I need help making the General Ledger, preparing unadjusted trial balances, and journal entries for all of the above. Pls help!!

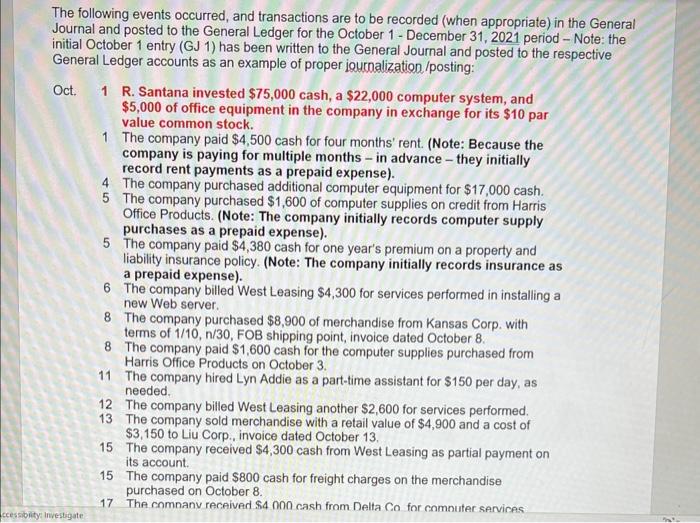

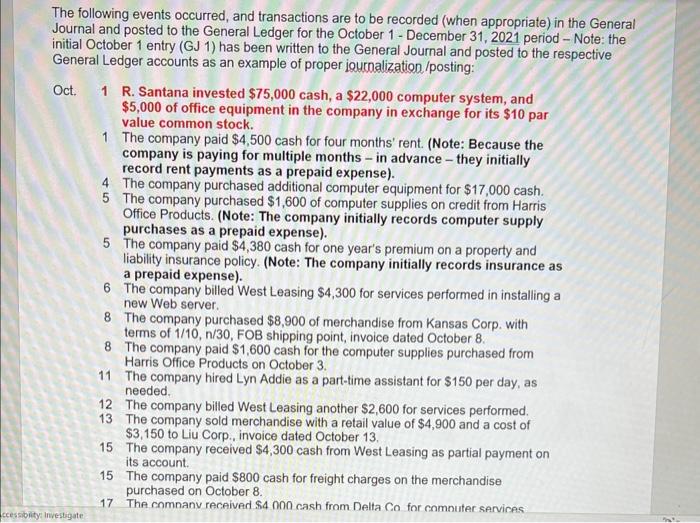

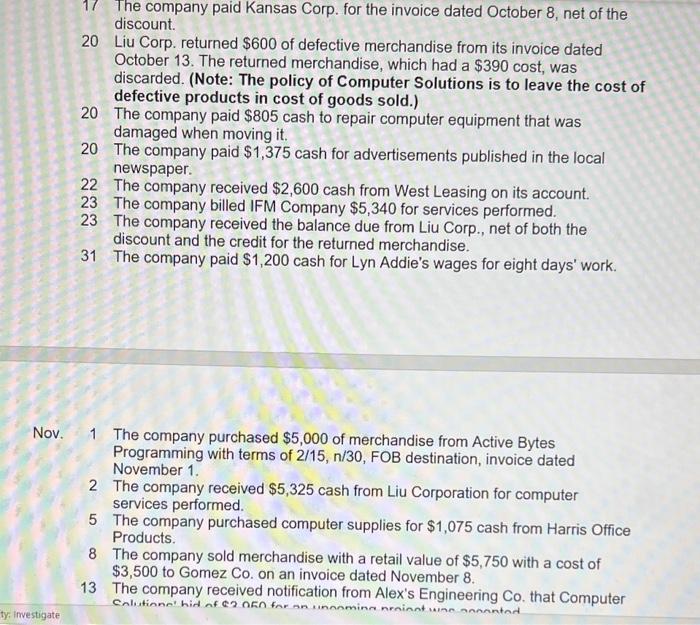

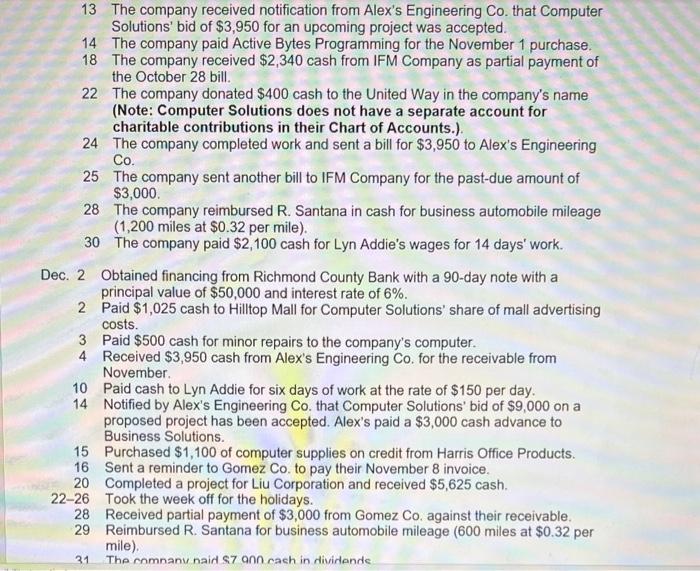

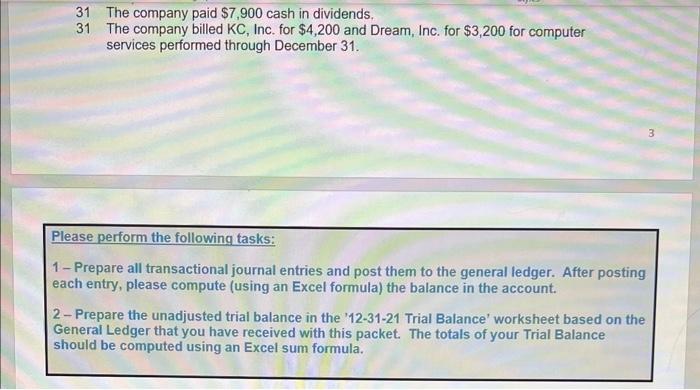

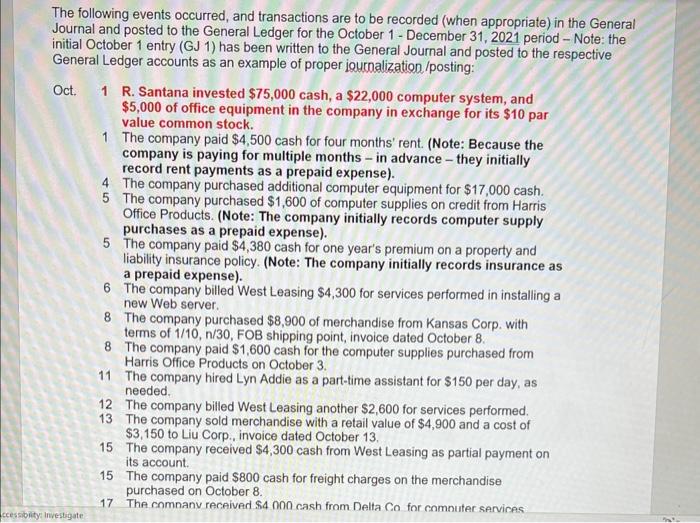

The following events occurred, and transactions are to be recorded (when appropriate) in the Journal and posted to the General Ledger for the October 1 - December 31, 2021 period - Note initial October 1 entry (GJ 1) has been written to the General Journal and posted to the respect General Ledger accounts as an example of proper journalization/posting: Oct. 1 R. Santana invested $75,000 cash, a $22,000 computer system, and $5,000 of office equipment in the company in exchange for its $10 par value common stock. 1 The company paid $4,500 cash for four months' rent. (Note: Because the company is paying for multiple months - in advance - they initially record rent payments as a prepaid expense). 4 The company purchased additional computer equipment for $17,000 cash. 5 The company purchased $1,600 of computer supplies on credit from Harris Office Products. (Note: The company initially records computer supply purchases as a prepaid expense). 5 The company paid $4,380 cash for one year's premium on a property and liability insurance policy. (Note: The company initially records insurance as a prepaid expense). 6 The company billed West Leasing $4,300 for services performed in installing a new Web server. 8 The company purchased $8,900 of merchandise from Kansas Corp. with terms of 1/10,n/30, FOB shipping point, invoice dated October 8 . 8 The company paid $1,600 cash for the computer supplies purchased from Harris Office Products on October 3. 11 The company hired Lyn Addie as a part-time assistant for $150 per day, as needed. 12 The company billed West Leasing another $2,600 for services performed. 13 The company sold merchandise with a retail value of $4,900 and a cost of $3,150 to Liu Corp., invoice dated October 13. 