Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help please Part 1: At January 1, 2023, Benton Company leased a machine from Zebra Manufacturer. The following information pertains to the lease

I need help please

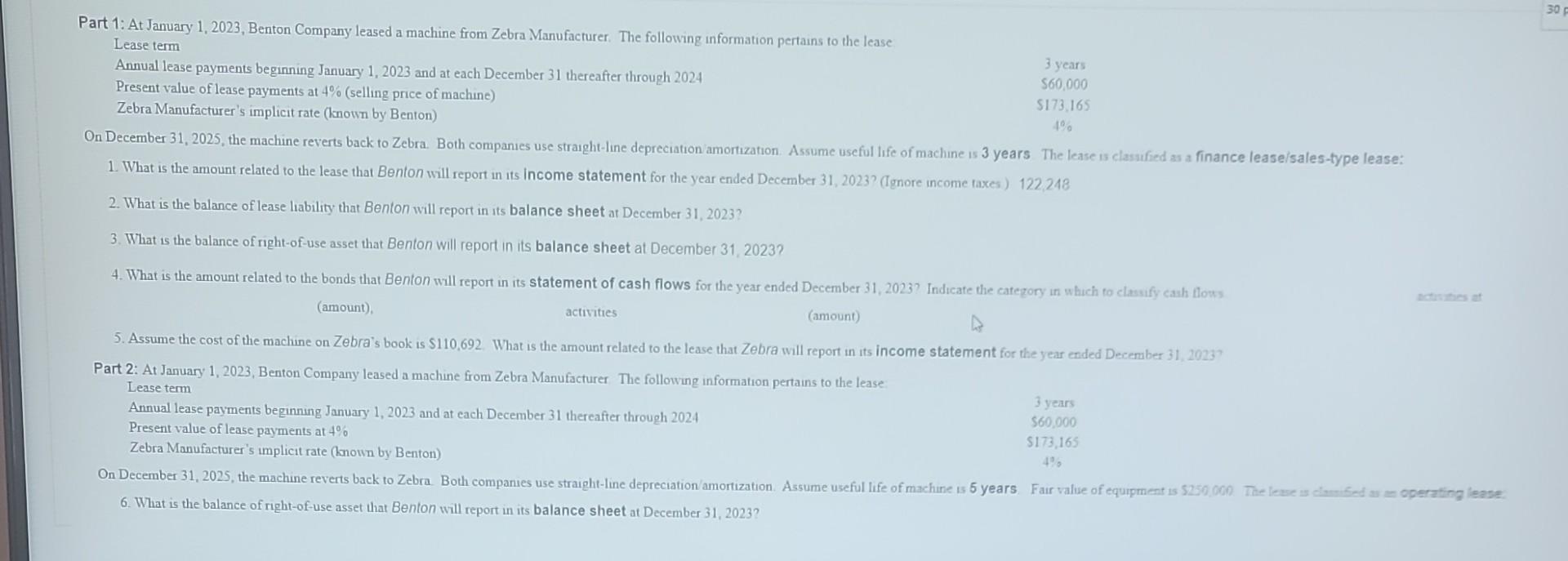

Part 1: At January 1, 2023, Benton Company leased a machine from Zebra Manufacturer. The following information pertains to the lease Lease term Annual lease payments beginning January 1, 2023 and at each December 31 thereafter through 2024 Present value of lease payments at 4% (selling price of machine) Zebra Manufacturer's implicit rate (known by Benton) 1. What is the amount related to the lease that Benton will report in its income statement for the year ended December 31,2023 ? (Ignore income taxes) 122,248 2. What is the balance of lease liability that Benton will report in its balance sheet at December 31,2023 ? 3. What is the balance of right-of-use asset that Benton will report in its balance sheet at December 31,2023 ? 4. What is the amount related to the bonds that Benton will report in its statement of cash flows for the year ended December 31,2023 ? Indicate the category in which to clawify caih flows (amount), activities (amount) 5. Assume the cost of the machine on Zebra's book is $110,692. What is the amount related to the lease that Zebra will report in its income statement for the year ended December 31 , 2023 ? Part 2: At January 1, 2023, Benton Company leased a machine from Zebra Manufacturer The following information pertains to the lease Lease term Annual lease payments beginning January 1, 2023 and at each December 31 thereafter through 2024 Present value of lease payments at 4% Zebra Manufacturer's implicit rate (known by Benton) 6. What is the balance of right-of-use asset that Benton will report in its balance sheet at December 31,2023Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started