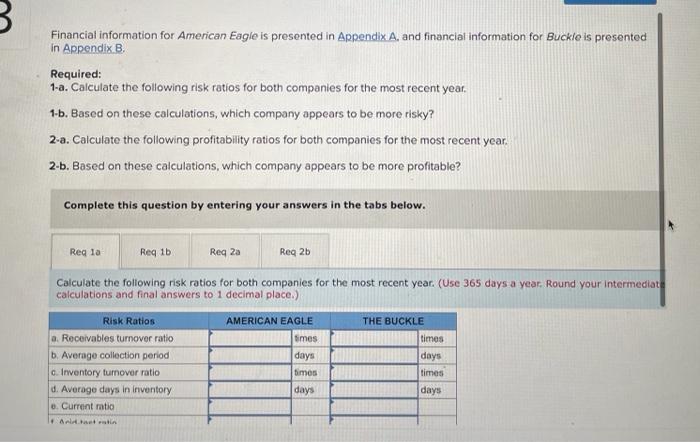

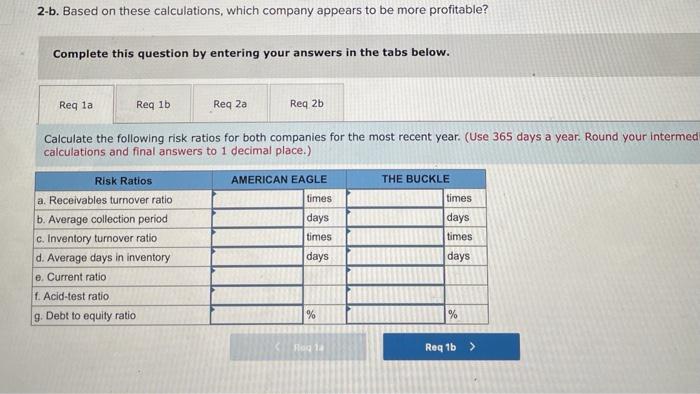

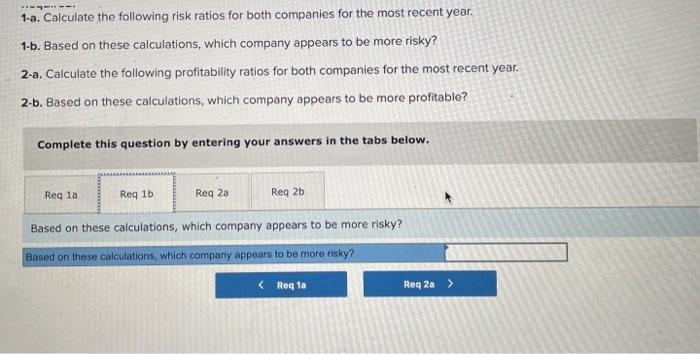

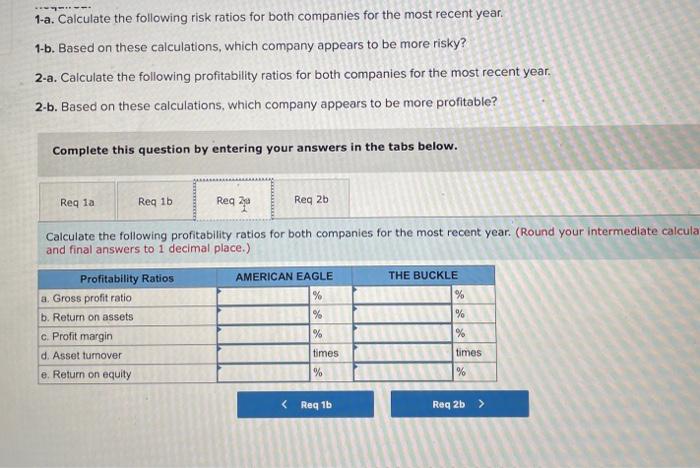

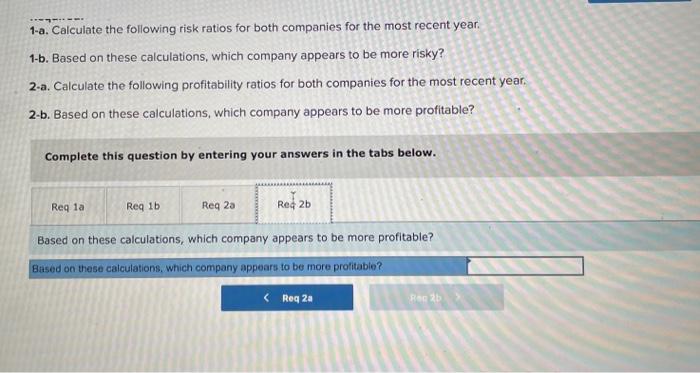

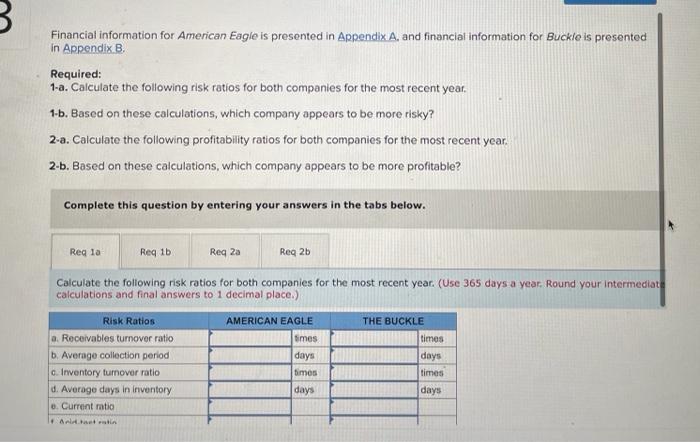

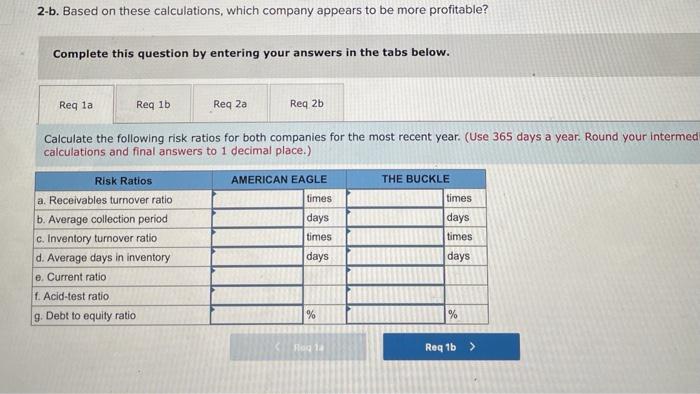

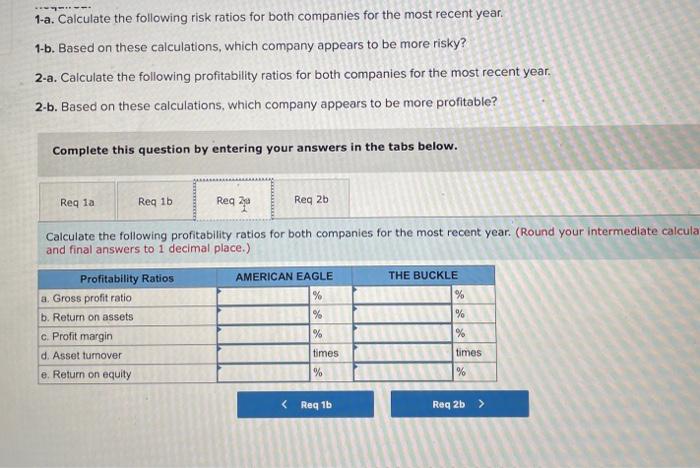

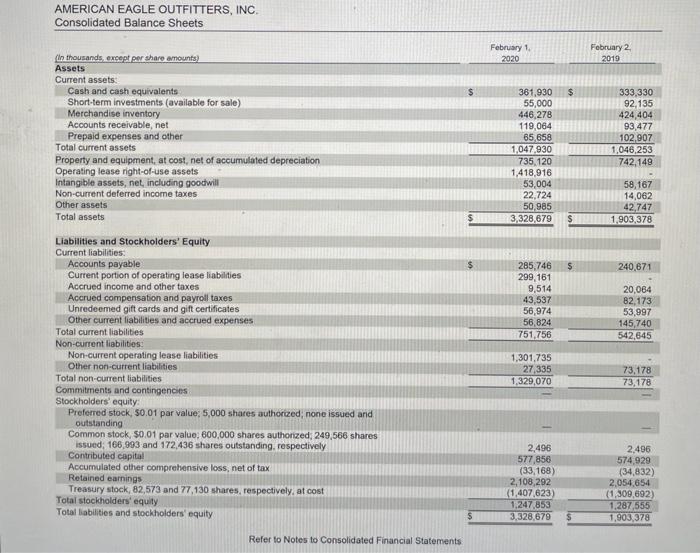

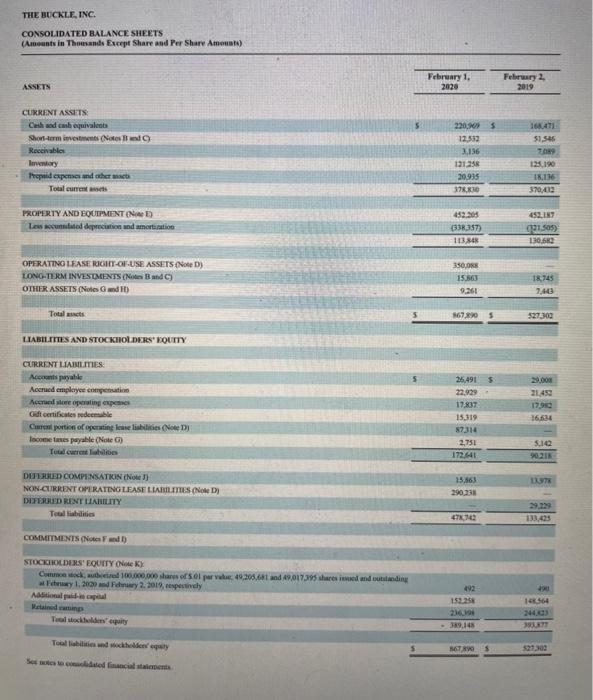

Financial information for American Eagle is presented in Appendix A, and financial information for Buckle is presented in Appendix. 8 . Required: 1-a. Calculate the following risk ratios for both companies for the most recent year. 1-b. Based on these calculations, which company appears to be more risky? 2-a. Calculate the following profitability ratios for both companies for the most recent year. 2-b. Based on these calculations, which company appears to be more profitable? Complete this question by entering your answers in the tabs below. Calculate the following risk ratios for both companies for the most recent year. (Use 365 days a year, Round your intermediat calculations and final answers to 1 decimal place.) 2-b. Based on these calculations, which company appears to be more profitable? Complete this question by entering your answers in the tabs below. Calculate the following risk ratios for both companies for the most recent year. (Use 365 days a year. Round your interme calculations and final answers to 1 decimal place.) 1-a. Calculate the following risk ratios for both companies for the most recent year. 1-b. Based on these calculations, which company appears to be more risky? 