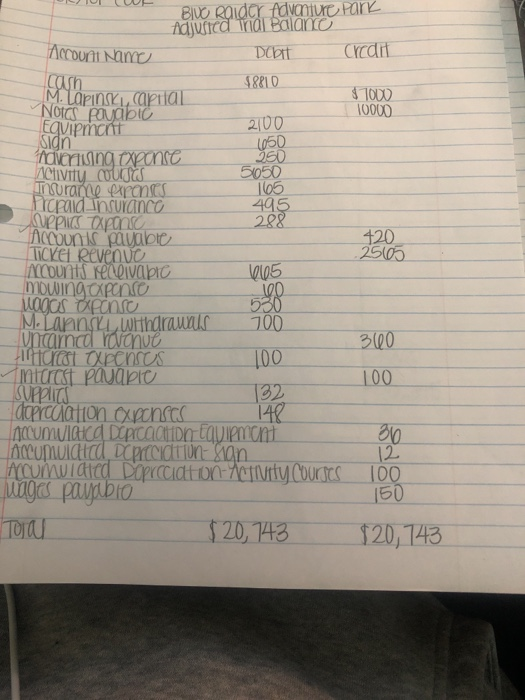

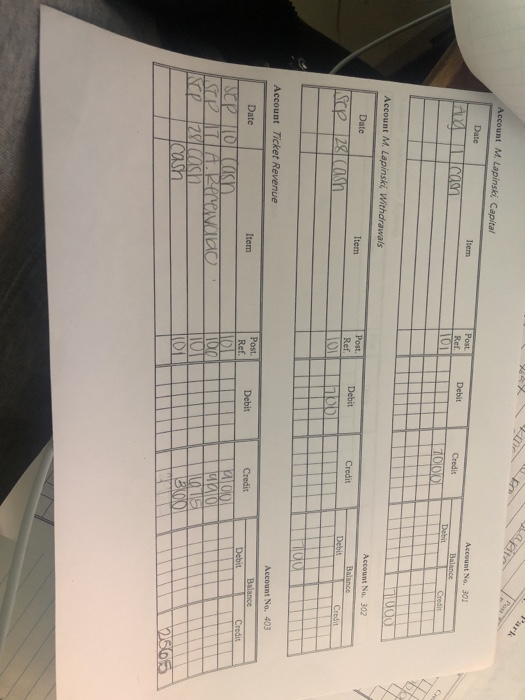

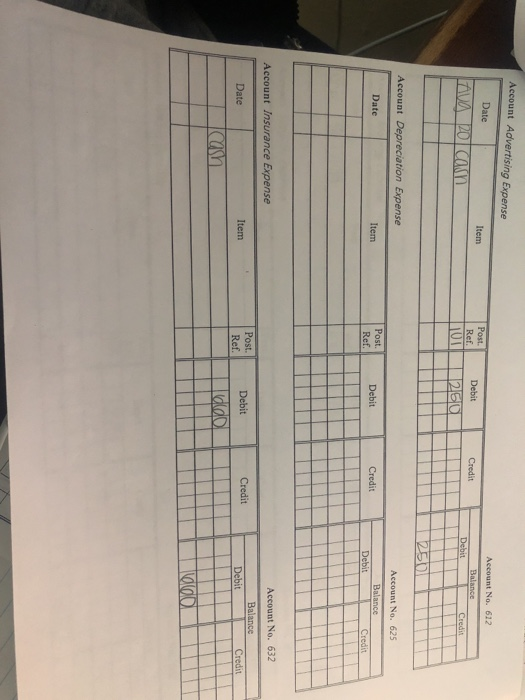

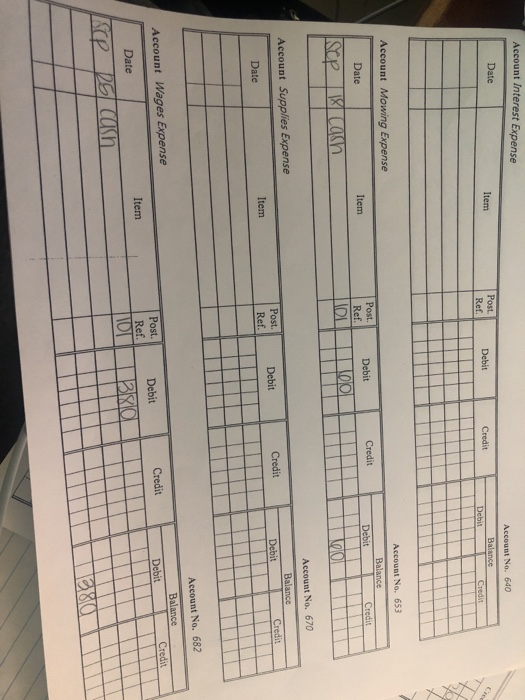

I need help preparing closing entries and the post-closing trial balance. The post closing trial balance should equal to $18,502, but I cant get the debits and credits to equal that.

