Answered step by step

Verified Expert Solution

Question

1 Approved Answer

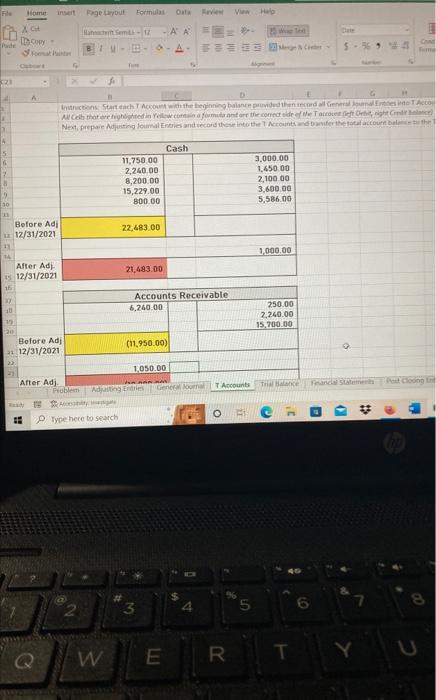

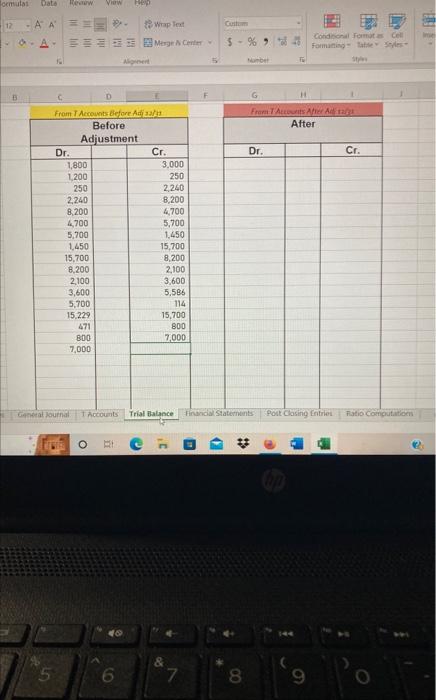

i need help making a T account, a trial balance and a finacial statement. i need help making a general journal, a t account, a

i need help making a T account, a trial balance and a finacial statement.

i need help making a general journal, a t account, a financal statment and a trail balance from this information

