I need help in this question. Please do it correctly and 100% and do not make any mistake.

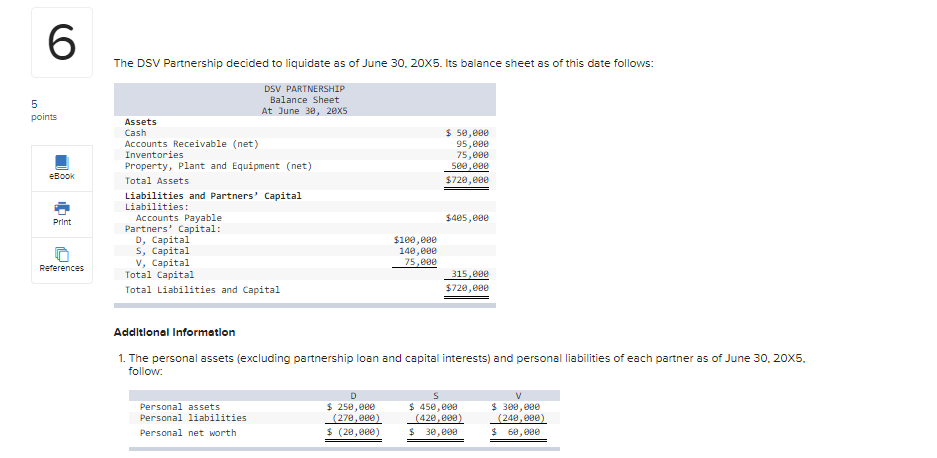

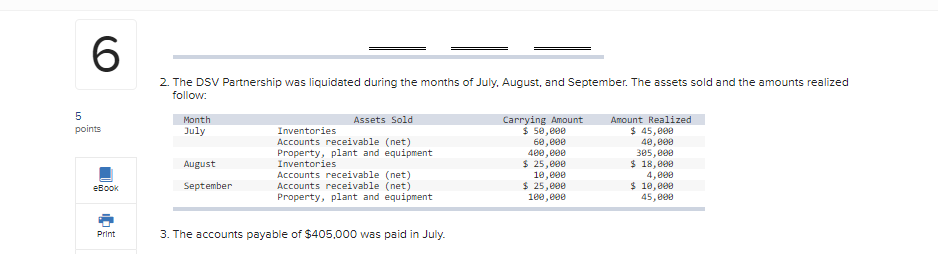

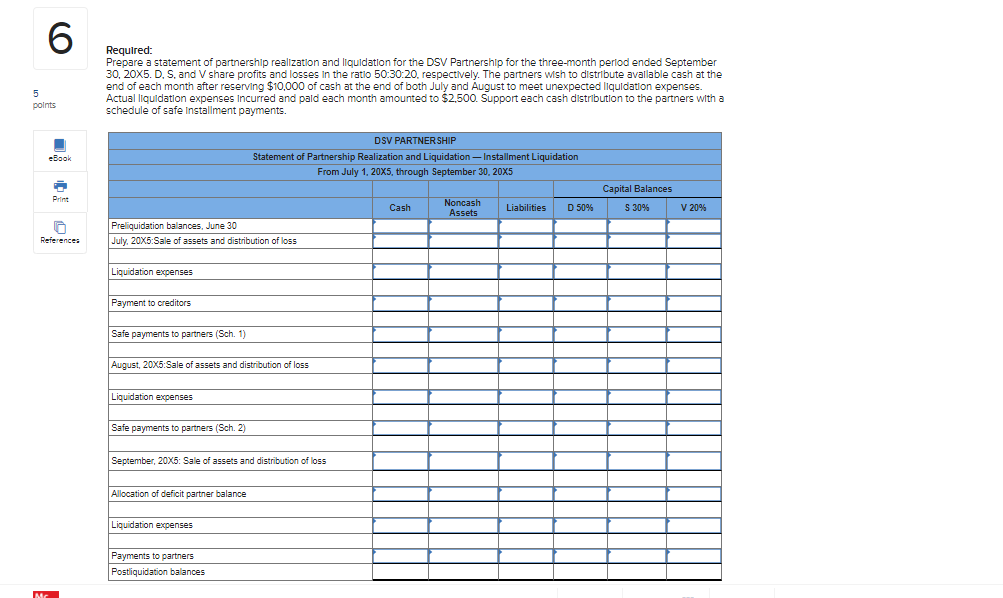

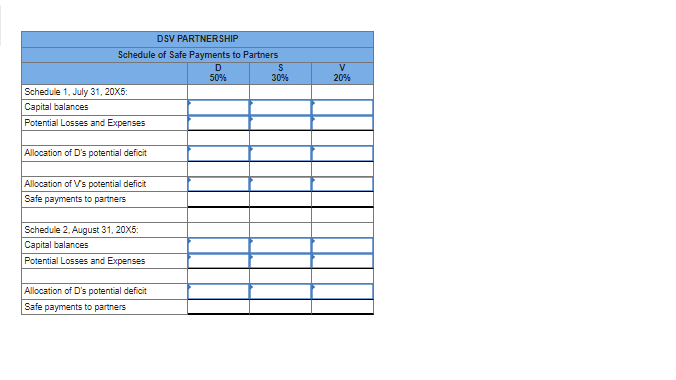

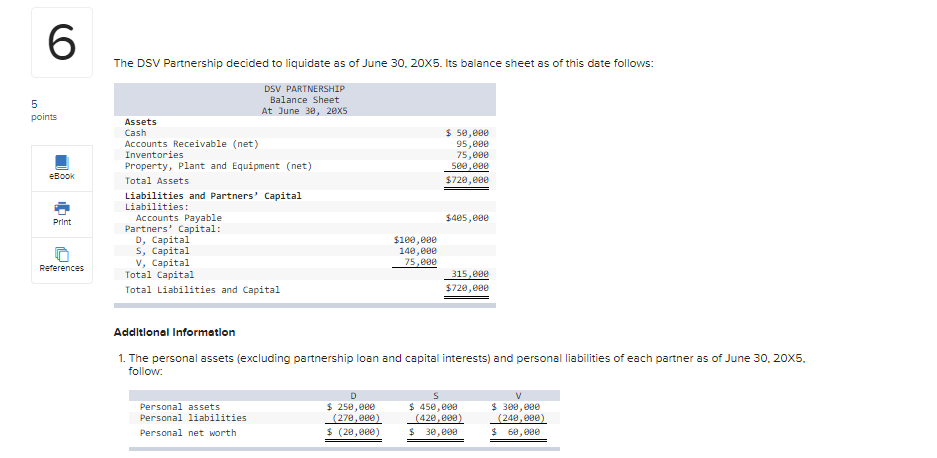

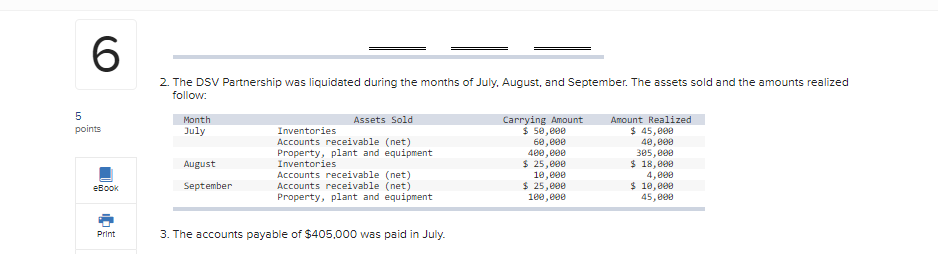

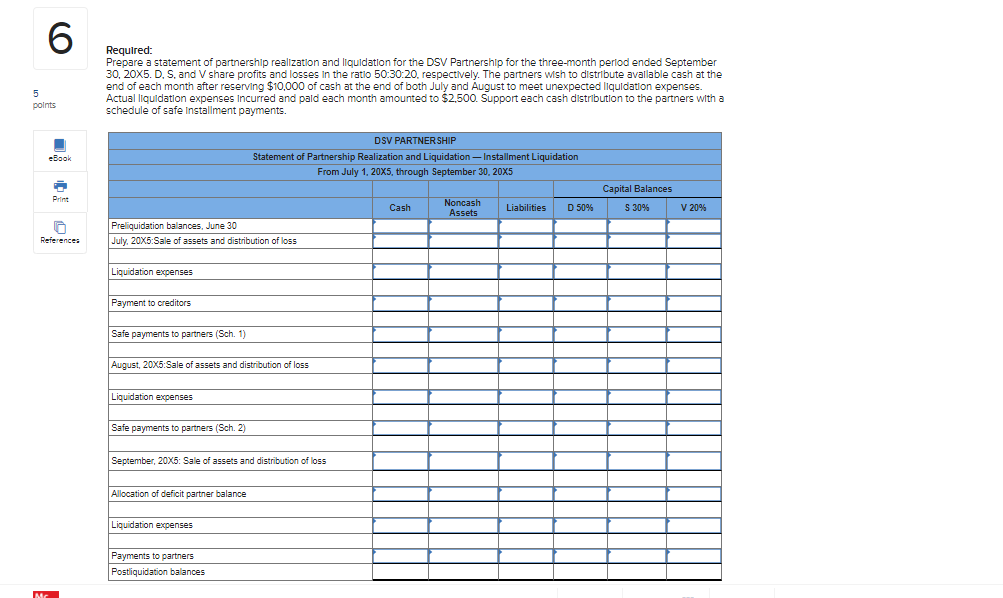

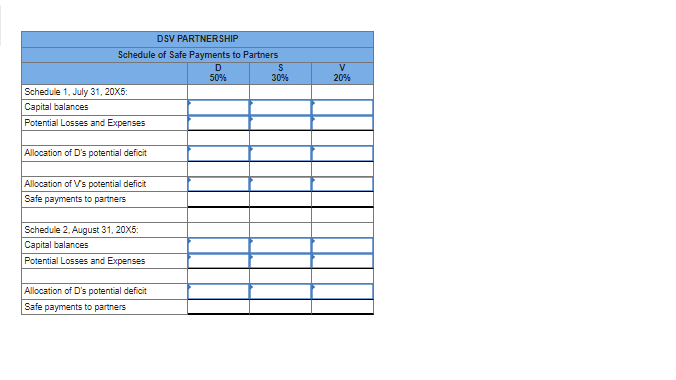

6 5 points eBook The DSV Partnership decided to liquidate as of June 30, 20X5. Its balance sheet as of this date follows: DSV PARTNERSHIP Balance Sheet At June 30, 2exs Assets Cash $ 50,eee Accounts Receivable (net) 95,eee Inventories 75,880 Property, plant and Equipment (net) 500,000 Total Assets $720,680 Liabilities and Partners' Capital Liabilities: Accounts Payable $425,280 Partners' Capital: D, Capital $100,000 S, Capital 140,000 V, Capital 75,eee Total Capital 315,80 Total Liabilities and Capital $720,000 Print References Additional Information 1. The personal assets (excluding partnership loan and capital interests) and personal liabilities of each partner as of June 30, 20X5. follow: Personal assets Personal