i need help please

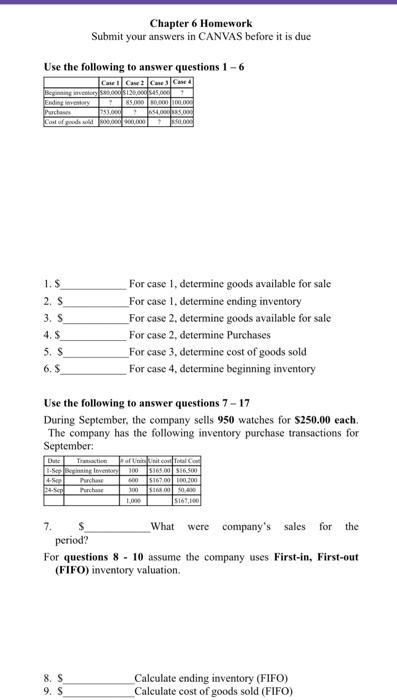

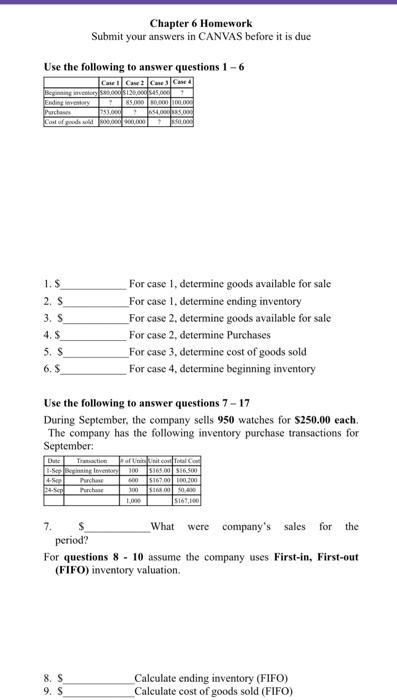

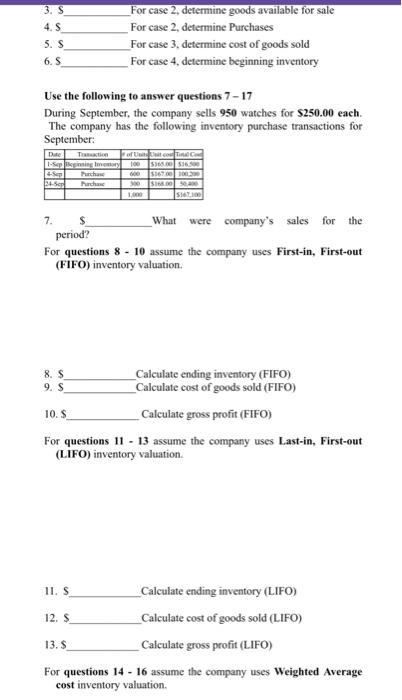

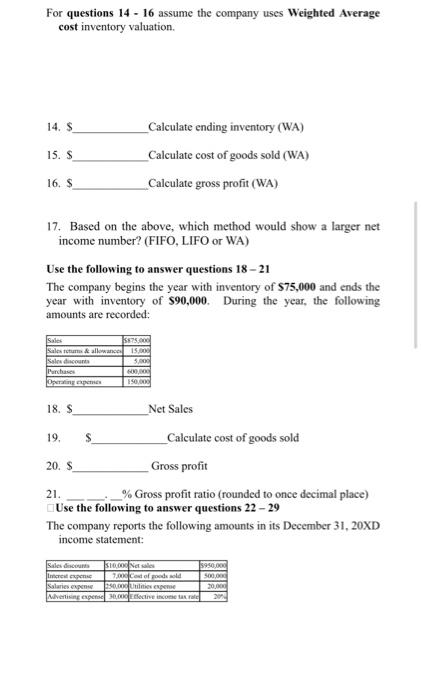

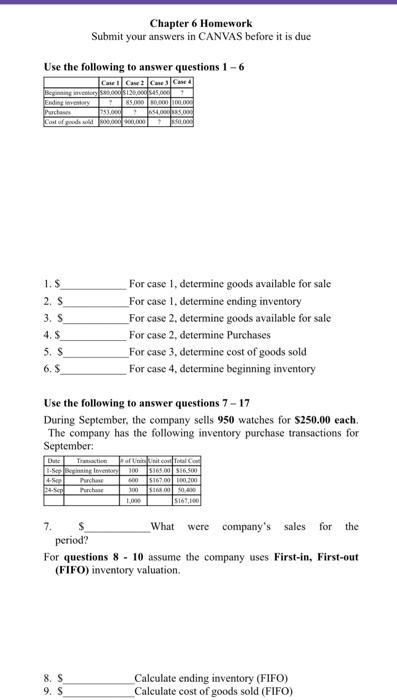

Chapter 6 Homework Submit your answers in CANVAS before it is due Use the following to answer questions 1-6 1.5 For case 1, determine goods available for sale 2. S For case 1, determine ending inventory 3. S For case 2, determine goods available for sale 4. $ For case 2, determine Purchases 5. S For case 3, determine cost of goods sold 6.5 For case 4, determine beginning inventory Use the following to answer questions 7-17 During September, the company sells 950 watches for $250.00 each. The company has the following inventory purchase transactions for September: 7. What were company's sales for the period? For questions 8 - 10 assume the company uses First-in, First-out (FIFO) inventory valuation. 8. S Calculate ending inventory (FIFO) 9. 5 Calculate cost of goods sold (FIFO) 3. For case 2 , determine goods available for sale 4. S For case 2, determine Purchases 5. S For case 3, determine cost of goods sold 6. S For case 4 , determine beginning inventory Use the following to answer questions 7-17 During September, the company sells 950 watches for $250.00 each. The company has the following inventory purchase transactions for September: 7. What were company's sales for the period? For questions 8 - 10 assume the company uses First-in, First-out (FIFO) inventory valuation. 8. $ Calculate ending inventory (FIFO) 9. $ Calculate cost of goods sold (FIFO) 10.$ Calculate gross profit (FIFO) For questions 11 - 13 assume the company uses Last-in, First-out (LIFO) inventory valuation. 11. S Calculate ending inventory (L.IFO) 12. 5 Calculate cost of goods sold (LIFO) 13.5 Calculate gross profit (LIFO) For questions 14 - 16 assume the company uses Weighted Average cost inventory valuation. For questions 14 - 16 assume the company uses Weighted Average cost inventory valuation. 14. $ Calculate ending inventory (WA) 15. S Calculate cost of goods sold (WA) 16. $ Calculate gross profit (WA) 17. Based on the above, which method would show a larger net income number? (FIFO, LIFO or WA) Use the following to answer questions 1821 The company begins the year with inventory of 575,000 and ends the year with inventory of $90,000. During the year, the following amounts are recorded: 18. $ Net Sales 19. $ Calculate cost of goods sold 20. $ Gross profit 21. % Gross profit ratio (rounded to once decimal place) Use the