Answered step by step

Verified Expert Solution

Question

1 Approved Answer

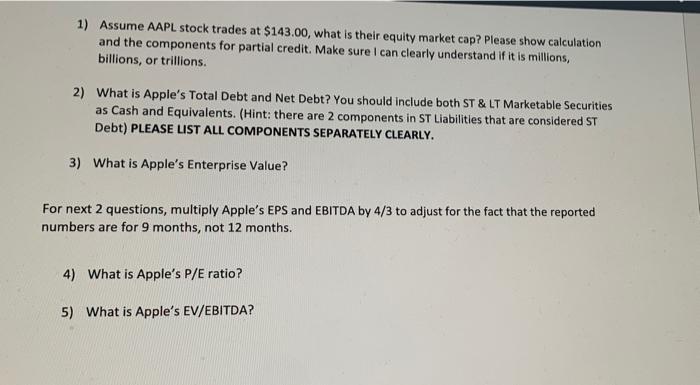

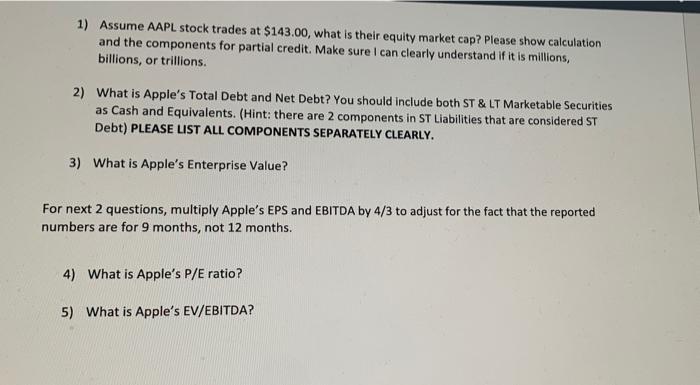

I need help please Asap preferably the last 2 questions please 1) Assume AAPL stock trades at $143.00, what is their equity market cap? Please