15 The company received $4,300 cash from West Leasing as partial payment on its account. 15 The company paid $800 cash for freight charges on the merchandise purchased on October 8 . 17 The comnanv receivad $4000 cash from Delta Co for comnuter sarvices discount. 20 Liu Corp. returned $600 of defective merchandise from its invoice dated October 13. The returned merchandise, which had a $390 cost, was discarded. (Note: The policy of Computer Solutions is to leave the cost of defective products in cost of goods sold.) 20 The company paid $805 cash to repair computer equipment that was damaged when moving it. 20 The company paid $1,375 cash for advertisements published in the local newspaper. 22 The company received $2,600 cash from West Leasing on its account. 23 The company billed IFM Company $5,340 for services performed. 23 The company received the balance due from Liu Corp., net of both the discount and the credit for the returned merchandise. 31 The company paid $1,200 cash for Lyn Addie's wages for eight days' work. Nov. 1 The company purchased $5,000 of merchandise from Active Bytes Programming with terms of 2/15,n/30,FOB destination, invoice dated November 1. 2 The company received $5,325 cash from Liu Corporation for computer services performed. 5 The company purchased computer supplies for $1,075 cash from Harris Office Products. 8 The company sold merchandise with a retail value of $5,750 with a cost of $3,500 to Gomez Co. on an invoice dated November 8 . 13 The company received notification from Alex's Engineering Co, that Computer 13 The company received notification from Alex's Engineering Co. that Computer Solutions' bid of $3,950 for an upcoming project was accepted. 14 The company paid Active Bytes Programming for the November 1 purchase. 18 The company received $2,340 cash from IFM Company as partial payment of the October 28 bill. 22 The company donated $400 cash to the United Way in the company's name (Note: Computer Solutions does not have a separate account for charitable contributions in their Chart of Accounts.). 