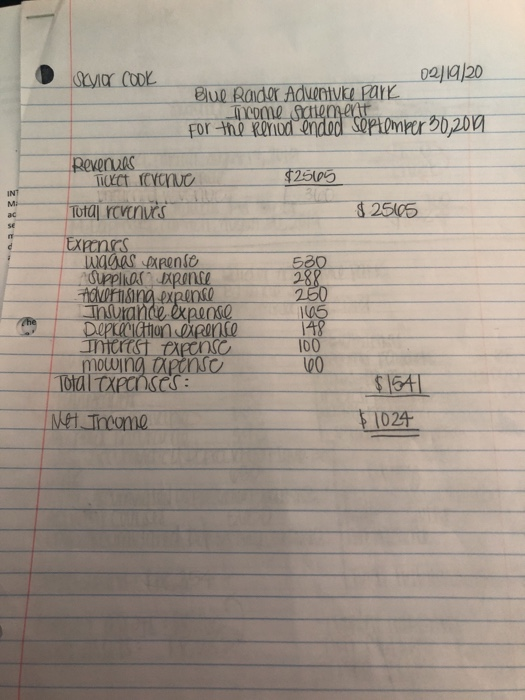

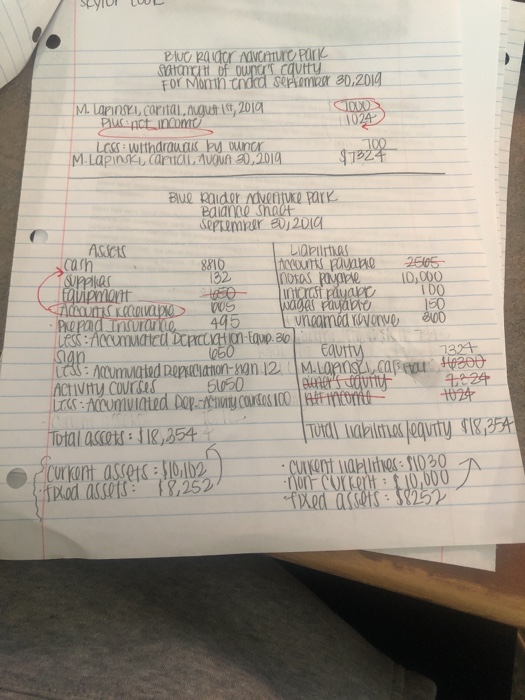

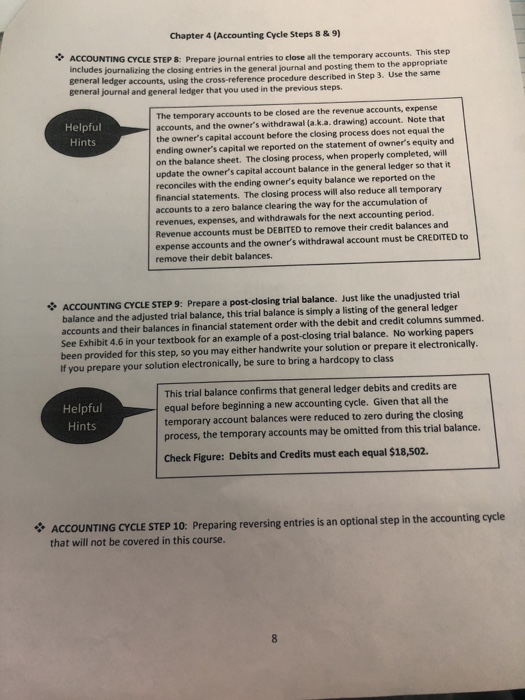

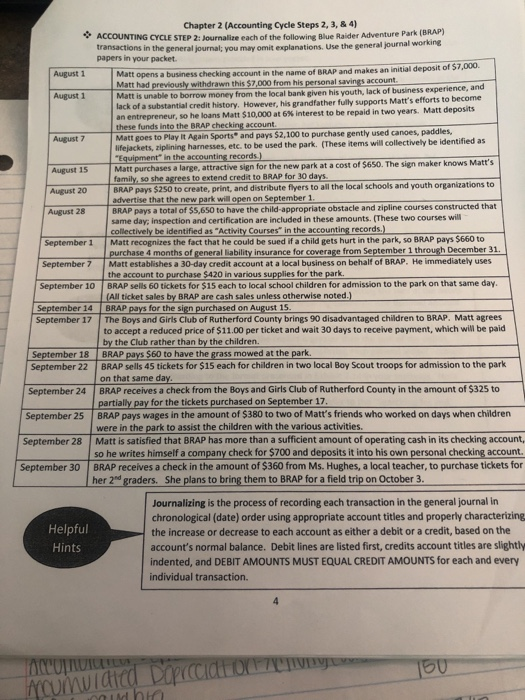

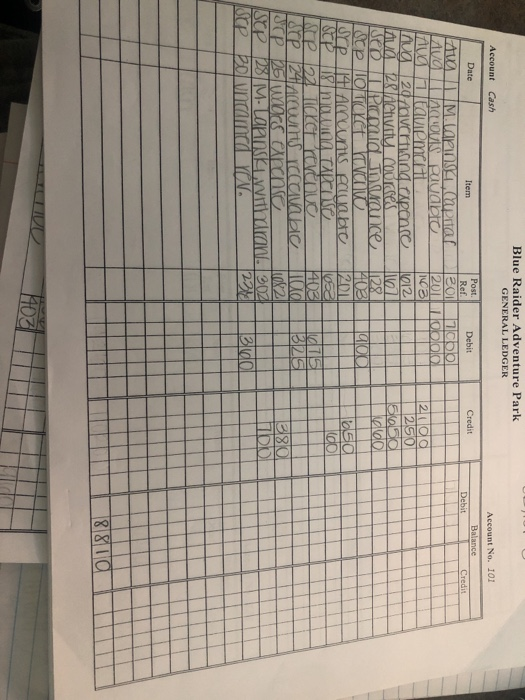

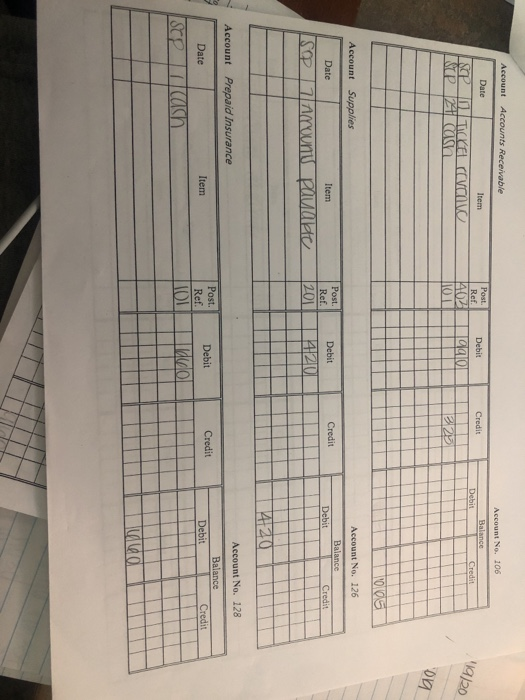

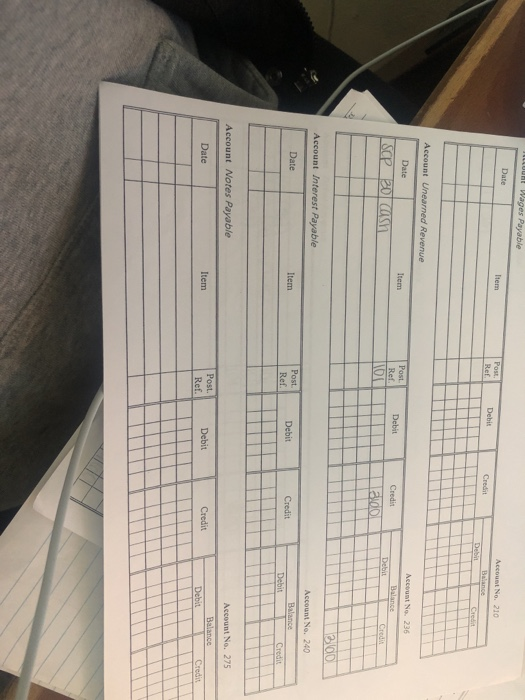

Skylar COOK 02|19|20 Blue Raider Adventure Park Throme Scitement for the period ended september 30, 2019 Revenues Ticket creve $25105 Tutaj revan's $ 25605 530 288 250 Expenses muggas expense Supplies expense Advertising expense Insurance expense Depkecichon expence Interest expense mowing Openso Total txpenses: 165 148 100 100 $1541 $1024 Met Income SLIUI LOL Blu Raider avanturo Park Salam of owner" cavity For Monin anda semu 0,2014 M. Lapinski coritai, augutt ist, 2019 C1000 Punct income LESS: Withdraudus by Duner M.Lapinsku carucinuount 20,2019 1024 $79220 150 Blue Raider Adventure park Balance sheet septemher 20, 2014 ASOCIS Lidbintas 8816 counts payaal 25605 supplier 132 notos payable 10,000 fiipment 100 lat payapo 100 Tom Kovadlo 00S Wagas payable Prepad Insurance 495 vncarnd worvo 300 Less: Accumulated DOPCLICH In-Equp. 300 aan 1050 Equity 7314 OS: Accumulated Depreciation-non 12 MALOPOS cabeu H0300 Activity courses 5650 Bier's sovitt 7224 LTC : Accumulated Dop. -Ayolny CONCOs 100 ini mnoort 1024 Total access : 18,354 Toid abilities equity 18,354 current assets : 0102 - current lapllitres : $1030 od assets 18.252 non current: 110,000 fed ai sens : 58252 ICO Chapter 4 (Accounting Cycle Steps 8 & 9) ACCOUNTING CYCLE STEP & Prepare journal entries to close all the temporary accounts. This step Includes journalizing the closing entries in the general journal and posting them to the appropriate general ledger accounts, using the cross-reference procedure described in Step 3. Use the same general journal and general ledger that you used in the previous steps. Helpful Hints The temporary accounts to be closed are the revenue accounts, expense accounts, and the owner's withdrawal (a.k.a. drawing) account. Note that the owner's capital account before the closing process does not equal the ending owner's capital we reported on the statement of owner's equity and on the balance sheet. The closing process, when properly completed, will update the owner's capital account balance in the general ledger so that it reconciles with the ending owner's equity balance we reported on the financial statements. The closing process will also reduce all temporary accounts to a zero balance clearing the way for the accumulation of revenues, expenses, and withdrawals for the next accounting period Revenue accounts must be DEBITED to remove their credit balances and expense accounts and the owner's withdrawal account must be CREDITED to remove their debit balances. ACCOUNTING CYCLE STEP 9: Prepare a post-closing trial balance. Just like the unadjusted trial balance and the adjusted trial balance, this trial balance is simply a listing of the general ledger accounts