I need help please Asap preferably the last 2 questions please

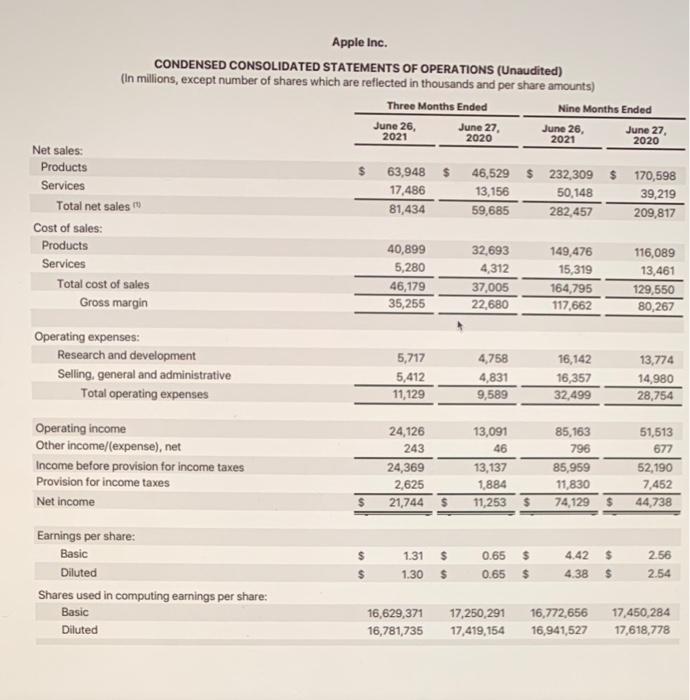

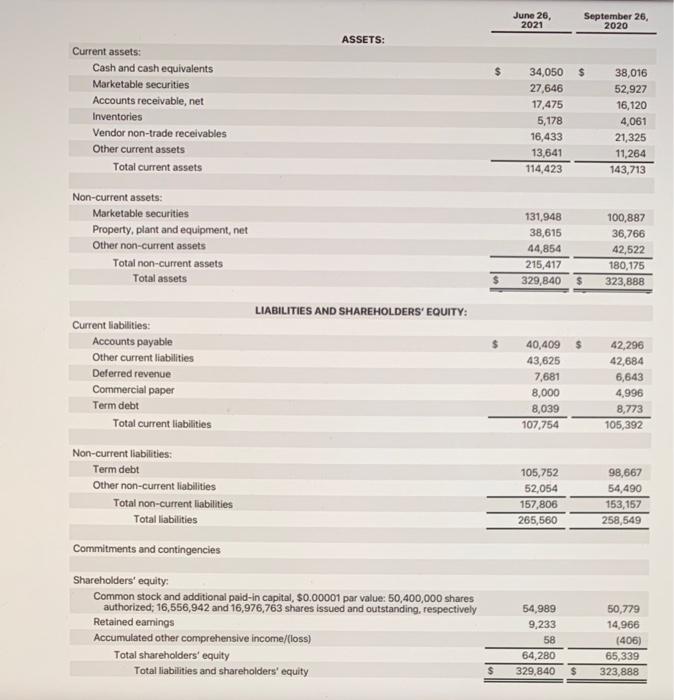

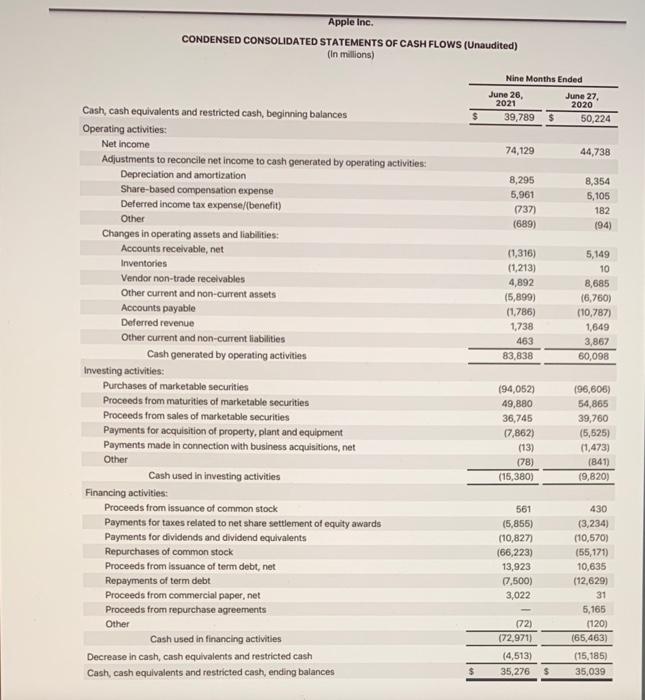

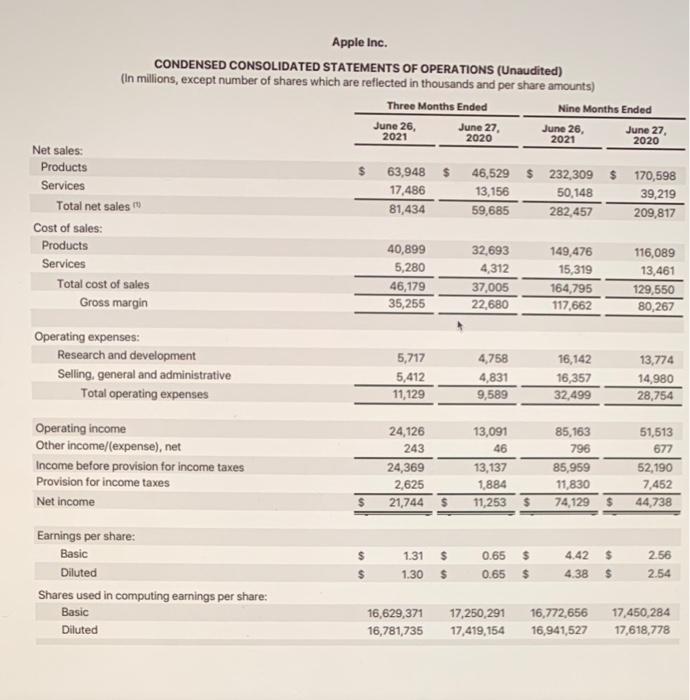

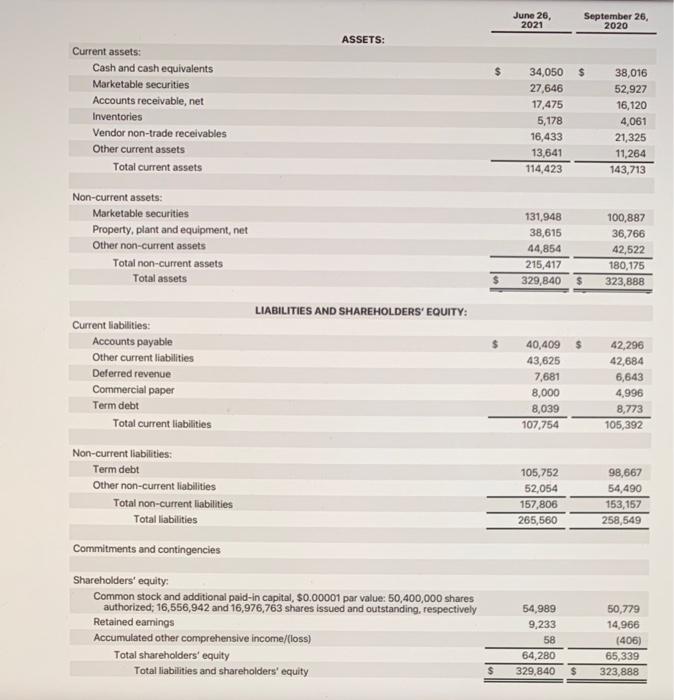

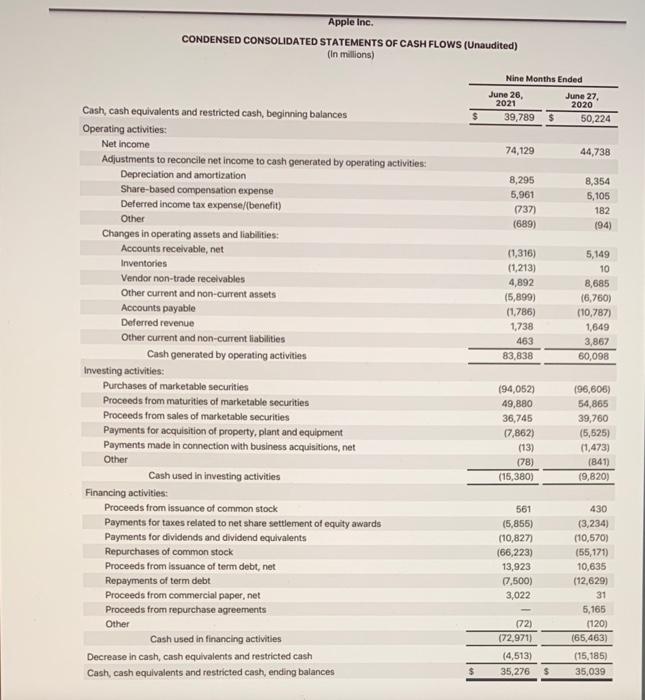

1) Assume AAPL stock trades at $143.00, what is their equity market cap? Please show calculation and the components for partial credit. Make sure I can clearly understand if it is millions, billions, or trillions 2) What is Apple's Total Debt and Net Debt? You should include both ST & LT Marketable Securities as Cash and Equivalents. (Hint: there are 2 components in ST Liabilities that are considered ST Debt) PLEASE LIST ALL COMPONENTS SEPARATELY CLEARLY. 3) What is Apple's Enterprise Value? For next 2 questions, multiply Apple's EPS and EBITDA by 4/3 to adjust for the fact that the reported numbers are for 9 months, not 12 months. 4) What is Apple's P/E ratio? 5) What is Apple's EV/EBITDA? Apple Inc. CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS (Unaudited) (In millions, except number of shares which are reflected in thousands and per share amounts) Three Months Ended Nine Months Ended June 26, June 27, June 26, June 27 2021 2020 2021 2020 Net sales: Products $ 63,948 $ 46,529 $ 232,309 $ 170,598 Services 17,486 13,156 50,148 39,219 Total net sales 81,434 59,685 282,457 209,817 Cost of sales: Products 40,899 32,693 149,476 116,089 Services 5,280 4,312 15,319 13,461 Total cost of sales 46,179 37,005 164,795 129,550 Gross margin 35,255 22,680 117,662 80,267 Operating expenses: Research and development Selling, general and administrative Total operating expenses 5,717 5,412 11,129 4,758 4,831 9,589 16,142 16,357 32,499 13,774 14,980 28,754 Operating income Other income/(expense), net Income before provision for income taxes Provision