Answered step by step

Verified Expert Solution

Question

1 Approved Answer

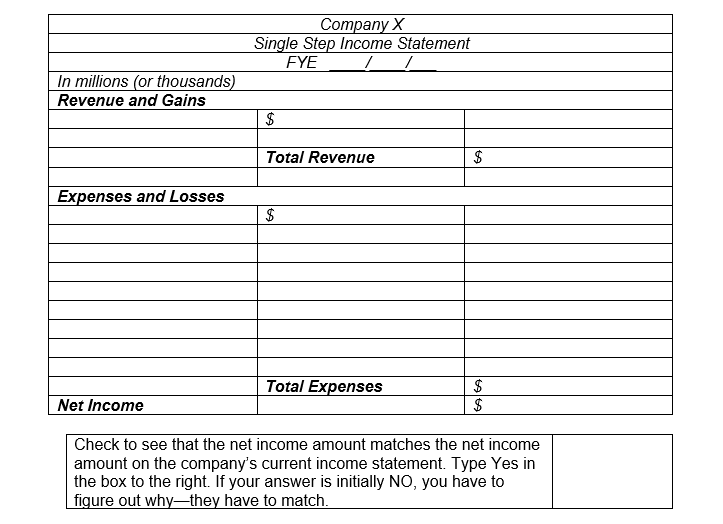

I need help preparing a single-step income statement from my company's financial statement which is Apple Inc. begin{tabular}{|l|l|l|} hline multicolumn{2}{|c|}{ Company X} hline multicolumn{2}{|c|}{

I need help preparing a single-step income statement from my company's financial statement which is Apple Inc.