and their balances in financial statement order with the debit and credit columns summed. See Exhibit 4.6 in your textbook for an example of a post-closing trial balance. No working papers been provided for this step, so you may either handwrite your solution or prepare it electronically If you prepare your solution electronically, be sure to bring a hardcopy to class Helpful Hints This trial balance confirms that general ledger debits and credits are equal before beginning a new accounting cycle. Given that all the temporary account balances were reduced to zero during the closing process, the temporary accounts may be omitted from this trial balance. Check Figure: Debits and Credits must each equal $18,502. ACCOUNTING CYCLE STEP 10: Preparing reversing entries is an optional step in the accounting cycle that will not be covered in this course. Chapter 2 (Accounting Cycle Steps 2, 3, & 4) Y ACCOUNTING CYCLE STEP 2: Journalire each of the following Blue Raider Adventure Park (BAP) transactions in the general journal: you may omit explanations. Use the general journal working papers in your packet. August 1 Matt opens a business checking account in the name of BRAP and makes an initial deposit of $7,000. Matt had previously withdrawn this $7,000 from his personal savings account August 1 Mattis unable to borrow money from the local bank given his youth, lack of business experience, and lack of a substantial credit story. However, his grandfather fully supports Matt's efforts to become an entrepreneur, so he loans Matt $10,000 at 6% Interest to be repaid in two years. Matt deposits these funds into the BRAP checking account. August 7 Matt goes to Play It Again Sports and pays $2,100 to purchase gently used canoes, paddles, lifejackets, ziplining harnesses, etc. to be used the park. (These items will collectively be identified as "Equipment in the accounting records) August 15 Matt purchases a large, attractive sign for the new park at a cost of $650. The sign maker knows Matt's family, so she agrees to extend credit to BRAP for 30 days. August 20 BRAP pays $250 to create, print, and distribute flyers to all the local schools and youth organizations to advertise that the new park will open on September 1 August 28 BRAP pays a total of $5,650 to have the child-appropriate obstacle and ripline courses constructed that same day, inspection and certification are included in these amounts. (These two courses will collectively be identified as "Activity Courses in the accounting records.) September 1 Matt recognizes the fact that he could be sued if a child gets hurt in the park, so BRAP pays $660 to purchase 4 months of general liability insurance for coverage from September 1 through December 31 September 7 Matt establishes a 30-day credit account at a local business on behalf of BRAP. He immediately uses the account to purchase $420 in various supplies for the park September 10 BRAP sells 60 tickets for $15 each to local school children