Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help inputting this into the 2021 Tax return. Using the IRS 2021 1040 Form. Use Schedule A and B, and form 8283, if

I need help inputting this into the 2021 Tax return.

Using the IRS 2021 1040 Form. Use Schedule A and B, and form 8283, if necessary.

Provide screenshots of the pdf

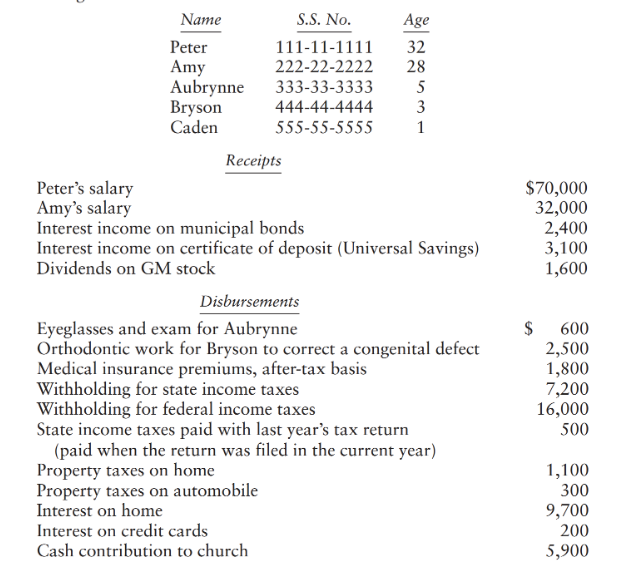

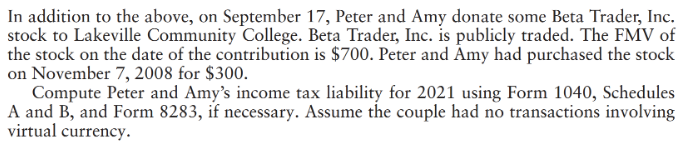

Peter's salary Amy's salary Interest income on municipal bonds Interest income on certificate of deposit (Universal Savings) Dividends on GM stock In addition to the above, on September 17 , Peter and Amy donate some Beta Trader, Inc. stock to Lakeville Community College. Beta Trader, Inc. is publicly traded. The FMV of the stock on the date of the contribution is $700. Peter and Amy had purchased the stock on November 7, 2008 for $300. Compute Peter and Amy's income tax liability for 2021 using Form 1040, Schedules A and B, and Form 8283 , if necessary. Assume the couple had no transactions involving virtual currency

Peter's salary Amy's salary Interest income on municipal bonds Interest income on certificate of deposit (Universal Savings) Dividends on GM stock In addition to the above, on September 17 , Peter and Amy donate some Beta Trader, Inc. stock to Lakeville Community College. Beta Trader, Inc. is publicly traded. The FMV of the stock on the date of the contribution is $700. Peter and Amy had purchased the stock on November 7, 2008 for $300. Compute Peter and Amy's income tax liability for 2021 using Form 1040, Schedules A and B, and Form 8283 , if necessary. Assume the couple had no transactions involving virtual currency Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started