Answered step by step

Verified Expert Solution

Question

1 Approved Answer

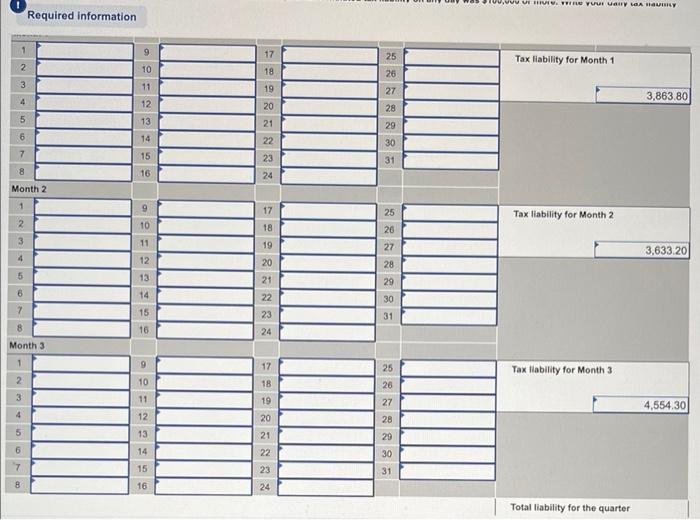

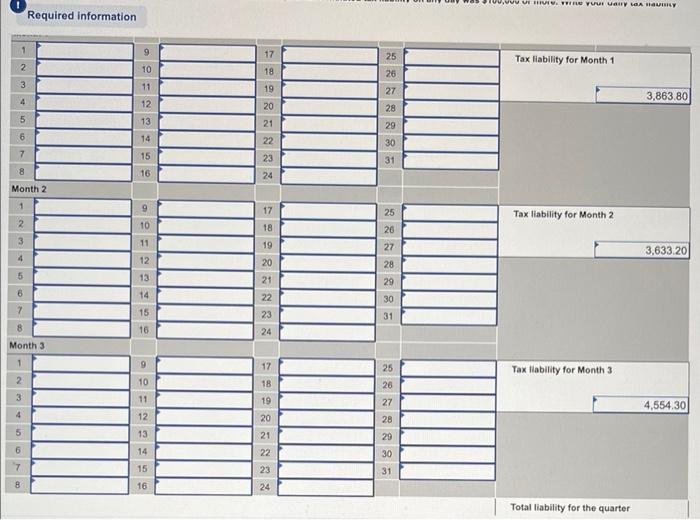

i need help on filling in those blanks for month 1,2, and 3. what info goes in those numbers 1-31? thank you A payroll summary

i need help on filling in those blanks for month 1,2, and 3. what info goes in those numbers 1-31?

