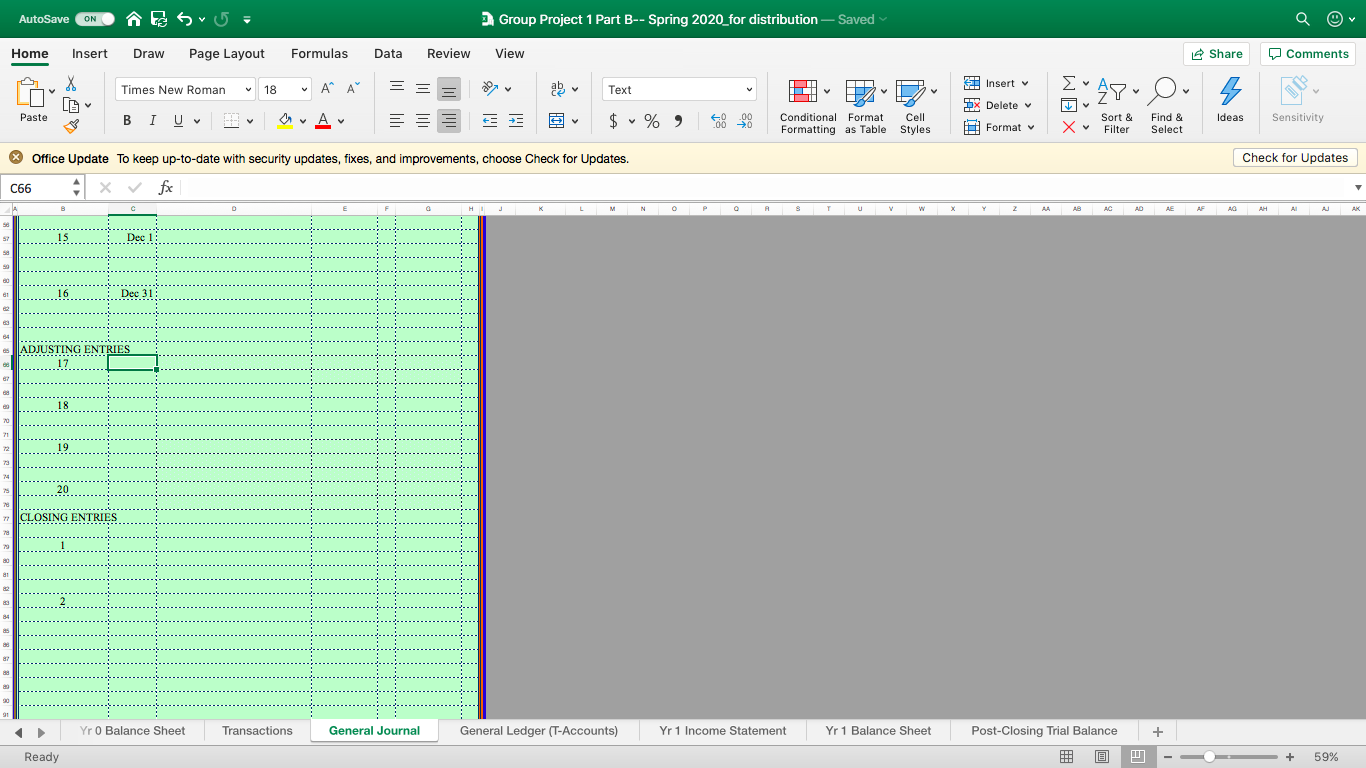

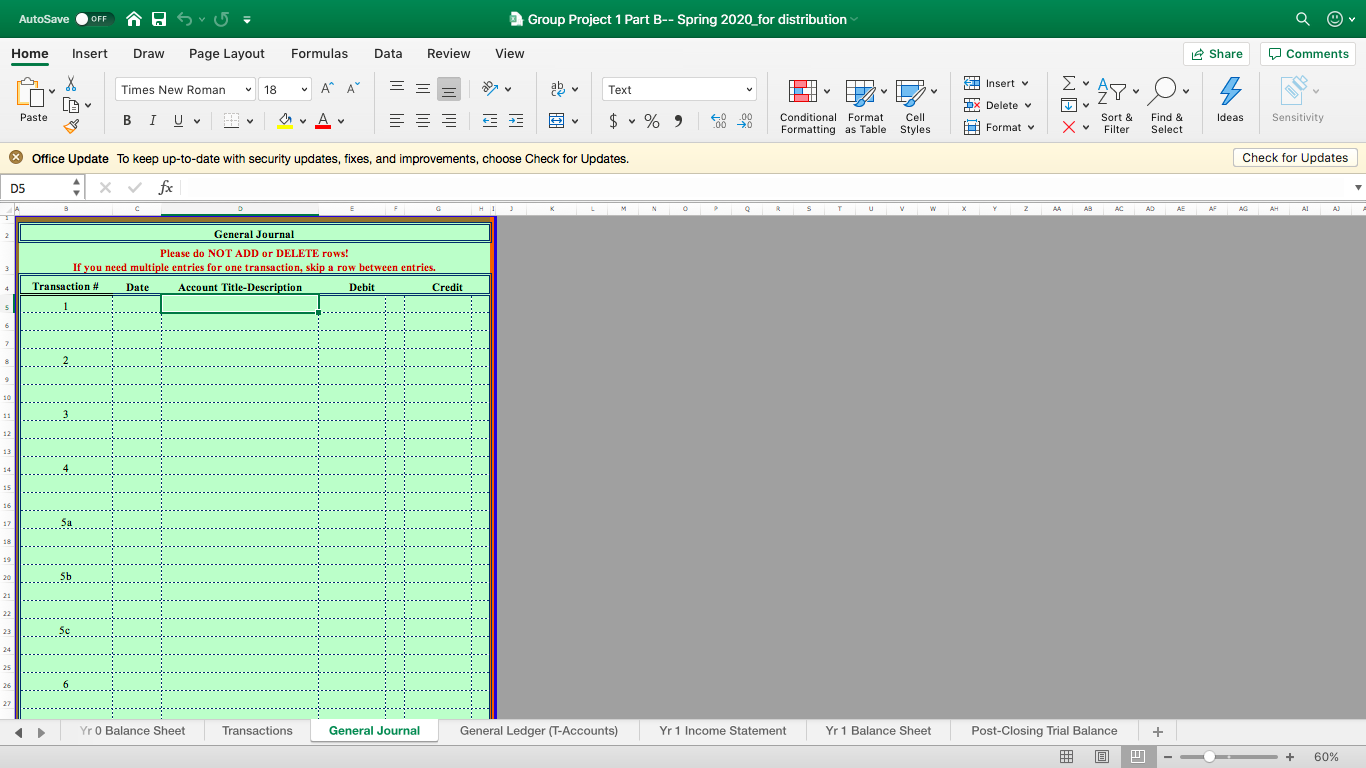

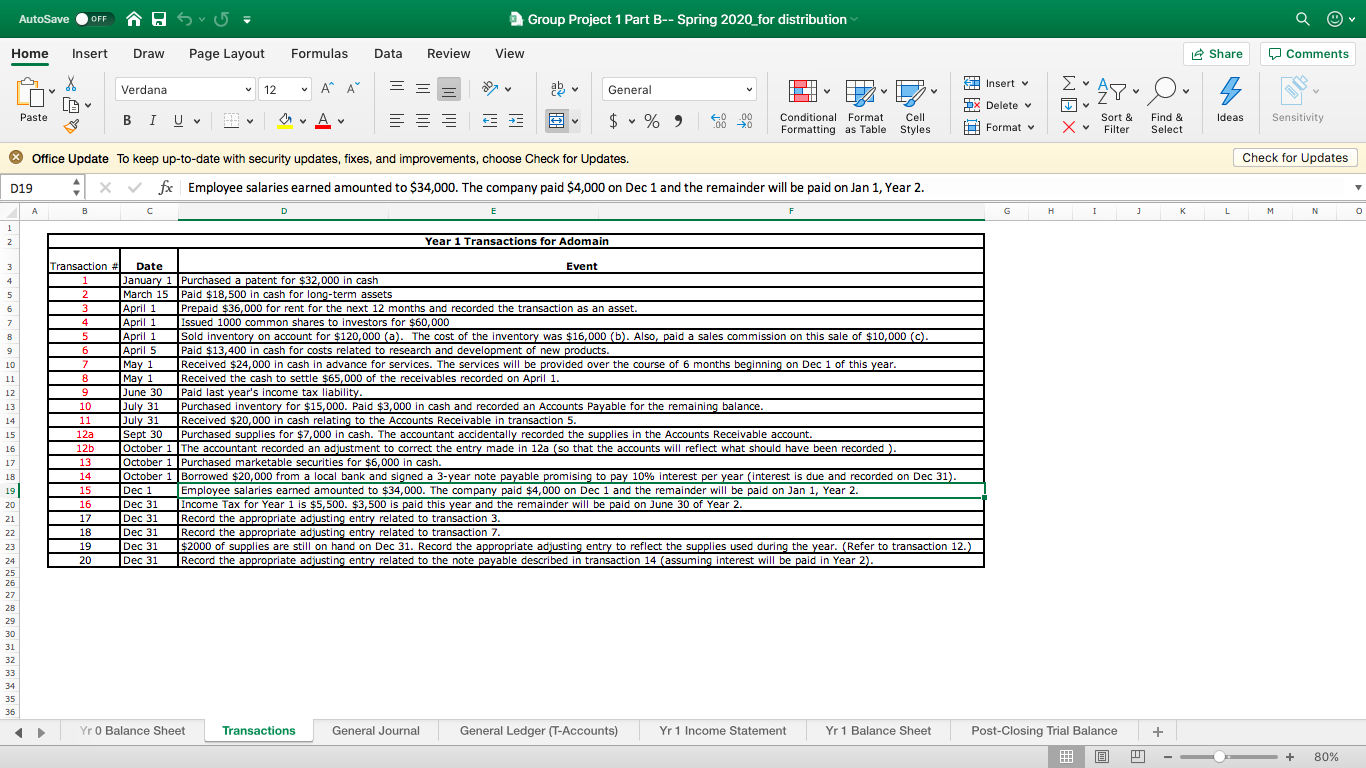

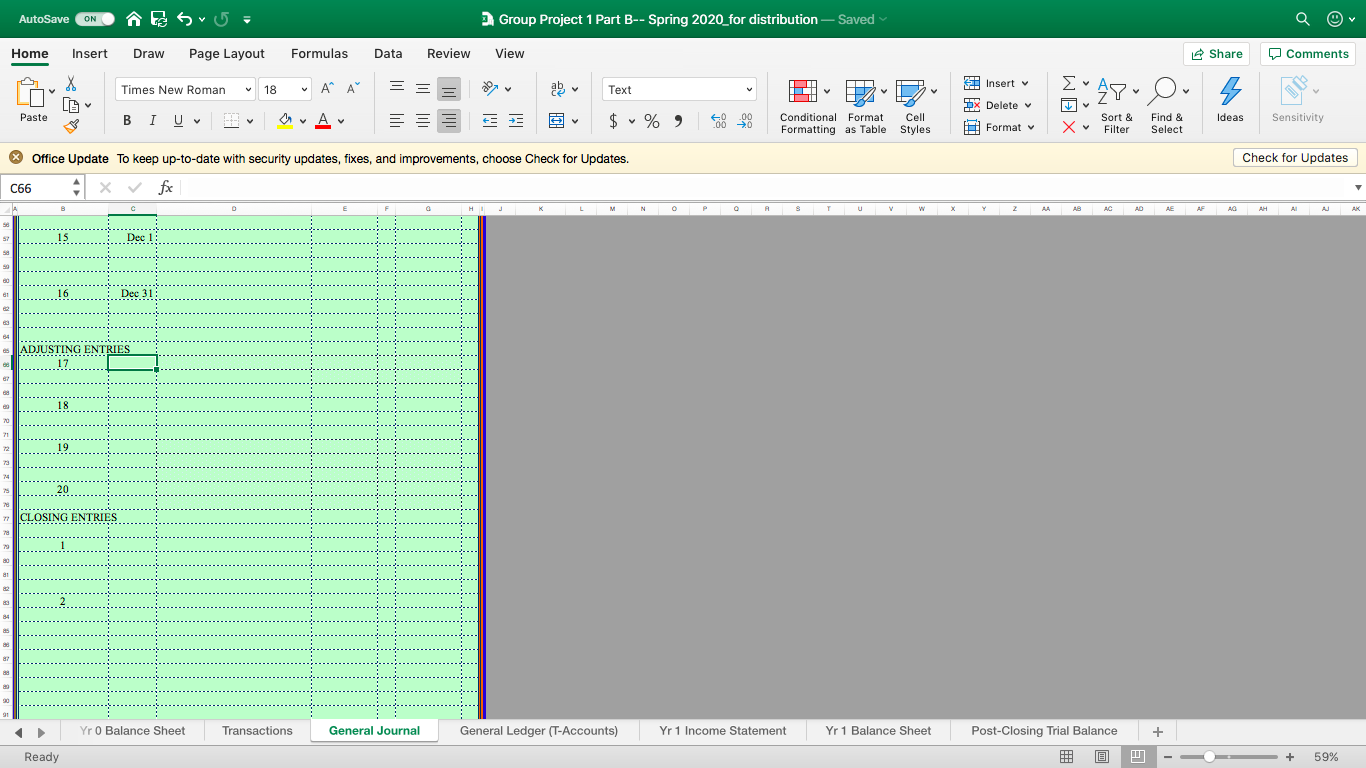

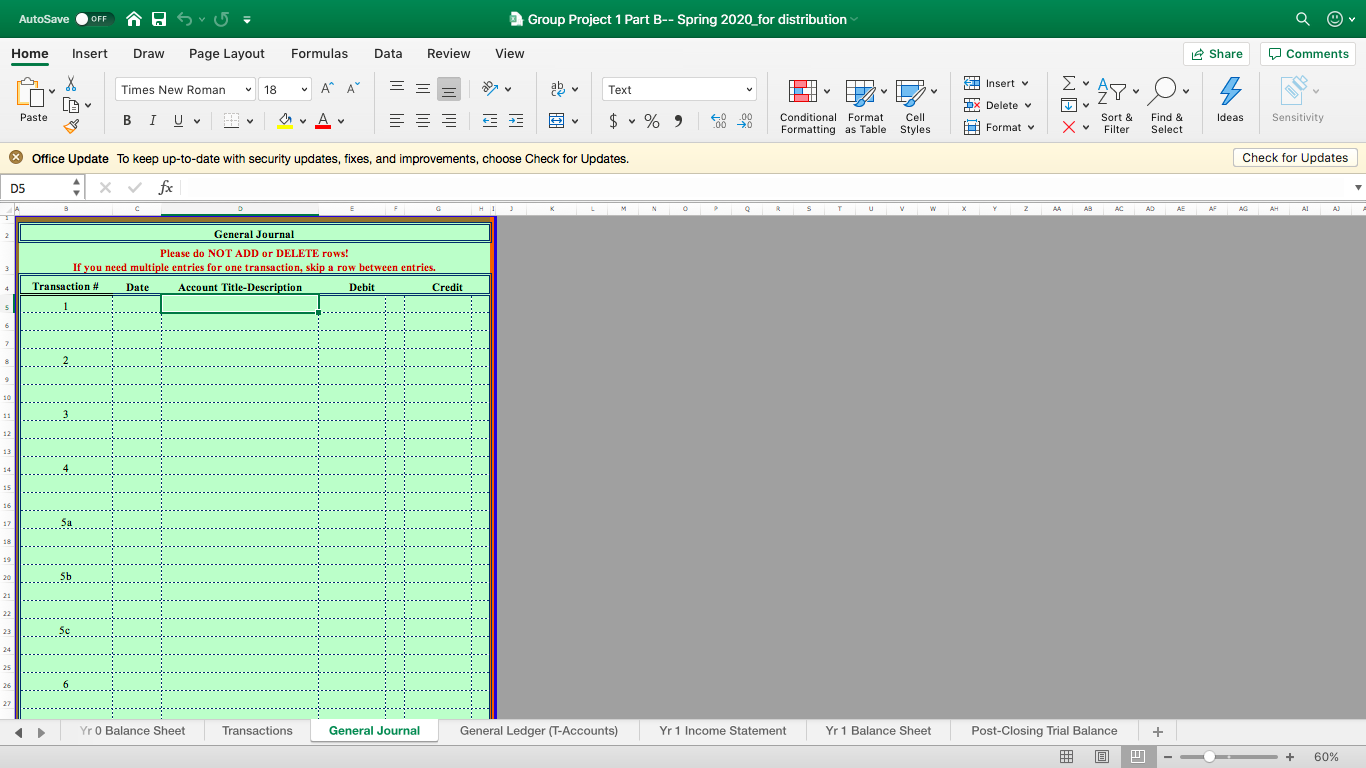

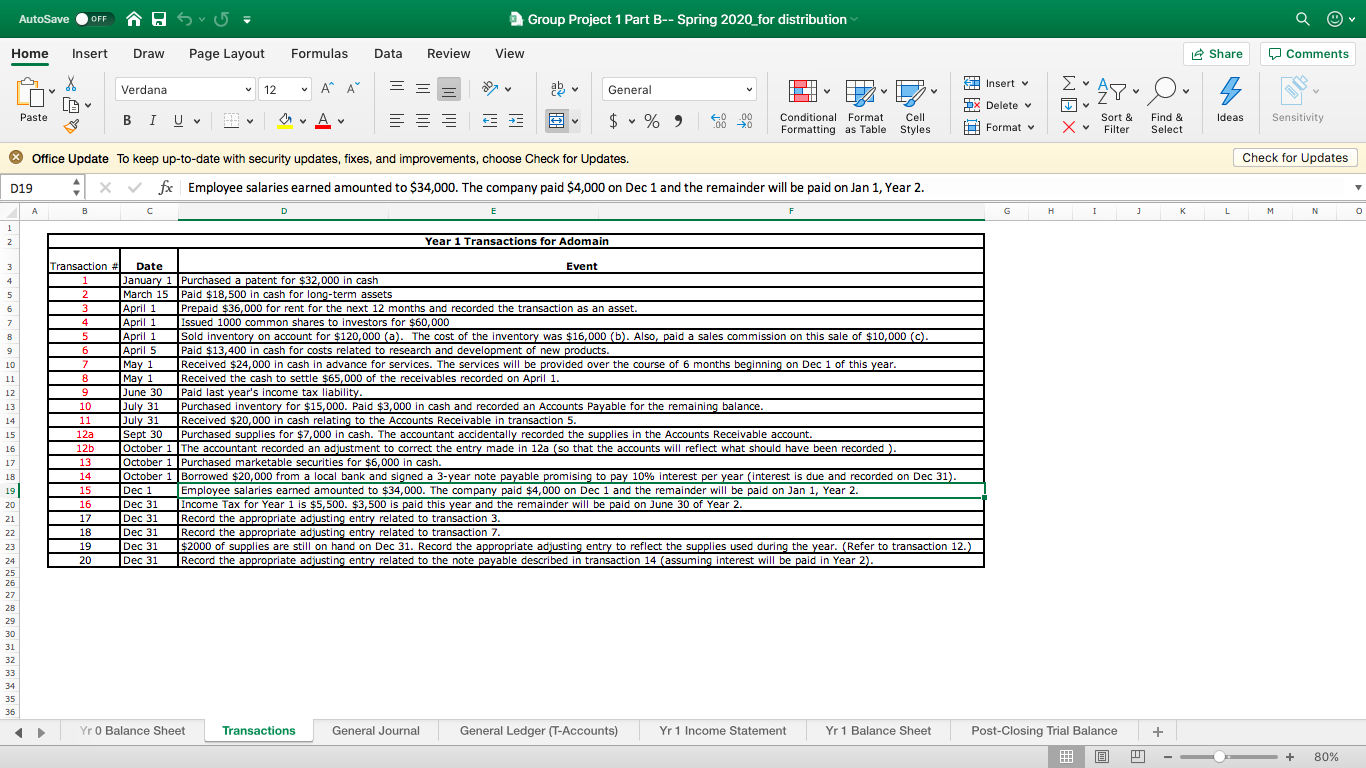

I need help making a general journal from those transactions. I also need help with the closing entries at the bottom of the journal

I need help making a general journal from those transactions. I also need help with the closing entries at the bottom of the journal

AutoSave OFF sv5- Group Project 1 Part B-- Spring 2020_for distribution Home Insert Draw Page Layout Formulas Data Review View Share Comments 18 A = = DO Text - E E 3 Insert v Ev 48- O 5 min Times New Roman BIU A A = E Paste $ % 48.20 Conditional Format Formatting as Table Cell Styles Sort & Filter ideas Format Find & Select Sensitivity X Check for Updates * Office Update To keep up-to-date with