for admission to the park on that same day. (All ticket sales by BRAP are cash sales unless otherwise noted.) September 14 BRAP pays for the sign purchased on August 15. September 17 The Boys and Girls Club of Rutherford County brings 90 disadvantaged children to BRAP. Matt agrees to accept a reduced price of $11.00 per ticket and wait 30 days to receive payment, which will be paid by the Club rather than by the children. September 18 BRAP pays $60 to have the grass mowed at the park. September 22 BRAP sells 45 tickets for $15 each for children in two local Boy Scout troops for admission to the park on that same day. September 24 BRAP receives a check from the Boys and Girls Club of Rutherford County in the amount of $325 to partially pay for the tickets purchased on September 17. September 25 BRAP pays wages in the amount of $380 to two of Matt's friends who worked on days when children were in the park to assist the children with the various activities September 28 Matt is satisfied that BRAP has more than a sufficient amount of operating cash in its checking account, so he writes himself a company check for $700 and deposits it into his own personal checking account, September 30 BRAP receives a check in the amount of $360 from Ms. Hughes, a local teacher, to purchase tickets for her 2 graders. She plans to bring them to BRAP for a field trip on October 3. Helpful Hints Journalizing is the process of recording each transaction in the general journal in chronological (date) order using appropriate account titles and properly characterizing the increase or decrease to each account as either a debit or a credit, based on the account's normal balance. Debit lines are listed first, credits account titles are slightly indented, and DEBIT AMOUNTS MUST EQUAL CREDIT AMOUNTS for each and every individual transaction. 150 numurcicu poprid O DOLCU BIVO Raider Adventure Park Adjufcd mal Balano Account Name Debat Credit carn $8810 M. Lapins, capital $1000 NOIOS podbio 10000 Equipment 2100 sign 650 navertising expense 250 Activity Cours 5050 unsuran exronics 165 cpaid Insurance 495 uppics cxpono 288 Accounts payable 420 Tickel Revenue 25605 Mounts receivable mouing oxpense wagas Oponso M. Lannsil withdrawals Uncarncd rovanie 360 orest arenos INTUCSI pauaple 100 supplies doprccation cxponics Accumulaca Depicaction Equipment Acumulched. Depreciation on meumidied Doprccidton-nctity courses 100 wagos pavabio 150 $20,743 820, 743 132 AR TOM Blue Raider Adventure Park GENERAL LEDGER Account Cash Account No. 101 Post. Ref. Balance Credit Debit 2017050 2011 1 oololo 1012 210g 250 51650 1660 Date Item Ann M. Le capital Avg AVIS RIUDO Augn avement Aug 20 Verang cipcnce u 28 chvity courses SO I Pcmid Trance | Stp op 1 Accountis palable SCP 18 NOLIC TRENU Lap 22 TICKET revenue SEP 24 Accounts YCCOLIO SCP 25 WOCS cancha SCP 28/M-Lennskuntia diep boundamad YON. 128 108 1900 1201 050 dol 75 3251 do 8 & 10 Account Accounts Receivable Account No. 106 Credit