I need help putting these adjusting entries entries into the general journal, please let me know if I need to add more information.

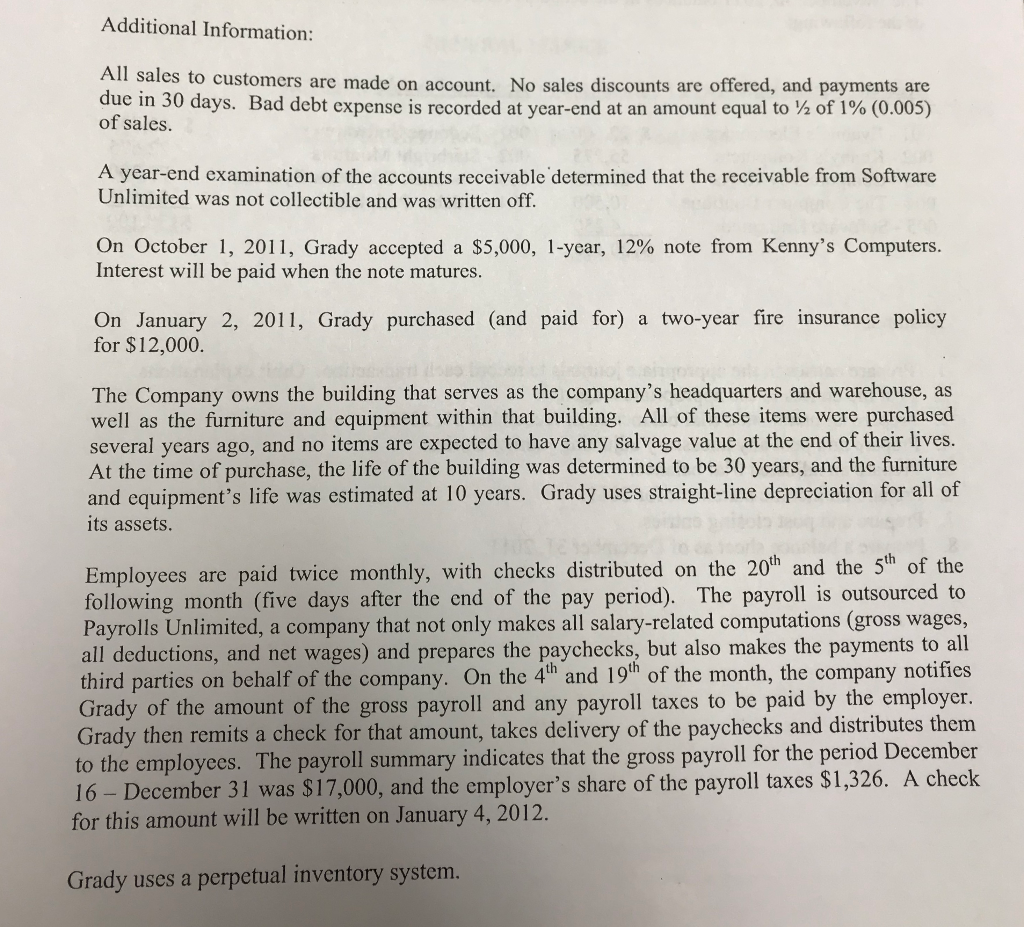

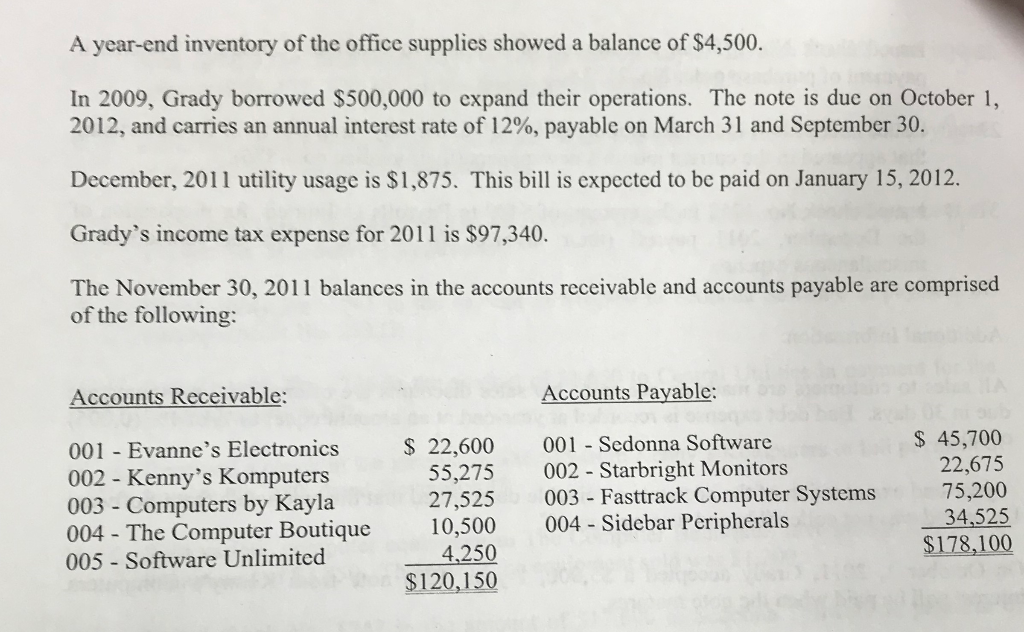

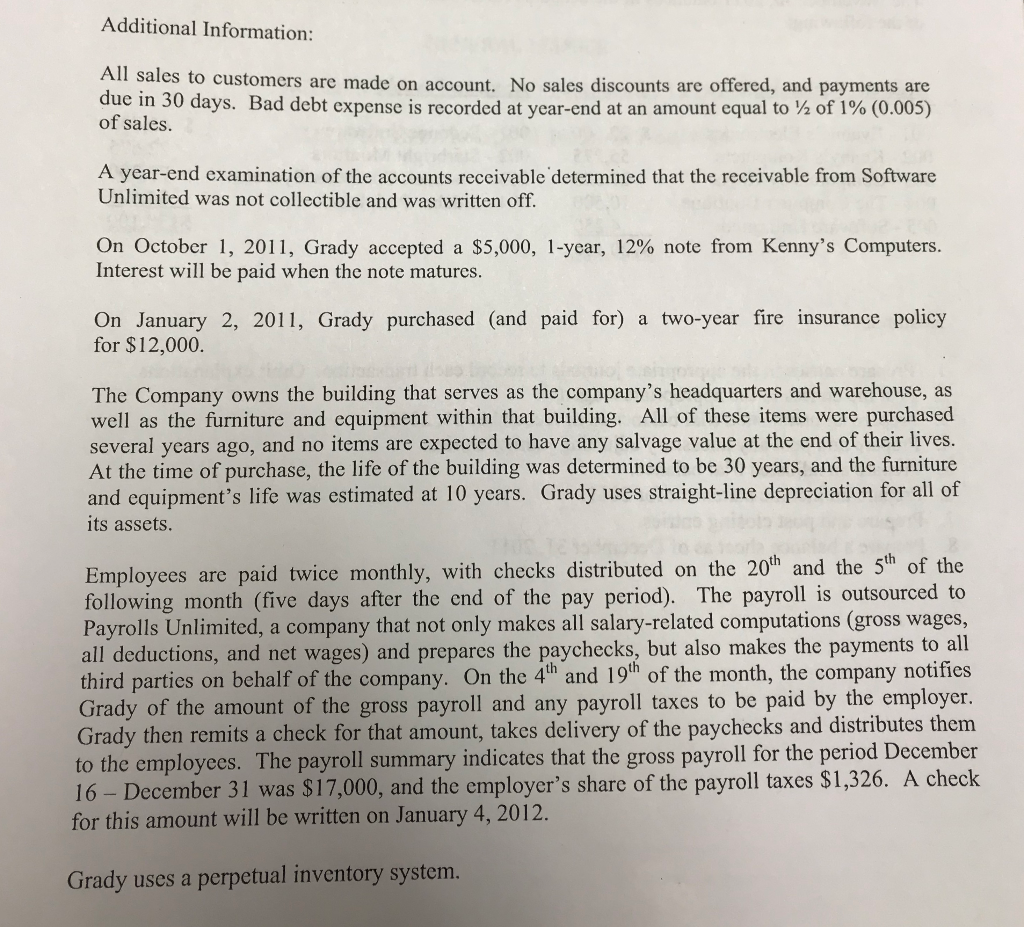

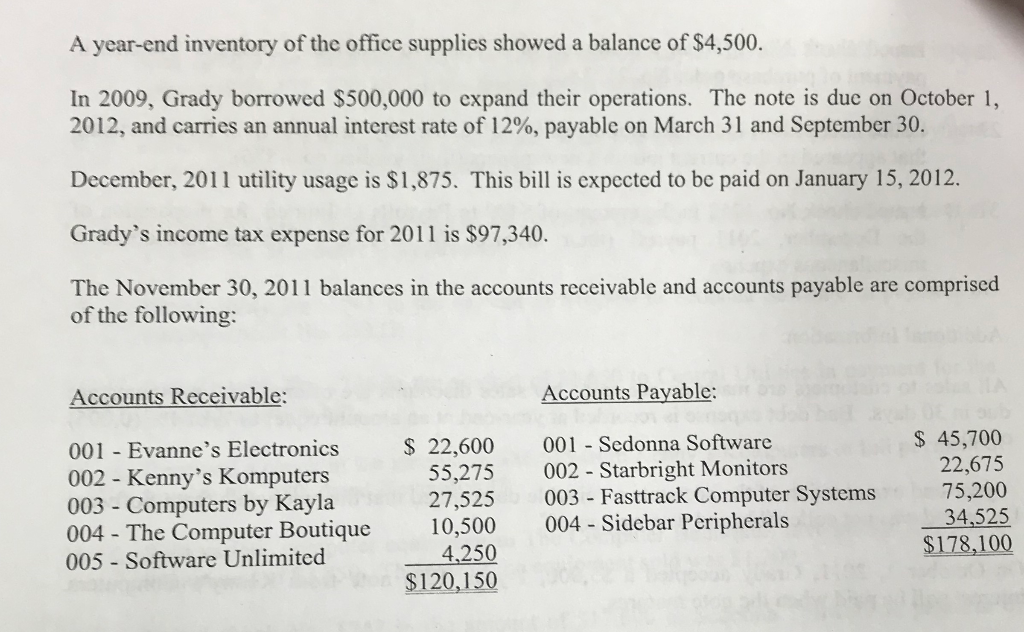

Additional Information: All sales to customers are made due in 30 days. Bad debt expense is recorded at year-end at an amount equal to on account. No sales discounts are offered, and payments are / of 1% (0.005) of sales A year-end examination of the accounts reccivable determined that the receivable from Software Unlimited was not collectible and was written off. On October 1, 2011, Grady accepted a $5,000, 1-year, 12% note from Kenny's Computers Interest will be paid when the note matures On January 2, 2011, Grady purchased (and paid for) a two-year fire insurance policy for $12,000. The Company owns the building that serves as the company's headquarters and warehouse, as well as the furniture and equipment within that building. All of these items were purchased several years ago, and no items are expected to have any salvage value at the end of their lives At the time of purchase, the life of the building was determined to be 30 years, and the furniture and equipment's life was estimated at 10 years. Grady uses straight-line depreciation for all of its assets Employees are paid twice monthly, with checks distributed on the 20th and the Sth of the following month (five days after the