I need help reviewing the journal entries and answering the questions that go with them!

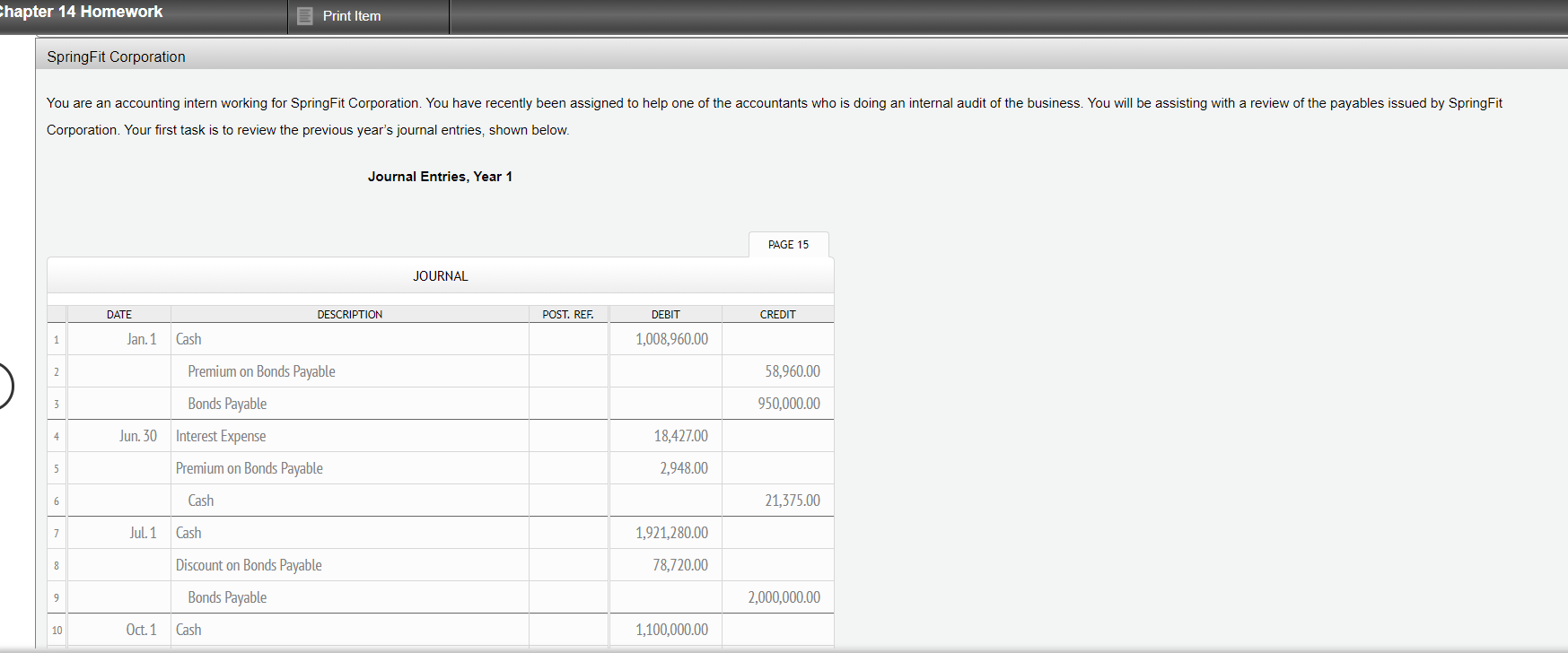

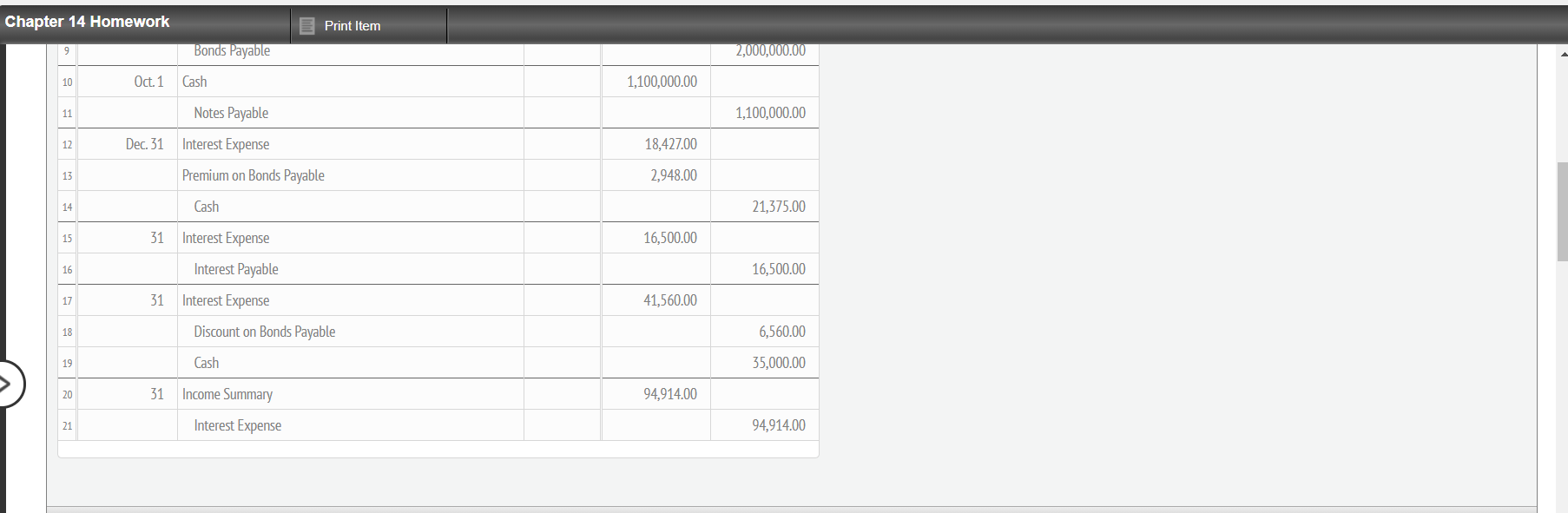

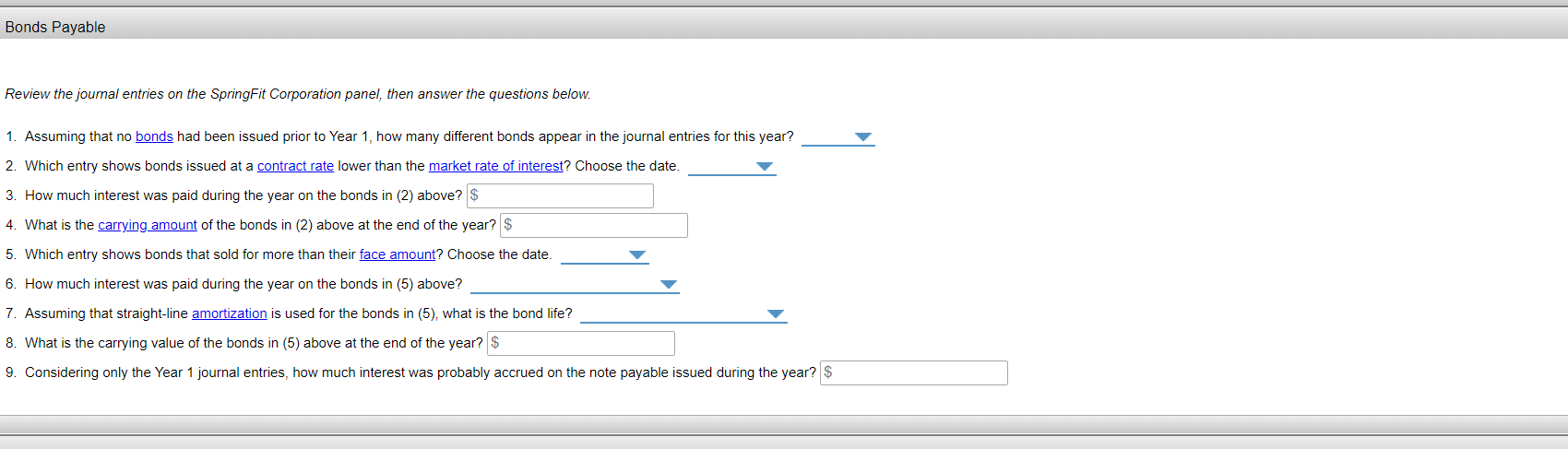

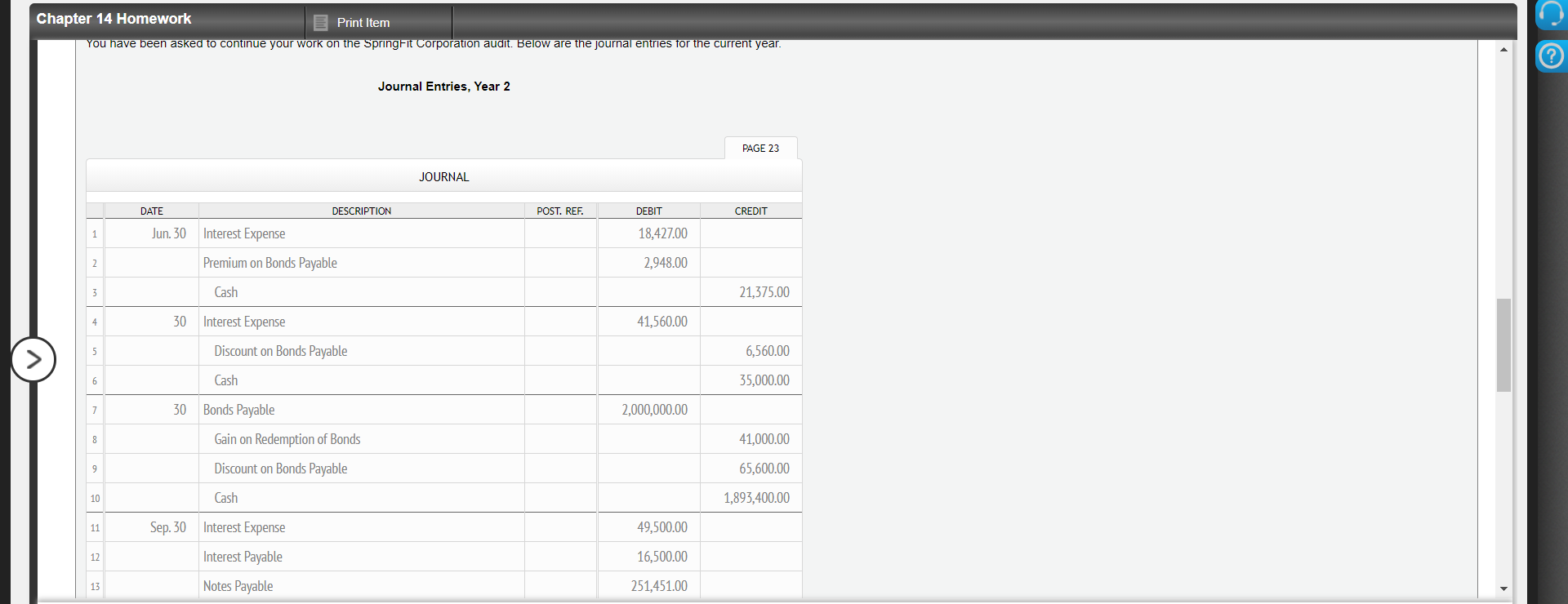

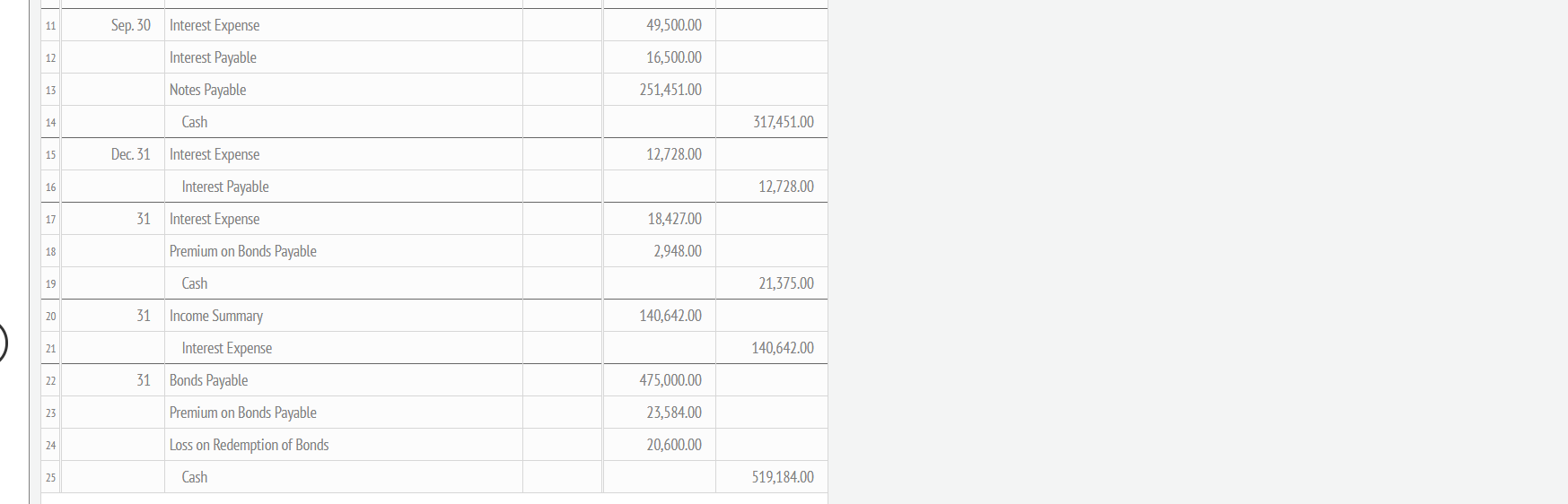

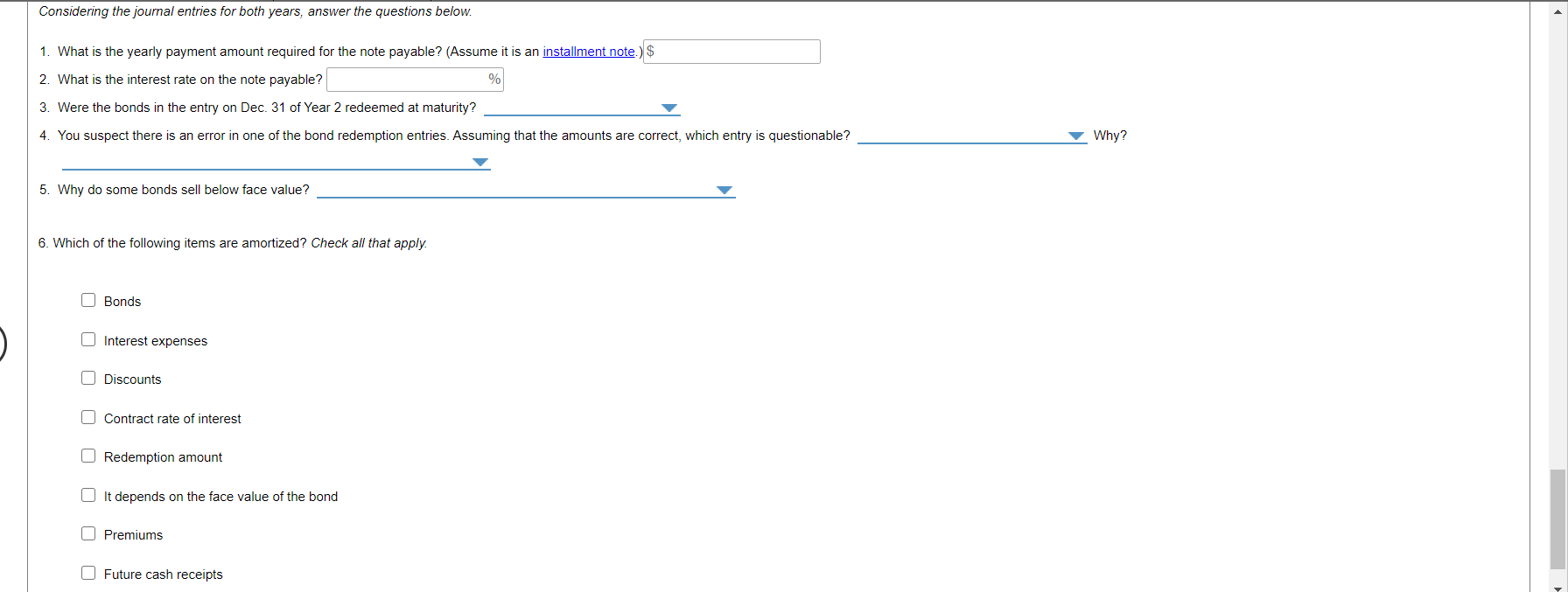

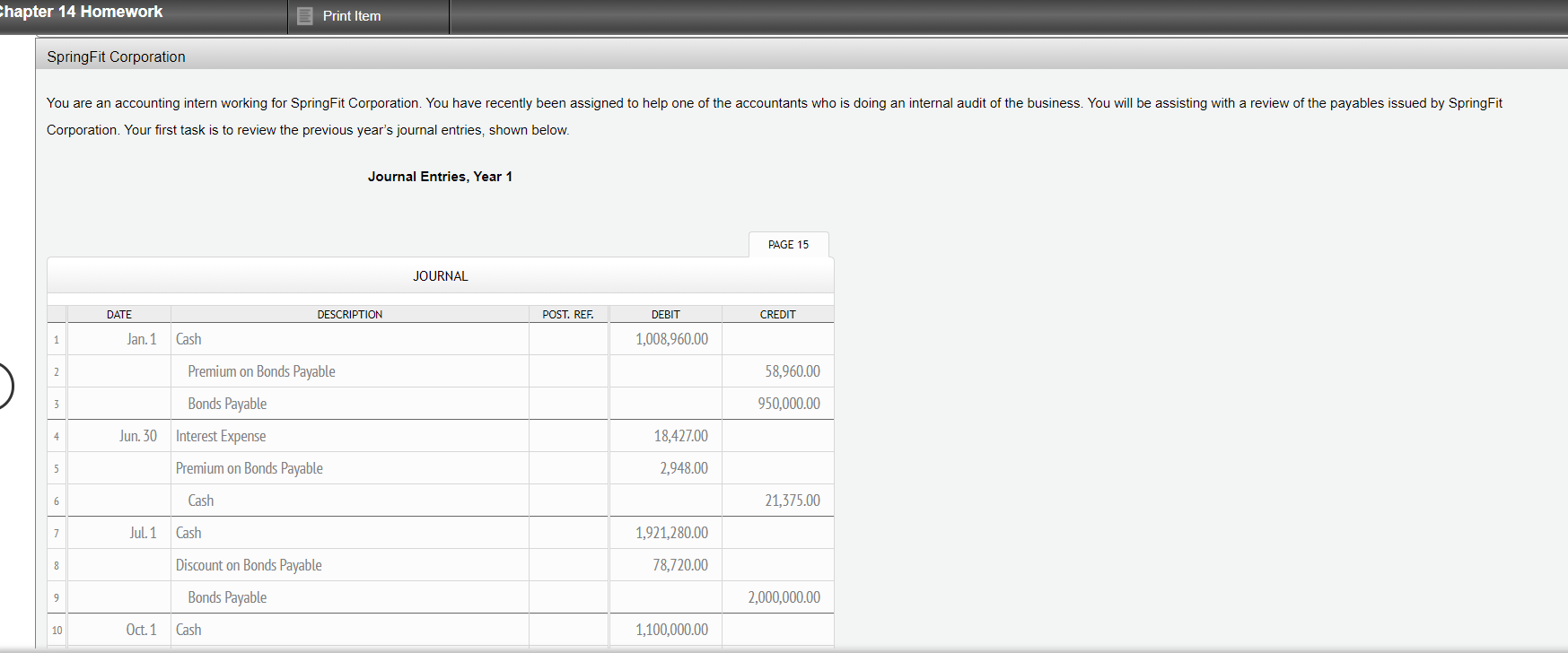

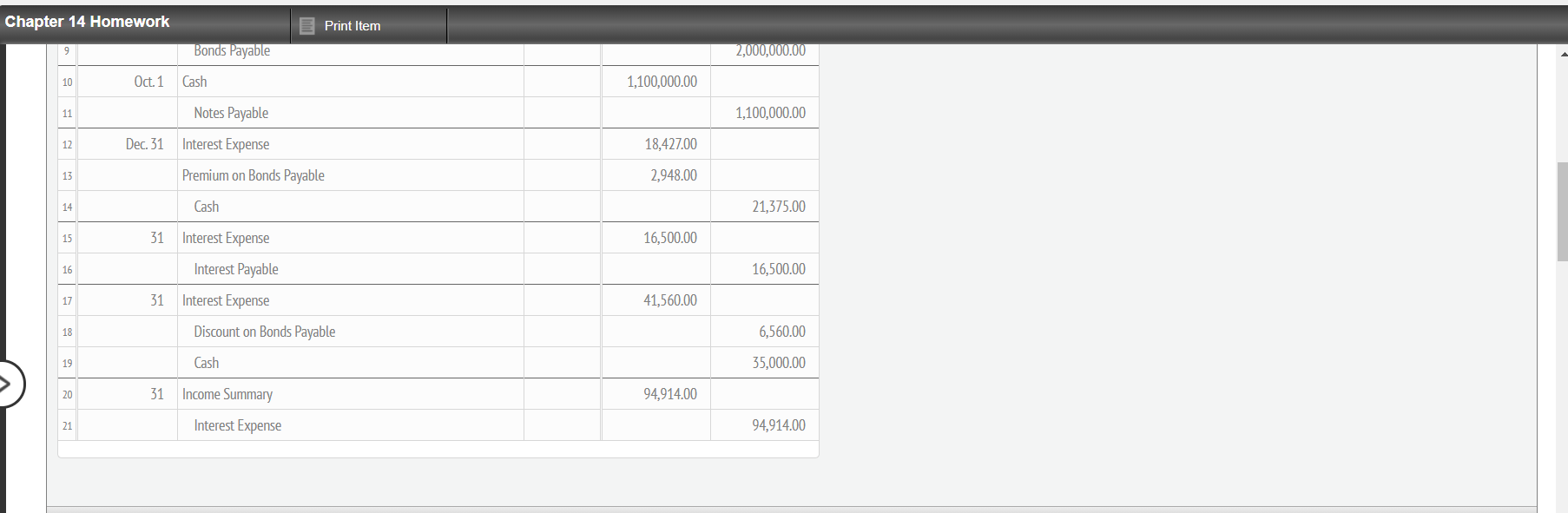

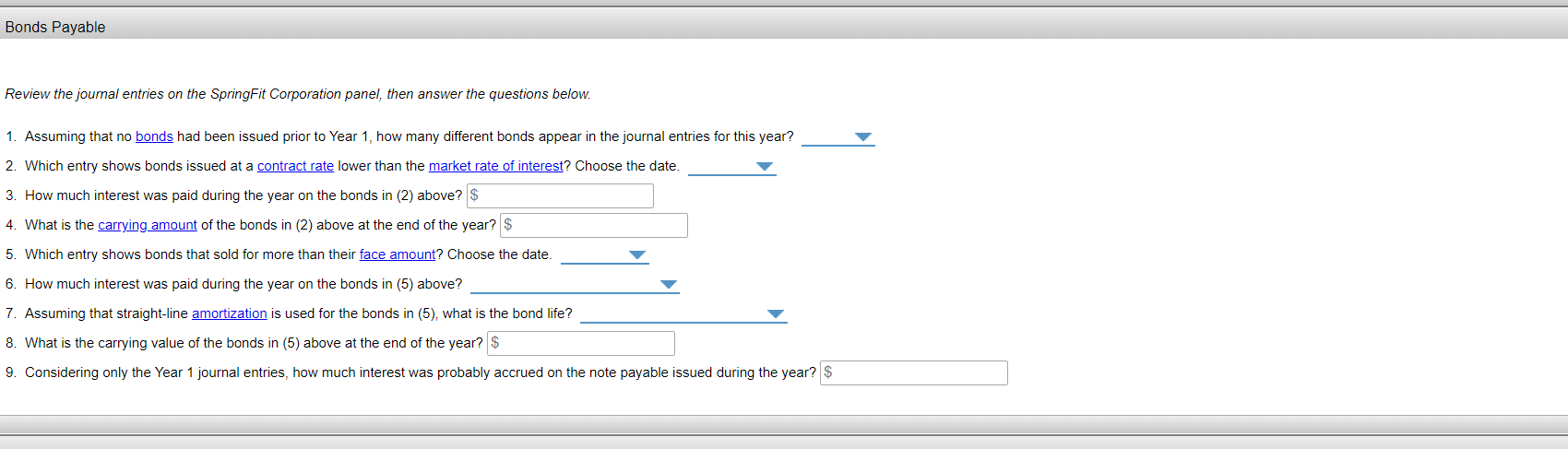

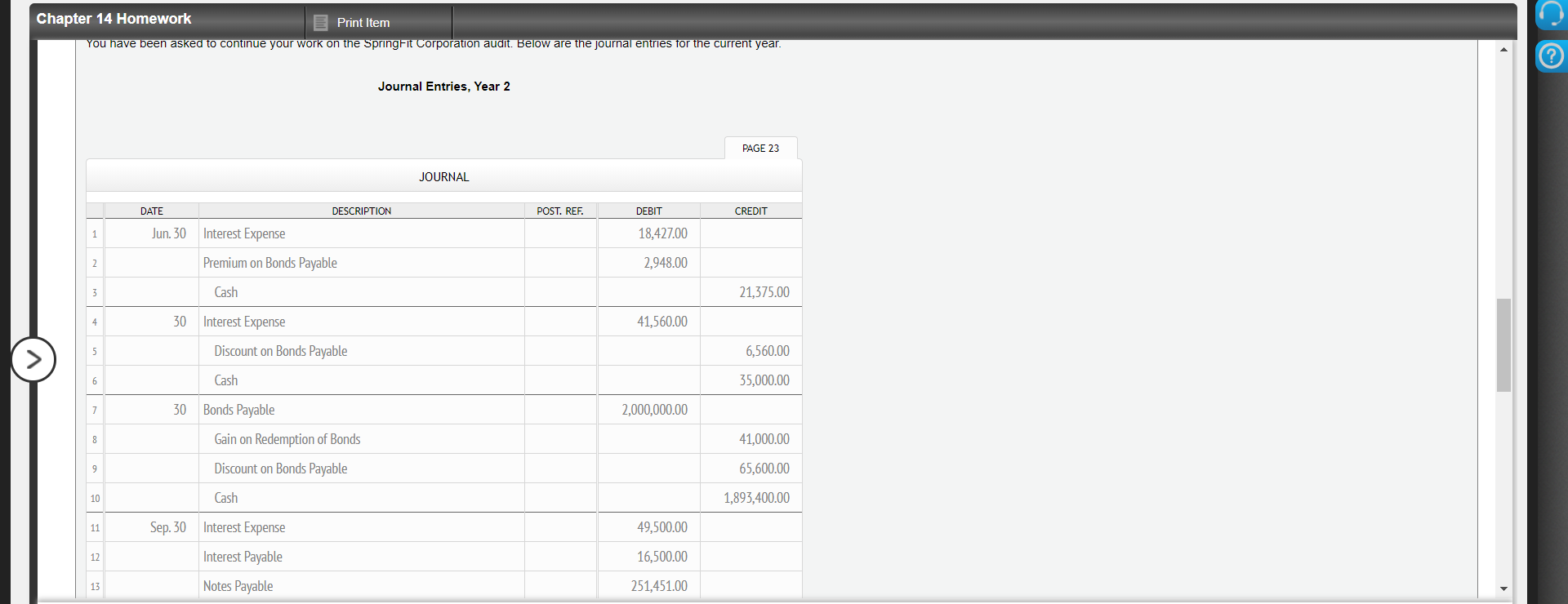

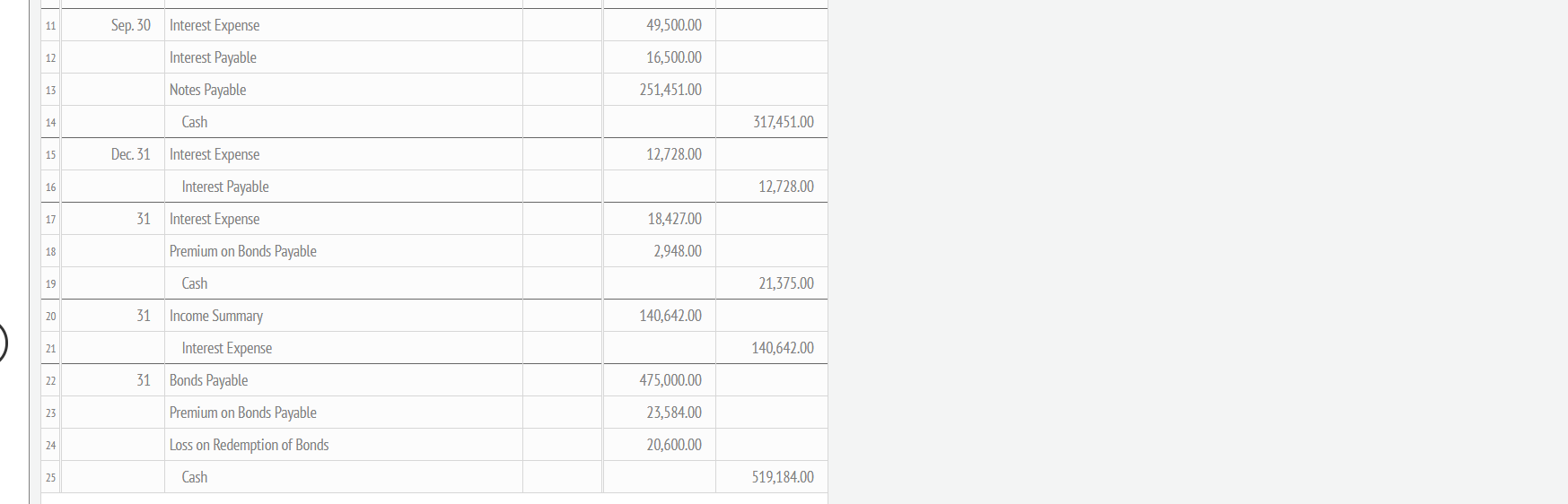

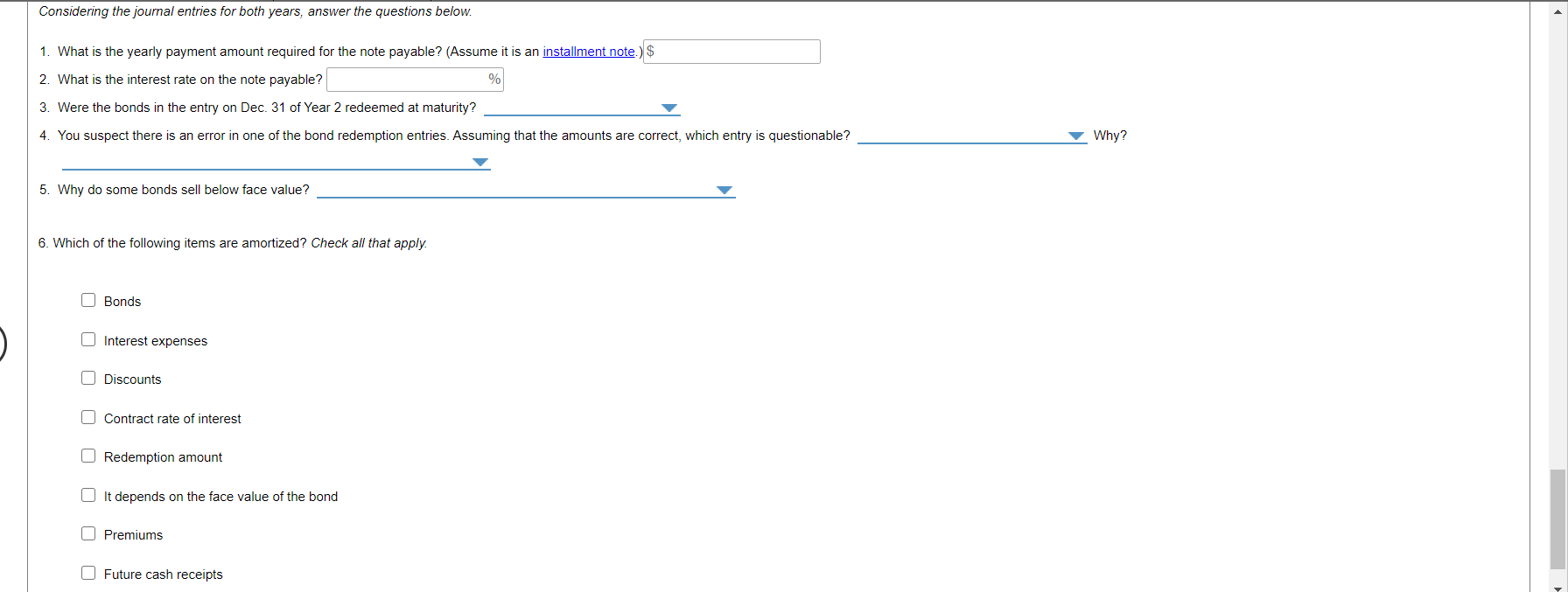