Date Item NP o TCCALCOVICINO SEP Can Debit 19910 19120 22 Da 11005 Account No. 126 Account Supplies Balance Date Item Post. Ref. Credit Debit Credit Debit 420 sop 7 Ammoniu pavde 201 41201 Account No. 128 Account Prepaid Insurance Balance Date Item Post. Ref. Debit Credit Debit Credit cas MOL Idol LLUUNWages Payable Date Account No. 210 Debit Credit Account Unearned Revenue Date Account No. 236 Item Post Ref Debit SCP_301 can 101 Credit ado 300 Account Interest Payable Account No. 240 Date Item Debit Credit Credit Account Notes Payable Account No. 275 Date Balance Item Post Ref. Debit Credit Account M. Lapinski Capital Date Item Account No. 301 Debit Credit TOODT Account M. Lapinski Withdrawals 100 Date Account No. 302 Item Credit SCP 28 cash Debit 1001 Credit Account Ticket Revenue Account No. 403 Debit Balance Credit Date Item SCP10 cash SEP IT A. Recendo NP 78 Cash Credit OO op 1015 B01 Account Advertising Expense Account No. 612 Item Date a 20 Com Credit Debit 250 250V Account Depreciation Expense Account No. 625 Date Item Debit Credit Balance Debit Credit Account Insurance Expense Account No. 632 Balance Debit Credit Post Date Item Debit Credit Ref. CUM dla Account Interest Expense Account No. 600 Date Item Post. Debit Credit Ref. Account No. 653 Account Mowing Expense Balance Post. Ref. Credit Debit Debit Credit Item Date KOLL OO ISCp 1 cash Account No. 670 Balance Account Supplies Expense Credit Credit Post. Ref. Debit Debit Date Item Account No. 682 Balance Credit Account Wages Expense Post. Credit Debit Item Date Debit I a P 25 carn Account Income Summary Account No. 999 Date Item Debit Credit Debit Credit Skylar COOK 02|19|20 Blue Raider Adventure Park Throme Scitement for the period ended september 30, 2019 Revenues Ticket creve $25105 Tutaj revan's $ 25605 530 288 250 Expenses muggas expense Supplies expense Advertising expense Insurance expense Depkecichon expence Interest expense mowing Openso Total txpenses: 165 148 100 100 $1541 $1024 Met Income SLIUI LOL Blu Raider avanturo Park Salam of owner" cavity For Monin anda semu 0,2014 M. Lapinski coritai, augutt ist, 2019 C1000 Punct income LESS: Withdraudus by Duner M.Lapinsku carucinuount 20,2019 1024 $79220 150 Blue Raider Adventure park Balance sheet septemher 20, 2014 ASOCIS Lidbintas 8816 counts payaal 25605 supplier 132 notos payable 10,000 fiipment 100 lat payapo 100 Tom Kovadlo 00S Wagas payable Prepad Insurance 495 vncarnd worvo 300 Less: Accumulated DOPCLICH In-Equp. 300 aan 1050 Equity 7314 OS: Accumulated Depreciation-non 12 MALOPOS cabeu H0300 Activity courses 5650 Bier's sovitt 7224 LTC : Accumulated Dop. -Ayolny CONCOs 100 ini mnoort 1024 Total access : 18,354 Toid abilities equity 18,354 current assets : 0102 - current lapllitres : $1030 od assets 18.252 non current: 110,000 fed ai sens : 58252 ICO Chapter 4 (Accounting Cycle Steps 8 & 9) ACCOUNTING CYCLE STEP & Prepare journal entries to close all the temporary accounts. This step Includes journalizing the