2-a. Calculate the following profitability ratios for both companies for the most recent year. 2-b. Based on these calculations, which company appears to be more profitable? Complete this question by entering your answers in the tabs below. Based on these calculations, which company appears to be more risky? Based on these calculations. which company appears to be more risky? 1-a. Calculate the following risk ratios for both companies for the most recent year. 1-b. Based on these calculations, which company appears to be more risky? 2-a. Calculate the following profitability ratios for both companies for the most recent year. 2-b. Based on these calculations, which company appears to be more profitable? Complete this question by entering your answers in the tabs below. Calculate the following profitability ratios for both companies for the most recent year. (Round your intermediate calcul and final answers to 1 decimal place.) 1-a. Calculate the following risk ratios for both companies for the most recent year. 1-b. Based on these calculations, which company appears to be more risky? 2-a. Calculate the following profitability ratios for both companies for the most recent year. 2-b. Based on these calculations, which company appears to be more profitable? Complete this question by entering your answers in the tabs below. Based on these calculations, which company appears to be more profitable? Based on these calculations, which company appears to be more profitable? UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 10-K ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURIIES EXCHANGE ACT OF 1934 For the fiscal year ended February 1, 2020 OR TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 Commission file number: 133338 AMERICAN EAGLE OUTFITTERS, INC. UNITED STATES SECURITIES AND EXCHANGE COMMISSION WASHINGTON, D.C. 20549 FORM 10-K [8] ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the Fiscal Year Ended February 