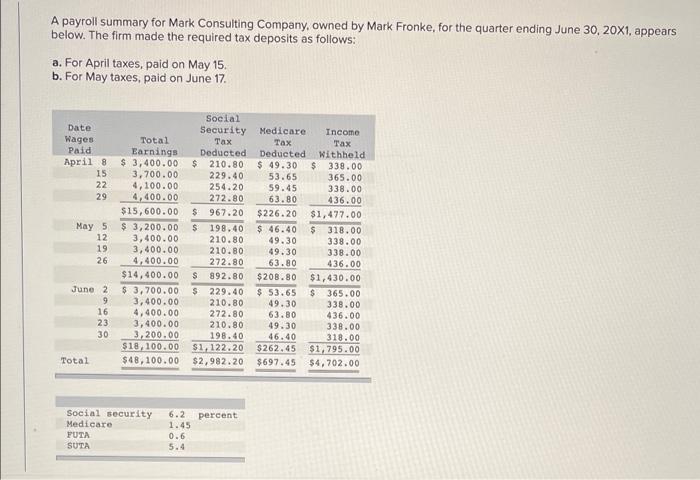

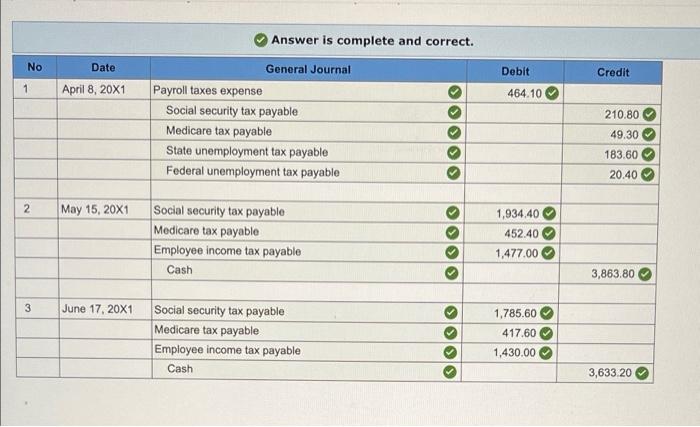

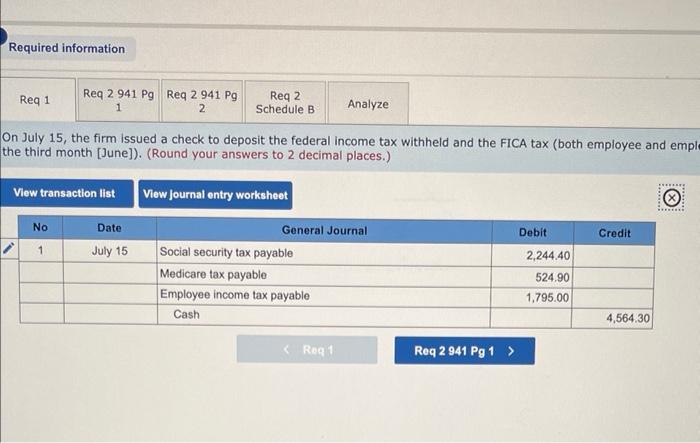

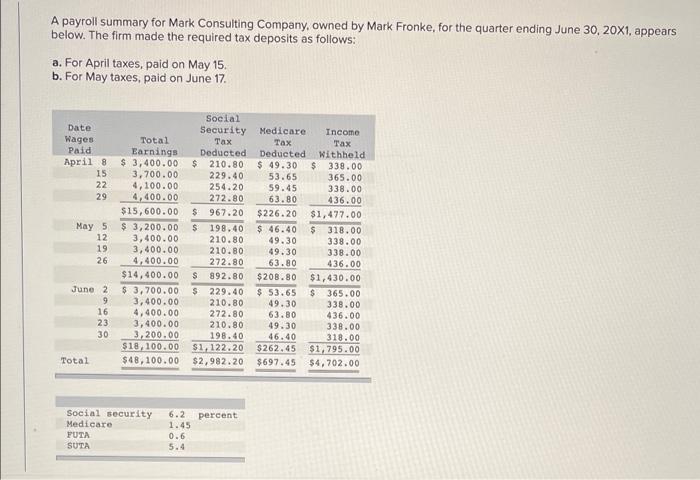

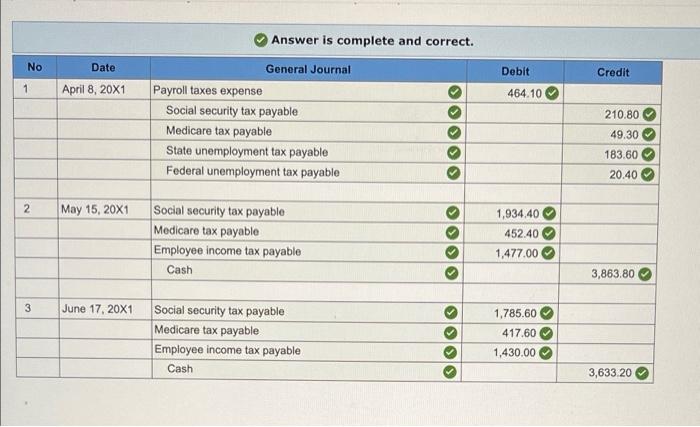

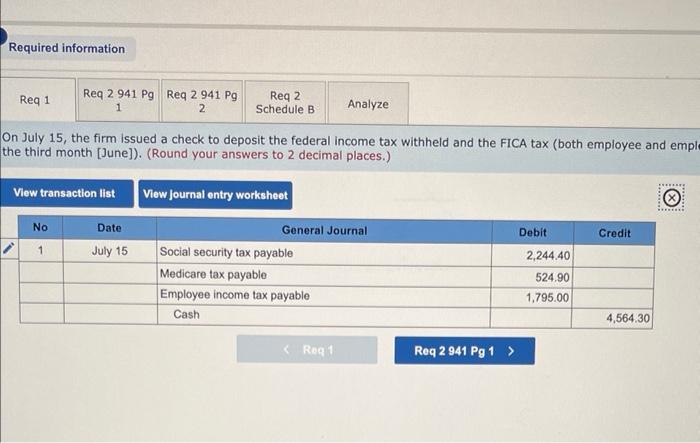

A payroll summary for Mark Consulting Company, owned by Mark Fronke, for the quarter ending June 30, 20X1, appears below. The firm made the required tax deposits as follows: a. For April taxes, paid on May 15. b. For May taxes, paid on June 17. Date Wages Paid April 8 15 22 29 US May 5 12 19 26 Total Earnings $ 3,400.00 3,700.00 4,100.00 4,400.00 $15,600.00 $ 3,200.00 3,400.00 3,400.00 4,400.00 $14,400.00 $ 3,700.00 3,400.00 4,400.00 3,400.00 3,200.00 $18,100.00 $48,100.00 Social Security Medicare Income Tax Tax Tax Deducted Deducted Withheld $ 210.80 $ 49.30 $ 338.00 229.40 53.65 365.00 254.20 59.45 338.00 272.80 63.80 436.00 $ 967.20 $ 226.20 $1,477.00 $ 198.40 $ 46.40 $ 318.00 210.80 49.30 338.00 210.80 49.30 338.00 272.80 63.80 436.00 S 892.80 $208.80 $1,430.00 $ 229.40 $ 53.65 $365.00 210.80 49.30 338.00 272.80 63.80 436.00 210.80 49.30 338.00 198.40 46.40 318.00 $1,122.20 $262.45 $1,795.00 $2,982.20 $697.45 $4,702.00 June 2 9 16 23 30 em Total 6.2 percent Social security Medicare FUTA SUTA 1.45 0.6 5.4 Answer is complete and correct. No Date General Journal Debit Credit 1 April 8, 20X1 464.10 210.80 Payroll taxes expense