I need help putting questions A Through T Into Journal Entries. Please HELP! I've Posted this Three times and no one Answers the whole question. I Just need the Journal entries for ALL OF THEM PLEASE!

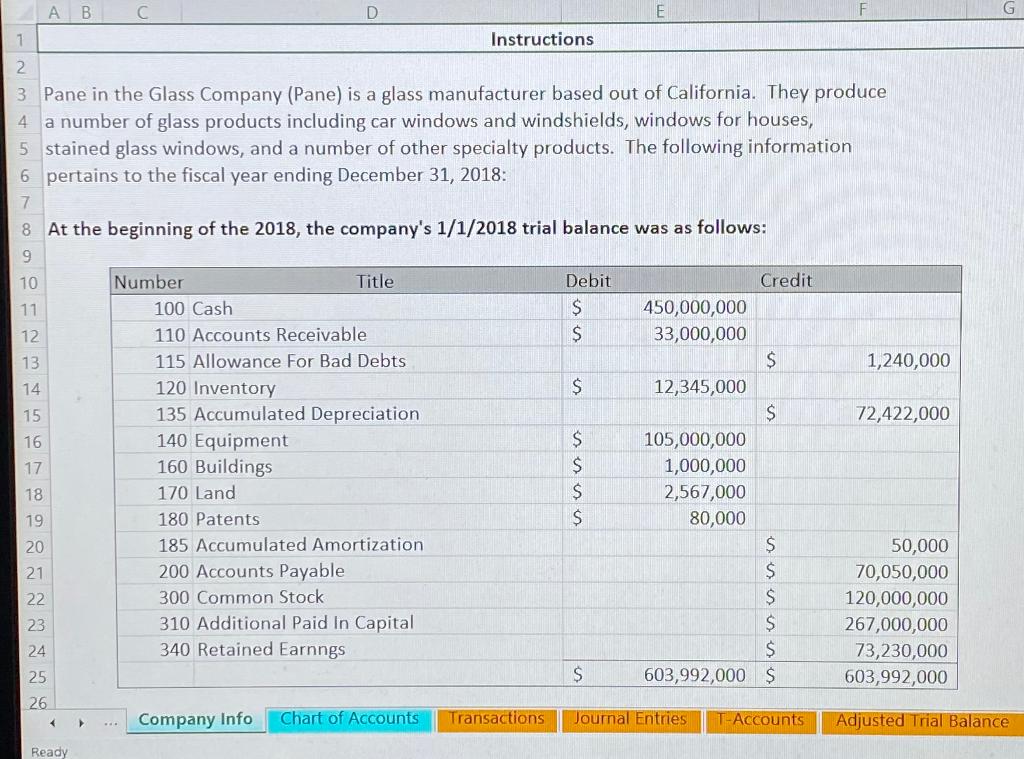

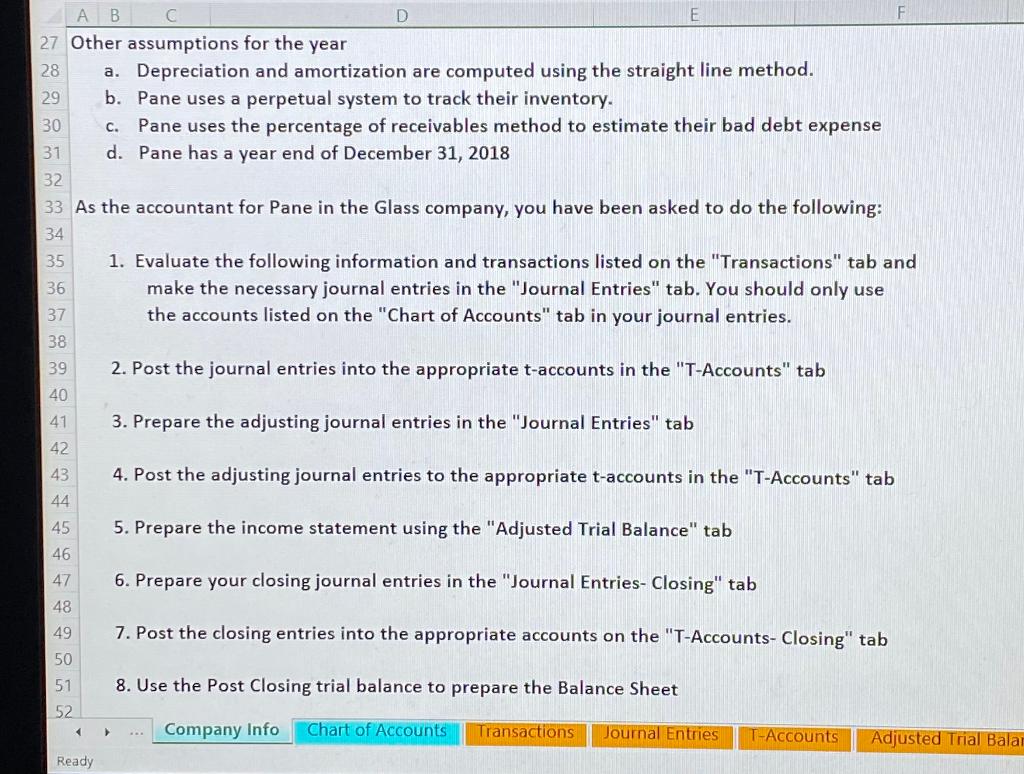

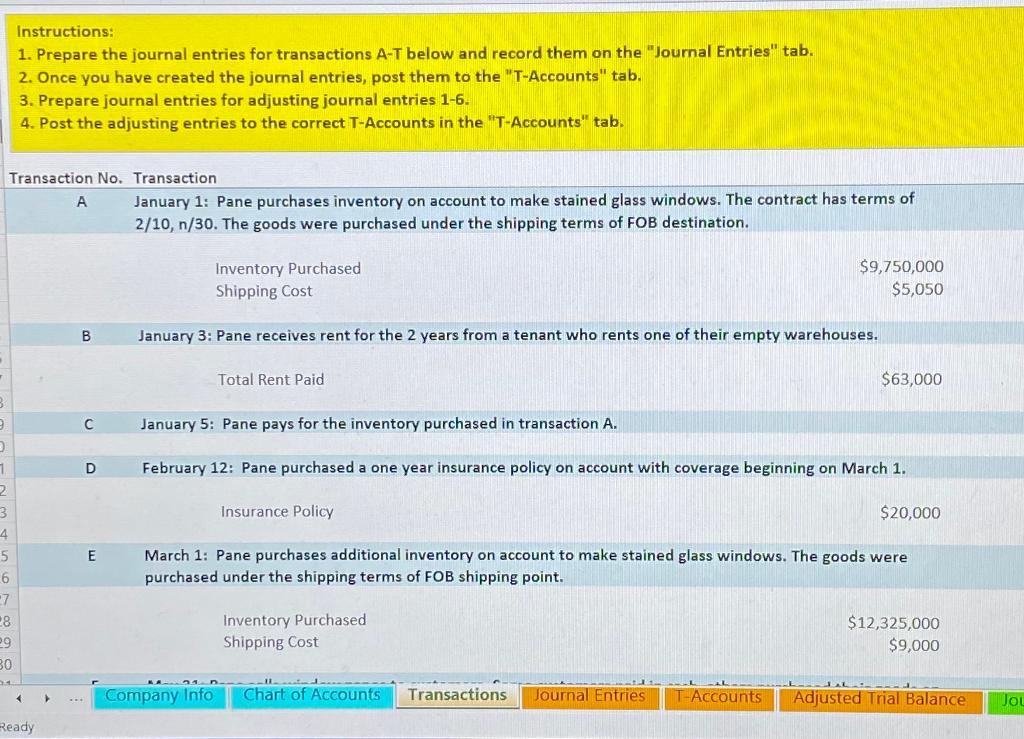

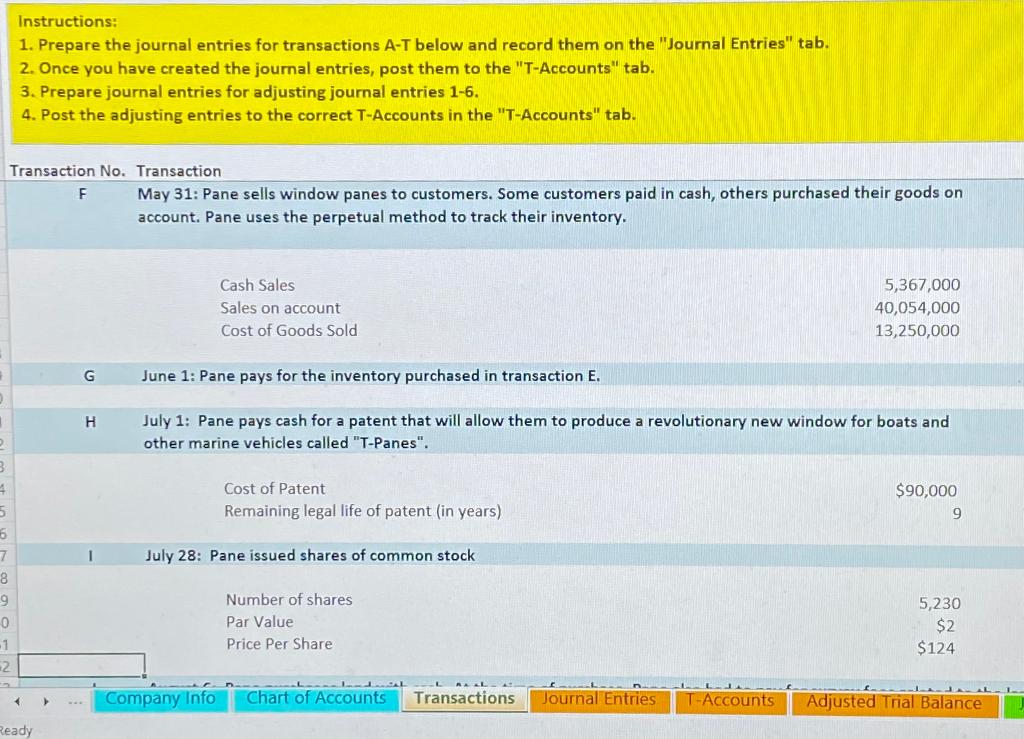

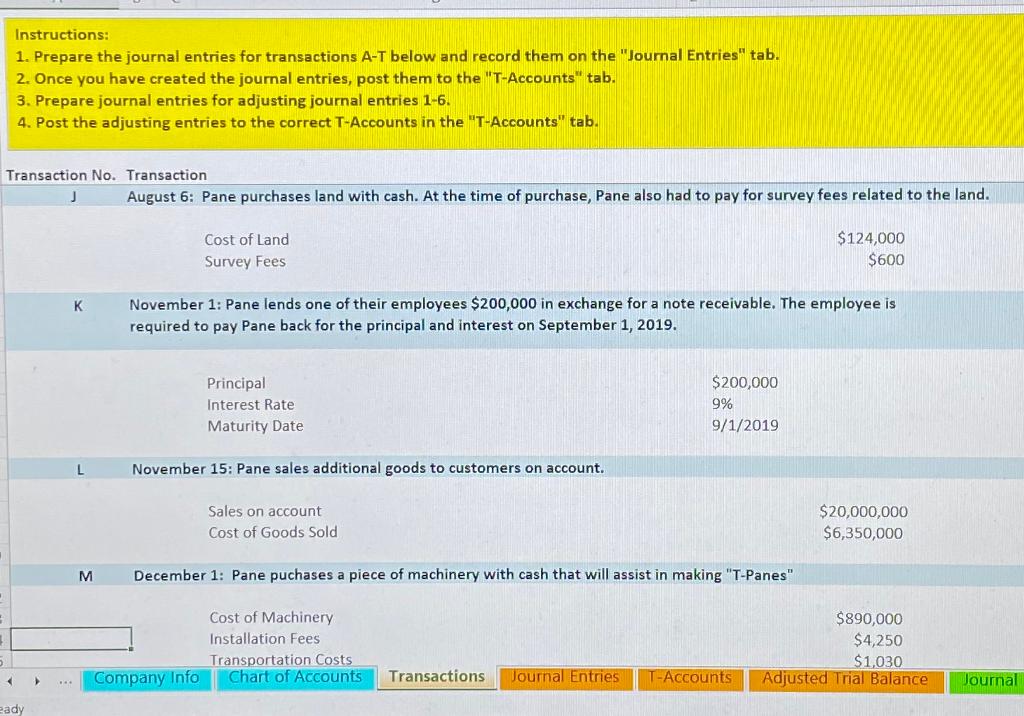

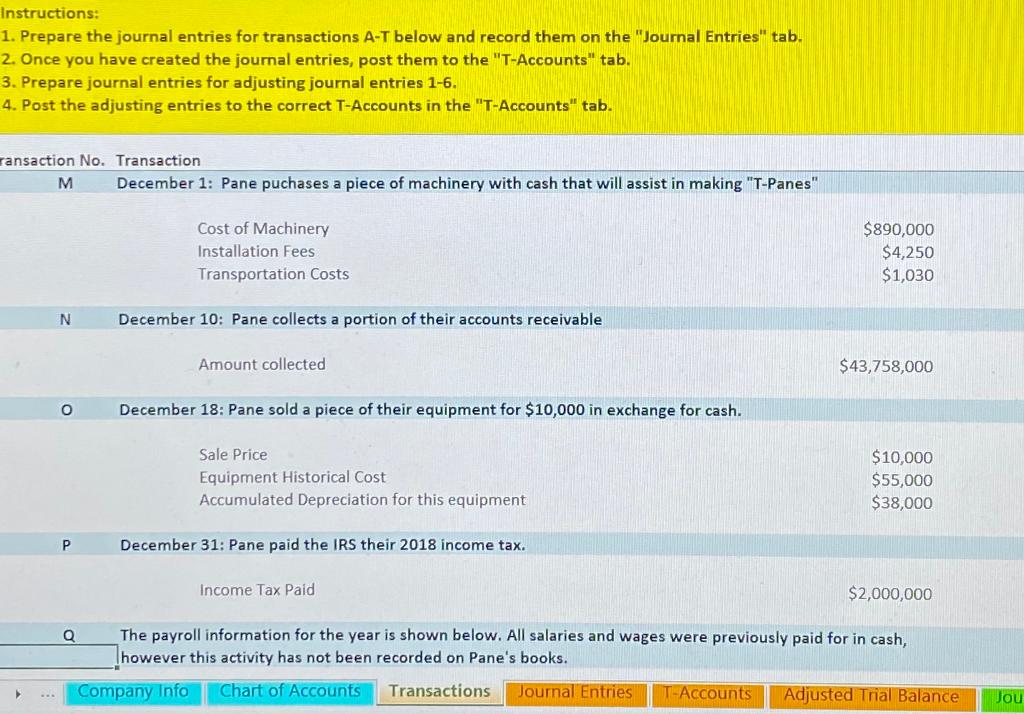

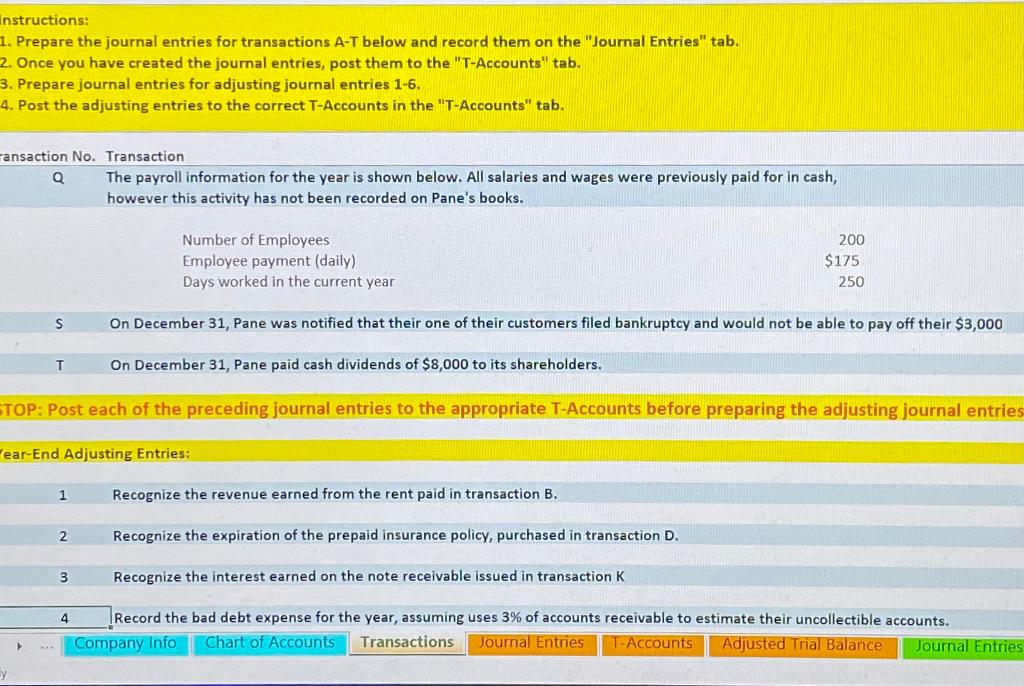

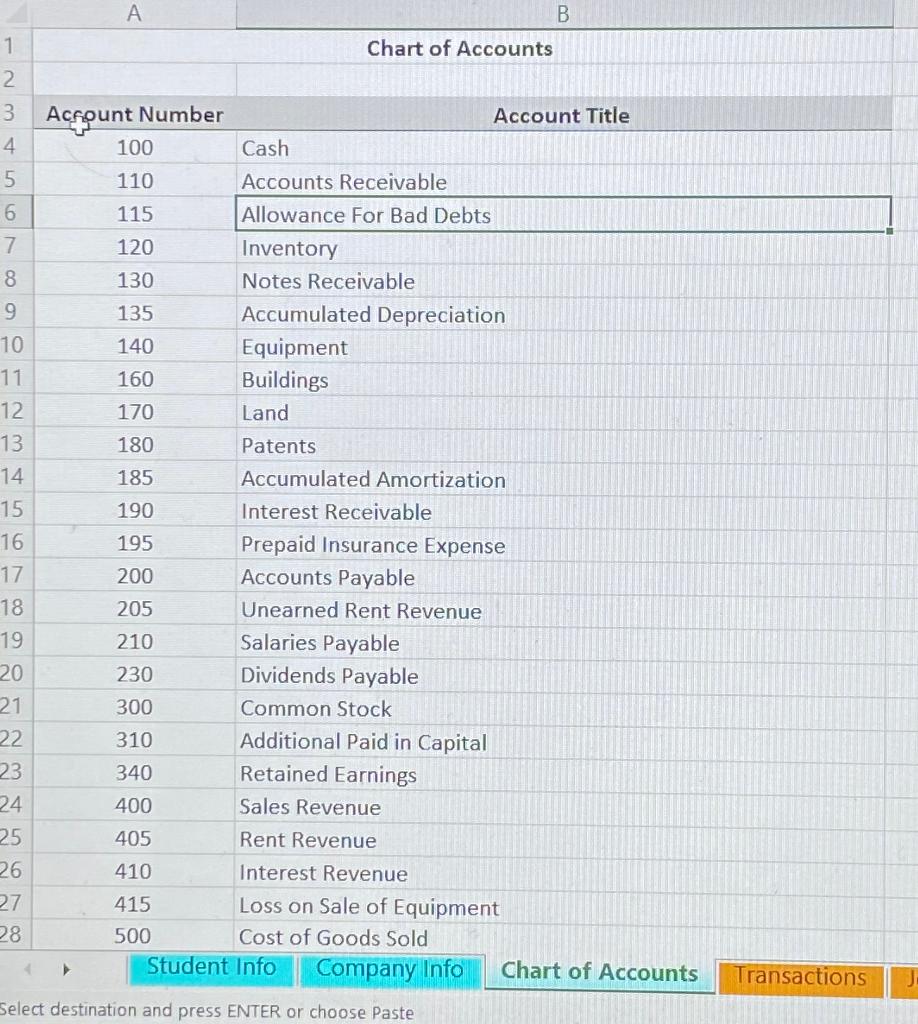

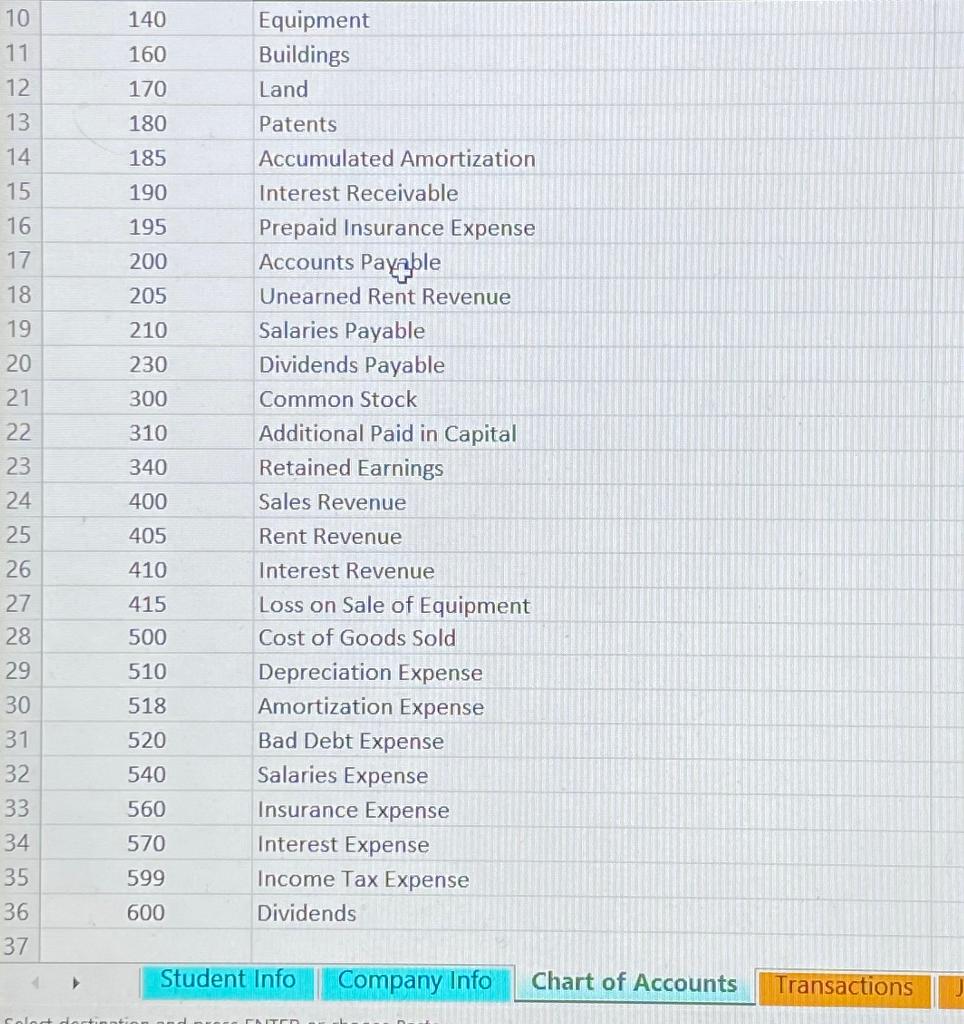

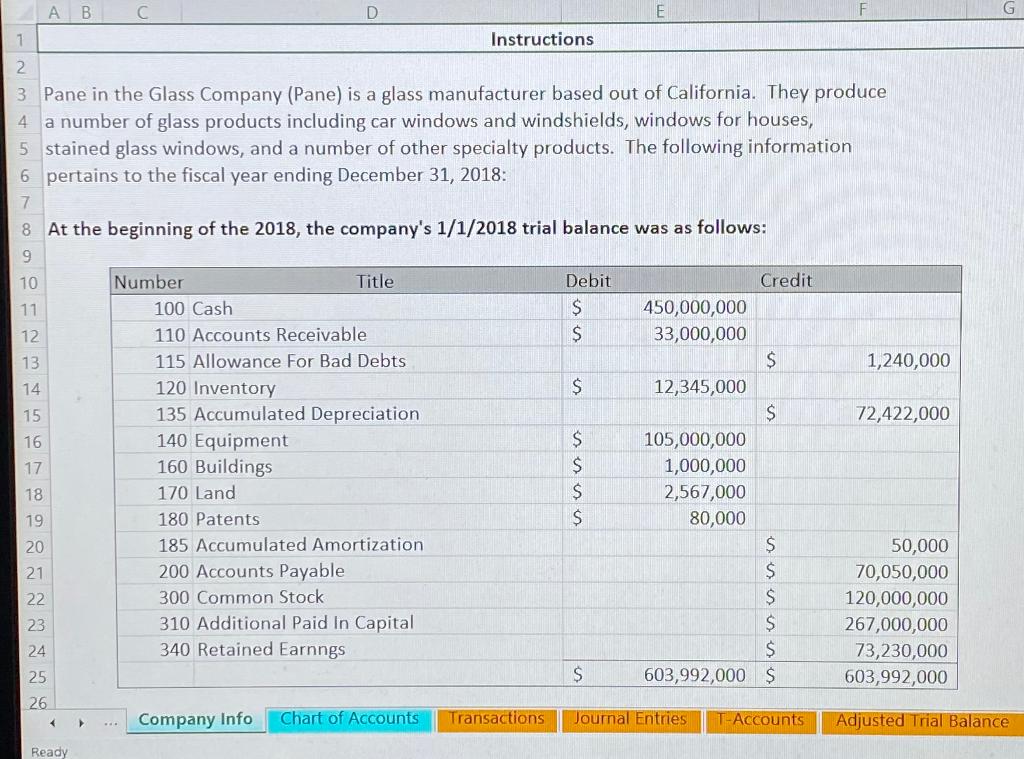

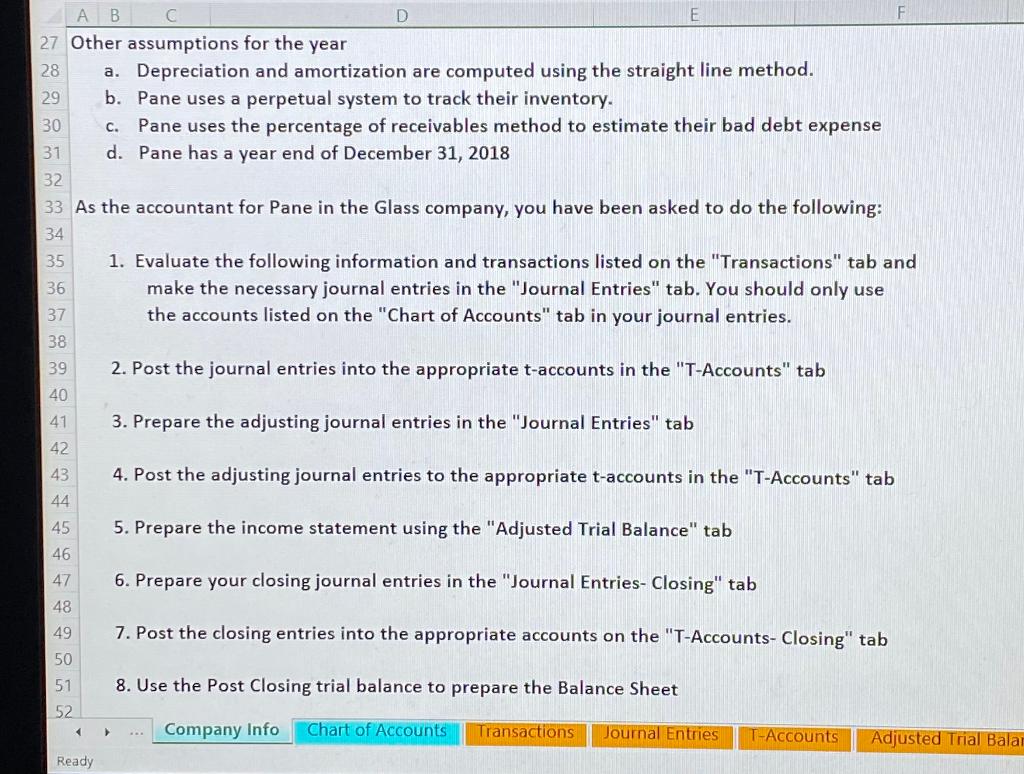

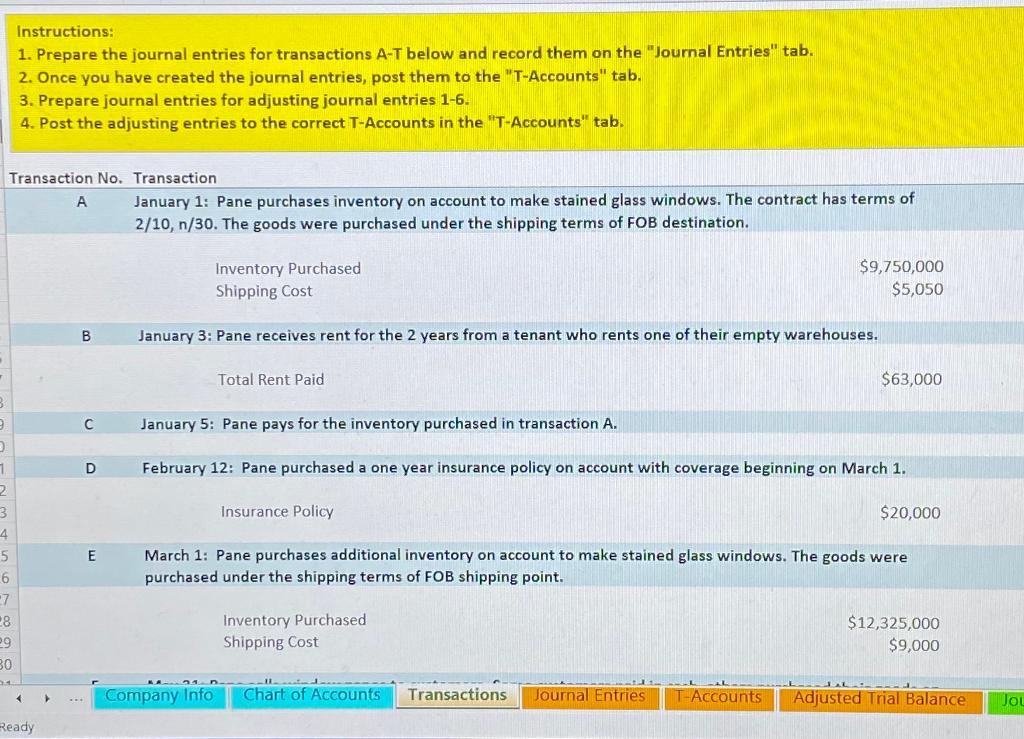

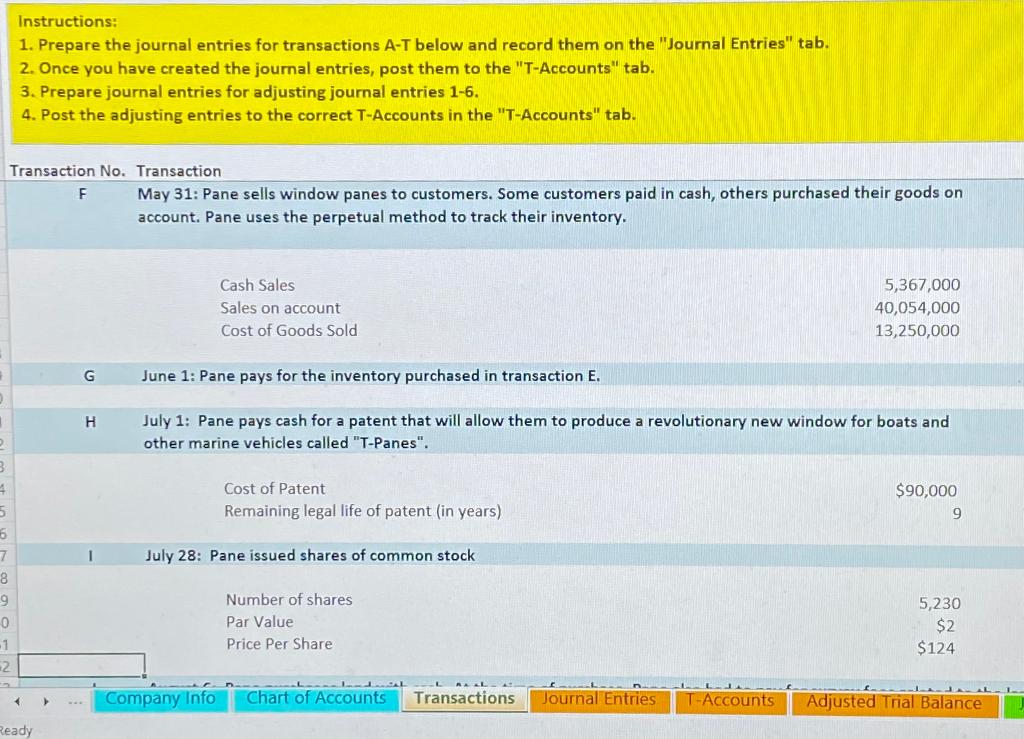

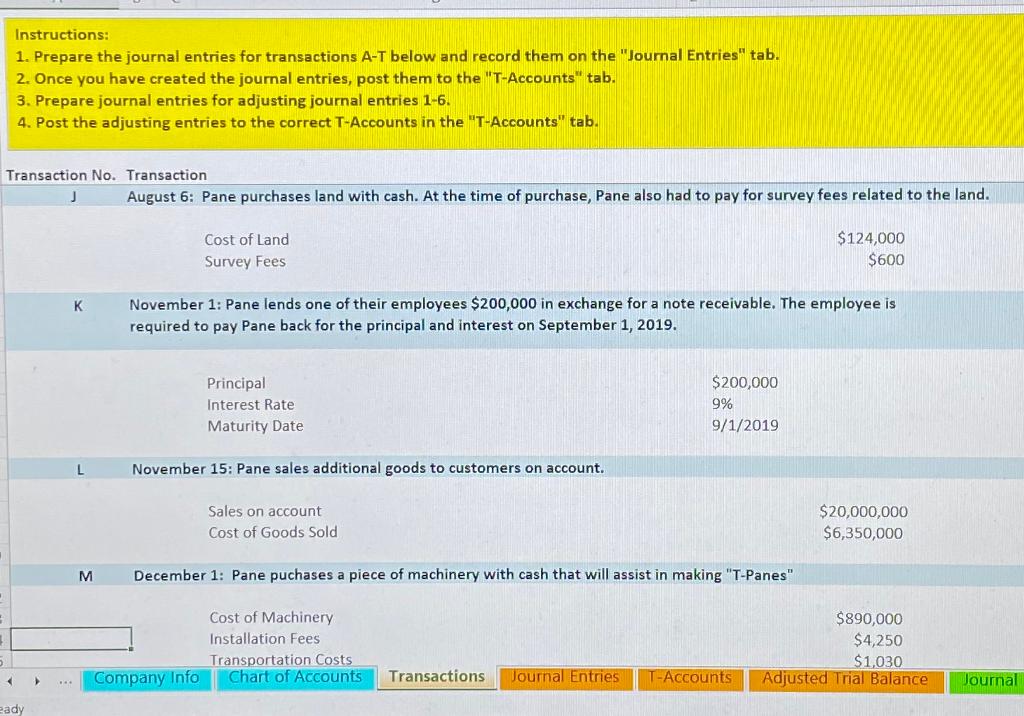

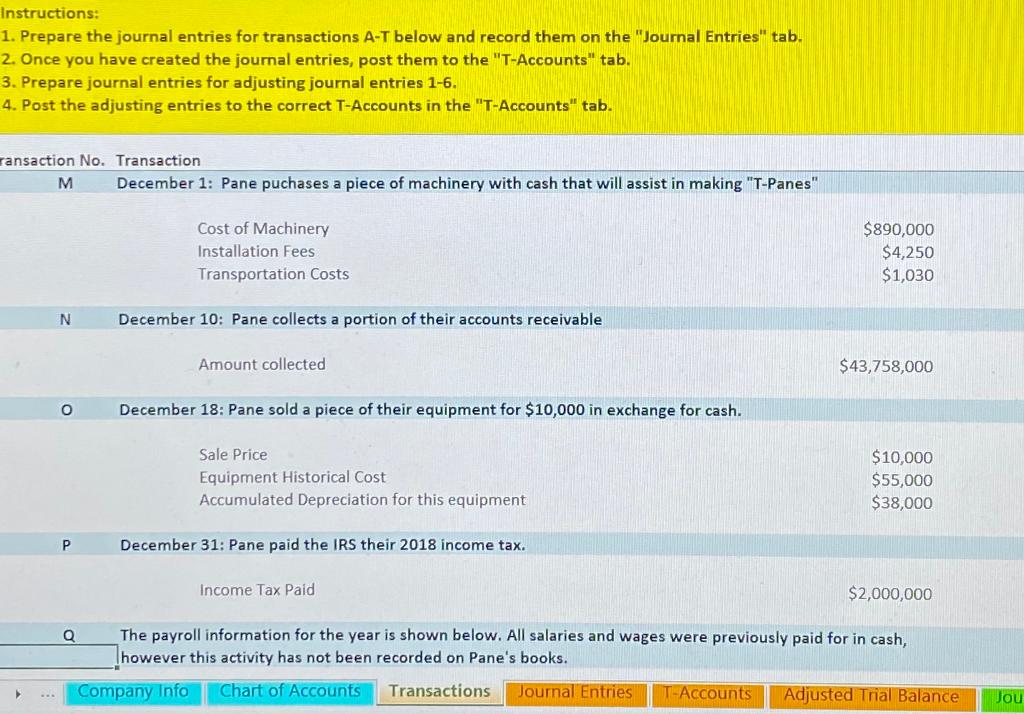

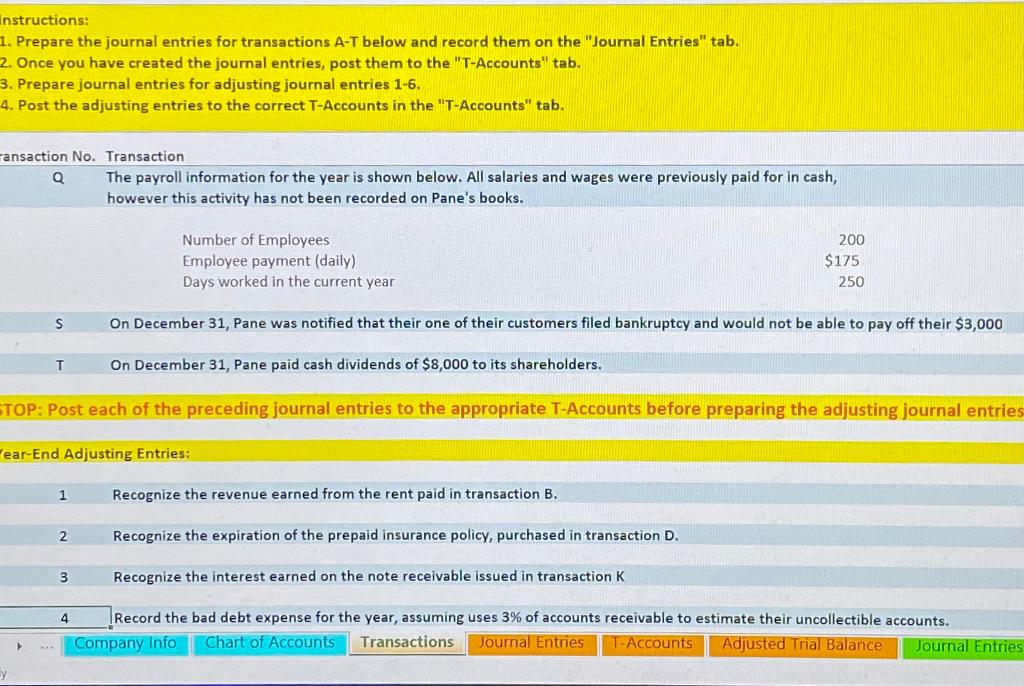

