Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help making sure i got the right calculations, an help finishing it. Pureform, Incorporated, uses the FIFO method in its process costing system.

I need help making sure i got the right calculations, an help finishing it.

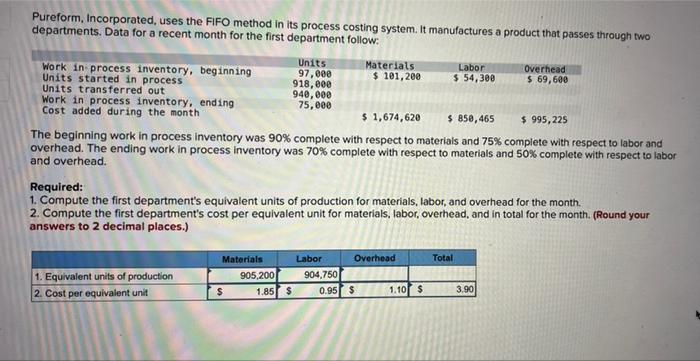

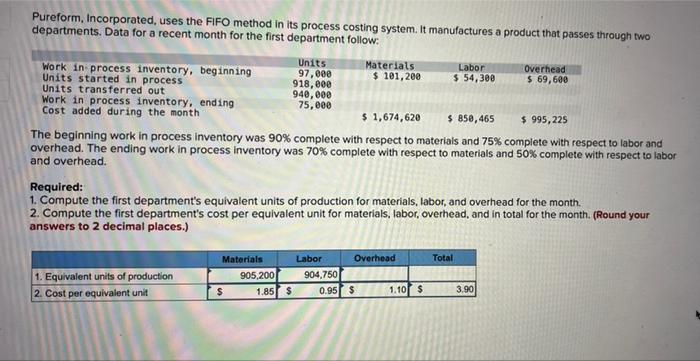

Pureform, Incorporated, uses the FIFO method in its process costing system. It manufactures a product that passes through two departments. Data for a recent month for the first department follow: Units Materials Labor Work in process inventory, beginning Overhead 97,000 Units started in process $ 101,200 $ 54,300 $ 69,600 918,000 Units transferred out 940,000 Work in process inventory, ending 75,000 Cost added during the month $ 1,674,620 $ 850,465 $ 995,225 The beginning work in process inventory was 90% complete with respect to materials and 75% complete with respect to labor and overhead. The ending work in process inventory was 70% complete with respect to materials and 50% complete with respect to labor and overhead. Required: 1. Compute the first department's equivalent units of production for materials, labor, and overhead for the month. 2. Compute the first department's cost per equivalent unit for materials, labor, overhead, and in total for the month. (Round your answers to 2 decimal places.) Total 1. Equivalent units of production 2. Cost per equivalent unit Materials 905,200 $ 1.85 $ Labor Overhead 904,750 0.95 $ 1.10 $ 3.90

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started