closing entries in the general journal and posting them to the appropriate general ledger accounts, using the cross-reference procedure described in Step 3. Use the same general journal and general ledger that you used in the previous steps. Helpful Hints The temporary accounts to be closed are the revenue accounts, expense accounts, and the owner's withdrawal (a.k.a. drawing) account. Note that the owner's capital account before the closing process does not equal the ending owner's capital we reported on the statement of owner's equity and on the balance sheet. The closing process, when properly completed, will update the owner's capital account balance in the general ledger so that it reconciles with the ending owner's equity balance we reported on the financial statements. The closing process will also reduce all temporary accounts to a zero balance clearing the way for the accumulation of revenues, expenses, and withdrawals for the next accounting period Revenue accounts must be DEBITED to remove their credit balances and expense accounts and the owner's withdrawal account must be CREDITED to remove their debit balances. ACCOUNTING CYCLE STEP 9: Prepare a post-closing trial balance. Just like the unadjusted trial balance and the adjusted trial balance, this trial balance is simply a listing of the general ledger accounts and their balances in financial statement order with the debit and credit columns summed. See Exhibit 4.6 in your textbook for an example of a post-closing trial balance. No working papers been provided for this step, so you may either handwrite your solution or prepare it electronically If you prepare your solution electronically, be sure to bring a hardcopy to class Helpful Hints This trial balance confirms that general ledger debits and credits are equal before beginning a new accounting cycle. Given that all the temporary account balances were reduced to zero during the closing process, the temporary accounts may be omitted from this trial balance. Check Figure: Debits and Credits must each equal $18,502. ACCOUNTING CYCLE STEP 10: Preparing reversing entries is an optional step in the accounting cycle that will not be covered in this course. Chapter 2 (Accounting Cycle Steps 2, 3, & 4) Y ACCOUNTING CYCLE STEP 2: Journalire each of the following Blue Raider Adventure Park (BAP) transactions in the general journal: you may omit explanations. Use the general journal working papers in your packet. August 1 Matt opens a business checking account in the name of BRAP and makes an initial deposit of $7,000. Matt had previously withdrawn this $7,000 from his personal savings account August 1 Mattis unable to borrow money from the local bank given his youth, lack of business experience, and lack of a substantial credit story. However, his grandfather fully supports Matt's efforts to become an entrepreneur, so he loans Matt $10,000 at 6% Interest to be repaid in two years. Matt deposits these funds into the BRAP checking