security updates, fixes, and improvements, choose Check for Updates. D5 x fx General Journal Please do NOT ADD or DELETE rows! If you need multiple entries for one transaction, skip a row between entries. Transaction # Date Account Title-Description Debit Credit ............. Sb.............. Yr O Balance Sheet Transactions General Journal General Ledger (T-Accounts) Yr 1 Income Statement Yr 1 Balance Sheet + Post-Closing Trial Balance 0 0 - GO + 60% AutoSave OFF A Svor Group Project 1 Part B-- Spring 2020_for distribution Home Insert Draw Page Layout Formulas Data Review View Comments = = = F General Verdana 12 AA BIUDA DO EE 3 Insert v 9X Delete EvAYO J Share 5 ideas Paste 0/ 9 4 000 Conditional Format Formatting as Table Cell Styles Find & Select Sort & Filter Sensitivity Format X Check for Updates * Office Update To keep up-to-date with security updates, fixes, and improvements, choose Check for Updates. 019 X fx Employee salaries earned amounted to $34,000. The company paid $4,000 on Dec 1 and the remainder will be paid on Jan 1, Year 2. Year 1 Transactions for Adomain F G H I J K L M N O Transaction # Date Event January 1 Purchased a patent for $32,000 in cash March 15 Paid $18,500 in cash for long-term assets April 1 Prepaid $36,000 for rent for the next 12 months and recorded the transaction as an asset. April 1 Issued 1000 common shares to investors for $60,000 April 1 Sold inventory on account for $120,000 (a). The cost of the inventory was $16,000 (b). Also, paid a sales commission on this sale of $10,000 (C). April 5 Paid $13,400 in cash for costs related to research and development of new products. May 1 Received $24,000 in cash in advance for services. The services will be provided over the course of 6 months beginning on Dec 1 of this year. May 1 Received the cash to settle $65,000 of the receivables recorded on April 1. June 30 Paid last year's income tax liability. 