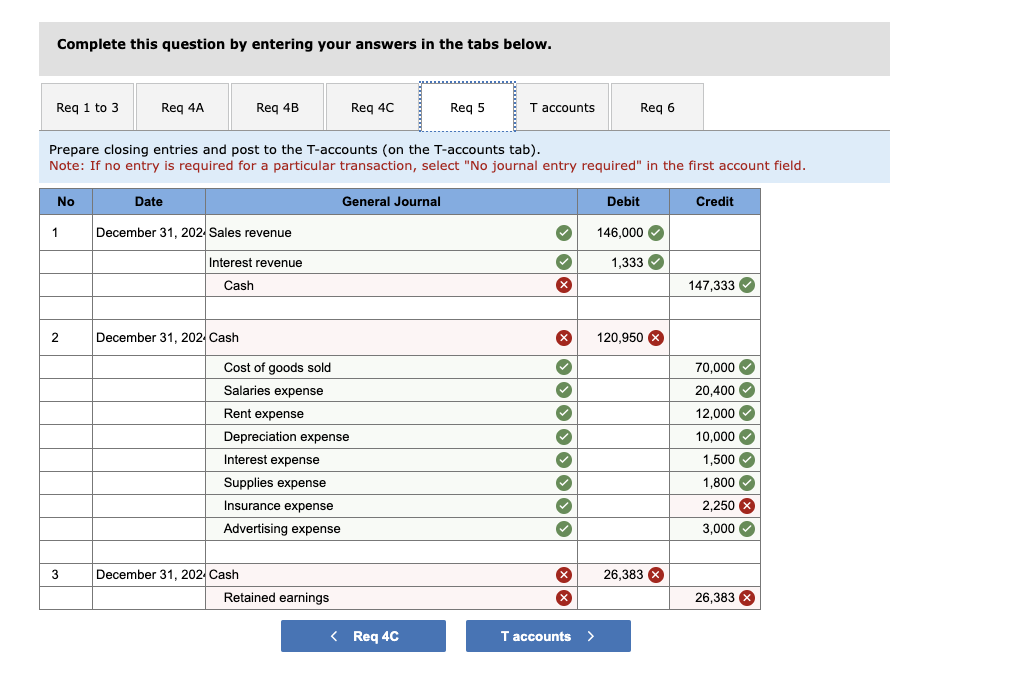

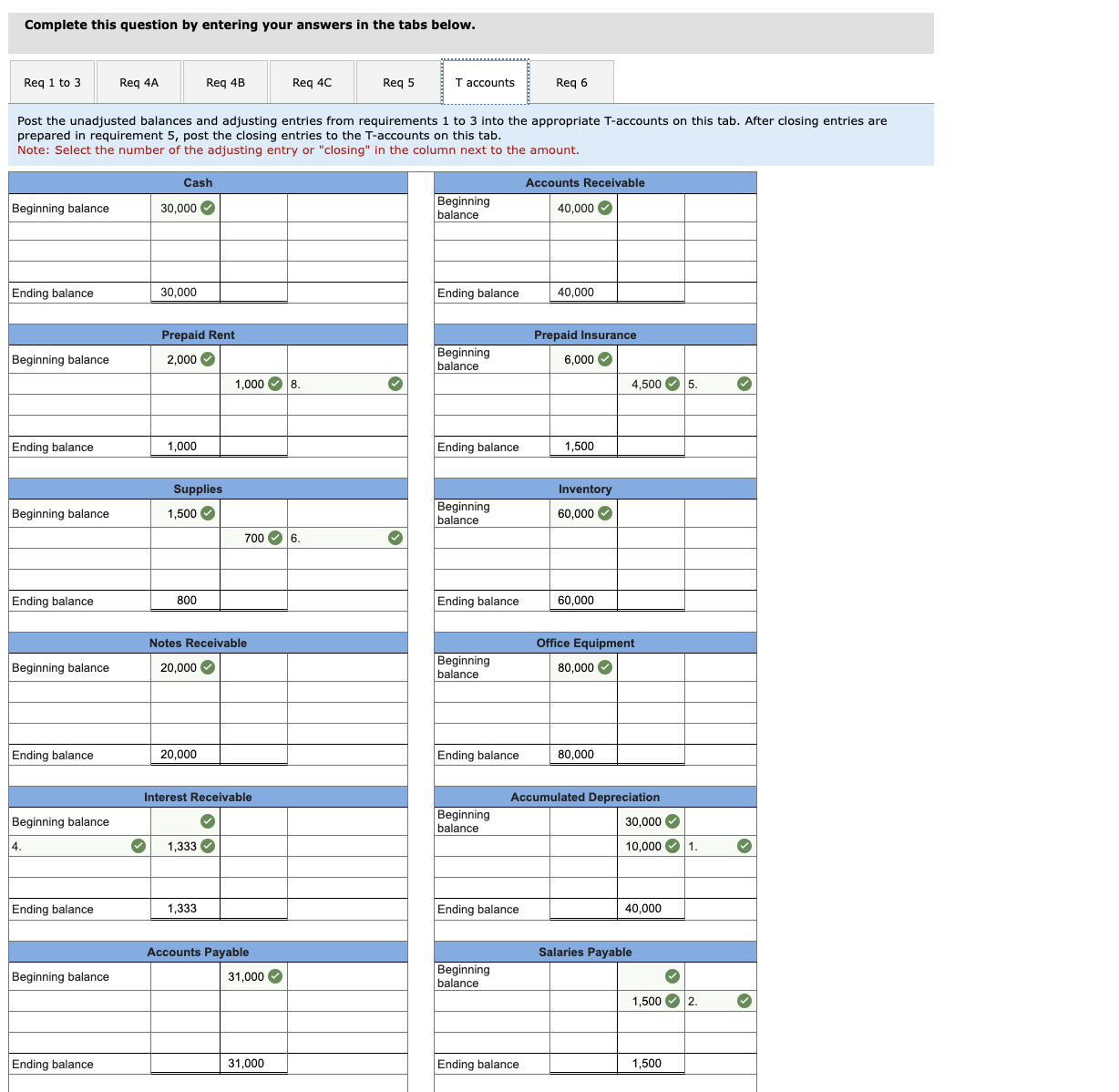

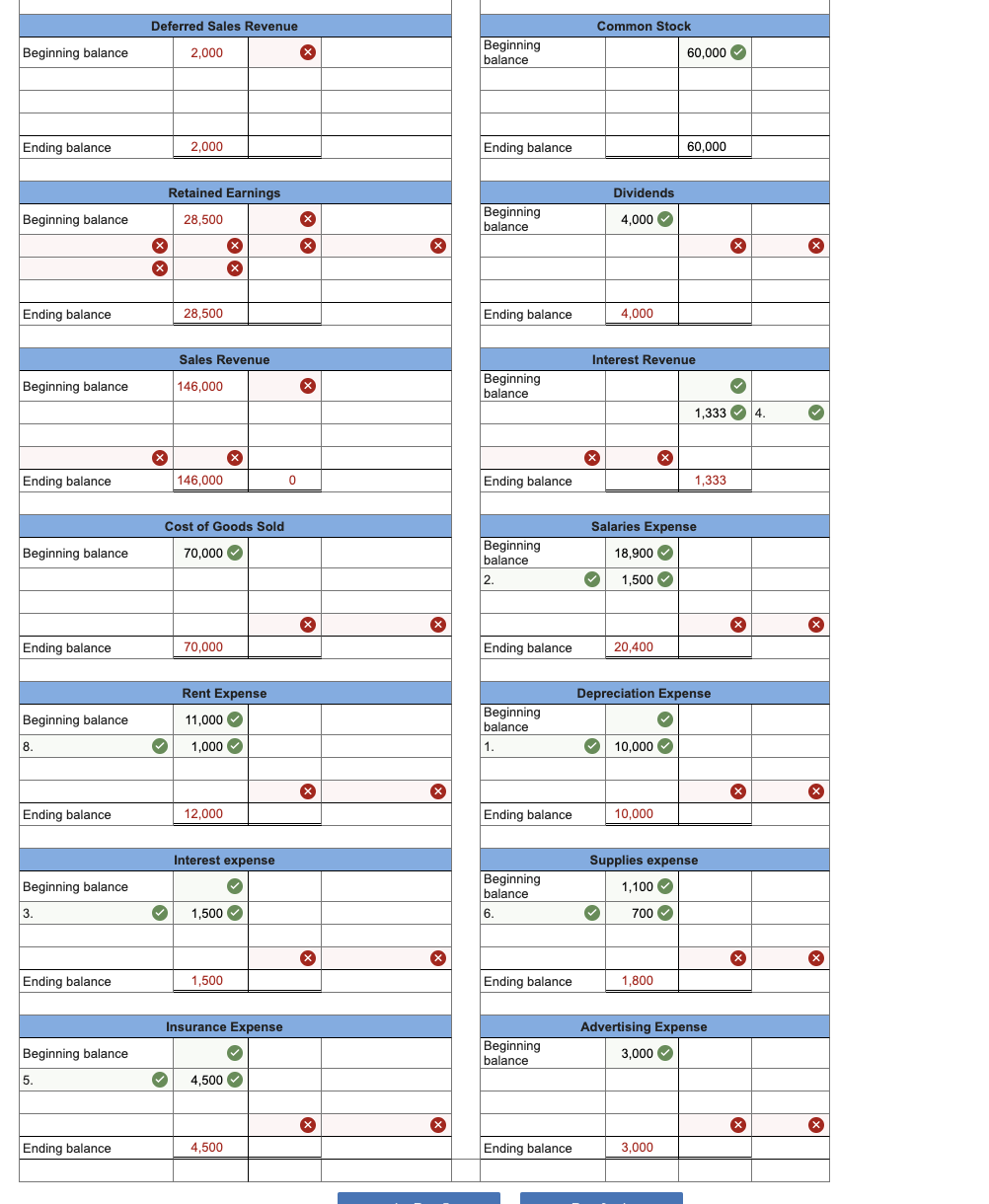

Complete this question by entering your answers in the tabs below. Prepare closing entries and post to the T-accounts (on the T-accounts tab). Note: If no entry is required for a particular transaction, select "No journal entry required" in the first account field. Required: 1 to 3. First, post the unadjusted balances from the unadjusted trial balance that was given and the adjusting entries that were made in Problem 2-3 into the appropriate T-accounts (on the T-accounts tab). Then prepare an adjusted trial balance. 4-a. Prepare an income statement for the year ended December 31, 2024. Assume that no common stock was issued during the year and that $4,000 in cash dividends were paid to shareholders during the year. 4-b. Prepare a statement of shareholders' equity for the year ended December 31,2024 . Assume that no common stock was issued during the year and that $4,000 in cash dividends were paid to shareholders during the year. 4-c. Prepare a classified balance sheet as of December 31, 2024. Assume that no common stock was issued during the year and that $4,000 in cash dividends were paid to shareholders during the year. 5. Prepare closing entries and post to the T-accounts (on the T-accounts tab). 6. Prepare a post-closing trial balance. Complete this question by entering your answers in the tabs below. Prepare a statement of shareholders' equity for the year ended December 31,2024 . Assume that no common stock was issued during the