Answered step by step

Verified Expert Solution

Question

1 Approved Answer

I need help please with these Analysts may examine the relationship between equity market capitalization and GDP as a rough indicator of whether a specific

I need help please with these

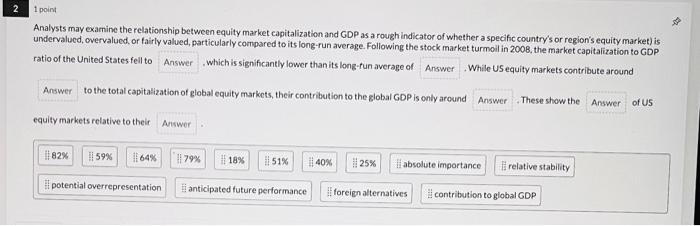

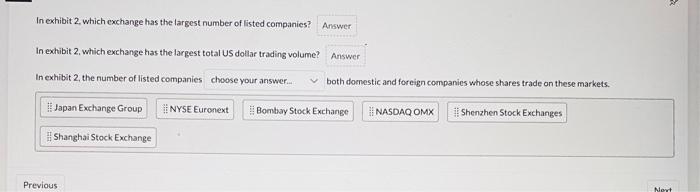

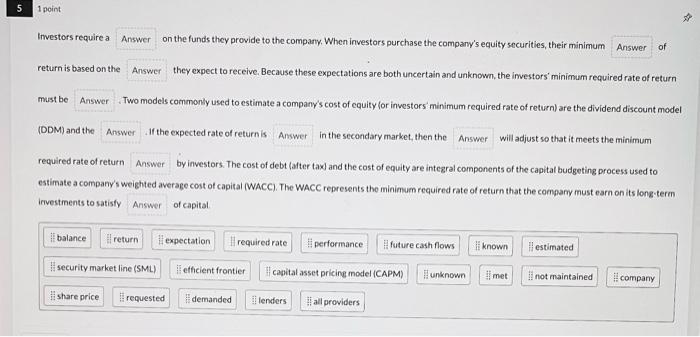

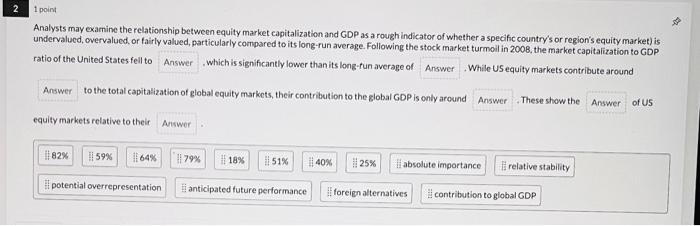

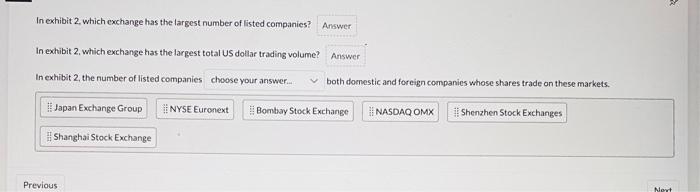

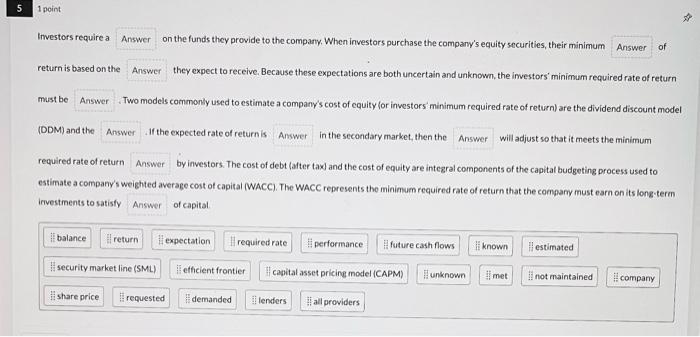

Analysts may examine the relationship between equity market capitalization and GDP as a rough indicator of whether a specific country's or region's equity market) is undervalued, overvalued, of fairly valued, particularly compared to its long-run average. Following the stock market turmoil in 200 , the market capitaization to GDP ratio of the United States fell to which is significantly lower than its long-tun average of While US equity markets contribute around to the total capitalization of global equity markets, their contribution to the global GDP is only around These show the of 45 equity markets relative to their In exhibit 2, which exchange has the largest number of listed companies? In exhibit 2, which exchange has the largest total US dollar trading volume? In exhibit 2, the number of listed companies both doenestic and foreign companies whose shares trade on these markets. Investors require a on the funds they provide to the company. When investors purchase the company's equity securities, their minimum of return is based on the they expect to receive. Because these expectations are both uncertain and unknown, the investors' minimum required rate of return mast be .Two models commonly used to estimate a company's cost of equity (or inwestors' minimum required rate of return) are the dividend discount model (DDM) and the If the expected rate of return is in the secondary market, then the will adjust so that it meets the minimum required rate of return by investors. The cost of debt (adter tax) and the cost of equity are integral components of the capital budgeting process used to estimate a company's weighted average cost of capital (WACC). The WACC represents the minimum required rate of return that the company must earn on its iong term irivestments to satisfy of capital

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started