I need help on #9 the calculation for a-f please, Thank you!

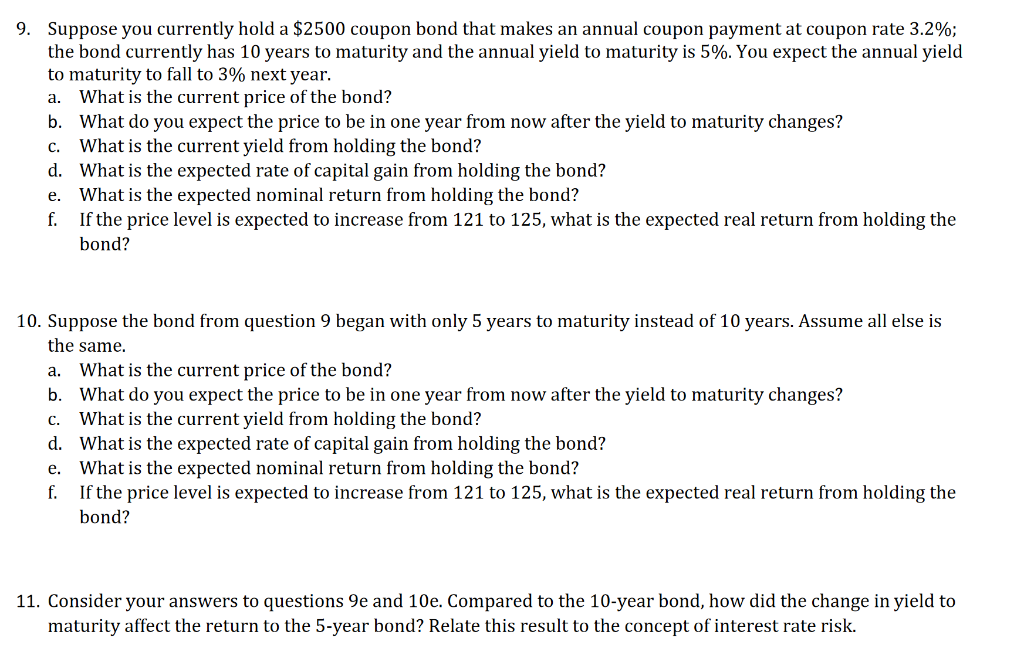

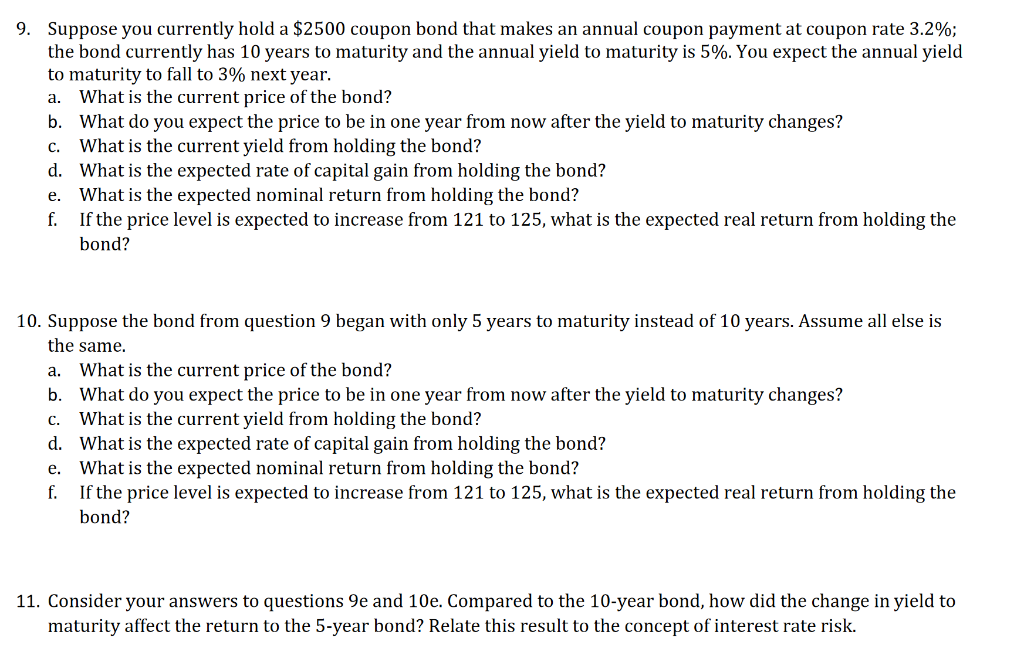

a. 9. Suppose you currently hold a $2500 coupon bond that makes an annual coupon payment at coupon rate 3.2%; the bond currently has 10 years to maturity and the annual yield to maturity is 5%. You expect the annual yield to maturity to fall to 3% next year. What is the current price of the bond? b. What do you expect the price to be in one year from now after the yield to maturity changes? c. What is the current yield from holding the bond? d. What is the expected rate of capital gain from holding the bond? e. What is the expected nominal return from holding the bond? f. If the price level is expected to increase from 121 to 125, what is the expected real return from holding the bond? 10. Suppose the bond from question 9 began with only 5 years to maturity instead of 10 years. Assume all else is the same. a. What is the current price of the bond? b. What do you expect the price to be in one year from now after the yield to maturity changes? c. What is the current yield from holding the bond? d. What is the expected rate of capital gain from holding the bond? e. What is the expected nominal return from holding the bond? f. If the price level is expected to increase from 121 to 125, what is the expected real return from holding the bond? 11. Consider your answers to questions 9e and 10e. Compared to the 10-year bond, how did the change in yield to maturity affect the return to the 5-year bond? Relate this result to the concept of interest rate risk. a. 9. Suppose you currently hold a $2500 coupon bond that makes an annual coupon payment at coupon rate 3.2%; the bond currently has 10 years to maturity and the annual yield to maturity is 5%. You expect the annual yield to maturity to fall to 3% next year. What is the current price of the bond? b. What do you expect the price to be in one year from now after the yield to maturity changes? c. What is the current yield from holding the bond? d. What is the expected rate of capital gain from holding the bond? e. What is the expected nominal return from holding the bond? f. If the price level is expected to increase from 121 to 125, what is the expected real return from holding the bond? 10. Suppose the bond from question 9 began with only 5 years to maturity instead of 10 years. Assume all else is the same. a. What is the current price of the bond? b. What do you expect the price to be in one year from now after the yield to maturity changes? c. What is the current yield from holding the bond? d. What is the expected rate of capital gain from holding the bond? e. What is the expected nominal return from holding the bond? f. If the price level is expected to increase from 121 to 125, what is the expected real return from holding the bond? 11. Consider your answers to questions 9e and 10e. Compared to the 10-year bond, how did the change in yield to maturity affect the return to the 5-year bond? Relate this result to the concept of interest rate risk