Answered step by step

Verified Expert Solution

Question

1 Approved Answer

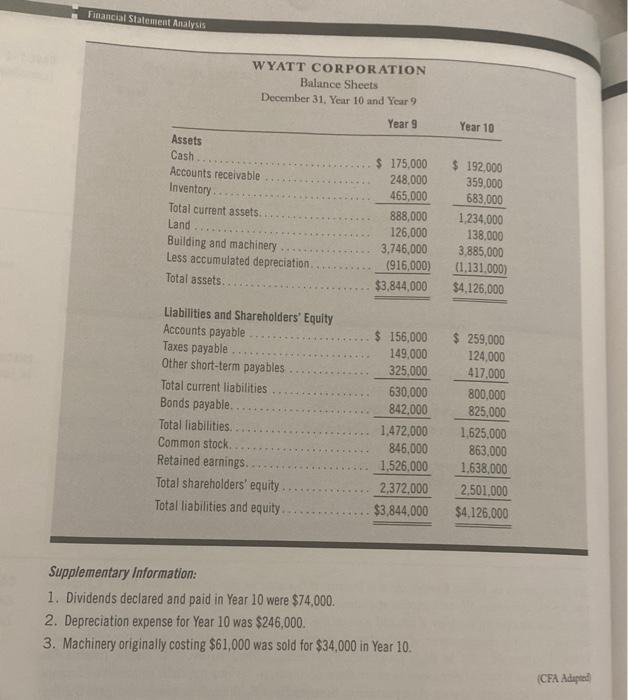

I need help mostly with question B. Thanks The management of Wyatt Corporation is frustrated because its parent company, SRW Corpora- CASE 7-3 tion, repeatedly

I need help mostly with question B.

