Answered step by step

Verified Expert Solution

Question

1 Approved Answer

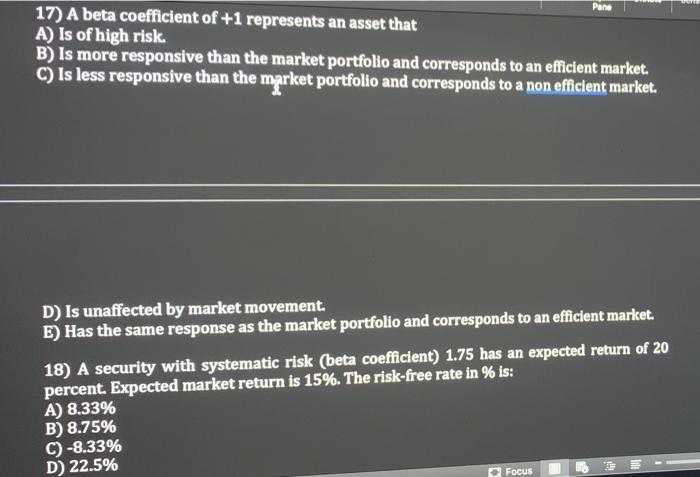

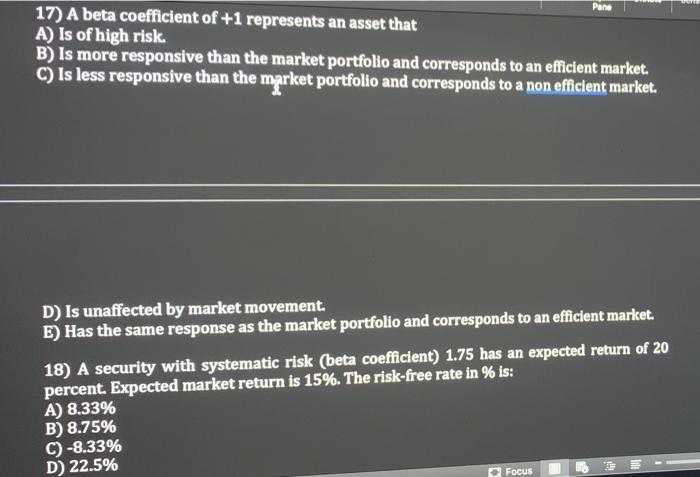

i need help pleasee!! Pane 17) A beta coefficient of +1 represents an asset that A) Is of high risk. B) Is more responsive than

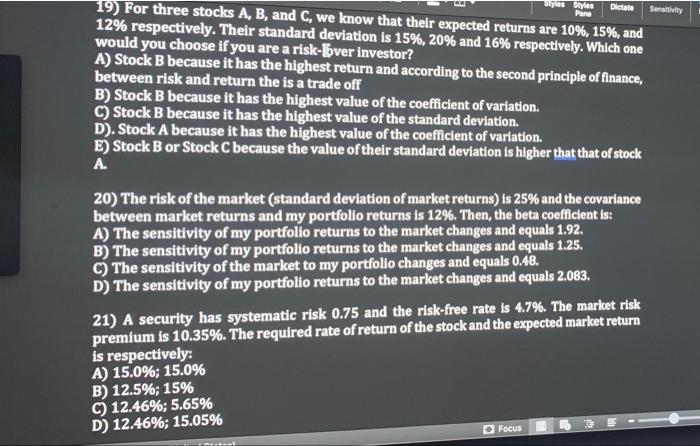

i need help pleasee!!

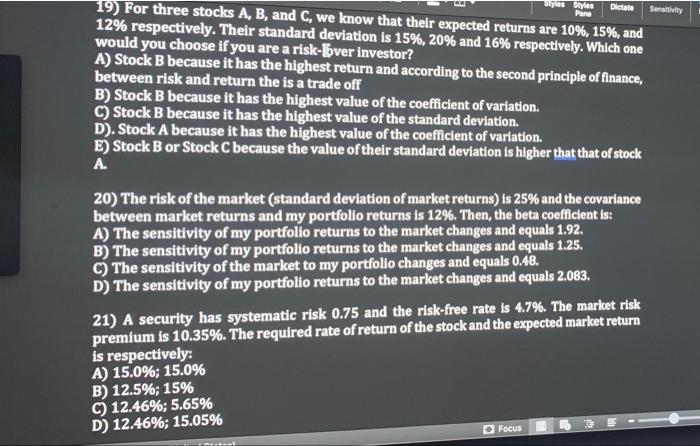

Pane 17) A beta coefficient of +1 represents an asset that A) Is of high risk. B) Is more responsive than the market portfolio and corresponds to an efficient market. C) Is less responsive than the market portfolio and corresponds to a non efficient market. D) Is unaffected by market movement. E) Has the same response as the market portfolio and corresponds to an efficient market. 18) A security with systematic risk (beta coefficient) 1.75 has an expected return of 20 percent. Expected market return is 15%. The risk-free rate in % is: A) 8.33% B) 8.75% C) -8.33% D) 22.5% Focus Styles Styles Pane Dictate Sensitivity 19) For three stocks A, B, and C, we know that their expected returns are 10%, 15%, and 12% respectively. Their standard deviation is 15%, 20% and 16% respectively. Which one would you choose if you are a risk- over investor? A) Stock B because it has the highest return and according to the second principle of finance, between risk and return the is a trade off B) Stock B because it has the highest value of the coefficient of variation. C) Stock B because it has the highest value of the standard deviation. D). Stock A because it has the highest value of the coefficient of variation. E) Stock Bor Stock C because the value of their standard deviation is higher that that of stock . 20) The risk of the market (standard deviation of market returns) is 25% and the covariance between market returns and my portfolio returns is 12%. Then, the beta coefficient is: A) The sensitivity of my portfolio returns to the market changes and equals 1.92. B) The sensitivity of my portfolio returns to the market changes and equals 1.25. C) The sensitivity of the market to my portfolio changes and equals 0.48. D) The sensitivity of my portfolio returns to the market changes and equals 2.083. 21) A security has systematic risk 0.75 and the risk-free rate is 4.7%. The market risk premium is 10.35%. The required rate of return of the stock and the expected market return is respectively: A) 15.0%; 15.0% B) 12.5%; 15% C) 12.46%; 5.65% D) 12.46%; 15.05% Focus

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started