10 July 31 Purchased inventory for $15,000. Paid $3,000 in cash and recorded an Accounts Payable for the remaining balance. July 31 Received $20,000 in cash relating to the Accounts Receivable in transaction 5. Sept 30 Purchased supplies for $7,000 in cash. The accountant accidentally recorded the supplies in the Accounts Receivable account. 12b October 1 The accountant recorded an adjustment to correct the entry made in 12a (so that the accounts will reflect what should have been recorded ). 13 October 1 Purchased marketable securities for $6,000 in cash. October 1 Borrowed $20,000 from a local bank and signed a 3-year note payable promising to pay 10% interest per year interest is due and recorded on Dec 31). 15 Dec 1 Employee salaries earned amounted to $34,000. The company paid $4,000 on Dec 1 and the remainder will be paid on Jan 1, Year 2. 16 Dec 31 Income Tax for Year 1 is $5,500. $3,500 is paid this year and the remainder will be paid on June 30 of Year 2. Dec 31 Record the appropriate adjusting entry related to transaction 3. 18 Dec 31 Record the appropriate adjusting entry related to transaction 7. 19 Dec 31 $2000 of supplies are still on hand on Dec 31. Record the appropriate adjusting entry to reflect the supplies used during the year. (Refer to transaction 12.) 20 Dec 31 Record the appropriate adjusting entry related to the note payable described in transaction 14 (assuming interest will be paid in Year 2). 12a 14 Yr O Balance Sheet Transactions General Journal General Ledger (T-Accounts) Yr 1 Income Statement Yr 1 Balance Sheet Post-Closing Trial Balance @ + - J O + 80% 2 Group Project 1 Part B-- Spring 2020_for distribution-Saved AutoSave On Home Insert svo Page Layout Draw Formulas Data Review View Share Comments = = = Text - E E 3 Insert v Ev 48- O 5 min Times New Roman 18 A A BI U BOA DO ES 3X Delete Paste E 3 $ - % 0 , 9 4000 7 Conditional Format Cell Formatting as Table Styles J2" Sort & X Filter Find & Select ideas Sensitivity Format Check for Updates Office Update To keep up-to-date with security updates, fixes, and improvements, choose Check for Updates. 066 x fx F G H IJ K L M N P R S T U V W X Y Z AA AB AC AD AE AF AG AH AI AJ AK ...Dec 1:.. Dec? ING ENTRIES CLOS NG ENTRIES.......... Yr 0 Balance Sheet Transactions General Journal General Ledger (T-Accounts) Yr 1 Income Statement Yr 1 Balance Sheet Post-Closing Trial Balance + JU - GO Ready + 59%

I need help making a general journal from those transactions. I also need help with the closing entries at the bottom of the journal

I need help making a general journal from those transactions. I also need help with the closing entries at the bottom of the journal