Social security tax payable Medicare tax payable State unemployment tax payable Federal unemployment tax payable 49.30 183.60 20.40 2 May 15, 20X1 Social security tax payable Medicare tax payable Employee income tax payable Cash 1,934.40 452.40 1,477.00 3,863.80 3 June 17, 20X1 Social security tax payable Medicare tax payable Employee income tax payable Cash ololo 1,785.60 417.60 1,430.00 3,633 20 Required information Req 1 Req 2 941 Pg Req 2 941 Pg 1 2 Req 2 Schedule B Analyze On July 15, the firm issued a check to deposit the federal income tax withheld and the FICA tax (both employee and emplo the third month [June]). (Round your answers to 2 decimal places.) View transaction list View Journal entry worksheet TELE No Debit Date July 15 Credit 1 General Journal Social security tax payable Medicare tax payable Employee income tax payable Cash 2,244.40 524.90 1.795.00 4,564.30 VIR Y AY GARY Required information 1 9 17 Tax liability for Month 1 2. 25 26 10 18 3 11 19 3,863.80 4 12 20 27 28 29 5 13 6 14 30 7 21 22 23 24 15 31 16 8 Month 2 1 17 9 10 25 Tax liability for Month 2 2. 18 3 4 26 27 19 11 12 3,633.20 28 20 21 5 13 29 6 14 15 22 23 30 31 8 16 24 Month 3 1 9 17 25 Tax Hability for Month 3 2 10 18 3 11 26 27 19 20 4,554.30 4 12 28 5 13 29 6 14 21 22 23 30 15 31 8 16 24 Total liability for the quarter thank you

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started