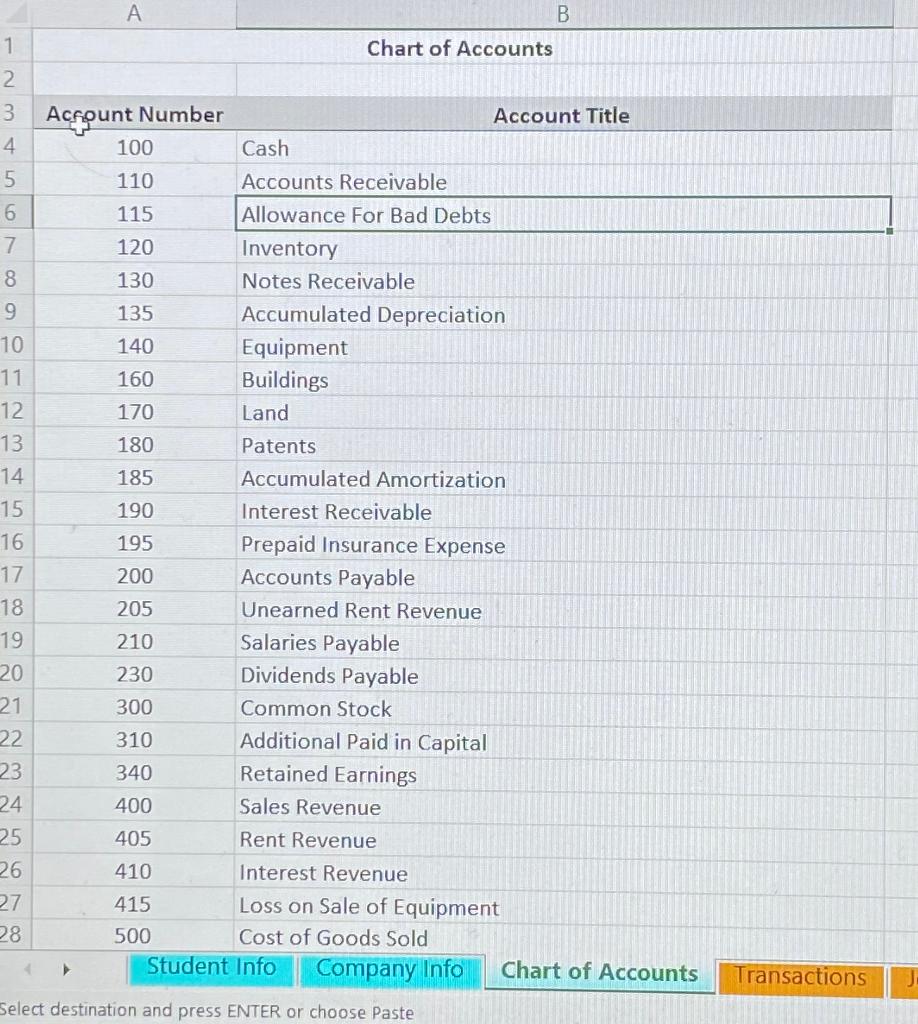

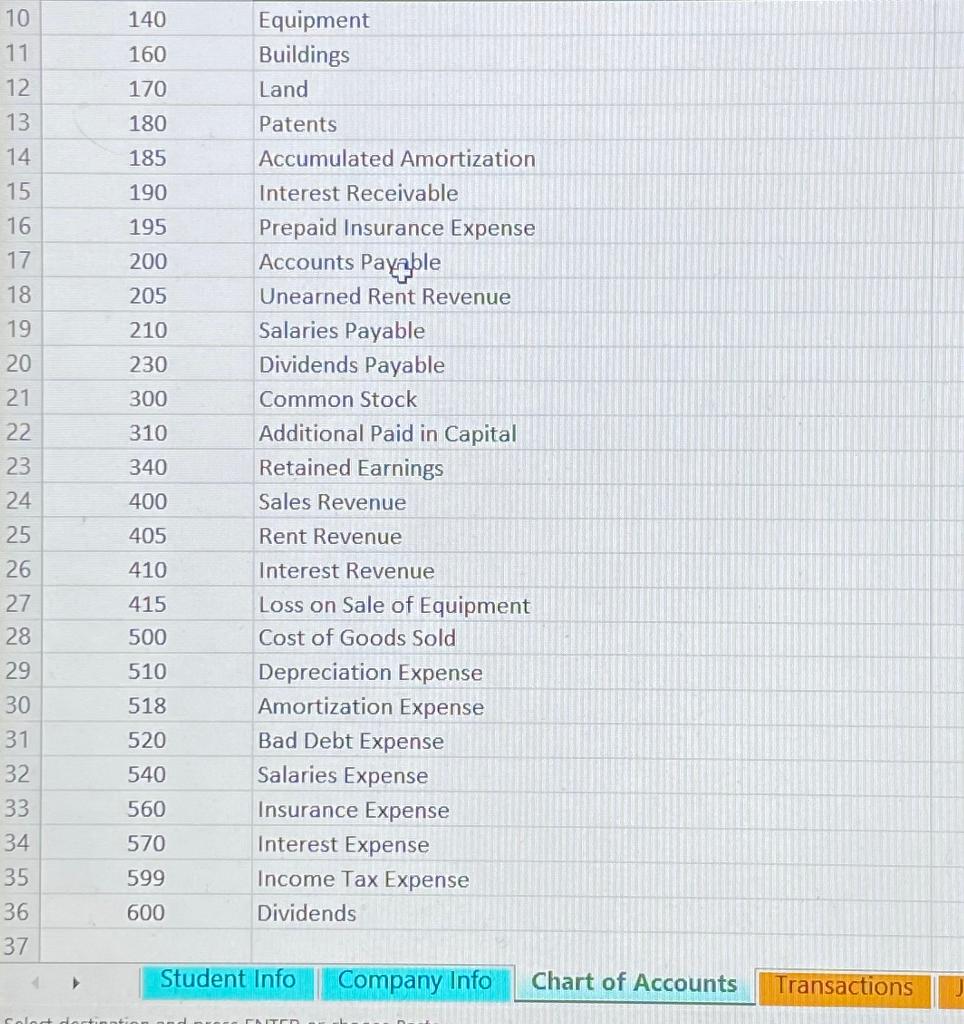

E 1 Instructions 2. 3 Pane in the Glass Company (Pane) is a glass manufacturer based out of California. They produce 4 a number of glass products including car windows and windshields, windows for houses, 5 stained glass windows, and a number of other specialty products. The following information 6 pertains to the fiscal year ending December 31, 2018: 7 8 At the beginning of the 2018, the company's 1/1/2018 trial balance was as follows: 9 10 Number Title Debit Credit 11 100 Cash $ 450,000,000 12 110 Accounts Receivable $ 33,000,000 13 115 Allowance For Bad Debts $ 1,240,000 14 120 Inventory $ 12,345,000 15 135 Accumulated Depreciation $ 72,422,000 16 140 Equipment $ 105,000,000 17 160 Buildings $ 1,000,000 18 170 Land $ 2,567,000 19 180 Patents $ 80,000 20 185 Accumulated