I need help on this chapter 14 problem thank you

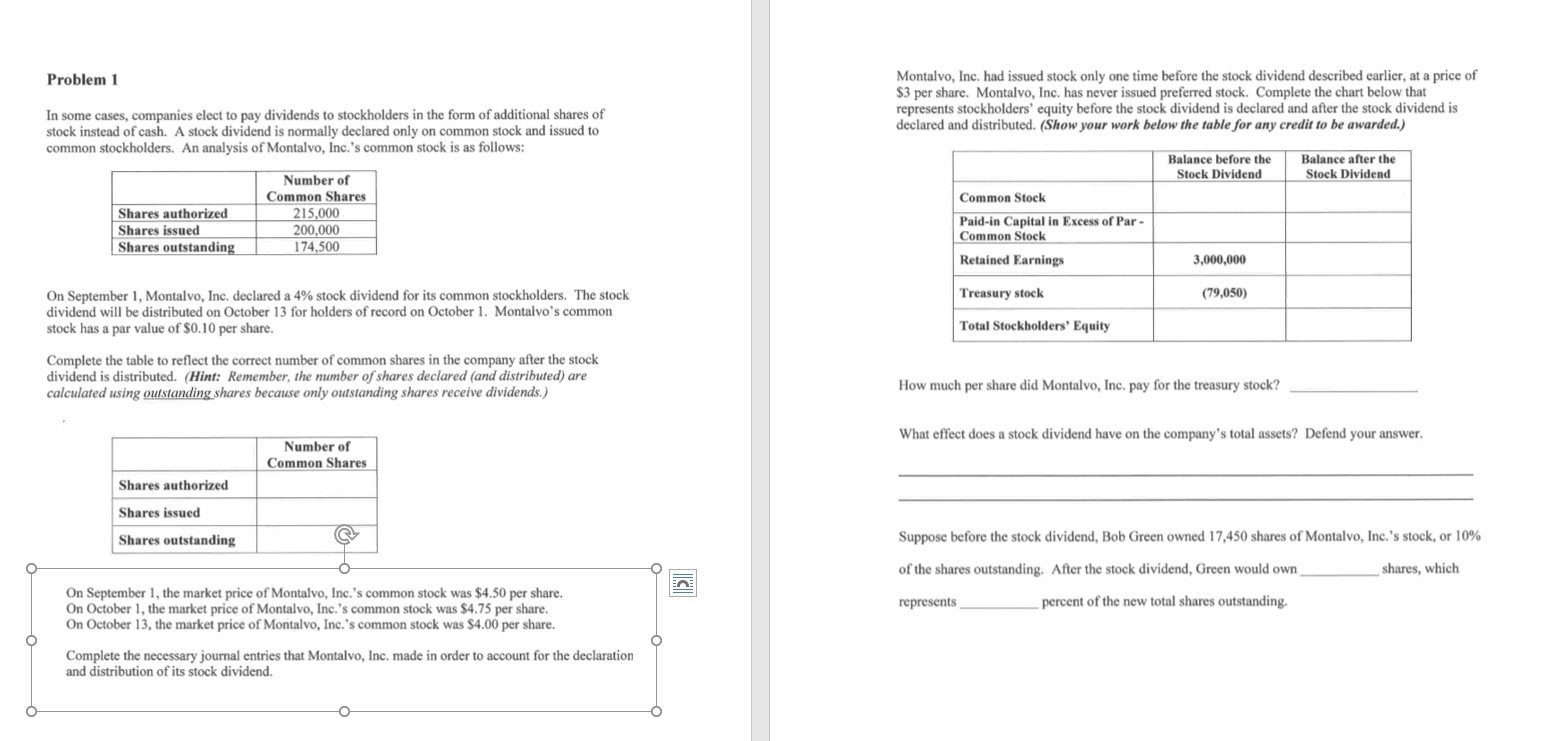

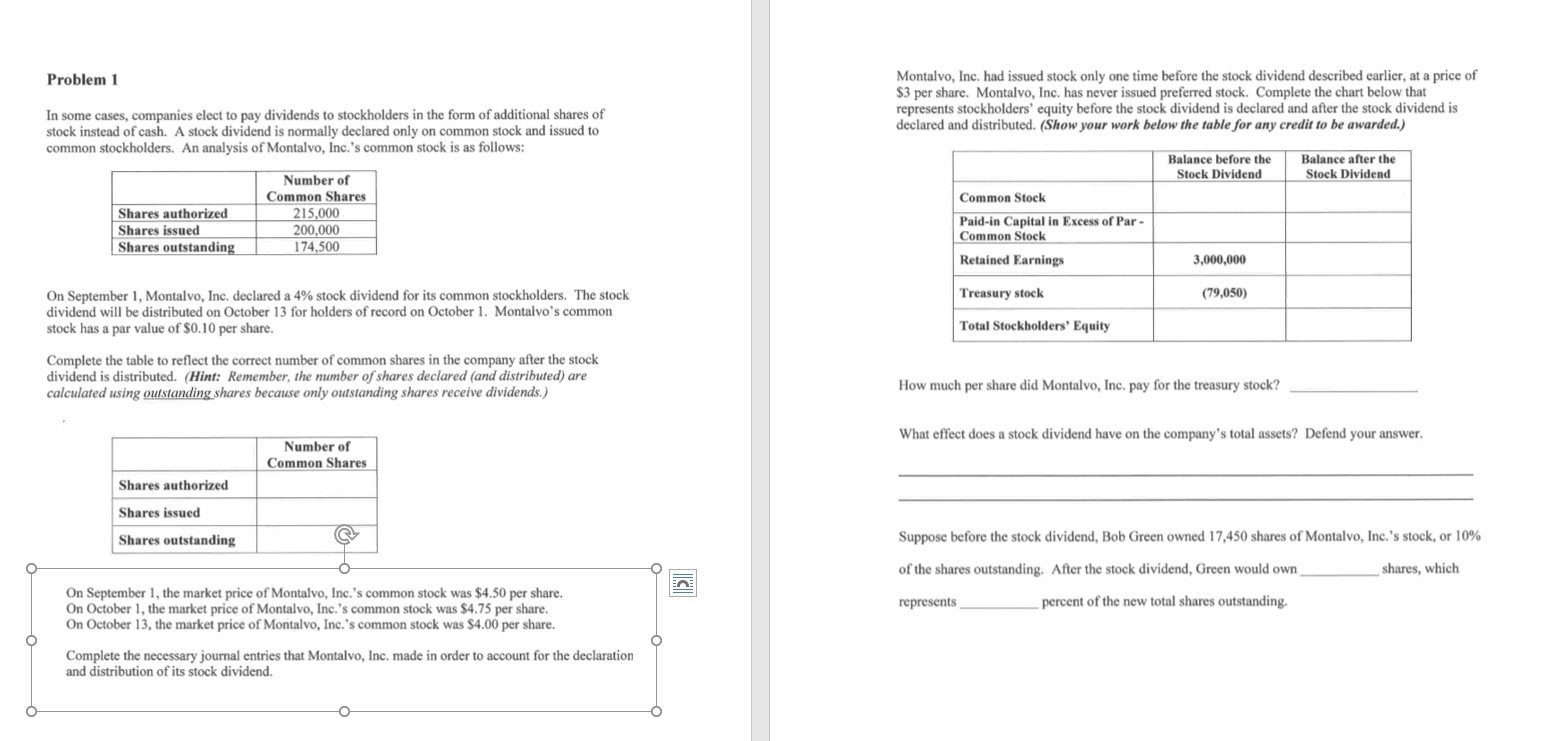

Problem 1 Montalvo, Inc. had issued stock only one time before the stock dividend described earlier, at a price of $3 per share. Montalvo, Inc. has never issued preferred stock. Complete the chart below that represents stockholders' equity before the stock dividend is declared and after the stock dividend is declared and distributed. (Show your work below the table for any credit to be awarded.) In some cases, companies elect to pay dividends to stockholders in the form of additional shares of stock instead of cash. A stock dividend is normally declared only on common stock and issued to common stockholders. An analysis of Montalvo, Inc.'s common stock is as follows: Balance before the Stock Dividend Balance after the Stock Dividend Shares authorized Shares issued | Shares outstanding Number of Common Shares 215,000 200,000 174,500 Common Stock Paid-in Capital in Excess of Par- Common Stock Retained Earnings 3,000,000 Treasury stock (79,050) On September 1, Montalvo, Inc. declared a 4% stock dividend for its common stockholders. The stock dividend will be distributed on October 13 for holders of record on October 1. Montalvo's common stock has a par value of $0.10 per share. Total Stockholders' Equity Complete the table to reflect the correct number of common shares in the company after the stock dividend is distributed. (Hint: Remember, the number of shares declared (and distributed) are calculated using outstanding shares because only outstanding shares receive dividends.) How much per share did Montalvo, Inc. pay for the treasury stock? What effect does a stock dividend have on the company's total assets? Defend your answer. Number of Common Shares Shares authorized Shares issued Shares outstanding Suppose before the stock dividend, Bob Green owned 17,450 shares of Montalvo, Inc.'s stock, or 10% of the shares outstanding. After the stock dividend, Green would own shares, which On September 1, the market price of Montalvo, Inc.'s common stock was $4.50 per share. On October 1, the market price of Montalvo, Inc.'s common stock was $4.75 per share. On October 13, the market price of Montalvo, Inc.'s common stock was $4.00 per share. represents percent of the new total shares outstanding. Complete the necessary journal entries that Montalvo, Inc. made in order to account for the declaration and distribution of its stock dividend