Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help on the following questions Present and future value tables of $1 at 3% are presented below N 1 2 36 3 4

I need help on the following questions

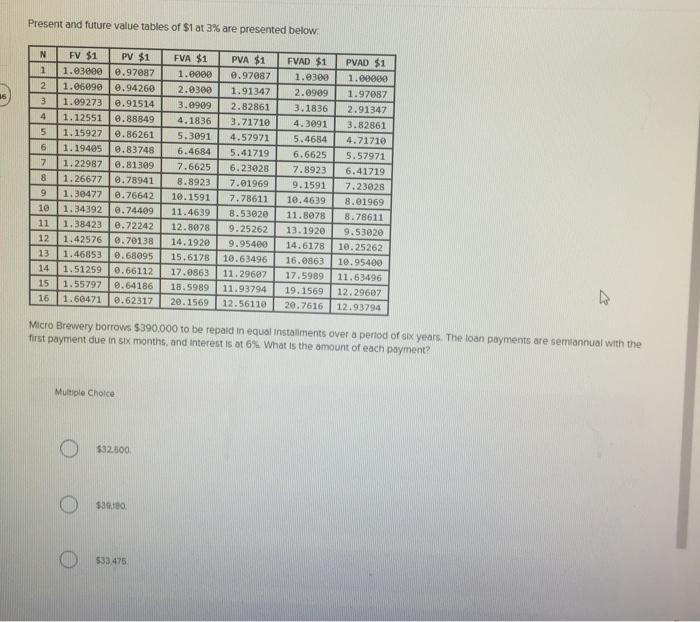

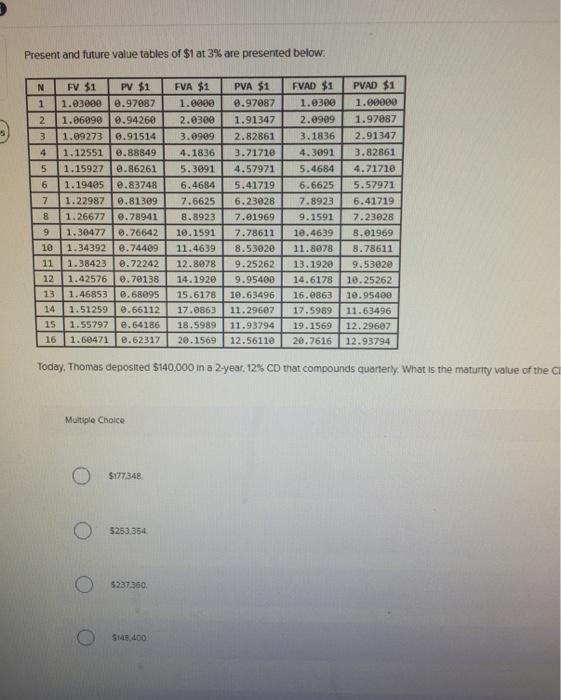

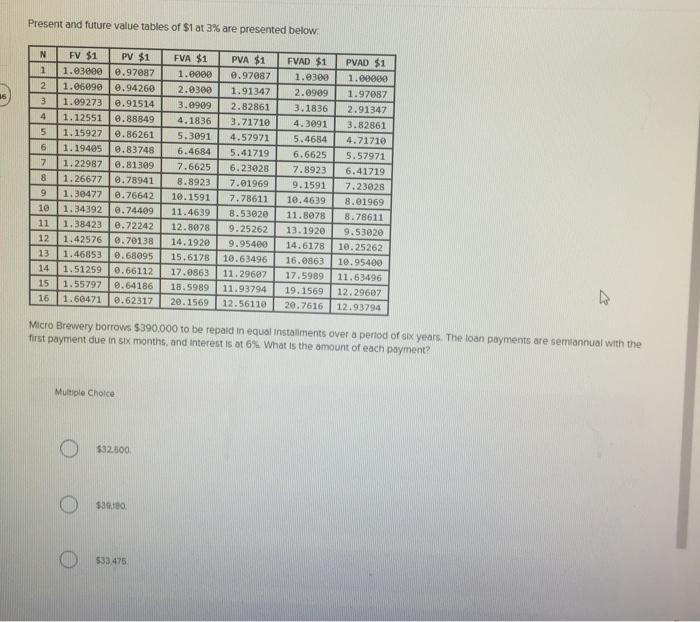

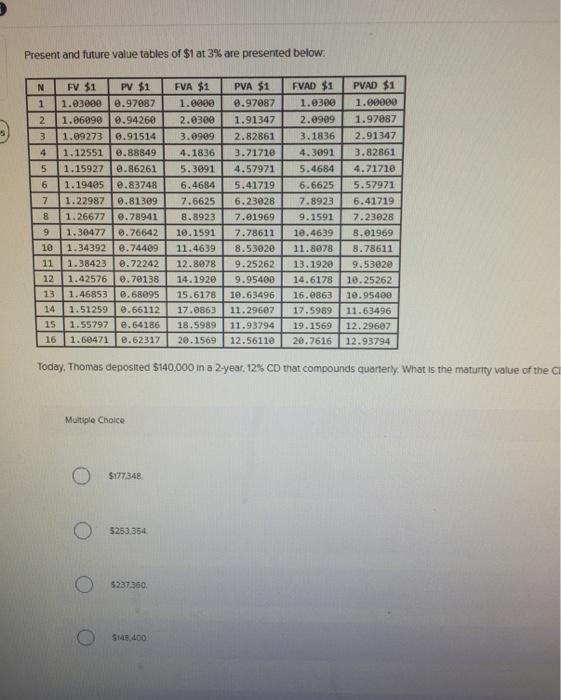

Present and future value tables of $1 at 3% are presented below N 1 2 36 3 4 5 6 7 8 9 10 11 12 FV $1 1.03800 1.06990 1.09273 1.12551 1.15927 1.19405 1.22987 1.26677 1.39477 1.34392 1.38423 1.42576 1.46853 1.51259 1.55797 1.60471 PV $1 0.97087 0.94260 0.91514 0.88849 9.86261 0.83748 0.81309 0.78941 0.76642 0.74409 0.72242 0.70138 0.68095 0.66112 0.64186 0.62317 FVA $1 1.0980 2.9300 3.0909 4.1836 5.3091 6.4684 7.6625 8.8923 10.1591 11.4639 12.8078 14.1929 15.6178 17.0863 18.5989 20.1569 PVA $1 0.97087 1.91347 2.82861 3.71710 4.57971 5.41719 6.23028 7.01969 7.78611 8.53020 9.25262 9.95400 10.63496 11.29607 11.93794 12.56110 FVAD $1 1.0309 2.0909 3.1836 4.3091 5.4684 6.6625 7.8923 9.1591 10.4639 11.8078 13.1920 14.6178 16.0863 17.5989 19.1569 20.7616 PVAD $1 1.00000 1.97087 2.91347 3.82861 4.71710 5.57971 6.41719 7.23028 8.01969 8.78611 9.53020 10.25262 10.95400 11.63496 12.29607 12.93794 13 14 15 16 Micro Brewery borrows $390,000 to be repaid in equal