Amortization $ 50,000 21 200 Accounts Payable $ 70,050,000 22 300 Common Stock $ 120,000,000 23 310 Additional Paid In Capital S 267,000,000 24 340 Retained Earnngs $ 73,230,000 25 $ 603,992,000 $ 603,992,000 26 Company Info Chart of Accounts Transactions Journal Entries T-Accounts Adjusted Trial Balance Ready D AB 27 Other assumptions for the year 28 a. Depreciation and amortization are computed using the straight line method. 29 b. Pane uses a perpetual system to track their inventory. 30 C. Pane uses the percentage of receivables method to estimate their bad debt expense 31 d. Pane has a year end of December 31, 2018 32 33 As the accountant for Pane in the Glass company, you have been asked to do the following: 34 35 1. Evaluate the following information and transactions listed on the "Transactions" tab and 36 make the necessary journal entries in the "Journal Entries" tab. You should only use 37 the accounts listed on the "Chart of Accounts" tab in your journal entries. 38 39 2. Post the journal entries into the appropriate t-accounts in the "T-Accounts" tab 40 41 3. Prepare the adjusting journal entries in the "Journal Entries" tab 42 4. Post the adjusting journal entries to the appropriate t-accounts in the "T-Accounts" tab 44 5. Prepare the income statement using the "Adjusted Trial Balance" tab 43 45 46 47 48 6. Prepare your closing journal entries in the "Journal Entries- Closing" tab 49 7. Post the closing entries into the appropriate accounts on the "T-Accounts- Closing" tab 50 8. Use the Post Closing trial balance to prepare the Balance Sheet 51 52 Company Info Chart of Accounts Transactions Journal Entries T-Accounts Adjusted Trial Bala Ready Instructions: 1. Prepare the journal entries for transactions