liabilities Personal net worth D $ 250, eee (279, 280) $ (29,8e) S $ 450,000 (420, 809) $ 30,000 $ 300,00 (248,280) $ 60,000 6 2. The DSV Partnership was liquidated during the months of July, August, and September. The assets sold and the amounts realized follow: 5 points Month July August Assets Sold Inventories Accounts receivable (net) Property, plant and equipment Inventories Accounts receivable (net) Accounts receivable (net) Property, plant and equipment Carrying Amount $ 50,000 60,000 4e2,eee $ 25,000 10,60e $ 25,00 1e8,eae Amount Realized $ 45,000 40,000 305,000 $ 18,899 4,800 $ 10,000 45,899 eBook September Print 3. The accounts payable of $405,000 was paid in July. 6 Required: Prepare a statement of partnership realization and liquidation for the DSV Partnership for the three-month period ended September 30, 20X5. D. S. and V share profits and losses in the ratio 50:30:20. respectively. The partners wish to distribute available cash at the end of each month after reserving $10,000 of cash at the end of both July and August to meet unexpected liquidation expenses. Actual liquidation expenses incurred and pald each month amounted to $2,500. Support each cash distribution to the partners with a schedule of safe installment payments 5 points eBook DSV PARTNERSHIP Statement of Partnership Realization and Liquidation - Installment Liquidation From July 1, 20X5, through September 30, 20X5 Capital Balances S 30% Cash Noncash Assets Liabilities D 50% V 20% Preliquidation balances, June 30 July, 20X5:Sale of assets and distribution of loss References Liquidation expenses Payment to creditors Safe payments to partners (Sch. 1) August, 20X5:Sale of assets and distribution of loss Liquidation expenses Safe payments to partners (Sch. 2) September, 20X5: Sale of assets and distribution of loss Allocation of deficit partner balance Liquidation expenses Payments to partners Postiquidation balances M V 20% DSV PARTNERSHIP Schedule of Safe Payments to Partners D S 50% 30% Schedule 1, July 31, 20X5: Capital balances Potential Losses and Expenses Allocation of D's potential deficit Allocation of V's potential deficit Safe payments to partners Schedule 2. August 31, 20X5: Capital balances Potential Losses and Expenses Allocation of D's potential deficit Safe payments to partners