i need help

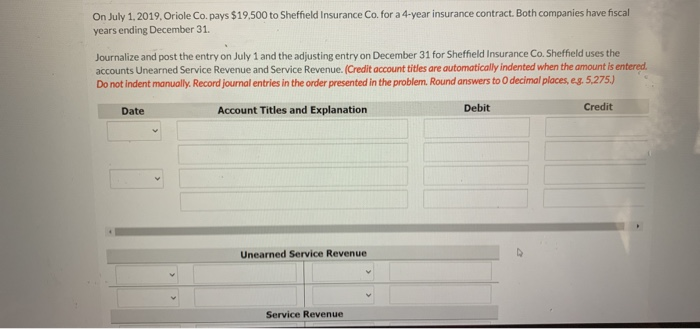

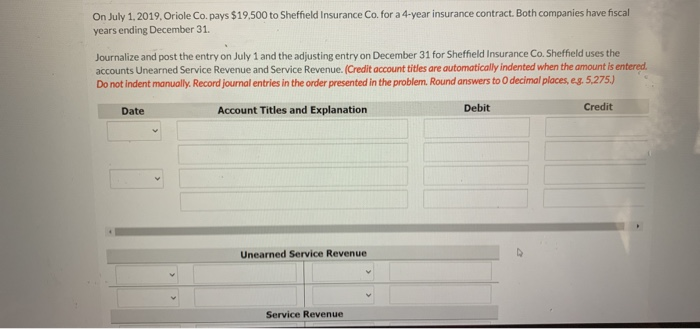

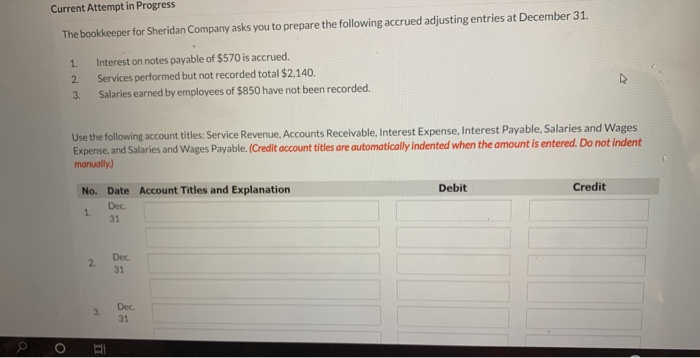

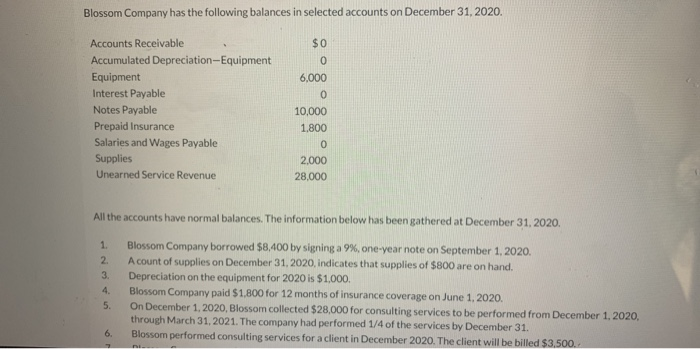

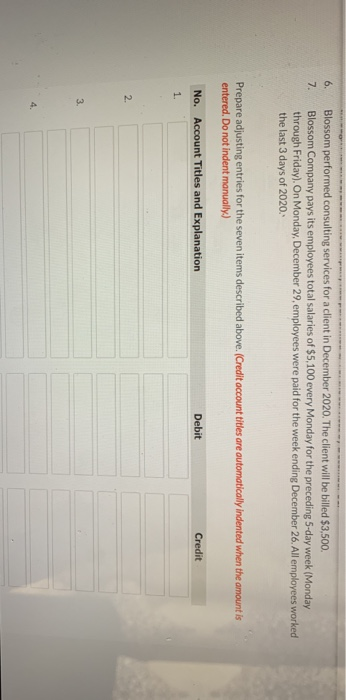

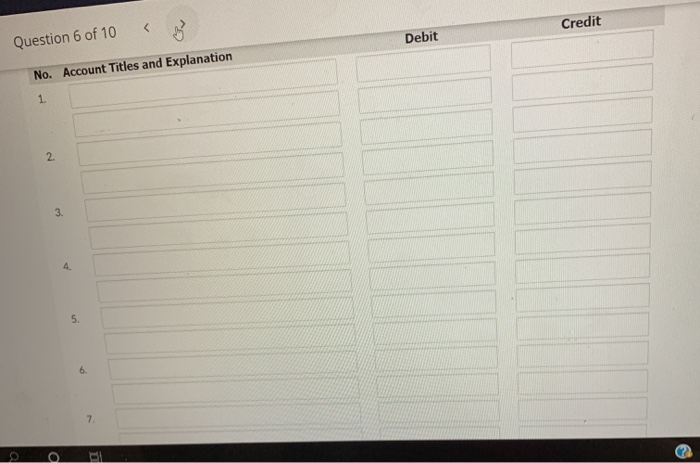

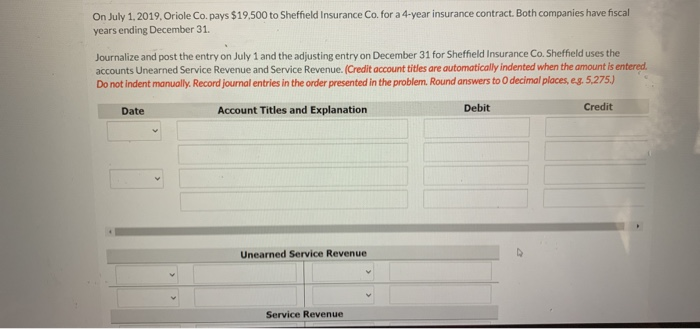

On July 1, 2019. Oriole Co.pays $19,500 to Sheffield Insurance Co. for a 4-year insurance contract. Both companies have fiscal years ending December 31. Journalize and post the entry on July 1 and the adjusting entry on December 31 for Sheffield Insurance Co. Sheffield uses the accounts Unearned Service Revenue and Service Revenue. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. Round answers to decimal places, eg. 5,275.) Date Account Titles and Explanation Credit Debit Unearned Service Revenue Service Revenue Current Attempt in Progress The bookkeeper for Sheridan Company asks you to prepare the following accrued adjusting entries at December 31. 1 2 3. Interest on notes payable of $570 is accrued. Services performed but not recorded total $2.140. Salaries earned by employees of $850 have not been recorded. Use the following account titles: Service Revenue, Accounts Receivable, Interest Expense, Interest Payable, Salaries and Wages Expense, and Salaries and Wages Payable. (Credit account titles are automatically indented when the amount is entered. Do not indent manually) Debit Credit No. Date Account Titles and Explanation Dec 1 31 2 Dec 31 3. Dec 31 Blossom Company has the following balances in selected