for income taxes Net income 24,126 243 24,369 2,625 21,744 $ 13,091 46 13,137 1,884 11,253 $ 85,163 796 85,959 11,830 74.129 $ 51,513 677 52,190 7,452 44,738 $ 1.31 $ 1.30 $ 0.65 $ 0.65 $ 4.42 $ 4.38 $ Earnings per share: Basic Diluted Shares used in computing earnings per share: Basic Diluted 2.56 2.54 $ 16,629,371 16,781,735 17,250,291 17,419,154 16,772,656 16,941,527 17,450,284 17,618,778 June 26, 2021 September 26, 2020 ASSETS: Current assets: Cash and cash equivalents Marketable securities Accounts receivable, net Inventories Vendor non-trade receivables Other current assets Total current assets 34,050 $ 27,646 17,475 5,178 16,433 13,641 114,423 38,016 52,927 16,120 4,061 21,325 11,264 143,713 Non-current assets: Marketable securities Property, plant and equipment, net Other non-current assets Total non-current assets Total assets 131,948 38,615 44,854 215,417 329,840 $ 100,887 36,766 42,522 180,175 323,888 $ LIABILITIES AND SHAREHOLDERS' EQUITY: Current liabilities: Accounts payable Other current liabilities Deferred revenue Commercial paper Term debt Total current liabilities Non-current liabilities: Term debt Other non-current liabilities Total non-current liabilities Total liabilities 40,409 $ 43,625 7,681 8,000 8,039 107,754 42,296 42,684 6,643 4,996 8,773 105,392 105,752 52,054 157,806 265,560 98,667 54,490 153,157 258,549 Commitments and contingencies Shareholders' equity: Common stock and additional paid-in capital, S0.00001 par value: 50,400,000 shares authorized: 16,556,942 and 16,976,763 shares issued and outstanding, respectively Retained earnings Accumulated other comprehensive income/loss) Total shareholders' equity Total liabilities and shareholders' equity 54,989 9,233 58 64,280 329,840 50,779 14,966 (406) 65,339 323,888 $ Apple Inc. CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited) (In millions) Nine Months Ended June 