Answered step by step

Verified Expert Solution

Question

1 Approved Answer

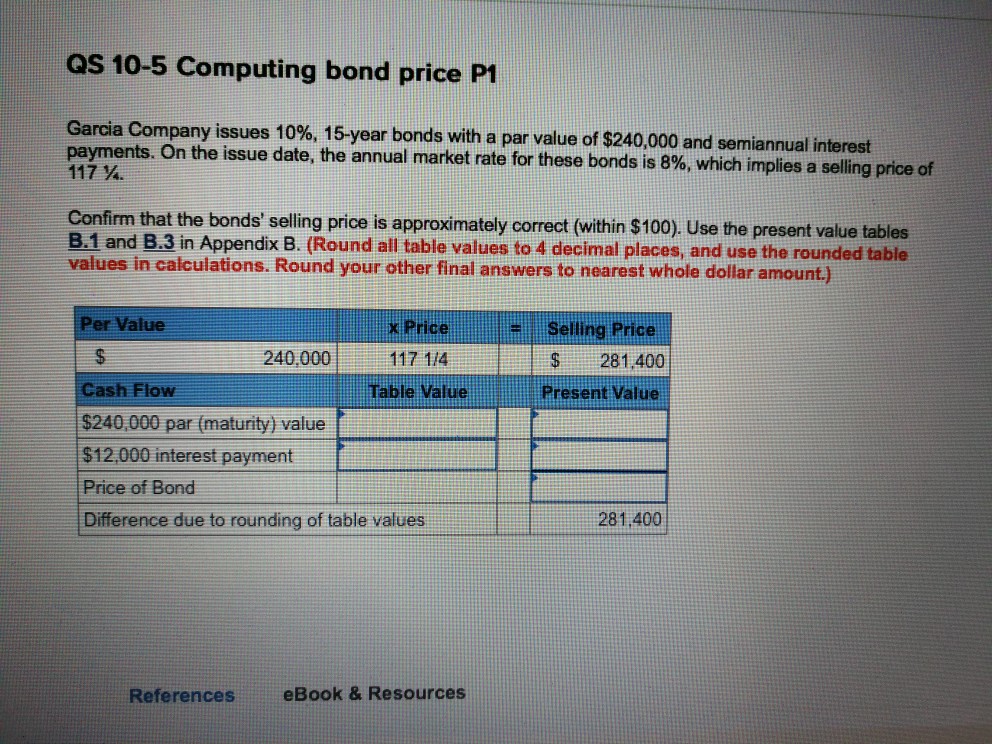

I need help plz. This is a quiz for chapter 10. The book is financial and managerial accounting wild, 6e as 10-5 Computing bond price

I need help plz. This is a quiz for chapter 10. The book is financial and managerial accounting wild, 6e

as 10-5 Computing bond price P1 Garcia Company issues 10%, 15-year bonds with a par value of $240,000 and semiannual interest payments. On the issue date, the annual market rate for these bonds is 8%, which implies a selling price of Confirm that the bonds' selling price is approximately correct (within $100), Use the present value tables B.1 and B.3 in Appendix B. (Round all table values to 4 declimal places, and use the rounded table values in calculations. Round your other final answers to nearest whole dollar amount) Per Value x Price Selling Price $ 281.400 Table ValuePresent Value 240,000 Cash Flow $240,000 par (maturity) value $12000 interest payment Price of Bond Difference due to rounding of table values 281.400 References eBook & ResourcesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started