I need help please with completing part (c)

I need help please with completing part (c)

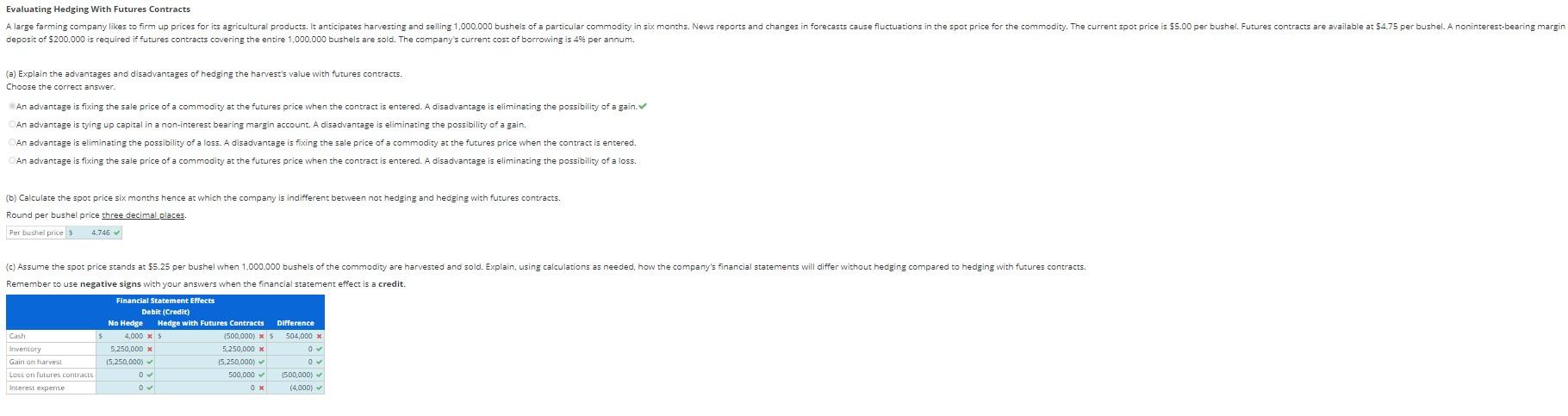

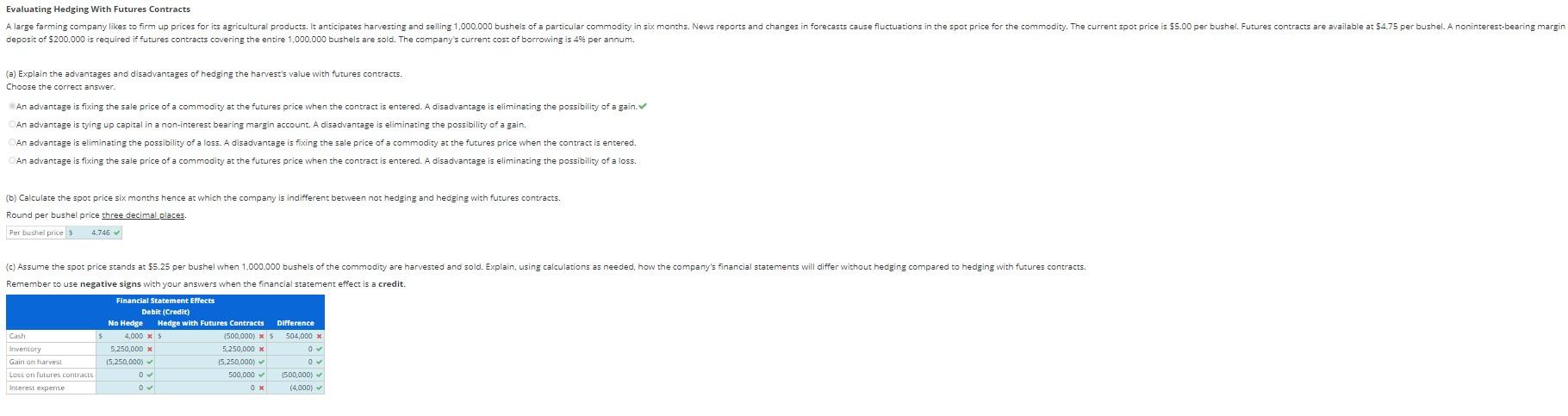

deposit of $200,000 is required if futures contracts covering the entire 1,000,000 bushels are sold. The company's current cost of borrowing is 4% per annum. (a) Explain the advantages and disadvantages of hedging the harvest's value with futures contracts. Choose the correct answer. An advantage is fixing the sale price of a commodity at the futures price when the contract is entered. A disadvantage is eliminating the possibility of a gain. An advantage is tying up capital in a non-interest bearing margin account. A disadvantage is eliminating the possibility of a gain. An advantage is eliminating the possibility of a loss. A disadvantage is fixing the sale price of a commodity at the futures price when the contract is entered. An advantage is fixing the sale price of a commodity at the futures price when the contract is entered. A disadvantage is eliminating the possibility of a loss. (b) Calculate the spot price six months hence at which the company is indifferent between not hedging and hedging with futures contracts. Round per bushel price three decimal places. Per bushel price 34.746 Remember to use negative signs with your answers when the financial statement effect is a credit. deposit of $200,000 is required if futures contracts covering the entire 1,000,000 bushels are sold. The company's current cost of borrowing is 4% per annum. (a) Explain the advantages and disadvantages of hedging the harvest's value with futures contracts. Choose the correct answer. An advantage is fixing the sale price of a commodity at the futures price when the contract is entered. A disadvantage is eliminating the possibility of a gain. An advantage is tying up capital in a non-interest bearing margin account. A disadvantage is eliminating the possibility of a gain. An advantage is eliminating the possibility of a loss. A disadvantage is fixing the sale price of a commodity at the futures price when the contract is entered. An advantage is fixing the sale price of a commodity at the futures price when the contract is entered. A disadvantage is eliminating the possibility of a loss. (b) Calculate the spot price six months hence at which the company is indifferent between not hedging and hedging with futures contracts. Round per bushel price three decimal places. Per bushel price 34.746 Remember to use negative signs with your answers when the financial statement effect is a credit

I need help please with completing part (c)

I need help please with completing part (c)