Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i need help on this Use the following information to answer Questions (10)-(12) Troy Engines manufactures a varicty of engines for use in heavy equipment.

i need help on this

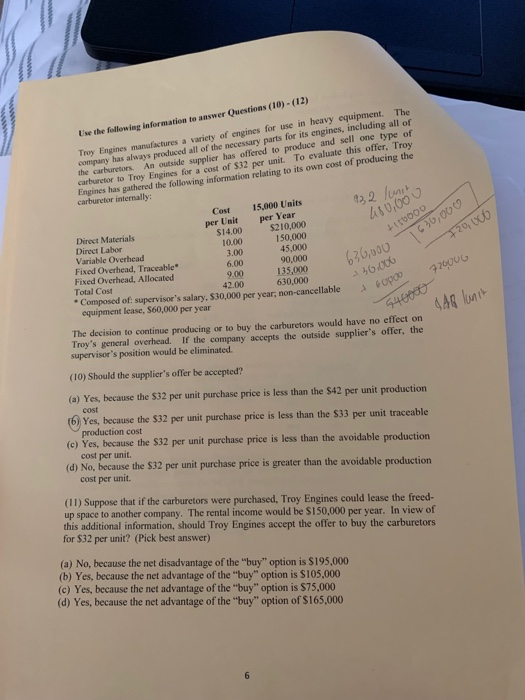

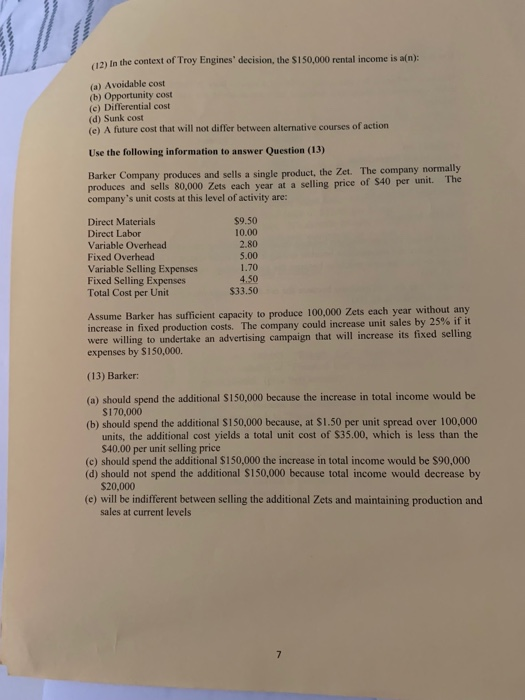

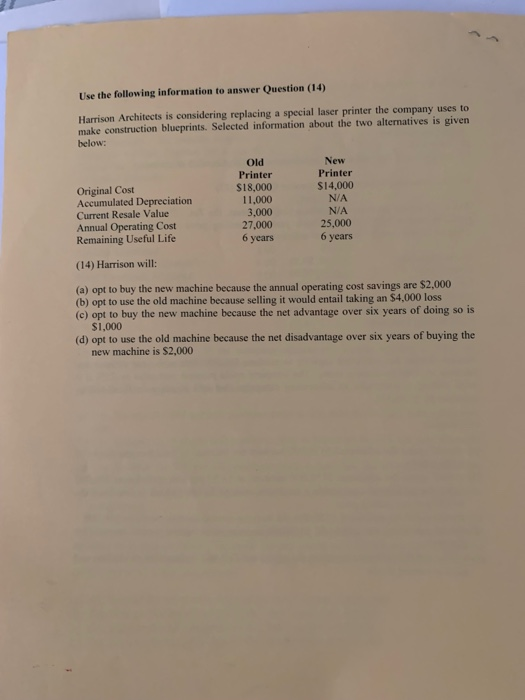

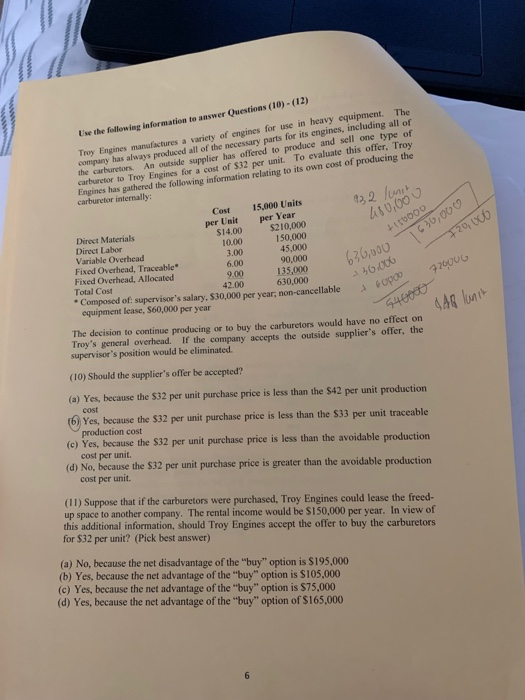

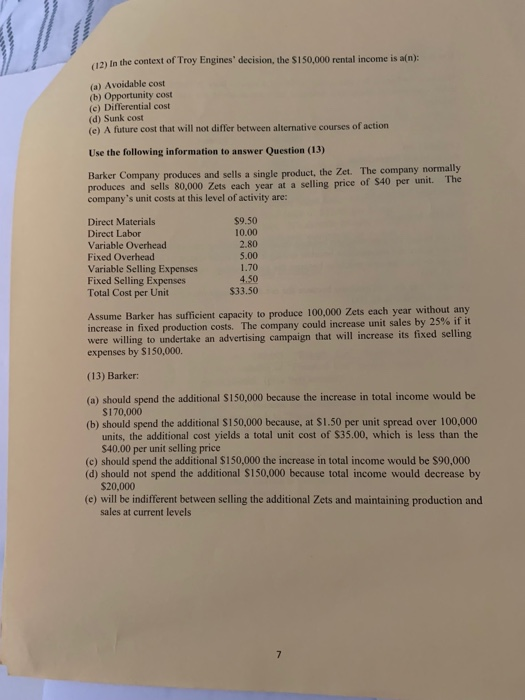

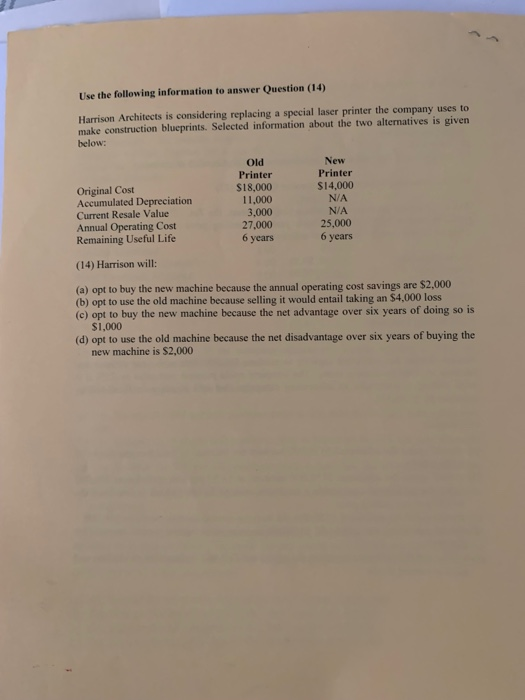

Use the following information to answer Questions (10)-(12) Troy Engines manufactures a varicty of engines for use in heavy equipment. The company has always produced all of the necessary parts for its engines, including all of the carburetors carburetor to Troy Engines for a cost of $32 per unit. To evaluate this offer, Troy Engines has gathered the following information relating to its own cost of producing the carburctor internally: An outside supplier has offered to produce and sell one type of 32 lun 460,00 15,000 Units per Year $210,000 150,000 45,000 90,000 135,000 630,000 Cost per Unit $14.00 10.00 3.00 6.00 9.00 42.00 Direct Materials Direct Labor Variable Overhead Fixed Overhead, Traceable Fixed Overhead, Allocated Total Cost Composed of: supervisor's salary, $30,000 per year; non-cancellable equipment lease, $60,000 per year 4ItbooD 30,00 0 636,000 40000 7200UG The decision to continue producing or to buy the carburetors would have no effect on 440000 448 kunik Troy's general overhead supervisor's position would be eliminated. If the company accepts the outside supplier's offer, the (10) Should the supplier's offer be accepted? (a) Yes, because the $32 per unit purchase price is less than the $42 per unit production cost (b) Yes, because the $32 per unit purchase price is less than the $33 per unit traceable production cost (c) Yes, because the $32 per unit purchase price is less than the avoidable production cost per unit. (d) No, because the $32 per unit purchase price is greater than the avoidable production cost per unit. (11) Suppose that if the carburetors were purchased, Troy Engines could lease the freed- up space to another company. The rental income would be $150,000 per year. In view of this additional information, should Troy Engines accept the offer to buy the carburetors for $32 per unit? (Pick best answer) (a) No, because the net disadvantage of the "buy" option is $195,000 (b) Yes, because the net advantage of the "buy" option is $105,000 (c) Yes, because the net advantage of the "buy" option