26, June 27, 2021 2020 39,789 50,224 74,129 44,738 8,295 5,961 (737) (689) 8,354 6,105 182 (94) (1,316) (1,213) 4,892 (5,899) (1,786) 1,738 463 83,838 5,149 10 8,685 16,760) (10,787) 1,649 3,867 60,098 Cash, cash equivalents and restricted cash, beginning balances Operating activities Net income Adjustments to reconcile net income to cash generated by operating activities: Depreciation and amortization Share-based compensation expense Deferred income tax expense/(benefit) Other Changes in operating assets and liabilities: Accounts receivable, net Inventories Vendor non-trade receivables Other current and non-current assets Accounts payable Deferred revenue Other current and non-current liabilities Cash generated by operating activities Investing activities: Purchases of marketable securities Proceeds from maturities of marketable securities Proceeds from sales of marketable securities Payments for acquisition of property, plant and equipment Payments made in connection with business acquisitions, net Other Cash used in investing activities Financing activities: Proceeds from issuance of common stock Payments for taxes related to net share settlement of equity awards Payments for dividends and dividend equivalents Repurchases of common stock Proceeds from issuance of term debt, net Repayments of term debt Proceeds from commercial paper, net Proceeds from repurchase agreements Other Cash used in financing activities Decrease in cash, cash equivalents and restricted cash Cash, cash equivalents and restricted cash, ending balances (94,052) 49,880 36,745 7,862) (13) (78) (15,380) (96,606) 64,865 39,760 (5,525) (1,473) (841) (9,820) 561 (5,855) (10,8277 (66,223) 13,923 (7,500) 3,022 430 (3,234) (10,570) (55,171) 10,635 (12,629) 31 5,165 (120) (65,463) (72) (72,971) (4,513) 35,276 (15,185 35,039 $ $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started