I need Help solving ASAP!! can anyone help?

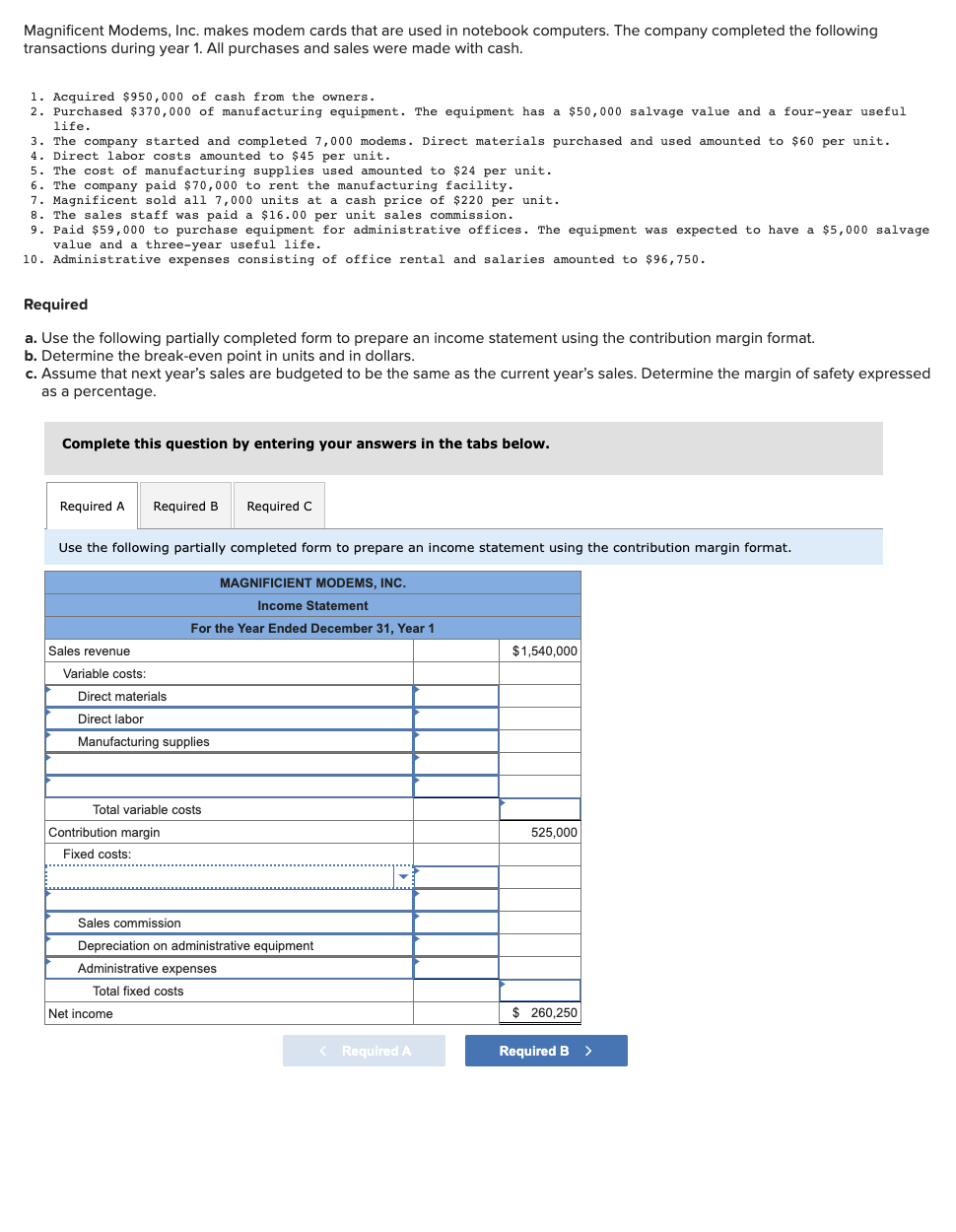

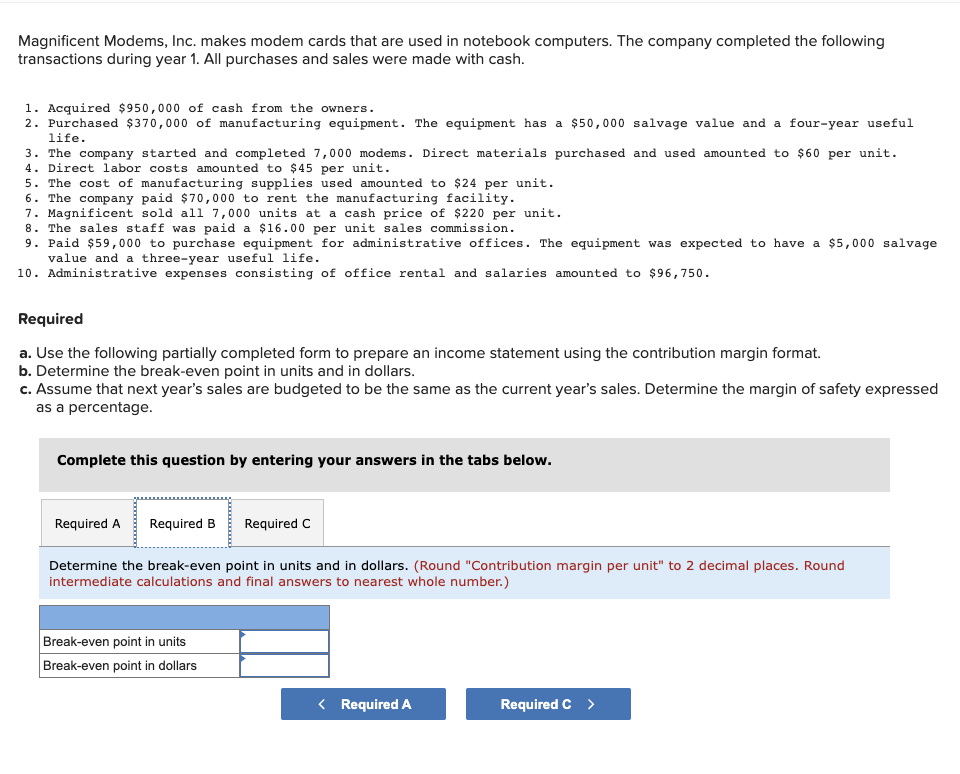

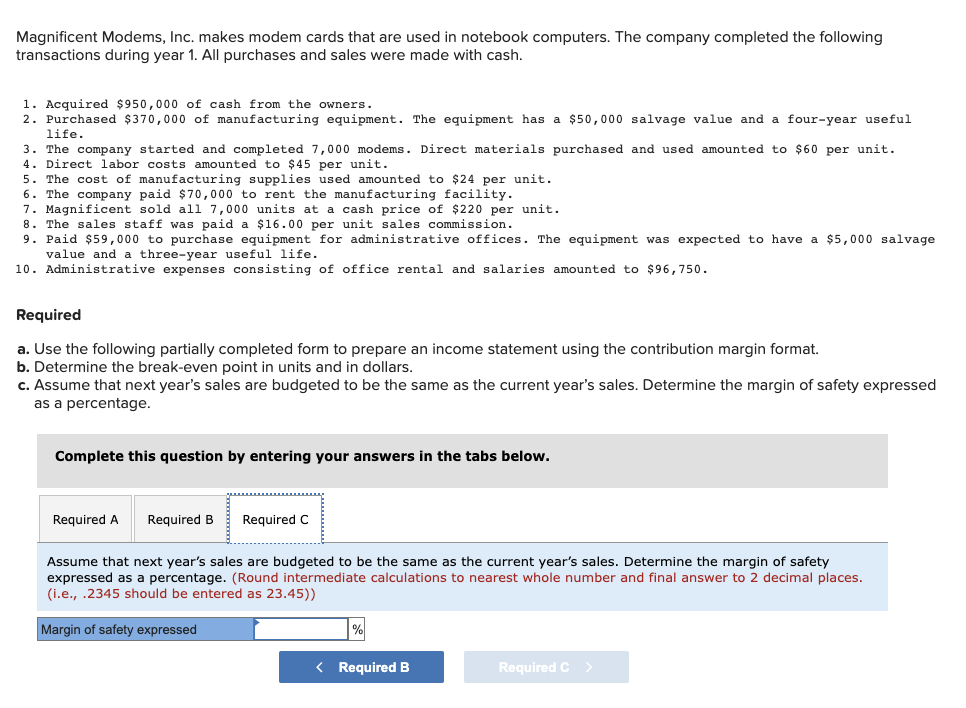

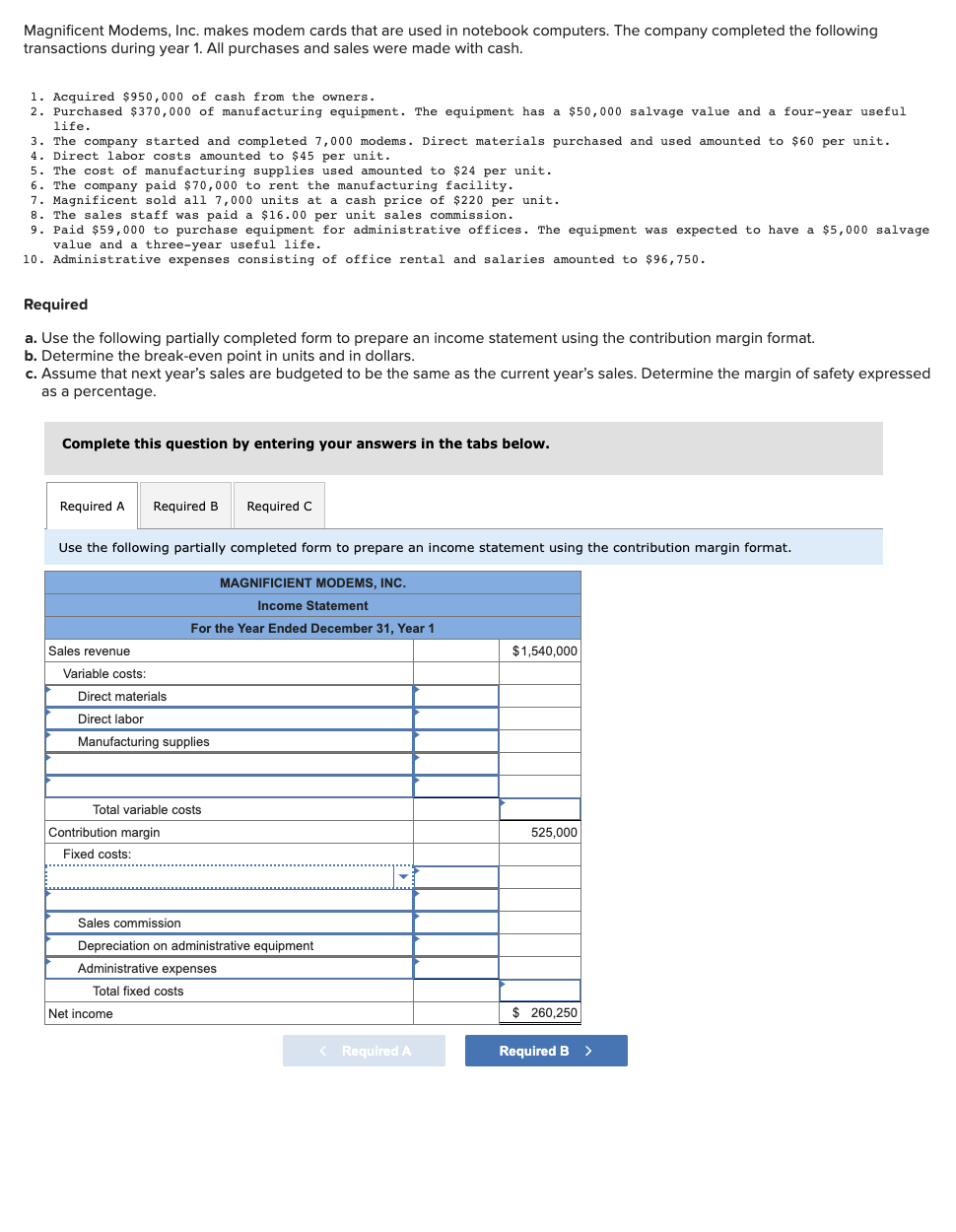

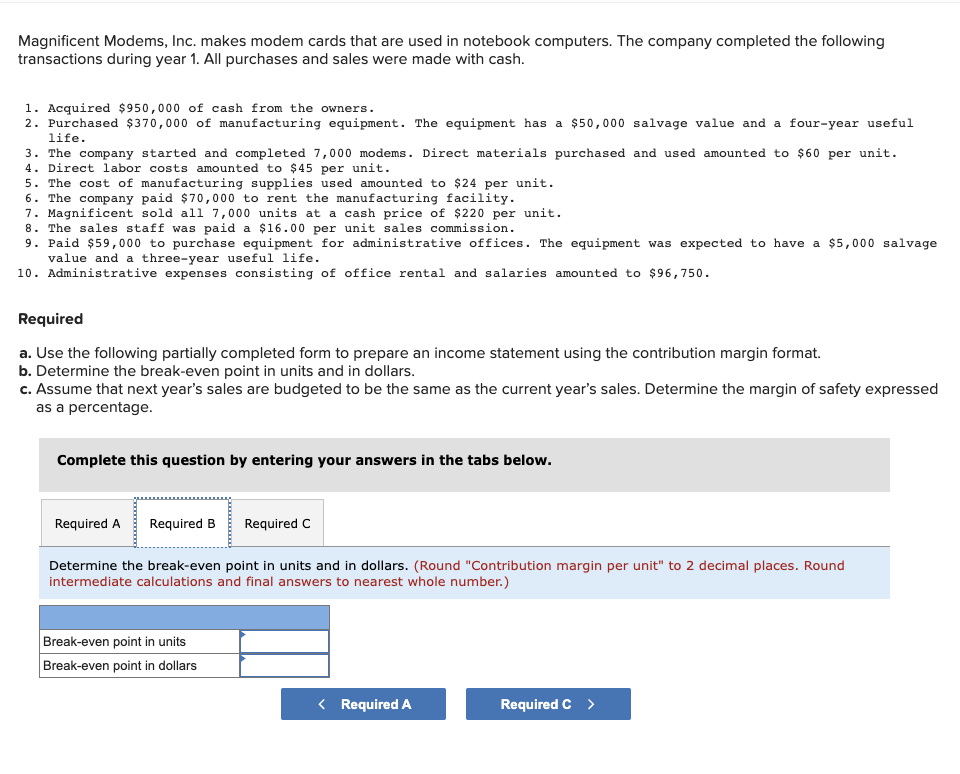

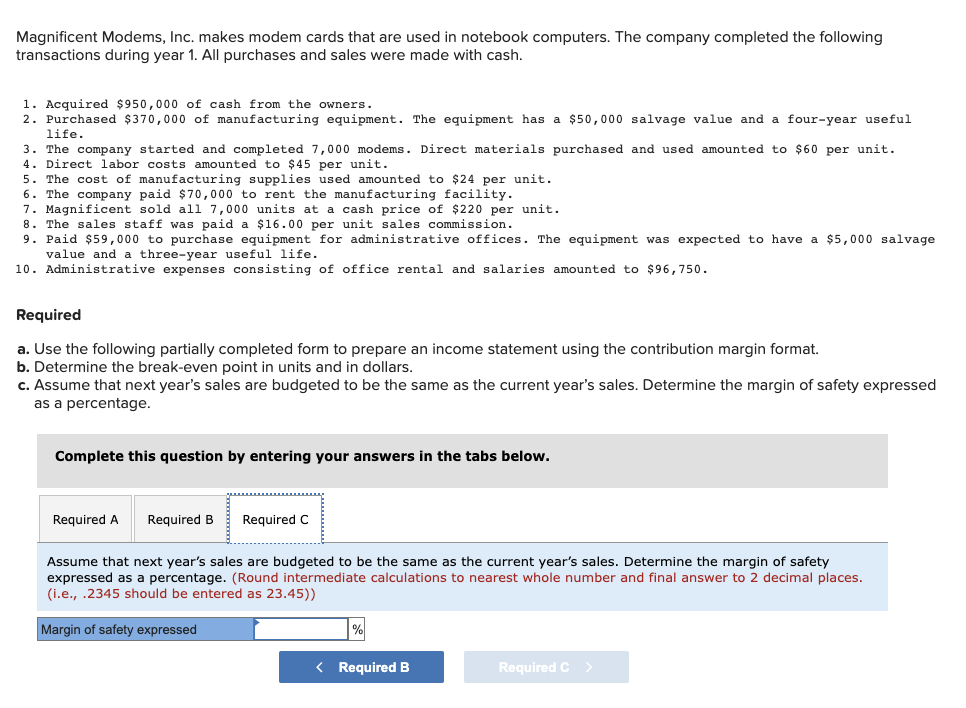

Magnificent Modems, Inc. makes modem cards that are used in notebook computers. The company completed the following transactions during year 1. All purchases and sales were made with cash. 1. Acquired $950,000 of cash from the owners. 2. Purchased $370,000 of manufacturing equipment. The equipment has a $50,000 salvage value and a four-year useful life. 3. The company started and completed 7,000 modems. Direct materials purchased and used amounted to $60 per unit. 4. Direct labor costs amounted to $45 per unit. 5. The cost of manufacturing supplies used amounted to $24 per unit. 6. The company paid $70,000 to rent the manufacturing facility. 7. Magnificent sold all 7,000 units at a cash price of $220 per unit. 8. The sales staff was paid a $16.00 per unit sales commission. 9. Paid $59,000 to purchase equipment for administrative offices. The equipment was expected to have a $5,000 salvage value and a three-year useful life. 10. Administrative expenses consisting of office rental and salaries amounted to $96,750. Required a. Use the following partially completed form to prepare an income statement using the contribution margin format. b. Determine the break-even point in units and in dollars. c. Assume that next year's sales are budgeted to be the same as the current year's sales. Determine the margin of safety expressed as a percentage. Complete this question by entering your answers in the tabs below. Required A Required B Required C Use the following partially completed form to prepare an income statement using the contribution margin format. MAGNIFICIENT MODEMS, INC. Income Statement For the Year Ended December 31, Year 1 Sales revenue $1,540,000 525,000 $260,250 Required B > Variable costs: Direct materials Direct labor Manufacturing supplies Total variable costs Contribution margin Fixed costs: Sales commission Depreciation on administrative equipment Administrative expenses Total fixed costs Net income Magnificent Modems, Inc. makes modem cards that are used in notebook computers. The company completed the following transactions during year 1. All purchases and sales were made with cash. 1. Acquired $950,000 of cash from the owners. 