Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help in question b, thankyou. Question 2) (Adapted from Chow, L., Kan, S., Taylor, D. & Tsui, C. (2006). Advanced Financial Accounting in

I need help in question b, thankyou.

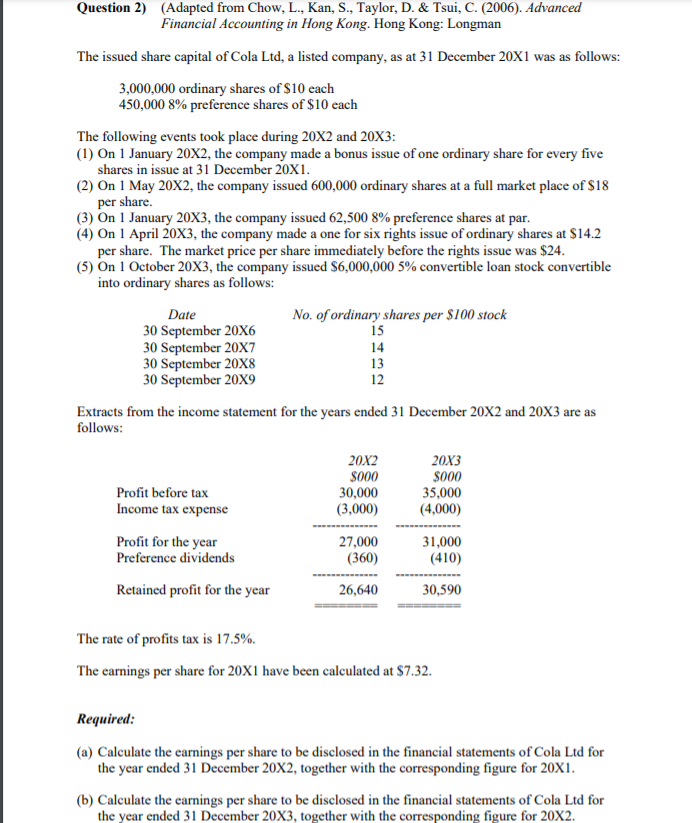

Question 2) (Adapted from Chow, L., Kan, S., Taylor, D. & Tsui, C. (2006). Advanced Financial Accounting in Hong Kong Hong Kong: Longman The issued share capital of Cola Ltd, a listed company, as at 31 December 20X1 was as follows: 3,000,000 ordinary shares of $10 each 450,000 8% preference shares of $10 each The following events took place during 20X2 and 20X3: (1) On 1 January 20X2, the company made a bonus issue of one ordinary share for every five shares in issue at 31 December 20X1. (2) On 1 May 20X2, the company issued 600,000 ordinary shares at a full market place of $18 per share. (3) On 1 January 20X3, the company issued 62,500 8% preference shares at par. (4) On 1 April 20X3, the company made a one for six rights issue of ordinary shares at $14.2 per share. The market price per share immediately before the rights issue was $24. (5) On 1 October 20X3, the company issued $6,000,000 5% convertible loan stock convertible into ordinary shares as follows: Date No. of ordinary shares per $100 stock 30 September 20X6 15 30 September 20X7 14 30 September 20x8 13 30 September 20x9 12 Extracts from the income statement for the years ended 31 December 20X2 and 20x3 are as follows: 20X2 $000 30,000 (3,000) 27,000 (360) 20x3 $000 35,000 (4,000) Profit before tax Income tax expense Profit for the year Preference dividends Retained profit for the year 31,000 (410) 26,640 30,590 The rate of profits tax is 17.5%. The earnings per share for 20X1 have been calculated at $7.32. Required: (a) Calculate the earnings per share to be disclosed in the financial statements of Cola Ltd for the year ended 31 December 20X2, together with the corresponding figure for 20X1. (b) Calculate the earnings per share to be disclosed in the financial statements of Cola Ltd for the year ended 31 December 20X3, together with the corresponding figure for 20X2Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started