Question

I need help please! The questions are related to table2 where adjustments are coming from table 1 after a merger . I need guidance as

I need help please!

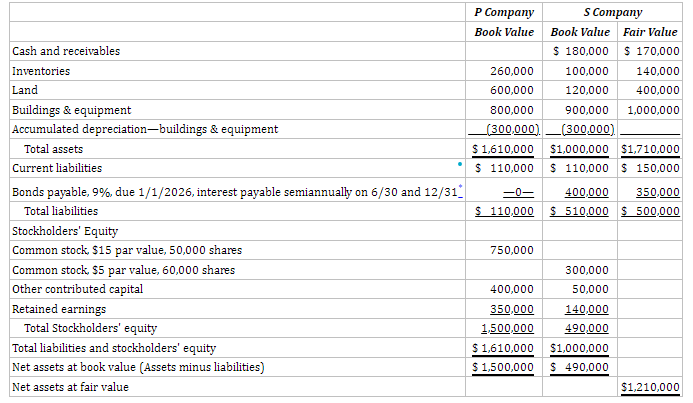

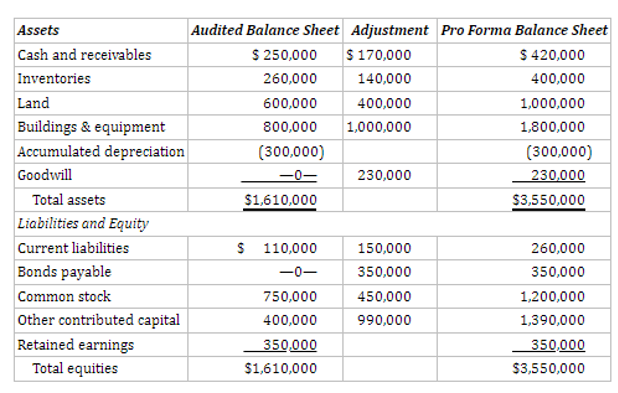

The questions are related to table2 where adjustments are coming from table 1 after a merger .

I need guidance as what type of adjustments are we talking about?

1 -Identify four to five adjustments that require footnotes.

2 -Explain irregularities based on the adjusted numbers using footnotes. Consider the following questions to guide your response:

3- What might be a potential reasonable explanation for the irregularity?

4- Why might certain original amounts in the audited balance sheet have previously been zero?

5 -Provide a rationale for why the footnotes are required. Consider the following questions to guide your response:

6- What criteria did you use to determine that an adjustment needed a footnote?

7- What threshold number created a concern, and why?

\begin{tabular}{|l|c|c|c|} \hline Assets & Audited Balance Sheet & Adjustment & Pro Forma Balance Sheet \\ \hline Cash and receivables & $250,000 & $170,000 & $420,000 \\ \hline Inventories & 260,000 & 140,000 & 400,000 \\ \hline Land & 600,000 & 400,000 & 1,000,000 \\ \hline Buildings \& equipment & 800,000 & 1,000,000 & 1,800,000 \\ \hline Accumulated depreciation & (300,000) & & (300,000) \\ \hline Goodwill & 0 & 230,000 & 230,000 \\ \hline Total assets & $1,610,000 & & $3,550,000 \\ \hline Liabilities and Equity & & & \\ \hline Current liabilities & 110,000 & 150,000 & 260,000 \\ \hline Bonds payable & 0 & 350,000 & 350,000 \\ \hline Common stock & 750,000 & 450,000 & 1,200,000 \\ \hline Other contributed capital & 400,000 & 990,000 & 1,390,000 \\ \hline Retained earnings & 350,000 & & 350,000 \\ \hline \multicolumn{1}{|c|}{ Total equities } & $1,610,000 & & $3,550,000 \\ \hline \end{tabular} \begin{tabular}{|l|c|c|c|} \hline Assets & Audited Balance Sheet & Adjustment & Pro Forma Balance Sheet \\ \hline Cash and receivables & $250,000 & $170,000 & $420,000 \\ \hline Inventories & 260,000 & 140,000 & 400,000 \\ \hline Land & 600,000 & 400,000 & 1,000,000 \\ \hline Buildings \& equipment & 800,000 & 1,000,000 & 1,800,000 \\ \hline Accumulated depreciation & (300,000) & & (300,000) \\ \hline Goodwill & 0 & 230,000 & 230,000 \\ \hline Total assets & $1,610,000 & & $3,550,000 \\ \hline Liabilities and Equity & & & \\ \hline Current liabilities & 110,000 & 150,000 & 260,000 \\ \hline Bonds payable & 0 & 350,000 & 350,000 \\ \hline Common stock & 750,000 & 450,000 & 1,200,000 \\ \hline Other contributed capital & 400,000 & 990,000 & 1,390,000 \\ \hline Retained earnings & 350,000 & & 350,000 \\ \hline \multicolumn{1}{|c|}{ Total equities } & $1,610,000 & & $3,550,000 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started