Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The following information is relevant for the 12 months to 31 October 2020: 1. The company made sales of 65,000 and purchased materials costing

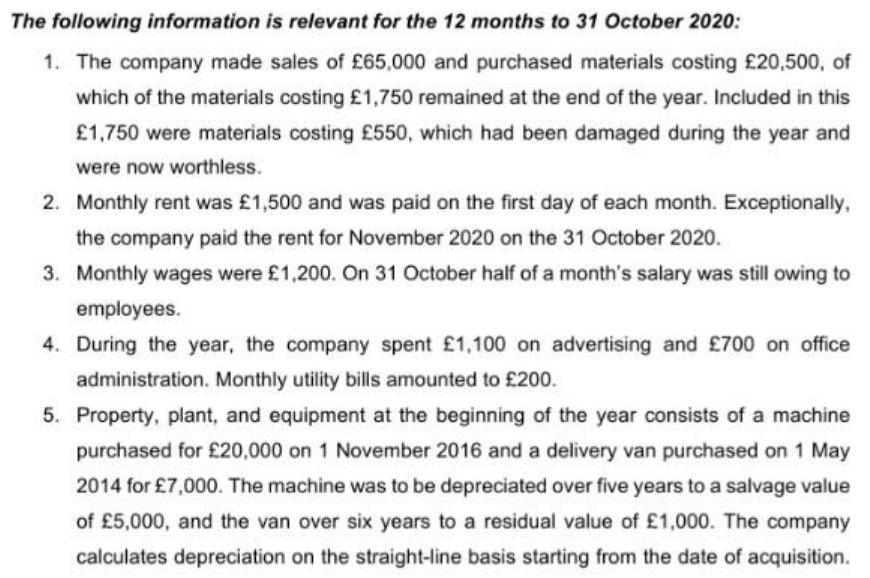

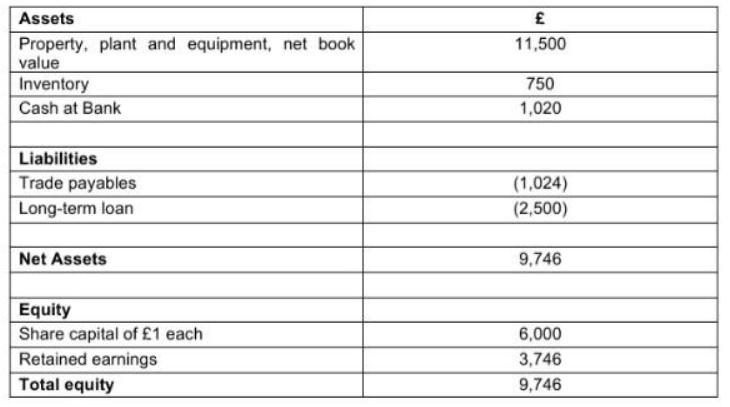

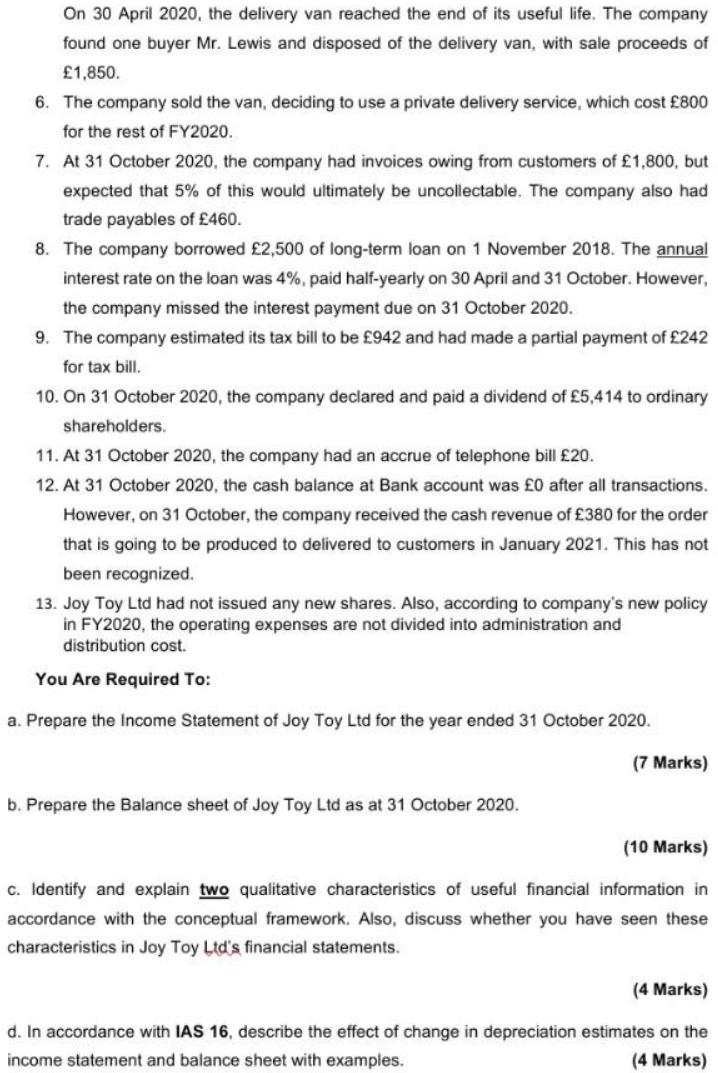

The following information is relevant for the 12 months to 31 October 2020: 1. The company made sales of 65,000 and purchased materials costing 20,500, of which of the materials costing 1,750 remained at the end of the year. Included in this 1,750 were materials costing 550, which had been damaged during the year and were now worthless. 2. Monthly rent was 1,500 and was paid on the first day of each month. Exceptionally, the company paid the rent for November 2020 on the 31 October 2020. 3. Monthly wages were 1,200. On 31 October half of a month's salary was still owing to employees. 4. During the year, the company spent 1,100 on advertising and 700 on office administration. Monthly utility bills amounted to 200. 5. Property, plant, and equipment at the beginning of the year consists of a machine purchased for 20,000 on 1 November 2016 and a delivery van purchased on 1 May 2014 for 7,000. The machine was to be depreciated over five years to a salvage value of 5,000, and the van over six years to a residual value of 1,000. The company calculates depreciation on the straight-line basis starting from the date of acquisition. Assets Property, plant and equipment, net book value 11,500 Inventory 750 Cash at Bank 1,020 Liabilities Trade payables (1,024) Long-term loan (2,500) Net Assets 9,746 Equity Share capital of 1 each Retained earnings Total equity 6,000 3,746 9,746 On 30 April 2020, the delivery van reached the end of its useful life. The company found one buyer Mr. Lewis and disposed of the delivery van, with sale proceeds of 1,850. 6. The company sold the van, deciding to use a private delivery service, which cost 800 for the rest of FY2020. 7. At 31 October 2020, the company had invoices owing from customers of 1,800, but expected that 5% of this would ultimately be uncollectable. The company also had trade payables of 460. 8. The company borrowed 2,500 of long-term loan on 1 November 2018. The annual interest rate on the loan was 4%, paid half-yearly on 30 April and 31 October. However, the company missed the interest payment due on 31 October 2020. 9. The company estimated its tax bill to be 942 and had made a partial payment of 242 for tax bill. 10. On 31 October 2020, the company declared and paid a dividend of 5,414 to ordinary shareholders. 11. At 31 October 2020, the company had an accrue of telephone bill 20. 12. At 31 October 2020, the cash balance at Bank account was 0 after all transactions. However, on 31 October, the company received the cash revenue of 380 for the order that is going to be produced to delivered to customers in January 2021. This has not been recognized. 13. Joy Toy Ltd had not issued any new shares. Also, according to company's new policy in FY2020, the operating expenses are not divided into administration and distribution cost. You Are Required To: a. Prepare the Income Statement of Joy Toy Ltd for the year ended 31 October 2020. (7 Marks) b. Prepare the Balance sheet of Joy Toy Ltd as at 31 October 2020. (10 Marks) c. Identify and explain two qualitative characteristics of useful financial information in accordance with the conceptual framework. Also, discuss whether you have seen these characteristics in Joy Toy Ltd's financial statements. (4 Marks) d. In accordance with IAS 16, describe the effect of change in depreciation estimates on the income statement and balance sheet with examples. (4 Marks) The following information is relevant for the 12 months to 31 October 2020: 1. The company made sales of 65,000 and purchased materials costing 20,500, of which of the materials costing 1,750 remained at the end of the year. Included in this 1,750 were materials costing 550, which had been damaged during the year and were now worthless. 