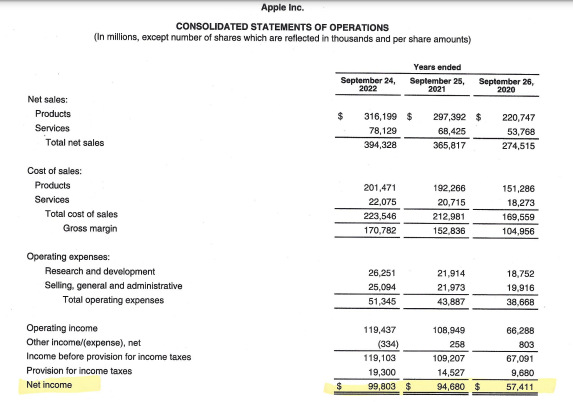

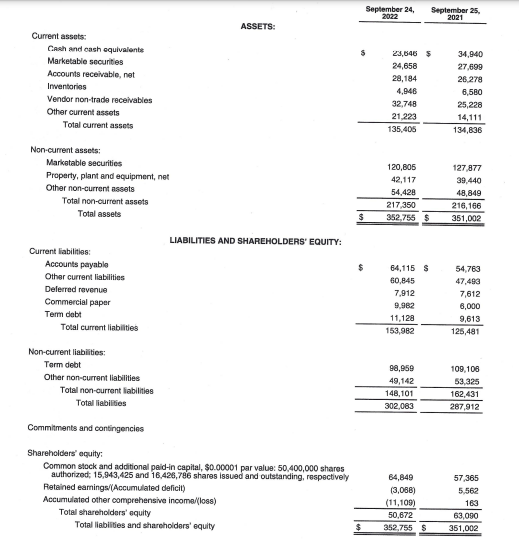

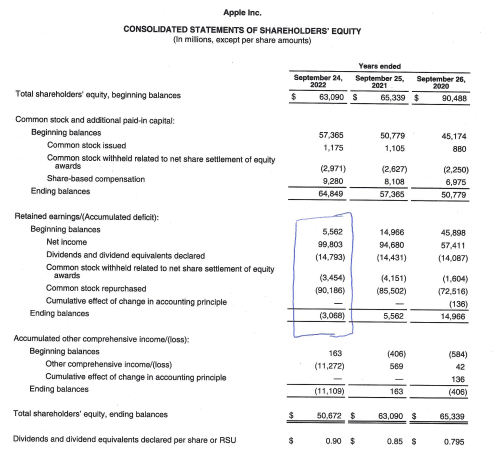

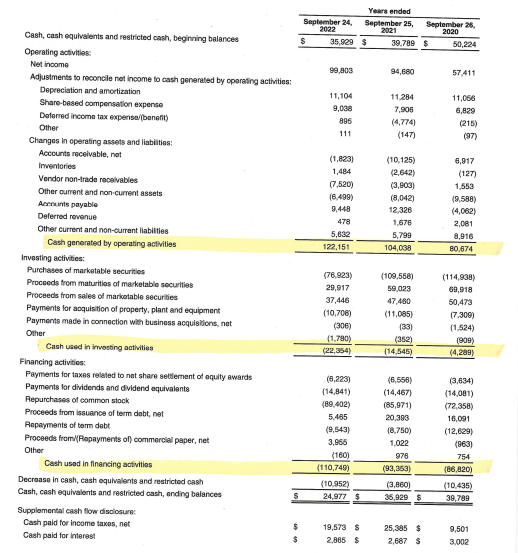

\begin{tabular}{|l|l|l|} \hline \multicolumn{2}{|c|}{ Company X} \\ \hline \multicolumn{2}{|c|}{ Single Step Income Statement } \\ \hline \multicolumn{2}{|c|}{ FYE / } \\ \hline In millions (or thousands) & $ \\ \hline Revenue and Gains & & \\ \hline & Total Revenue & \\ \hline & \multicolumn{2}{|c|}{} \\ \hline & $ & \\ \hline & & \\ \hline Expenses and Losses & \multicolumn{2}{|c|}{} \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline \end{tabular} Check to see that the net income amount matches the net income amount on the company's current income statement. Type Yes in the box to the right. If your answer is initially NO, you have to figure out why-they have to match. Apple Inc. CONSOLIDATED STATEMENTS OF OPERATIONS (In millions, except number of shares which are retlected in thousands and per share amounts) Net sales: Products Services Total net sales Cost of sales: Products Services Total cost of sales Gross margin Operating expenses: Research and development Selling, general and administrative Total operating expenses Operating income Other income/(expense), net Income before provision for income taxes Provision for income taxes Net income \begin{tabular}{rll} 26,251 & 21,914 & 18,752 \\ 25,094 \\ \hline 51,345 \\ \hline \end{tabular} ASSETS: Current assots: Cash and cash equivalent: Marketable securities Accounts receivable, net Inventories Vendor non-trade receivables Other current assets Total current assots \begin{tabular}{rrr} 35,646 & $ & 34,940 \\ 24,658 & & 27,699 \\ 28,184 & & 26,278 \\ 4,946 & 6,560 \\ 32,748 & 25,228 \\ 21,223 & & 14,111 \\ \hline 135,405 & & 134,836 \end{tabular} Non-current assets: Marketable securities Property, plant end equipment, net Other non-current assets Total non-current assets Total assets Current liabilities: Accounts payable Other curremt liabilities Delerred ravenue Commercial paper Term dabt Total current liabilities LIABILITIES AND SHAREHOLDERS' EQUITY: Non-current liabtios: Torm debt Other non-current liabilities Total non-current liabilities Total liabilies Commitments and contingencios Shareholders' equity; Common stock and additionel peid-in capital, $0.00001 par value: 50,400,000 shares authorized; 15,943,425 and 16,426,786 shares issued and outstanding, respectively Retained eamings/(Accumulated delicil) Accumulated other comprehensive income/lloss) Total shareholders' equity Total liabilies and sharsholders' equity Apple lne. CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EOUITY (In milions, axcept per share amounts) Total shareholders' oquity, beginning balances Common stock and additional paid-in cepital: Beginning balances Common slock issuod Common stock withheid rolated to net share settlement of equity awards Share-based compensation Ending balances Retained aarnings/(Accumulated deficit): Beginning balanoss Net income Dividends and dividend equivalents declared Common stock withheid related to net share settiement of equity awards Common stock repurchased Cumulative ellect of change in accounting principle Ending balances Accumulated other comprehensive incomen(loss); \begin{tabular}{rrr} 57,365 & 50,779 & 45,174 \\ 1,175 & 1,105 & 860 \\ (2,971) & (2,627) & (2,250) \\ 9,280 & 8,109 & 6,975 \\ \hline 64,849 \\ \hline \end{tabular} Beginning balanous Other comprehensive incomelloss) Cumulative effect of change in acoounting principle Ending balances Total sharehoiders' equily, ending balances \begin{tabular}{|r|rr} \hline 5,562 & 14,966 & 45,898 \\ 99,803 & 94,680 & 57,411 \\ (14,793) & (14,431) & (14,067) \\ (3,454) & (4,151) & (1,604) \\ (90,186) & (85,502) & (72,516) \\ (3,068) & & (136) \\ \hline & 5,562 & 14,966 \\ \hline \end{tabular} \begin{tabular}{rcc} 163 & (406) & (594) \\ (11,272) & 569 & 42 \\ & & 136 \\ \hline(11,109) & 163 \\ \hline \end{tabular} Dividends and dividend equivalents declared per share or RSU $$50.6720.90$$63,0900.85$$65.3390.795 Cash, cash equhalents and restricted oash, beginning balances Operaling activitias: Net inoame Adjustments to reconcile net income to cash genarated by oparafing activities: Depreciation and amortization Share-besed compensation expense Deferred incomn tax expensav(benent) Other 99,90394,68057,411 Changes in eperating assets and liabitios: Accounts receivable, not Irmentories Vendar non-trade receivables Other ourrent and non-current gssets Acreunts payable Delerred rewenue Other current and non-current liabilties Cash generated by operating activities Invasting activities: Purchases of marketable securtion Proceeds from maturitias of marketablo socuritias Proceeds from sales of marketable securifies Payments for abquisition of property, plant and equipment Payments made in connection with business acquisioris, nat Other Cash used in irmosting aothities Financing activities: Payments for tnxes relaled to nat share sellement of oquity awards Payments for dividends and dividend equivalents Repurchases of common slock Proceeds from issuance of term debt, net Repayments of term debt 11,1049,03889611111,2847,906(4,774)(147)11,0666,829(215)(97) Proceecls fromlipopayments of) commerclal paper, net Dither Cash used in financing actitties Decraase in cash, cash equhalents and restrictod cash Cash, cash equivalents and restricted cash, onding balences Supplemental cash flow disclocum: Cash paid for income taxas, net Cash paid for interest \begin{tabular}{ccc} (1,823) & (10,125) & 6,917 \\ 1,484 & (2,642) & (127) \\ (7,520) & (3,903) & 1,553 \\ (6,489) & (8,042) & (9,586) \\ 9,448 & 12,326 & (4,062) \\ 478 & 1,676 & 2,081 \\ 5,682 & 5,799 & 8,916 \\ \hline 122,151 & 104,038 & 80,674 \\ \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started