A-T below and record them on the "Journal Entries" tab. 2. Once you have created the journal entries, post them to the "T-Accounts" tab. 3. Prepare journal entries for adjusting journal entries 1-6. 4. Post the adjusting entries to the correct T-Accounts in the "T-Accounts" tab. Transaction No. Transaction A January 1: Pane purchases inventory on account to make stained glass windows. The contract has terms of 2/10, n/30. The goods were purchased under the shipping terms of FOB destination. Inventory Purchased Shipping Cost $9,750,000 $5,050 B January 3: Pane receives rent for the 2 years from a tenant who rents one of their empty warehouses. Total Rent Paid $63,000 January 5: Pane pays for the inventory purchased in transaction A. 2 1 D February 12: Pane purchased a one year insurance policy on account with coverage beginning on March 1. 2 Insurance Policy $20,000 3 4 5 E March 1: Pane purchases additional inventory on account to make stained glass windows. The goods were purchased under the shipping terms of FOB shipping point. 6 17 8 29 30 Inventory Purchased Shipping Cost $12,325,000 $9,000 Company Info Chart of Accounts Transactions Journal Entries T-Accounts Adjusted Trial Balance Jou Ready Instructions: 1. Prepare the journal entries for transactions A-T below and record them on the "Journal Entries" tab. 2. Once you have created the journal entries, post them to the "T-Accounts" tab. 3. Prepare journal entries for adjusting journal entries 1-6. 4. Post the adjusting entries to the correct T-Accounts in the "T-Accounts" tab. Transaction No. Transaction F May 31: Pane sells window panes to customers. Some customers paid in cash, others purchased their goods on account. Pane uses the perpetual method to