account. August 7 Matt goes to Play It Again Sports and pays $2,100 to purchase gently used canoes, paddles, lifejackets, ziplining harnesses, etc. to be used the park. (These items will collectively be identified as "Equipment in the accounting records) August 15 Matt purchases a large, attractive sign for the new park at a cost of $650. The sign maker knows Matt's family, so she agrees to extend credit to BRAP for 30 days. August 20 BRAP pays $250 to create, print, and distribute flyers to all the local schools and youth organizations to advertise that the new park will open on September 1 August 28 BRAP pays a total of $5,650 to have the child-appropriate obstacle and ripline courses constructed that same day, inspection and certification are included in these amounts. (These two courses will collectively be identified as "Activity Courses in the accounting records.) September 1 Matt recognizes the fact that he could be sued if a child gets hurt in the park, so BRAP pays $660 to purchase 4 months of general liability insurance for coverage from September 1 through December 31 September 7 Matt establishes a 30-day credit account at a local business on behalf of BRAP. He immediately uses the account to purchase $420 in various supplies for the park September 10 BRAP sells 60 tickets for $15 each to local school children for admission to the park on that same day. (All ticket sales by BRAP are cash sales unless otherwise noted.) September 14 BRAP pays for the sign purchased on August 15. September 17 The Boys and Girls Club of Rutherford County brings 90 disadvantaged children to BRAP. Matt agrees to accept a reduced price of $11.00 per ticket and wait 30 days to receive payment, which will be paid by the Club rather than by the children. September 18 BRAP pays $60 to have the grass mowed at the park. September 22 BRAP sells 45 tickets for $15 each for children in two local Boy Scout troops for admission to the park on that same day. September 24 BRAP receives a check from the Boys and Girls Club of Rutherford County in the amount of $325 to partially pay for the tickets purchased on September 17. September 25 BRAP pays wages in the amount of $380 to two of Matt's friends who worked on days when children were in the park to assist the children with the various activities September 28 Matt is satisfied that BRAP has more than a sufficient amount of operating cash in its checking account, so he writes himself a company check for $700 and deposits it into his own personal checking account, September 30 BRAP receives a check in the amount of $360 from Ms. Hughes, a local teacher, to purchase tickets for her 2 graders. She plans to bring them to BRAP for a field trip on October 3. Helpful Hints Journalizing is the process of recording each transaction in the general journal in chronological (date) order using appropriate account titles and properly characterizing the increase or decrease to each account as either a debit or a credit, based on the account's normal balance. Debit lines are listed first, credits account titles are slightly indented, and DEBIT AMOUNTS MUST EQUAL CREDIT AMOUNTS for each and every individual transaction. 