2. Purchased $370,000 of manufacturing equipment. The equipment has a $50,000 salvage value and a four-year useful life. 3. The company started and completed 7,000 modems. Direct materials purchased and used amounted to $60 per unit. 4. Direct labor costs amounted to $45 per unit. 5. The cost of manufacturing supplies used amounted to $24 per unit. 6. The company paid $70,000 to rent the manufacturing facility. 7. Magnificent sold all 7,000 units at a cash price of $220 per unit. 8. The sales staff was paid $16.00 per unit sales commission. 9. Paid $59,000 to purchase equipment for administrative offices. The equipment was expected to have a $5,000 salvage value and a three-year useful life. 10. Administrative expenses consisting of office rental and salaries amounted to $96,750. Required a. Use the following partially completed form to prepare an income statement using the contribution margin format. b. Determine the break-even point in units and in dollars. c. Assume that next year's sales are budgeted to be the same as the current year's sales. Determine the margin of safety expressed as a percentage. Complete this question by entering your answers in the tabs below. Required A Required B Required C Assume that next year's sales are budgeted to be the same as the current year's sales. Determine the margin of safety expressed as a percentage. (Round intermediate calculations to nearest whole number and final answer to 2 decimal places. (i.e., .2345 should be entered as 23.45)) Margin of safety expressed