is $75,000 (d) Yes, because the net advantage of the "buy" option of $165,000 6 wwwww 12) In the context of Troy Engines' decision, the $150,000 rental income is a(n): (a) Avoidable cost (b) Opportunity cost (c) Differential cost (d) Sunk cost (e) A future cost that will not differ between alternative courses of action Use the following information to answer Question (13) Barker Company produces and sells a single product, the Zet. The company normally produces and sells 80,000 Zets each year at a selling price of $40 per unit. The company's unit costs at this level of activity are: Direct Materials $9.50 Direct Labor Variable Overhead Fixed Overhead Variable Selling Expenses Fixed Selling Expenses Total Cost per Unit 10.00 2.80 5.00 1.70 4.50 $33.50 Assume Barker has sufficient capacity to produce 100,000 Zets each year without any increase in fixed production costs. The company could increase unit sales by 25 % if it were willing to undertake an advertising campaign that will increase its fixed selling expenses by $150,000. (13) Barker: (a) should spend the additional $150,000 because the increase in total income would be $170,000 (b) should spend the additional $150,000 because, at $1.50 per unit spread over 100,000 units, the additional cost yields a total unit cost of $35.00, which is less than the $40.00 per unit selling price (c) should spend the additional $150,000 the increase in total income would be $90,000 (d) should not spend the additional $150,000 because total income would decrease by $20,000 (e) will be indifferent between selling the additional Zets and maintaining production and sales at current levels 7 wwww Use the following information to answer Question (14) a special laser printer the company uses to Harrison Architects is considering replacing make construction blueprints. Selected information about the two alternatives is given below: New Old Printer Printer $18,000 11,000 3,000 27,000 $14,000 Original Cost Accumulated Depreciation Current Resale Value Annual Operating Cost Remaining Useful Life N/A N/A 25,000 6 years 6 years (14) Harrison will: (a) opt to buy the new machine because the annual operating cost savings are $2,000 (b) opt to use the old machine because selling it would entail taking an $4,000 loss (c) opt to buy the new machine because the net advantage over six years of doing so is $1,000 (d) opt to use the old machine because the net disadvantage over six years of buying the new machine is $2,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started