150 numurcicu poprid O DOLCU BIVO Raider Adventure Park Adjufcd mal Balano Account Name Debat Credit carn $8810 M. Lapins, capital $1000 NOIOS podbio 10000 Equipment 2100 sign 650 navertising expense 250 Activity Cours 5050 unsuran exronics 165 cpaid Insurance 495 uppics cxpono 288 Accounts payable 420 Tickel Revenue 25605 Mounts receivable mouing oxpense wagas Oponso M. Lannsil withdrawals Uncarncd rovanie 360 orest arenos INTUCSI pauaple 100 supplies doprccation cxponics Accumulaca Depicaction Equipment Acumulched. Depreciation on meumidied Doprccidton-nctity courses 100 wagos pavabio 150 $20,743 820, 743 132 AR TOM Blue Raider Adventure Park GENERAL LEDGER Account Cash Account No. 101 Post. Ref. Balance Credit Debit 2017050 2011 1 oololo 1012 210g 250 51650 1660 Date Item Ann M. Le capital Avg AVIS RIUDO Augn avement Aug 20 Verang cipcnce u 28 chvity courses SO I Pcmid Trance | Stp op 1 Accountis palable SCP 18 NOLIC TRENU Lap 22 TICKET revenue SEP 24 Accounts YCCOLIO SCP 25 WOCS cancha SCP 28/M-Lennskuntia diep boundamad YON. 128 108 1900 1201 050 dol 75 3251 do 8 & 10 Account Accounts Receivable Account No. 106 Credit Date Item NP o TCCALCOVICINO SEP Can Debit 19910 19120 22 Da 11005 Account No. 126 Account Supplies Balance Date Item Post. Ref. Credit Debit Credit Debit 420 sop 7 Ammoniu pavde 201 41201 Account No. 128 Account Prepaid Insurance Balance Date Item Post. Ref. Debit Credit Debit Credit cas MOL Idol LLUUNWages Payable Date Account No. 210 Debit Credit Account Unearned Revenue Date Account No. 236 Item Post Ref Debit SCP_301 can 101 Credit ado 300 Account Interest Payable Account No. 240 Date Item Debit Credit Credit Account Notes Payable Account No. 275 Date Balance Item Post Ref. Debit Credit Account M. Lapinski Capital Date Item Account No. 301 Debit Credit TOODT Account M. Lapinski Withdrawals 100 Date Account No. 302 Item Credit SCP 28 cash Debit 1001 Credit Account Ticket Revenue Account No. 403 Debit Balance Credit Date Item SCP10 cash SEP IT A. Recendo NP 78 Cash Credit OO op 1015 B01 Account Advertising Expense Account No. 612 Item Date a 20 Com Credit Debit 250 250V Account Depreciation Expense Account No. 625 Date Item Debit Credit Balance Debit Credit Account Insurance Expense Account No. 632 Balance Debit Credit Post Date Item Debit Credit Ref. CUM dla Account Interest Expense Account No. 600 Date Item Post. Debit Credit Ref. Account No. 653 Account Mowing Expense Balance Post. Ref. Credit Debit Debit Credit Item Date KOLL OO ISCp 1 cash Account No. 670 Balance Account Supplies Expense Credit Credit Post. Ref. Debit Debit Date Item Account No. 682 Balance Credit Account Wages Expense Post. Credit Debit Item Date Debit I a P 25 carn Account Income Summary Account No. 999 Date Item Debit Credit Debit Credit