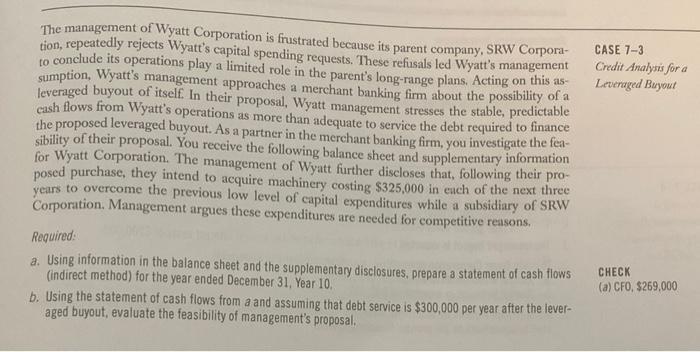

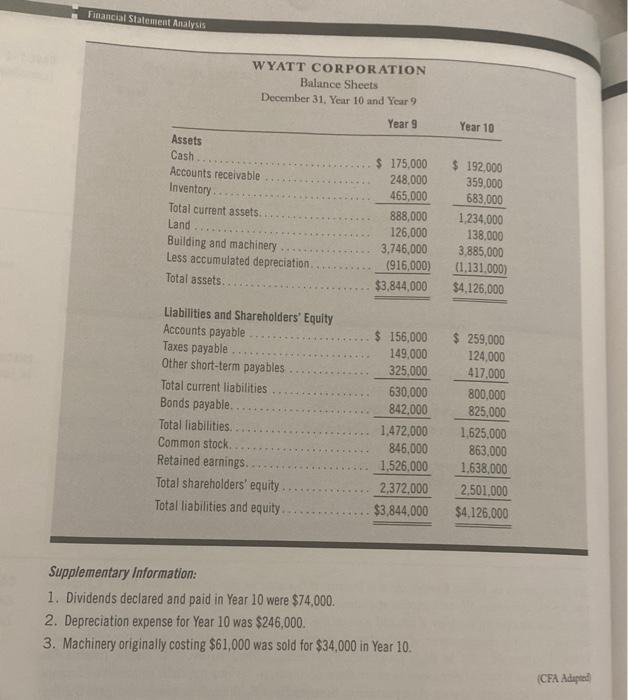

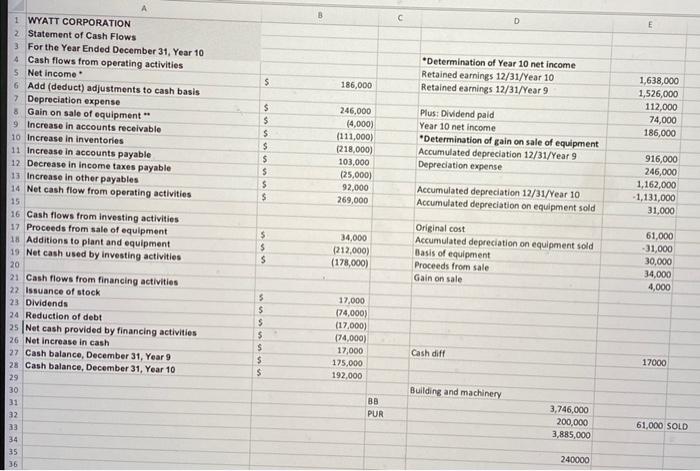

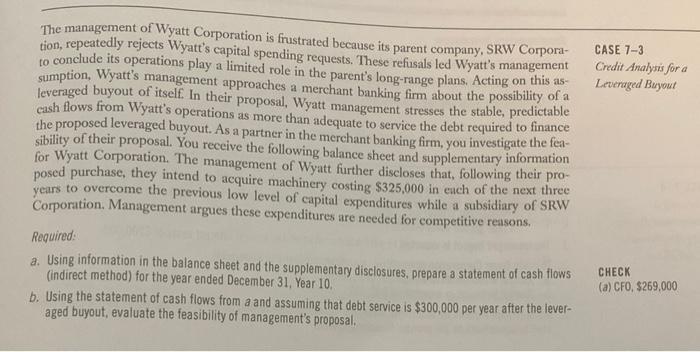

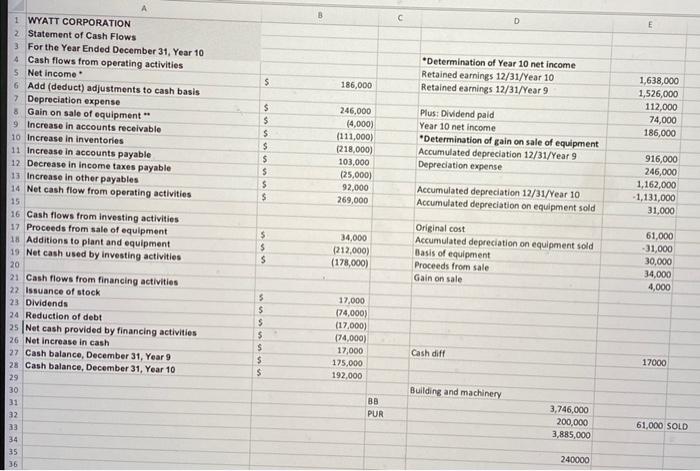

The management of Wyatt Corporation is frustrated because its parent company, SRW Corpora- CASE 7-3 tion, repeatedly rejects Wyatt's capital spending requests. These refusals led Wyatt's management Credit Analyris for a to conclude its operations play a limited role in the parent's long-range plans. Acting on this as- Leveraged Buyout leveraged buyout of itself. In their proposal. Wyatt management stresses the stable, predictable the proposed leveraged buperations as more than adequate to service the debt required to finance sibility of their proposal. You receive the following merchant banking firm, you investigate the feafor Wyatt Corporation. The management of ballance sheet and supplementary information posed purchase, they intend to aceuire matt further discloses that, following their proyears to overcome the previous low level of eapital expers $325,000 in euch of the next three Corporation. Management argues these level of capital expenditures while a subsidiary of SRW Required: a. Using information in the balance sheet and the supplementary disclosures, prepare a statement of cash flows (indirect method) for the year ended December 31, Year 10 . CHECK b. Using the statement of cash flows from a and assuming that debt service is $300,000 per year after the lever- (a) CFO, $269.000 aged buyout, evaluate the feasibility of management's proposal. WYATT CORDODATION Supplementary Information: 1. Dividends declared and paid in Year 10 were $74,000. 2. Depreciation expense for Year 10 was $246,000. 3. Machinery originally costing $61,000 was sold for $34,000 in Year 10 Thanks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started