installments over a period of six years. The loan payments are semiannual with the first payment due in six months, and interests of 69 What is the amount of each payment? Multiple Choice $32.100 $100 0 533475 Present and future value tables of $1 at 3% are presented below: PVAD $1 1.00000 1.97087 2.91347 N FV $1 PV $1 1 1.03000 0.97087 2 1.86890 0.94260 3 1.89273 0.91514 4 1.12551 0.88849 5 1.15927 0.86261 6 1.19405 2.83748 7 1.22987 0.81309 8 1.26677 8.78941 9 1.30477 0.76642 10 1.34392 @.74409 11 1.38423 @.72242 12 1.42576 0.70138 13 1.46853 0.68095 14 1.51259 6.66112 15 1.55797 0.64186 16 1.68471 0.62317 FVA $1 1.0000 2.9300 3.0989 4.1836 5.3091 6.4684 7.6625 8.8923 10.1591 11.4639 12.8078 14.1920 15.6178 17.0863 18.5989 20.1569 PVA $1 0.97087 1.91347 2.82861 3.71710 4.57971 5.41719 6.23028 7.81969 7.78611 8.53020 9.25262 9.95400 10.63496 11.29607 11.93794 12.56110 FVAD $1 1.0300 2.0909 3.1836 4.3091 5.4684 6.6625 7.8923 9.1591 10.4639 11.8878 13.1920 14.6178 16.0863 17.5989 19.1569 20.7616 3.82861 4.71710 5.57971 6.41719 7.23028 8.01969 8.78611 9.53020 10.25262 10.95400 11.63496 12.29607 12.93794 Today, Thomas deposited $140,000 in a 2-year, 12% CD that compounds quarterly. What is the maturity value of the Multiple Choice $177348 5253.354 5237.360 $145.000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started