accounts on December 31, 2020. $0 0 6,000 Accounts Receivable Accumulated Depreciation-Equipment Equipment Interest Payable Notes Payable Prepaid Insurance Salaries and Wages Payable Supplies Unearned Service Revenue 0 10,000 1.800 0 2.000 28,000 1 All the accounts have normal balances. The information below has been gathered at December 31, 2020. Blossom Company borrowed $8,400 by signing a 9%, one-year note on September 1, 2020. 2. A count of supplies on December 31, 2020, indicates that supplies of $800 are on hand. 3. Depreciation on the equipment for 2020 is $1,000 Blossom Company paid $1,800 for 12 months of insurance coverage on June 1, 2020. On December 1, 2020, Blossom collected $28,000 for consulting services to be performed from December 1, 2020, through March 31, 2021. The company had performed 1/4 of the services by December 31. Blossom performed consulting services for a client in December 2020. The client will be billed $3,500. 5. 6 6. 7 Blossom performed consulting services for a client in December 2020. The client will be billed $3,500. Blossom Company pays its employees total salaries of $5,100 every Monday for the preceding 5-day week (Monday through Friday). On Monday, December 29, employees were paid for the week ending December 26. All employees worked the last 3 days of 2020. Prepare adjusting entries for the seven items described above. (Credit account titles are automatically indented when the amount is entered. Do not indent manually) No. Account Titles and Explanation Debit Credit 1 2. 3.