2. Monthly rent was 1,500 and was paid on the first day of each month. Exceptionally, the company paid the rent for November 2020 on the 31 October 2020. 3. Monthly wages were 1,200. On 31 October half of a month's salary was still owing to employees. 4. During the year, the company spent 1,100 on advertising and 700 on office administration. Monthly utility bills amounted to 200. 5. Property, plant, and equipment at the beginning of the year consists of a machine purchased for 20,000 on 1 November 2016 and a delivery van purchased on 1 May 2014 for 7,000. The machine was to be depreciated over five years to a salvage value of 5,000, and the van over six years to a residual value of 1,000. The company calculates depreciation on the straight-line basis starting from the date of acquisition. Assets Property, plant and equipment, net book value 11,500 Inventory 750 Cash at Bank 1,020 Liabilities Trade payables (1,024) Long-term loan (2,500) Net Assets 9,746 Equity Share capital of 1 each Retained earnings Total equity 6,000 3,746 9,746 On 30 April 2020, the delivery van reached the end of its useful life. The company found one buyer Mr. Lewis and disposed of the delivery van, with sale proceeds of 1,850. 6. The company sold the van, deciding to use a private delivery service, which cost 800 for the rest of FY2020. 7. At 31 October 2020, the company had invoices owing from customers of 1,800, but expected that 5% of this would ultimately be uncollectable. The company also had trade payables of 460. 8. The company borrowed 2,500 of long-term loan on 1 November 2018. The annual interest rate on the loan was 4%, paid half-yearly on 30 April and 31 October. However, the company missed the interest payment due on 31 October 2020. 9. The company estimated its tax bill to be 942 and had made a partial payment of 242 for tax bill. 10. On 31 October 2020, the company declared and paid a dividend of 5,414 to ordinary shareholders. 11. At 31 October 2020, the company had an accrue of telephone bill 20. 12. At 31 October 2020, the cash balance at Bank account was 0 after all transactions. However, on 31 October, the company received the cash revenue of 380 for the order that is going to be produced to delivered to customers in January 2021. This has not been recognized. 13. Joy Toy Ltd had not issued any new shares. Also, according to company's new policy in FY2020, the operating expenses are not divided into administration and distribution cost. You Are Required To: a. Prepare the Income Statement of Joy Toy Ltd for the year ended 31 October 2020. (7 Marks) b. Prepare the Balance sheet of Joy Toy Ltd as at 31 October 2020. (10 Marks) c. Identify and explain two qualitative characteristics of useful financial information in accordance with the conceptual framework. Also, discuss whether you have seen these characteristics in Joy Toy Ltd's financial statements. (4 Marks) d. In accordance with IAS 16, describe the effect of change in depreciation estimates on the income statement and balance sheet with examples. (4 Marks) The following information is relevant for the 12 months to 31 October 2020: 1. The company made sales of 65,000 and purchased materials costing 20,500, of which of the materials costing 1,750 remained at the end of the year. Included in this 1,750 were materials costing 550, which had been damaged during the year and were now worthless. 