Answered step by step

Verified Expert Solution

Question

1 Approved Answer

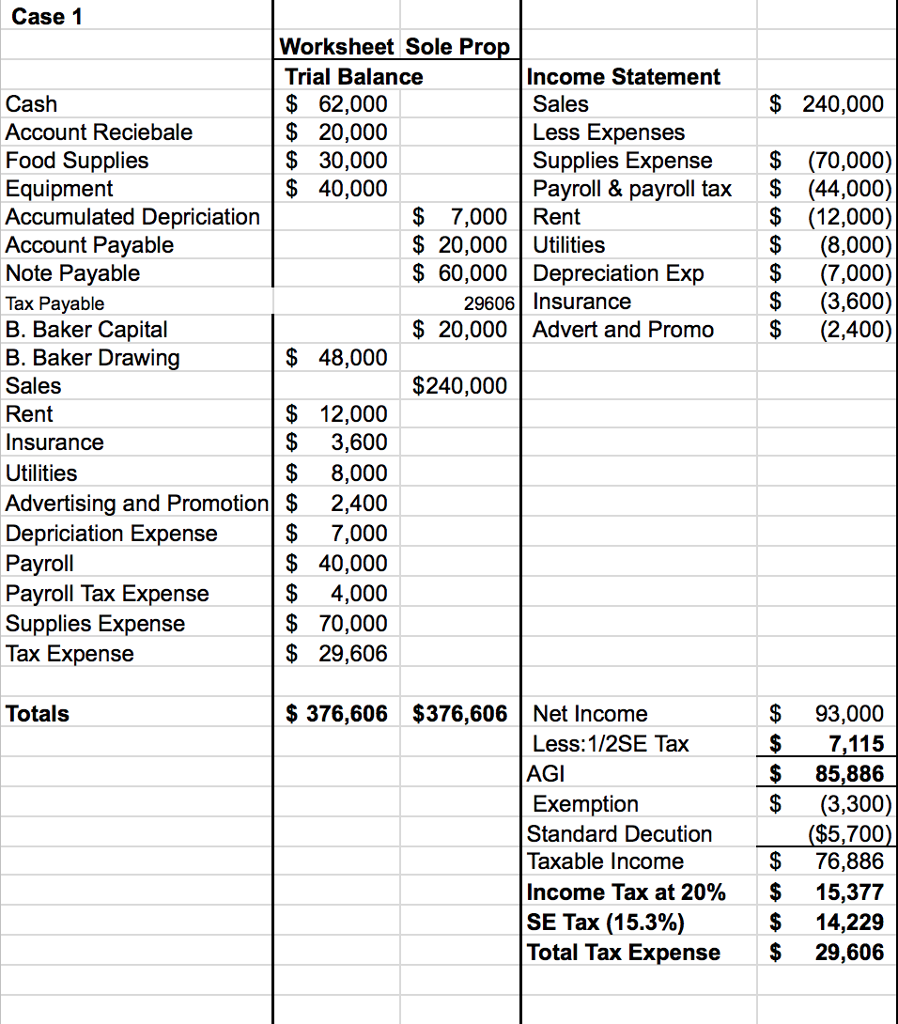

I need help making a year end balance sheet for this problem, the company is a sole proprietorship Case 1 Worksheet Sole Pro Trial Balance

I need help making a year end balance sheet for this problem, the company is a sole proprietorship

Case 1 Worksheet Sole Pro Trial Balance $ 62,000 $ 20,000 $ 30,000 $ 40,000 Income Statement Sales Less ExpensesS $ 240,000 Cash Account Reciebale Food Supplies Equipment Accumulated Depriciation Account Payable Note Payable Tax Payable B. Baker Capital B. Baker Drawing Sales Rent Insurance Utilities Advertising and Promotion$ 2,400 Depriciation Expense Payroll Payroll Tax Expense Supplies Expense Tax Expense Supplies Expense S(70,000) Payroll & payroll tax$ (44,000) $(12,000) $(8,000) $ 60,000|Depreciation Exp$(7,000) $(3,600) $ 20,000 Advert and Promo$(2,400) $7,000 Rent $ 20,000 Utilitiess 29606 Insurance $ 48,000 $240,000 $ 12,000 $ 3,600 $ 8,000 $7,000 $40,000 $4,000 $ 70,000 $ 29,606 Totals $93,000 $7115 $85,886 $(3,300) $5,700 $76,886 Income Tax at 20% $ 15,377 $ 14,229 Total Tax Expense$ 29,606 $ 376,606 $376,606 Net Income Less: 1/2SE Tax AGI Exemption Standard Decution laxable Income SE Tax (15.3%)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started