end of the pay period). The payroll is outsourced to Payrolls Unlimited, a company that not only makes all salary-related computations (gross wages, all deductions, and net wages) and prepares the paychecks, but also makes the payments to all third parties on behalf of the company. On the 4th and 19th of the month, the company notifies Grady of the amount of the gross payroll and any payroll taxes to be paid by the employer. Grady then remits a check for that amount, takes delivery of the paychecks and distributes them to the employees. The payroll summary indicates that the gross payroll for the period December 16 - December 31 was $17,000, and the employer's share of the payroll taxes S1,326. A check for this amount will be written on January 4, 2012 Grady uses a perpetual inventory system A year-end inventory of the office supplies showed a balance of $4,500. In 2009, Grady borrowed $500,000 to expand their operations. The note is duc on October 1, 2012, and carries an annual interest rate of 12%, payable on March 31 and September 30. December, 2011 utility usage is $1,875. This bill is expected to be paid on January 15, 2012. Grady's income tax expense for 2011 is $97,340. The November 30, 2011 balances in the accounts receivable and accounts payable are comprised of the following: Accounts Receivable Accounts Payable S 45,700 22,675 S 22,600 001 Sedonna Software 001 - Evanne's Electronics 002 - Kenny's Komputers 003 - Computers by Kayla 004 - The Computer Boutique 10,500004 005 - Software Unlimited4,250 55,275 27,525 002- Starbright Monitors 003 - Fasttrack Computer Systems 75,200 34,525 - Sidebar Peripherals $178,100 S120,150 Additional Information: All sales to customers are made due in 30 days. Bad debt expense is recorded at year-end at an amount equal to on account. No sales discounts are offered, and payments are / of 1% (0.005) of sales A year-end examination of the accounts reccivable determined that the receivable from Software Unlimited was not collectible and was written off. On October 1, 2011, Grady accepted a $5,000, 1-year, 12% note from Kenny's Computers Interest will be paid when the note matures On January 2, 2011, Grady purchased (and paid for) a two-year fire insurance policy for $12,000. The Company owns the building that serves as the company's headquarters and warehouse, as well as the furniture and equipment within that building. All of these items were purchased several years ago, and no items are expected to have any salvage value at the end of their lives At the time of purchase, the life of the building was determined to be 30 years, and the furniture and equipment's life was estimated at 10 years. Grady uses straight-line depreciation for all of its assets Employees are paid twice monthly, with checks distributed on the 20th and the Sth of the following month (five days after the end of the pay period). The payroll is outsourced to Payrolls Unlimited, a company that not only makes all salary-related computations (gross wages, all deductions, and net wages) and prepares the paychecks, but also makes the payments to all third parties on behalf of the company. On the 4th and 19th of the month, the company notifies Grady of the amount of the gross payroll and any payroll taxes to be paid by the employer. Grady then remits a check for that amount, takes delivery of the paychecks and distributes them to the employees. The payroll summary indicates that the gross payroll for the period December 16 - December 31 was $17,000, and the employer's share of the payroll taxes S1,326. A check for this amount will be written on January 4, 2012 Grady uses a perpetual inventory system A year-end inventory of the office supplies showed a balance of $4,500. In 2009, Grady borrowed $500,000 to expand their operations. The note is duc on October 1, 2012, and carries an annual interest rate of 12%, payable on March 31 and September 30. December, 2011 utility usage is $1,875. This bill is expected to be paid on January 15, 2012. Grady's income tax expense for 2011 is $97,340. The November 30, 2011 balances in the accounts receivable and accounts payable are comprised of the following: Accounts Receivable Accounts Payable S 45,700 22,675 S 22,600 001 Sedonna Software 001 - Evanne's Electronics 002 - Kenny's Komputers 003 - Computers by Kayla 004 - The Computer Boutique 10,500004 005 - Software Unlimited4,250 55,275 27,525 002- Starbright Monitors 003 - Fasttrack Computer Systems 75,200 34,525 - Sidebar Peripherals $178,100 S120,150