Question

Evaluate these tax return problems with the support of tax forms, the tax assignment prompt will be shown below: You have been assigned to review

Evaluate these tax return problems with the support of tax forms, the tax assignment prompt will be shown below:

You have been assigned to review the tax return.. Please casually review the return for accuracy and completness and respond to the following:

Line 32 of Form 4797 is $16,998--$8,998 is 25% gain and $8,000 is 15% gain. Can you trace these amounts to Schedule D and Form 1040?

Line 31 of Form 4797 is $2,500. Can you trace this amount to Form 1040 and see that it is ordinary income (Section 1245)?

Line 2 of Form 4797 is $34,000 is 15% gain. Can you trace this amount to Schedule D and Form 1040?

Does the QBI deduction appear to be correct? This assumes that considering facts and circumstances that the rental activiies qualify as a trade or business.

The completion of this tax return involves receiving the records from the client, a client interview virtually or in person, the return preparation using computer software. your review, and delivery of the return with an exit interview in person or virtually. What sort of fee (i.e., how much?) do you think would be appropriate for this valuable service?

Here are the documents required for this assignment:

form 4797:

Schedule D:

Form 1040:

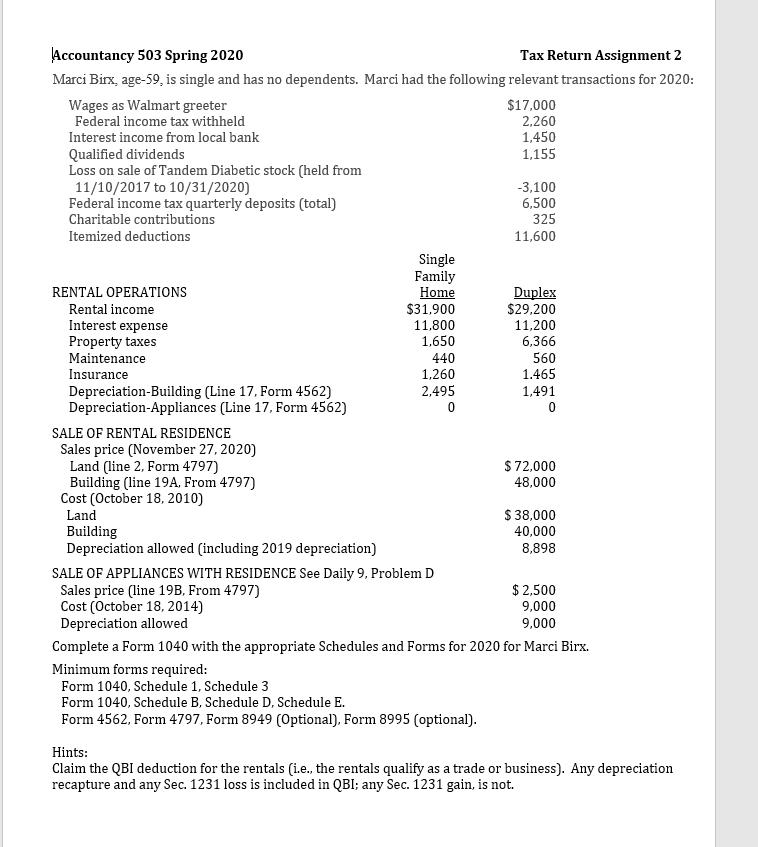

Accountancy 503 Spring 2020 Tax Return Assignment 2 Marci Birx, age-59, is single and has no dependents. Marci had the following relevant transactions for 2020: Wages as Walmart greeter Federal income tax withheld Interest income from local bank Qualified dividends Loss on sale of Tandem Diabetic stock (held from 11/10/2017 to 10/31/2020) Federal income tax quarterly deposits (total) Charitable contributions Itemized deductions RENTAL OPERATIONS Rental income Interest expense Property taxes Maintenance Insurance Depreciation-Building (Line 17, Form 4562) Depreciation-Appliances (Line 17, Form 4562) SALE OF RENTAL RESIDENCE Sales price (November 27, 2020) Land (line 2, Form 4797) Building (line 19A, From 4797) Cost (October 18, 2010) Land Building Depreciation allowed (including 2019 depreciation) Single Family Home $31.900 11,800 1,650 440 1,260 2,495 0 SALE OF APPLIANCES WITH RESIDENCE See Daily 9, Problem D Sales price (line 19B, From 4797) Cost (October 18, 2014) Depreciation allowed $17,000 2,260 1,450 1,155 -3,100 6,500 325 11,600 Duplex $29,200 11,200 6,366 560 1.465 1,491 0 $72,000 48,000 $ 38,000 40,000 8,898 $2,500 9,000 9,000 Complete a Form 1040 with the appropriate Schedules and Forms for 2020 for Marci Birx. Minimum forms required: Form 1040, Schedule 1, Schedule 3 Form 1040, Schedule B. Schedule D, Schedule E. Form 4562, Form 4797, Form 8949 (Optional), Form 8995 (optional). Hints: Claim the QBI deduction for the rentals (i.e., the rentals qualify as a trade or business). Any depreciation recapture and any Sec. 1231 loss is included in QBI; any Sec. 1231 gain, is not.

Step by Step Solution

3.56 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

Yes line 32 of Form 4797 can be traced to Schedule D and Form 1040 On Schedule D the 8998 25 g...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started