24 The company completed work and sent a bill for $3,950 to Alex's Engineering Co. 25 The company sent another bill to IFM Company for the past-due amount of $3,000. 28 The company reimbursed R. Santana in cash for business automobile mileage (1,200 miles at $0.32 per mile). 30 The company paid $2,100 cash for Lyn Addie's wages for 14 days' work. Dec. 2 Obtained financing from Richmond County Bank with a 90-day note with a principal value of $50,000 and interest rate of 6%. 2 Paid $1,025 cash to Hilltop Mall for Computer Solutions' share of mall advertising costs. 3 Paid $500 cash for minor repairs to the company's computer. 4 Received $3,950 cash from Alex's Engineering Co. for the receivable from November. 10 Paid cash to Lyn Addie for six days of work at the rate of $150 per day. 14 Notified by Alex's Engineering Co. that Computer Solutions' bid of $9,000 on a proposed project has been accepted. Alex's paid a $3,000 cash advance to Business Solutions. 15 Purchased $1,100 of computer supplies on credit from Harris Office Products. 16 Sent a reminder to Gomez Co. to pay their November 8 invoice. 20 Completed a project for Liu Corporation and received $5,625 cash. 22-26 Took the week off for the holidays. 28 Received partial payment of $3,000 from Gomez Co. against their receivable. 29 Reimbursed R. Santana for business automobile mileage ( 600 miles at $0.32 per mile). 31 The mmnanu naid S7 ann rach in dividands 31 The company paid $7,900 cash in dividends. 31 The company billed KC, Inc. for $4,200 and Dream, Inc. for $3,200 for computer services performed through December 31. Please perform the following tasks: 1 - Prepare all transactional journal entries and post them to the general ledger. After posting each entry, please compute (using an Excel formula) the balance in the account. 2- Prepare the unadjusted trial balance in the '12-31-21 Trial Balance' worksheet based on the General Ledger that you have received with this packet. The totals of your Trial Balance should be computed using an Excel sum formula