i need help in figuring out number 4

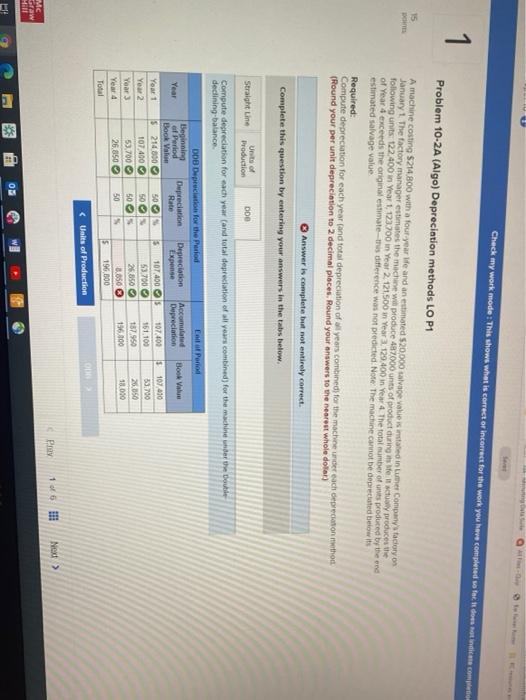

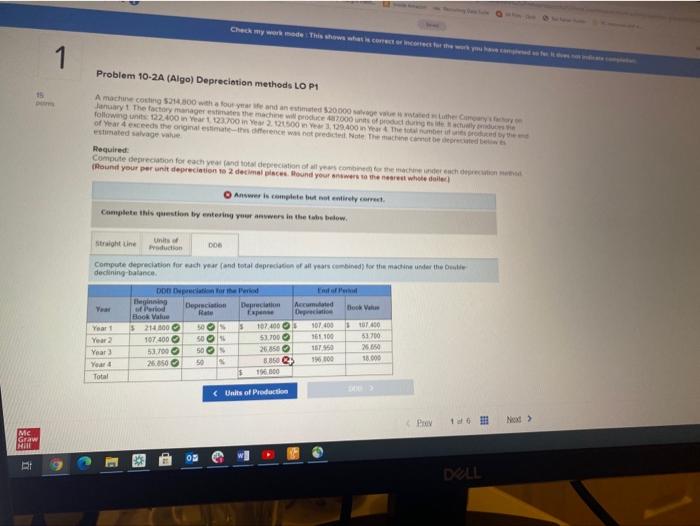

Check my work mode: This shows what is corrector incorrect for the work you have completed so far, it does not indicate complete 1 Problem 10-2A (Algo) Depreciation methods LO P1 15 A machine costing $214 800 with a four year and an estimated $20.000 avevalused in Lume Companyadoro January 1 The factory manager estimates the machine will produce 487000 unts of product during med produces following units 122.400 in Year 1.123.700 in Year 2.121500 in Year 129.400 in Yew The total number of units produced by the end of Year 4 exceeds the original estimate this difference was not predicted. Note: The machine cannot be deprecated below estimated salvage value Required: Compute depreciation for each year and total depreciation of years combined for the machine under each depreciation method (Round your per unit depreciation to 2 decimal places. Round your answers to the nearest whole dolar) Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Straight line Units of Production ODO Compute decreciation for each year and total depreciation of all years combined) for the machine under the Double declining balance Year Yeart You 2 Year Yeard Total DDB Depreciation for the Period Beginning of Period Depreciation Depreciation Book Valur Expense $ 214800 50 $ 107 400 107 400 50 53.700 53.700 50 26.850 26.050 30 8.056 5 196 000 Call of Period Accomutatud Depreciation Book Value 107.000 Is 107 410 151.100 33.700 137.950 26.050 196.000 18000 Mc Graw Hill 1 Problem 10-2A (Algo) Depreciation methods LO P1 A machine coch 14.00 houtyewe ndanese S20 000 geted the many January 1 The factory managers the machine wote 7000 g following 192.400 in Yeart 123.700 2.2500.00.40 Themed of Year exceeds the original state terence was not predetected mated salvage value Required Compute depreciation for each year and total deprecatione (Round your per unit depreciation to 2 decimal place Round your whole Answer is complete but not entirely.com Complete this question by entering your wars in the the below straight line units of Production Compute depreciation for each year and total apreciation of all years combined) for the machine under the best declining balance Year Accumulated to V Yeart Year 2 Year Year Total DDB preciation for the Period Beginning Depreciation Depec Book Value Exp $ 214800 50S 107.000 107 400 503 53.700 53.700 50S 26856 26850 50 8850 3 1300 107.000 6.100 1650 100 17.400 53.700 ES 18.000 MC Graw Hill du 3 RE E DELL