Answered step by step

Verified Expert Solution

Question

1 Approved Answer

i need help Problem IV: (17 points) On April 1, 2023, Dixon Corp. purchased a truck and a machine for a combined cost of $1,500,000.

i need help

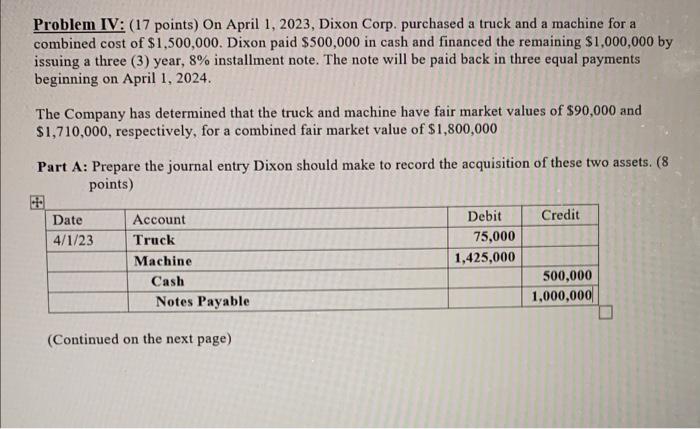

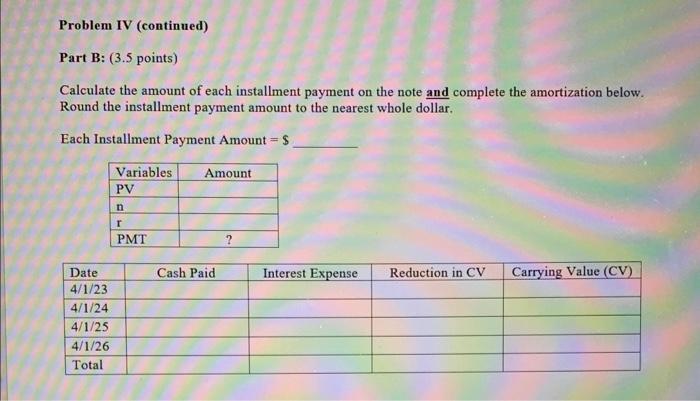

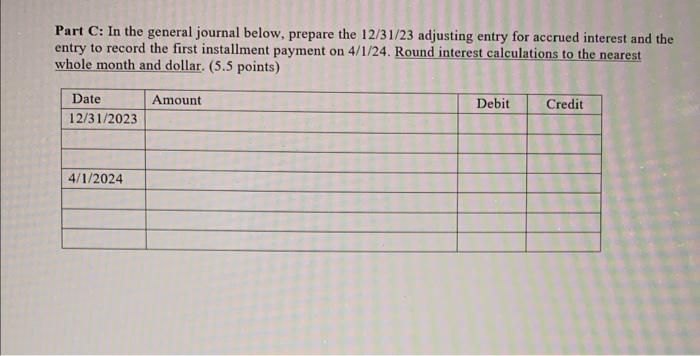

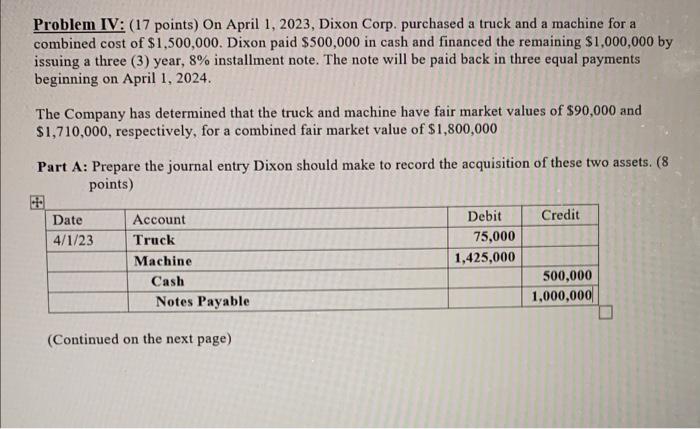

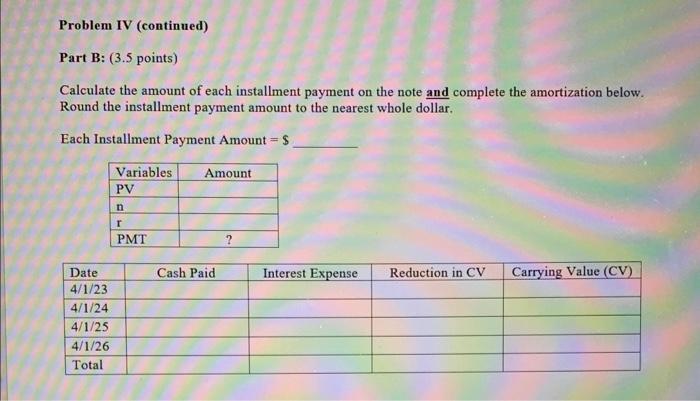

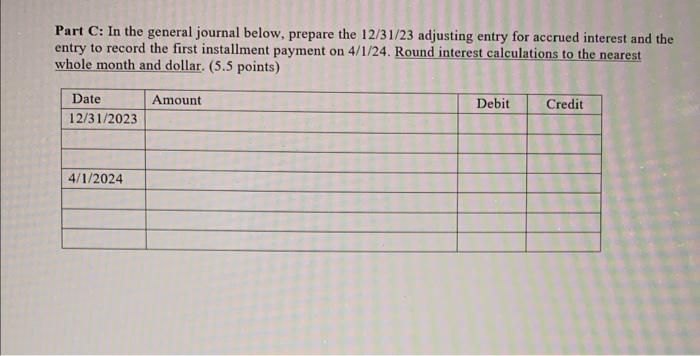

Problem IV: (17 points) On April 1, 2023, Dixon Corp. purchased a truck and a machine for a combined cost of $1,500,000. Dixon paid $500,000 in cash and financed the remaining $1,000,000 by issuing a three (3) year, 8% installment note. The note will be paid back in three equal payments beginning on April 1, 2024. The Company has determined that the truck and machine have fair market values of $90,000 and $1,710,000, respectively, for a combined fair market value of $1,800,000 Part A: Prepare the journal entry Dixon should make to record the acquisition of these two assets. ( 8 points) (Continued on the next page) Calculate the amount of each installment payment on the note and complete the amortization below. Round the installment payment amount to the nearest whole dollar. Each Installment Payment Amount =$ Part C: In the general journal below, prepare the 12/31/23 adjusting entry for accrued interest and the entry to record the first installment payment on 4/1/24. Round interest calculations to the nearest whole month and dollar. ( 5.5 points) Problem IV: (17 points) On April 1, 2023, Dixon Corp. purchased a truck and a machine for a combined cost of $1,500,000. Dixon paid $500,000 in cash and financed the remaining $1,000,000 by issuing a three (3) year, 8% installment note. The note will be paid back in three equal payments beginning on April 1, 2024. The Company has determined that the truck and machine have fair market values of $90,000 and $1,710,000, respectively, for a combined fair market value of $1,800,000 Part A: Prepare the journal entry Dixon should make to record the acquisition of these two assets. ( 8 points) (Continued on the next page) Calculate the amount of each installment payment on the note and complete the amortization below. Round the installment payment amount to the nearest whole dollar. Each Installment Payment Amount =$ Part C: In the general journal below, prepare the 12/31/23 adjusting entry for accrued interest and the entry to record the first installment payment on 4/1/24. Round interest calculations to the nearest whole month and dollar. ( 5.5 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started