1, 2020 TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 For the Transition Period from to Commission File Number; 001-12951 THE BUCKLE, INC. (Exact name of Registrant as specified in its charter) AMERICAN EAGLE OUTFITTERS, INC. Consolidated Balance Sheets \begin{tabular}{|c|c|c|c|c|} \hline (in thousands, except per share omounts) & \multicolumn{2}{|c|}{\begin{tabular}{l} February 1 \\ 2020 \end{tabular}} & \multicolumn{2}{|r|}{\begin{tabular}{l} Fobruary 2 \\ 2019 \end{tabular}} \\ \hline \multicolumn{5}{|l|}{ Assets } \\ \hline \multicolumn{5}{|l|}{ Current assets: } \\ \hline Cash and cash equivalents & $ & 361,930 & $ & 333,330 \\ \hline Short-term investments (available for sale) & & 55,000 & & 92,135 \\ \hline Merchandise imventory & & 446,278 & & 424,404 \\ \hline Accounts receivable, net & & 119,064 & & 93,477 \\ \hline Prepaid expenses and other & & 65,658 & & 102,907 \\ \hline Total current assets & & 1,047.930 & & 1,046,253 \\ \hline Propenty and equipment, at cost, net of accumulated depreciation & & 735,120 & & 742,149 \\ \hline Operating lease right-of-use assets & & 1,418,916 & & = \\ \hline Intangible assets, net, including goodwill & & 53,004 & & 58,167 \\ \hline Non-current deferred income taxes & & 22,724 & & 14,062 \\ \hline Other assets & & 50,985 & & 42,747 \\ \hline Total assets & $ & 3,328,679 & $ & 1,903,378 \\ \hline \multicolumn{5}{|l|}{ Liabilities and Stockholders' Equity } \\ \hline \multicolumn{5}{|l|}{ Current liabilities: } \\ \hline Accounts payable & $ & 285,746 & $ & 240,671 \\ \hline \begin{tabular}{l} Current portion of operating lease liabilities: \\ Accrued income and other taxes \end{tabular} & & \begin{tabular}{r} 299,161 \\ 9,514 \end{tabular} & & 20,064 \\ \hline Accrued compensabion and payroll taxes & & 43,537 & & 82,173 \\ \hline Unredeemed gift cards and gift certificates & & 56,974 & & 53,997 \\ \hline Other current liabilities and accrued expenses & & 56,824 & & 145,740 \\ \hline Total current liabilities & & 751,756 & & 542,645 \\ \hline \multicolumn{5}{|l|}{ Non-current liabilities: } \\ \hline Non-current operating lease liabilities- & & 1,301,735 & & - \\ \hline Other non-current liabilities & & 27,335 & & 73,178 \\ \hline Total non-current liabilities & & 1,329,070 & & 73,178 \\ \hline Commitments and contingencies . & & = & & = \\ \hline \multicolumn{5}{|l|}{\begin{tabular}{l} Stockholders' equity: \\ Preferred stock 50.01 par value: 5.000 shares authorized none issued and \end{tabular}} \\ \hline \begin{tabular}{l} Preferred stock, 50.01 par value; 5,000 shares authorized; none issued and \\ outstanding \end{tabular} & & - & & \\ \hline \begin{tabular}{l} Common stock, $0,01 par value; 600,000 shares authorized; 249,566 shares \\ issued; 166,993 and 172,436 shares outstanding, respectively \end{tabular} & & 2,496 & & 2,496 \\ \hline Contributed capital & & 577.856 & & 574,929 \\ \hline Accumulated other comprehensive loss, net of tax & & (33,168) & & (34,832) \\ \hline Retained earnings & & 2,108,292 & & 2,054,654 \\ \hline Treasury stock, 82,573 and 77,130 shares, respectively, at cost & & (1,407,623) & & (1,309,692) \\ \hline Total stockholders' equily & & 1,247.853 & & 1,287,555 \\ \hline Total liabilities and stockholders' equity & $ & 3,328,679 & $ & 1,903,378 \\ \hline \end{tabular} Refer to Notes to Consolidated Financial Statements THE BUCKLE, TNC. CONSOLIDATED BALANCE SHEETS (Ameants in Themands Except Share and Fer Share Amenew) ASER \begin{tabular}{c} \hline \begin{tabular}{c} Fibreary 1, \\ 2026 \end{tabular} \\ \hline \end{tabular} CURRRNT Assis