Chapter 14 Homework Print Item SpringFit Corporation You are an accounting intern working for SpringFit Corporation. You have recently been assigned to help one of the accountants who is doing an internal audit of the business. You will be assisting with a review of the payables issued by SpringFit Corporation. Your first task is to review the previous year's journal entries, shown below. Journal Entries, Year 1 PAGE 15 JOURNAL DATE DESCRIPTION POST. REF. DEBIT CREDIT 1 Jan. 1 Cash 1,008,960.00 2 Premium on Bonds Payable 58,960.00 3 Bonds Payable 950,000.00 4 Jun. 30 Interest Expense 18,427.00 5 Premium on Bonds Payable 2,948.00 6 Cash 21,375.00 7 Jul. 1 Cash 1,921,280.00 8 Discount on Bonds Payable 78,720.00 9 Bonds Payable 2,000,000.00 10 Oct. 1 Cash 1,100,000.00 Chapter 14 Homework Print Item 9 Bonds Payable 2,000,000.00 10 Oct. 1 Cash 1,100,000.00 11 Notes Payable 1,100,000.00 12 Dec. 31 Interest Expense 18,427.00 13 Premium on Bonds Payable 2,948.00 14 Cash 21,375.00 15 31 Interest Expense 16,500.00 16 Interest Payable 16,500.00 17 31 Interest Expense 41,560.00 18 Discount on Bonds Payable 6,560.00 19 Cash 