i need help making an adjusted trial balance and financial statement and closing entries. the entries above are all correct

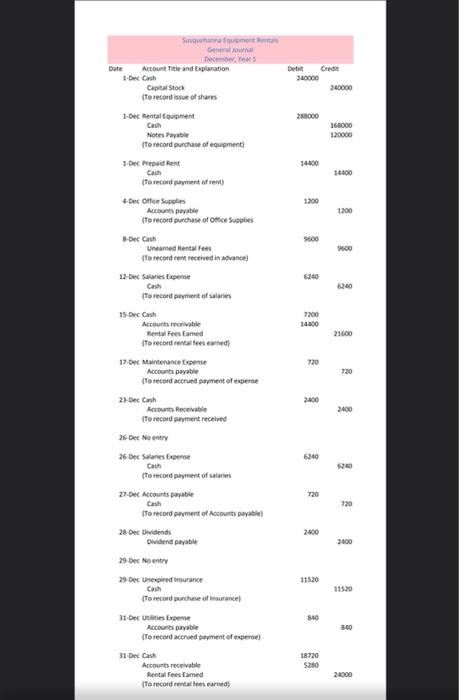

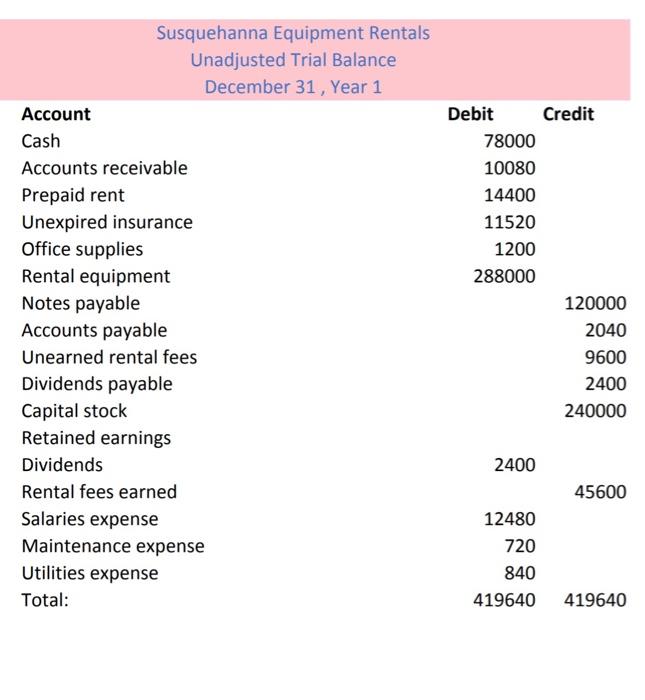

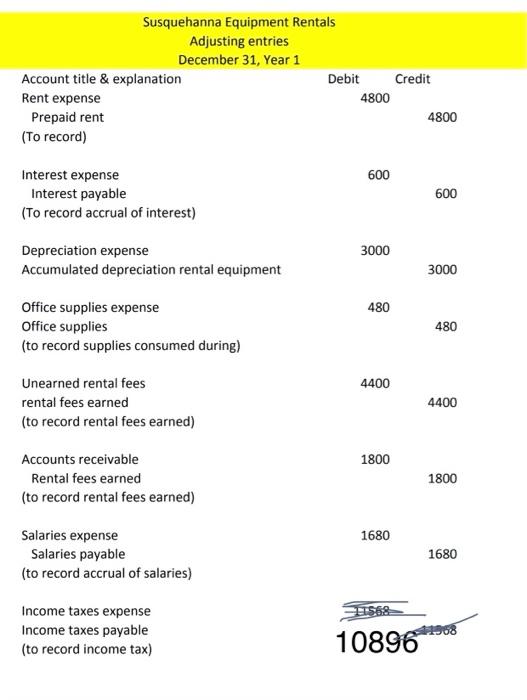

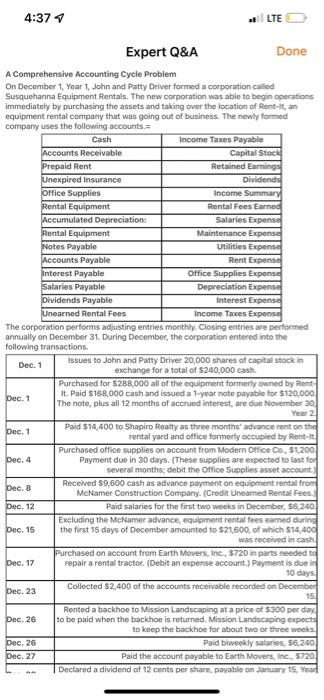

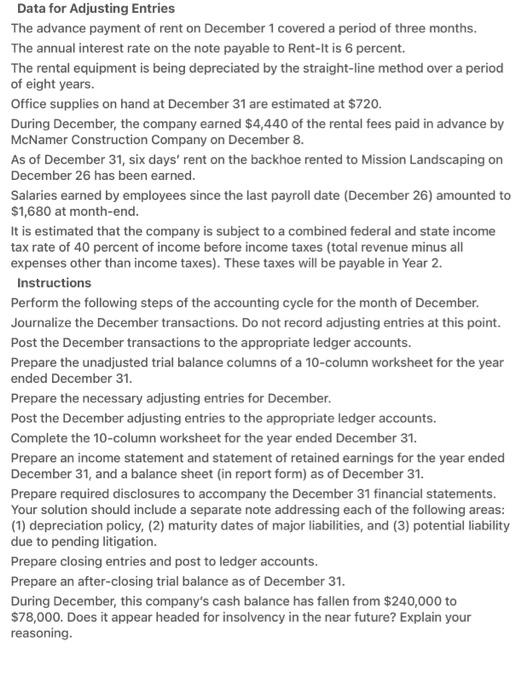

Susquehanna Equipment Rentals Unadjusted Trial Balance December 31 , Year 1 AccountCashAccountsreceivablePrepaidrentUnexpiredinsuranceOfficesuppliesRentalequipmentNotespayableAccountspayableUnearnedrentalfeesDividendspayableCapitalstockRetainedearningsDividendsRentalfeesearnedSalariesexpenseMaintenanceexpenseUtilitiesexpenseTotal:Debit780001008014400115201200288000240012480720840419640Credit12000020409600240024000045600419640 Susquehanna Equipment Rentals Adjusting entries December 31, Year 1 Account title \& explanation DebitCredit48004800 Rent expense Prepaid rent (To record) Interest expense 600 Interest payable 600 (To record accrual of interest) Depreciation expense 3000 Accumulated depreciation rental equipment 3000 Office supplies expense 480 Office supplies 480 (to record supplies consumed during) Unearned rental fees 4400 rental fees earned 4400 (to record rental fees earned) Accounts receivable 1800 Rental fees earned 1800 (to record rental fees earned) Salaries expense 1680 Salaries payable 1680 (to record accrual of salaries) Income taxes expense Income taxes payable (to record income tax) 10896 A Comprehensive Accounting Cycle Problem On December 1, Year 1, John and Patty Driver formed a coeporation called Susquehanna Equipment fentals. The new coeporation was able to begin operations immediately by purchasing the assets and taking over the location of Rent-lit, an equipment rental company that was going out of bcisiness. The newly formed comparw uses the followind accourts.