2. Monthly rent was 1,500 and was paid on the first day of each month. Exceptionally, the company paid the rent for November 2020 on the 31 October 2020. 3. Monthly wages were 1,200. On 31 October half of a month's salary was still owing to employees. 4. During the year, the company spent 1,100 on advertising and 700 on office administration. Monthly utility bills amounted to 200. 5. Property, plant, and equipment at the beginning of the year consists of a machine purchased for 20,000 on 1 November 2016 and a delivery van purchased on 1 May 2014 for 7,000. The machine was to be depreciated over five years to a salvage value of 5,000, and the van over six years to a residual value of 1,000. The company calculates depreciation on the straight-line basis starting from the date of acquisition. Assets Property, plant and equipment, net book value 11,500 Inventory 750 Cash at Bank 1,020 Liabilities Trade payables (1,024) Long-term loan (2,500) Net Assets 9,746 Equity Share capital of 1 each Retained earnings Total equity 6,000 3,746 9,746 On 30 April 2020, the delivery van reached the end of its useful life. The company found one buyer Mr. Lewis and disposed of the delivery van, with sale proceeds of 1,850. 6. The company sold the van, deciding to use a private delivery service, which cost 800 for the rest of FY2020. 7. At 31 October 2020, the company had invoices owing from customers of 1,800, but expected that 5% of this would ultimately be uncollectable. The company also had trade payables of 460. 8. The company borrowed 2,500 of long-term loan on 1 November 2018. The annual interest rate on the loan was 4%, paid half-yearly on 30 April and 31 October. However, the company missed the interest payment due on 31 October 2020. 9. The company estimated its tax bill to be 942 and had made a partial payment of 242 for tax bill. 10. On 31 October 2020, the company declared and paid a dividend of 5,414 to ordinary shareholders. 11. At 31 October 2020, the company had an accrue of telephone bill 20. 12. At 31 October 2020, the cash balance at Bank account was 0 after all transactions. However, on 31 October, the company received the cash revenue of 380 for the order that is going to be produced to delivered to customers in January 2021. This has not been recognized. 13. Joy Toy Ltd had not issued any new shares. Also, according to company's new policy in FY2020, the operating expenses are not divided into administration and distribution cost. You Are Required To: a. Prepare the Income Statement of Joy Toy Ltd for the year ended 31 October 2020. (7 Marks) b. Prepare the Balance sheet of Joy Toy Ltd as at 31 October 2020. (10 Marks) c. Identify and explain two qualitative characteristics of useful financial information in accordance with the conceptual framework. Also, discuss whether you have seen these characteristics in Joy Toy Ltd's financial statements. (4 Marks) d. In accordance with IAS 16, describe the effect of change in depreciation estimates on the income statement and balance sheet with examples. (4 Marks)

Step by Step Solution

★★★★★

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Income Statement Sales 65000 Cost of goods sold 20050 Gross profit 44950 Operative expenses Rent 150...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started