35,000.00 20 31 Income Summary 94,914.00 21 Interest Expense 94,914.00 Bonds Payable Review the journal entries on the SpringFit Corporation panel, then answer the questions below. 1. Assuming that no bonds had been issued prior to Year 1, how many different bonds appear in the journal entries for this year? 2. Which entry shows bonds issued at a contract rate lower than the market rate of interest? Choose the date. 3. How much interest was paid during the year on the bonds in (2) above? $ 4. What is the carrying amount of the bonds in (2) above at the end of the year? $ 5. Which entry shows bonds that sold for more than their face amount? Choose the date. 6. How much interest was paid during the year on the bonds in (5) above? 7. Assuming that straight-line amortization is used for the bonds in (5), what is the bond life? 8. What is the carrying value of the bonds in (5) above at the end of the year? $ 9. Considering only the Year 1 journal entries, how much interest was probably accrued on the note payable issued during the year? $ Chapter 14 Homework Print Item You have been asked to continue your work on the SpringFit Corporation audit. Below are the journal entries for the current year. Journal Entries, Year 2 PAGE 23 JOURNAL DATE DESCRIPTION POST. REF. DEBIT CREDIT 1 Jun. 30 Interest Expense 18,427.00 2 Premium on Bonds Payable 2,948.00 3 Cash 21,375.00 4 30 Interest Expense 41,560.00 5 Discount on Bonds Payable 6,560.00 6 Cash 35,000.00 7 30 Bonds Payable 2,000,000.00 8 41,000.00 Gain on Redemption of Bonds Discount on Bonds Payable 9 65,600.00 10 Cash 1,893,400.00 11 Sep.30 Interest Expense 49,500.00 12 Interest Payable 16,500.00 13 Notes Payable 251,451.00 11 49,500.00 Sep 30 Interest Expense Interest Payable 12 16,500.00 13 Notes Payable 251,451.00 14 Cash 317,451.00 Dec. 31 Interest Expense 12,728.00 16 Interest Payable 12,728.00 17 31 Interest Expense 18,427.00 18 Premium on Bonds Payable 2,948.00 19 Cash 21,375.00 20 31 Income Summary 140,642.00 21 Interest Expense 140,642.00 22 31 Bonds Payable 475,000.00 23 Premium on Bonds Payable 23,584.00 24 Loss on Redemption of Bonds 20,600.00 25 Cash 519,184.00 Considering the journal entries for both years, answer the questions below. 1. What is the yearly payment amount required for the note payable? (Assume it is an installment note.) $ 2. What is the interest rate on the note payable? 3. Were the bonds in the entry on Dec. 31 of Year 2 redeemed at maturity? 4. You suspect there is an error in one of the bond redemption entries. Assuming that the amounts are correct, which entry is questionable? Why? 5. Why do some bonds sell below face value? 6. Which of the following items are amortized? Check all that apply. O Bonds O Interest expenses O Discounts Contract rate of interest O Redemption amount U It depends on the face value of the bond O Premiums O Future cash receipts