track their inventory. Cash Sales Sales on account Cost of Goods Sold 5,367,000 40,054,000 13,250,000 G June 1: Pane pays for the inventory purchased in transaction E. H July 1: Pane pays cash for a patent that will allow them to produce a revolutionary new window for boats and other marine vehicles called "T-Panes". 4 Cost of Patent Remaining legal life of patent (in years) $90,000 9 5 6 July 28: Pane issued shares of common stock 7 8 9 0 - 1 2. Number of shares Par Value Price Per Share 5,230 $2 $124 Company Info Chart of Accounts Transactions Journal Entries T-Accounts Adjusted Trial Balance Ready Instructions: 1. Prepare the journal entries for transactions A-T below and record them on the "Journal Entries" tab. 2. Once you have created the journal entries, post them to the "T-Accounts" tab. 3. Prepare journal entries for adjusting journal entries 1-6. 4. Post the adjusting entries to the correct T-Accounts in the "T-Accounts" tab. Transaction No. Transaction August 6: Pane purchases land with cash. At the time of purchase, Pane also had to pay for survey fees related to the land. Cost of Land Survey Fees $124,000 $600 K November 1: Pane lends one of their employees $200,000 in exchange for a note receivable. The employee is required to pay Pane back for the principal and interest on September 1, 2019. Principal Interest Rate Maturity Date $200,000 9% 9/1/2019 November 15: Pane sales additional goods to customers on account. Sales on account Cost of Goods Sold $20,000,000 $6,350,000 M December 1: Pane puchases a piece of machinery with cash that will assist in making "T-Panes" Cost of Machinery Installation Fees Transportation Costs Company Info Chart of Accounts $890,000 $4,250 $1,030 Adjusted Trial Balance