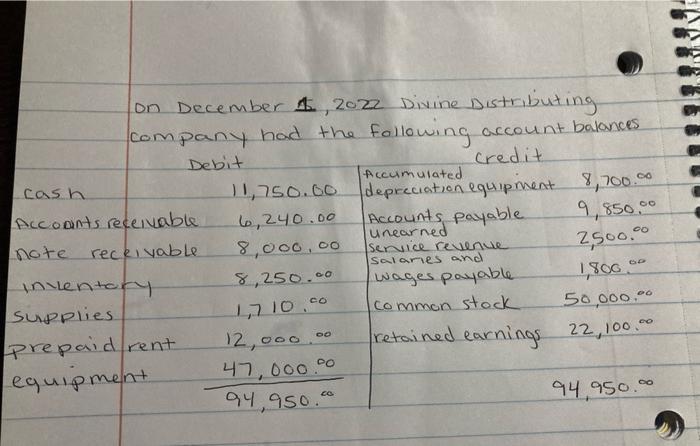

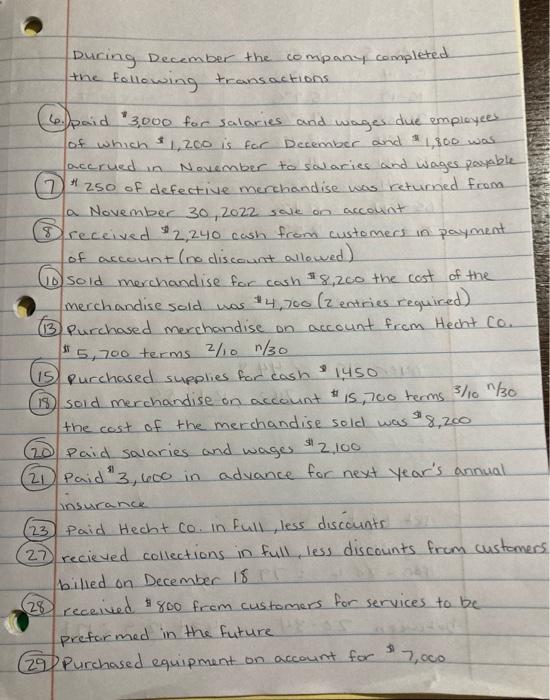

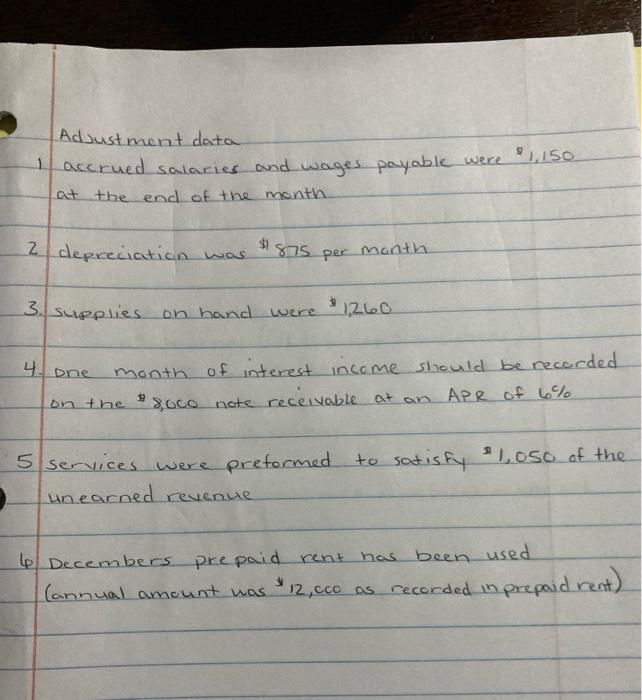

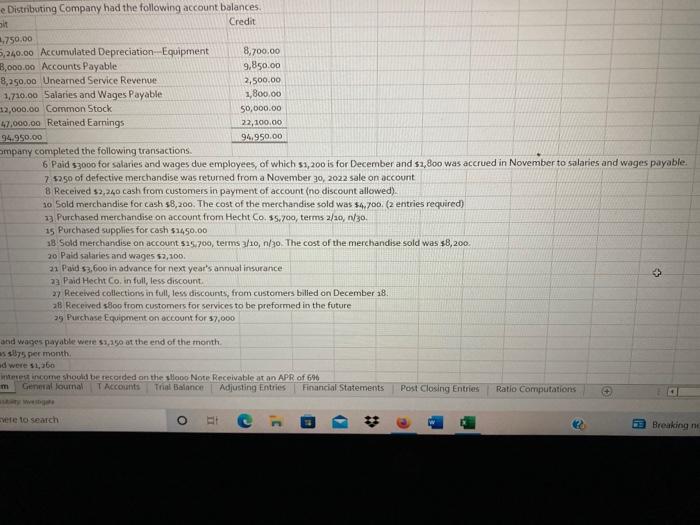

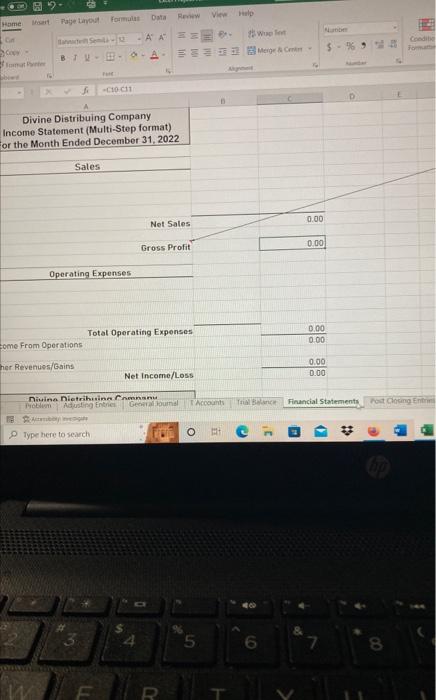

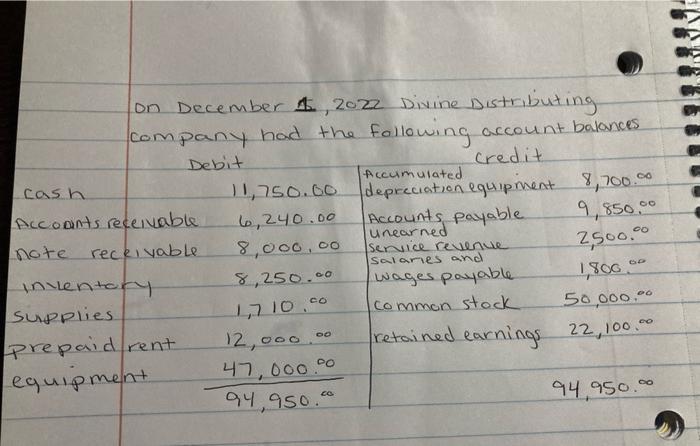

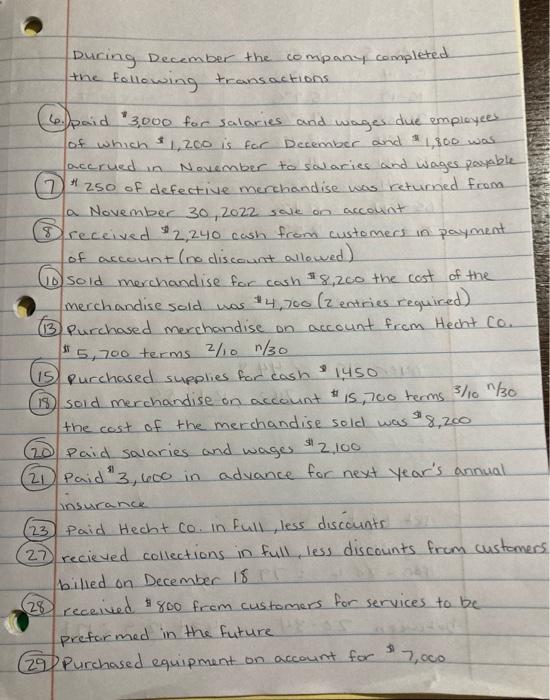

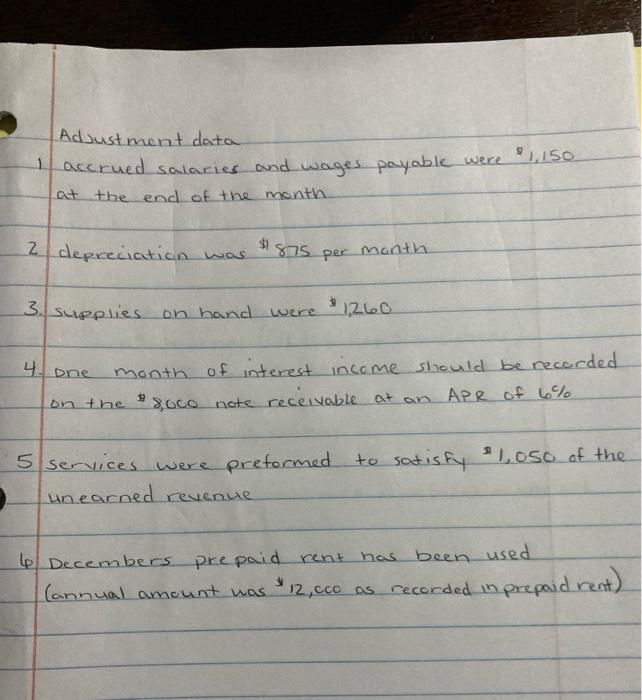

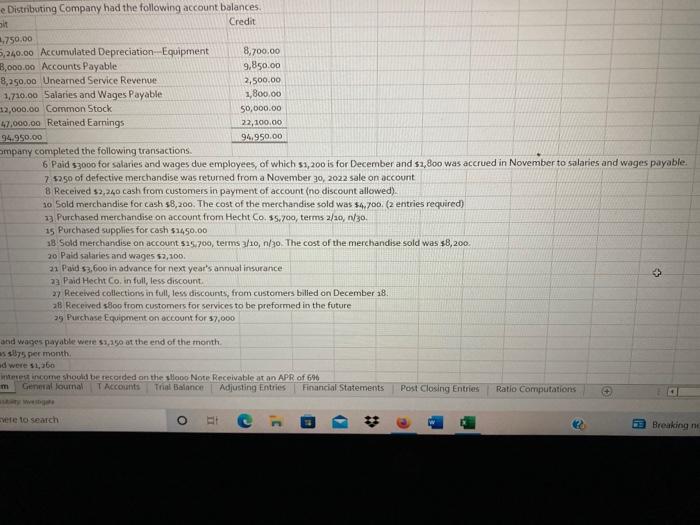

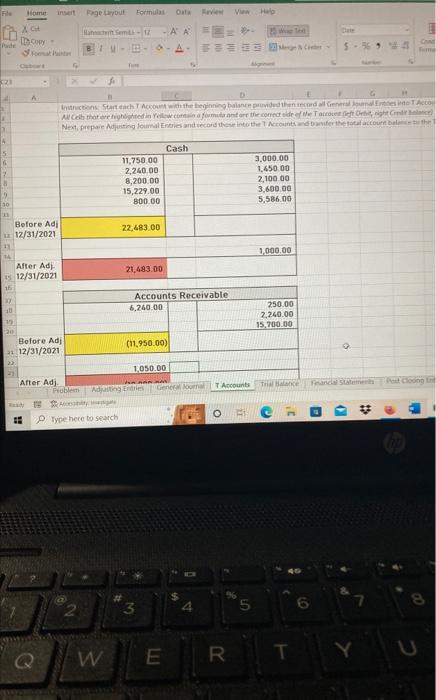

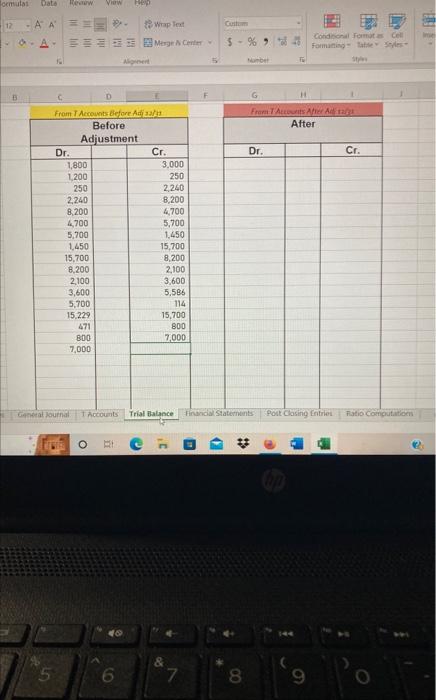

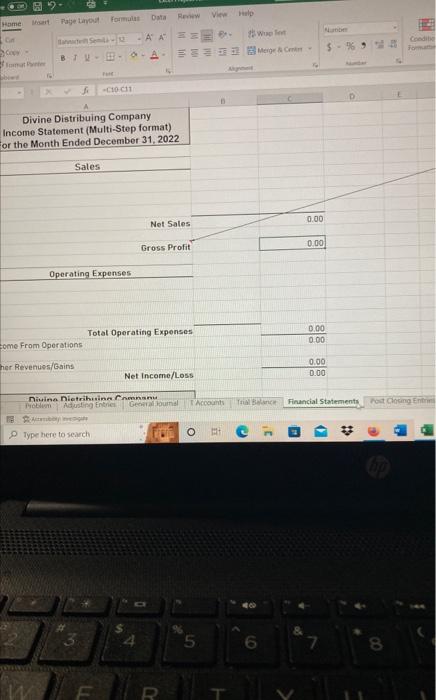

on December 1,20z2 Divine Distributing company had the following account balances During December the company completed the following transactions (6.) Paid "3,000 for salaries and wages due employees of which $1,200 is for December and \$1,800 was accrued in Navember to salaries and Wages payable (7) H1250 of defective merchandise was returned from a November 30,2022 sale on account (8) received "2,240 cash from customers in payment of account (no discount allowed) (10) Sold merchandise for cosh \$8,200 the cost of the merchandise sold was 14,700 (2 entries reguired) (13) Purchased