following to answer questions 2229 The company reports the following amounts in its December 31, 20XD income statement: Chapter 6 Homework Submit your answers in CANVAS before it is due Use the following to answer questions 1-6 1.5 For case 1, determine goods available for sale 2. S For case 1, determine ending inventory 3. S For case 2, determine goods available for sale 4. $ For case 2, determine Purchases 5. S For case 3, determine cost of goods sold 6.5 For case 4, determine beginning inventory Use the following to answer questions 7-17 During September, the company sells 950 watches for $250.00 each. The company has the following inventory purchase transactions for September: 7. What were company's sales for the period? For questions 8 - 10 assume the company uses First-in, First-out (FIFO) inventory valuation. 8. S Calculate ending inventory (FIFO) 9. 5 Calculate cost of goods sold (FIFO) 3. For case 2 , determine goods available for sale 4. S For case 2, determine Purchases 5. S For case 3, determine cost of goods sold 6. S For case 4 , determine beginning inventory Use the following to answer questions 7-17 During September, the company sells 950 watches for $250.00 each. The company has the following inventory purchase transactions for September: 7. What were company's sales for the period? For questions 8 - 10 assume the company uses First-in, First-out (FIFO) inventory valuation. 8. $ Calculate ending inventory (FIFO) 9. $ Calculate cost of goods sold (FIFO) 10.$ Calculate gross profit (FIFO) For questions 11 - 13 assume the company uses Last-in, First-out (LIFO) inventory valuation. 11. S Calculate ending inventory (L.IFO) 12. 5 Calculate cost of goods sold (LIFO) 13.5 Calculate gross profit (LIFO) For questions 14 - 16 assume the company uses Weighted Average cost inventory valuation. For questions 14 - 16 assume the company uses Weighted Average cost inventory valuation. 14. $ Calculate ending inventory (WA) 15. S Calculate cost of goods sold (WA) 16. $ Calculate gross profit (WA) 17. Based on the above, which method would show a larger net income number? (FIFO, LIFO or WA) Use the following to answer questions 1821 The company begins the year with inventory of 575,000 and ends the year with inventory of $90,000. During the year, the following amounts are recorded: 18. $ Net Sales 19. $ Calculate cost of goods sold 20. $ Gross profit 21. % Gross profit ratio (rounded to once decimal place) Use the following to answer questions 2229 The company reports the following amounts in its December 31, 20XD income statement