= The corporation pernorms abyusting entnes monthy. closing entres are pernormed annually on December 31. During December, the corporation entered into the following transactions. Data for Adjusting Entries The advance payment of rent on December 1 covered a period of three months. The annual interest rate on the note payable to Rent-It is 6 percent. The rental equipment is being depreciated by the straight-line method over a period of eight years. Office supplies on hand at December 31 are estimated at $720. During December, the company earned $4,440 of the rental fees paid in advance by McNamer Construction Company on December 8. As of December 31, six days' rent on the backhoe rented to Mission Landscaping on December 26 has been earned. Salaries earned by employees since the last payroll date (December 26) amounted to $1,680 at month-end. It is estimated that the company is subject to a combined federal and state income tax rate of 40 percent of income before income taxes (total revenue minus all expenses other than income taxes). These taxes will be payable in Year 2. Instructions Perform the following steps of the accounting cycle for the month of December. Journalize the December transactions. Do not record adjusting entries at this point. Post the December transactions to the appropriate ledger accounts. Prepare the unadjusted trial balance columns of a 10-column worksheet for the year ended December 31. Prepare the necessary adjusting entries for December. Post the December adjusting entries to the appropriate ledger accounts. Complete the 10-column worksheet for the year ended December 31 . Prepare an income statement and statement of retained earnings for the year ended December 31, and a balance sheet (in report form) as of December 31. Prepare required disclosures to accompany the December 31 financial statements. Your solution should include a separate note addressing each of the following areas: (1) depreciation policy, (2) maturity dates of major liabilities, and (3) potential liability due to pending litigation. Prepare closing entries and post to ledger accounts. Prepare an after-closing trial balance as of December 31 . During December, this company's cash balance has fallen from $240,000 to $78,000. Does it appear headed for insolvency in the near future? Explain your reasoning