merchandise on account from Hecht CO. if 5,700 terms 2/10 n/30 (15) Purchased supplies for eash 1,450 (18) Sold merchandise on account $15,700 terms 3/10n/30 the cost of the merchandise sold was 8,200 (20) Paid salaries and wages \$2.100 (21) Paid" 3,600 in advance for next Year's annual insurance (23) Paid Hecht Co. In Full, less discounts (27) recieved collections in full, less discounts from customer billed on December 18 28) received \$800 frem customers for services to be preformed in the future 29. Purchased equipment on account for 37,000 Adjustment data 1 accrued salaries and wages payable were "1,150 at the end of the month 2 depreciation was \$875 per month 3. Supplies on hand were 1,260 4. Dhe month of interest income should be recorded on the "8,000 note receivable at an APR of 6% 5 services were preformed to satisfy"1,050 of the unearned revenue 4. Decembers prepaid rent has been used (annual amount was $12,cc0 as recorded in prepaid rent) 6 Paid s3000 for salaries and wages due employees, of which s1,200 is for December and $2,800 was accrued in November to salaries and wages payable. 7.5250 of defective merchandise was retumed from a November 30,2022 sale on account 8 Received $2,240 cash from customers in payment of account (no discount allowed). 105 old merchandise for cash 58,200 . The cost of the merchandise sold was \$4. 700. ( 2 entries required) 13. Purchased merchandise on account from Hecht Co, 35.700, terms 2/20, n/30. 15 Purchased supplies for cash \$1450.00 18 . Sold merchandise on account 515,700 , terms 3/10, n/30. The cost of the merchandise sold was $8,200. 20 Paid salaries and wages 52,100 . 21 Paid-53,600 in-advance for next year's annuat insurance 23. Paid Hecht Co, in full, less discount. 2) Received collections in full, less discotints, fram customers billed on December 18 . 28 Received 2800 from customess for services to be preformed in the future 29 Purchase Equipment on account for 37,000 Divine Distribuing Company Income Statement (Multi-Step format) or the Month Ended December 31, 2022 \begin{tabular}{l} Sales \\ \hline Operating Expenses \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started