year and that $4,000 in cash dividends were paid to shareholders during the year. Complete this question by entering your answers in the tabs below. Prepare a classified balance sheet as of December 31, 2024. Assume that no common stock was issued during the year and that $4,000 in cash dividends were paid to shareholders during the year. Note: Amounts to be deducted should be indicated by a minus sign. *Red text indicates no response was expected in a cell or a formula-based calculation is incorrect; no points deducted. Complete this question by entering your answers in the tabs below. Post the unadjusted balances and adjusting entries from requirements 1 to 3 into the appropriate T-accounts on this tab. After closing entries are prepared in requirement 5 , post the closing entries to the T-accounts on this tab

Complete this question by entering your answers in the tabs below. Prepare closing entries and post to the T-accounts (on the T-accounts tab). Note: If no entry is required for a particular transaction, select "No journal entry required" in the first account field. Required: 1 to 3. First, post the unadjusted balances from the unadjusted trial balance that was given and the adjusting entries that were made in Problem 2-3 into the appropriate T-accounts (on the T-accounts tab). Then prepare an adjusted trial balance. 4-a. Prepare an income statement for the year ended December 31, 2024. Assume that no common stock was issued during the year and that $4,000 in cash dividends were paid to shareholders during the year. 4-b. Prepare a statement of shareholders' equity for the year ended December 31,2024 . Assume that no common stock was issued during the year and that $4,000 in cash dividends were paid to shareholders during the year. 4-c. Prepare a classified balance sheet as of December 31, 2024. Assume that no common stock was issued during the year and that $4,000 in cash dividends were paid to shareholders during the year. 5. Prepare closing entries and post to the T-accounts (on the T-accounts tab). 6. Prepare a post-closing trial balance. Complete this question by entering your answers in the tabs below. Prepare a statement of shareholders' equity for the year ended December 31,2024 . Assume that no common stock was issued during the year and that $4,000 in cash dividends were paid to shareholders during the year. Complete this question by entering your answers in the tabs below. Prepare a classified balance sheet as of December 31, 2024. Assume that no common stock was issued during the year and that $4,000 in cash dividends were paid to shareholders during the year. Note: Amounts to be deducted should be indicated by a minus sign. *Red text indicates no response was expected in a cell or a formula-based calculation is incorrect; no points deducted. Complete this question by entering your answers in the tabs below. Post the unadjusted balances and adjusting entries from requirements 1 to 3 into the appropriate T-accounts on this tab. After closing entries are prepared in requirement 5 , post the closing entries to the T-accounts on this tab Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started