Answered step by step

Verified Expert Solution

Question

1 Approved Answer

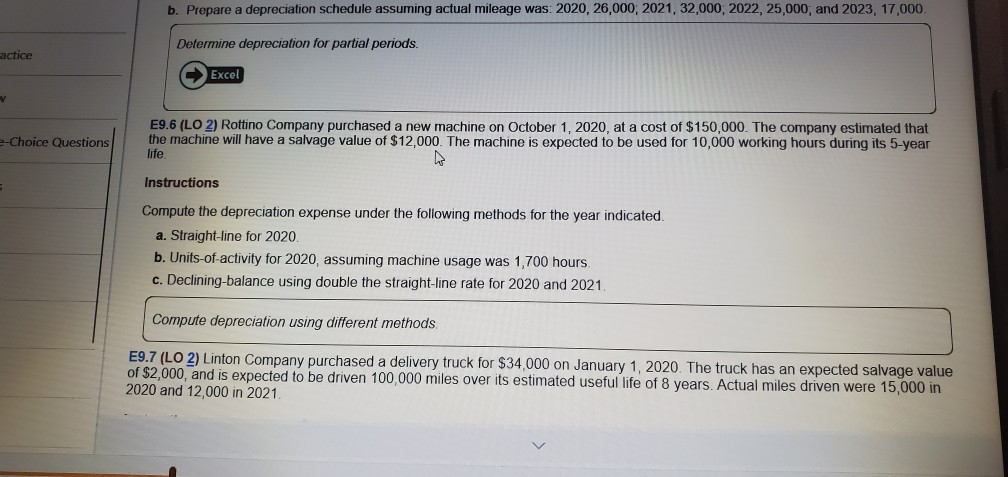

I need help solving exercise 6 b. Prepare a depreciation schedule assuming actual mileage was: 2020, 26,000, 2021, 32,000, 2022, 25,000; and 2023, 17,000 actice

I need help solving exercise 6

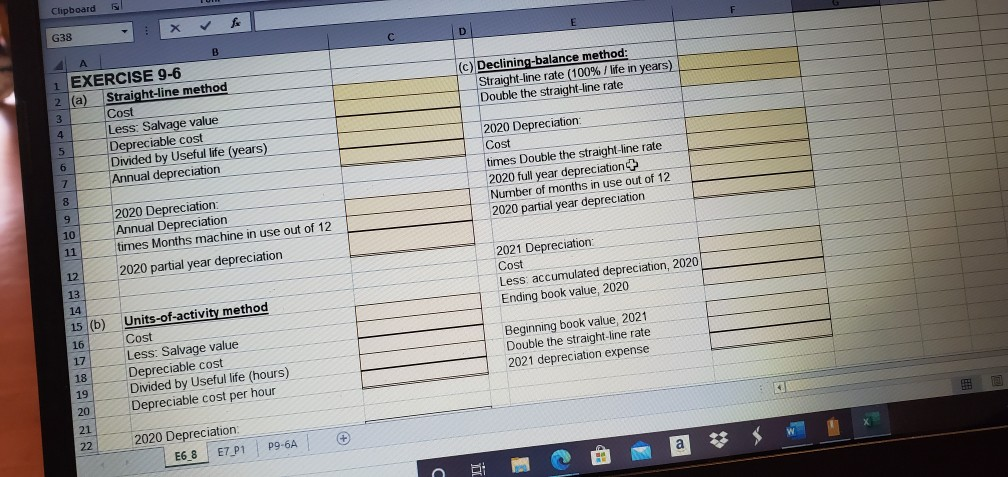

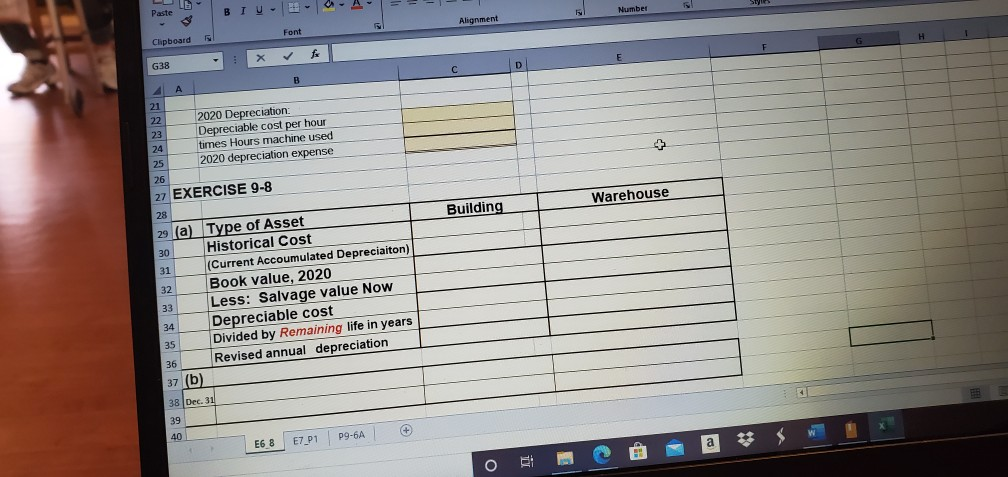

b. Prepare a depreciation schedule assuming actual mileage was: 2020, 26,000, 2021, 32,000, 2022, 25,000; and 2023, 17,000 actice Determine depreciation for partial periods. Excel --Choice Questions E9.6 (LO 2) Rottino Company purchased a new machine on October 1, 2020, at a cost of $150,000. The company estimated that the machine will have a salvage value of $12,000. The machine is expected to be used for 10,000 working hours during its 5-year life Instructions Compute the depreciation expense under the following methods for the year indicated. a. Straight-line for 2020. b. Units-of-activity for 2020, assuming machine usage was 1,700 hours c. Declining-balance using double the straight-line rate for 2020 and 2021 Compute depreciation using different methods. E9.7 (LO 2) Linton Company purchased a delivery truck for $34,000 on January 1, 2020. The truck has an expected salvage value of $2,000, and is expected to be driven 100,000 miles over its estimated useful life of 8 years. Actual miles driven were 15,000 in 2020 and 12,000 in 2021 Clipboard * A G38 (c) Declining-balance method: Straight-line rate 100% / life in years) Double the straight-line rate 4A 1 EXERCISE 9-6 2 (a) Straight-line method Cost Less: Salvage value Depreciable cost Divided by Useful life (years) Annual depreciation 2020 Depreciation: Cost times Double the straight-line rate 2020 full year depreciation Number of months in use out of 12 2020 partial year depreciation 2020 Depreciation: Annual Depreciation times Months machine in use out of 12 2020 partial year depreciation 2021 Depreciation: Cost Less accumulated depreciation, 2020 Ending book value, 2020 15 (b) Units-of-activity method Cost Beginning book value, 2021 Double the straight-line rate 2021 depreciation expense Less: Salvage value Depreciable cost Divided by Useful life (hours) Depreciable cost per hour 2020 Depreciation E6 8 E7 P1 096A Font Alignment Number Clipboard G38 : f 22 23 2020 Depreciation: Depreciable cost per hour times Hours machine used 2020 depreciation expense EXERCISE 9-8 Building Warehouse 29 (a) Type of Asset Historical Cost (Current Accoumulated Depreciaiton) Book value, 2020 Less: Salvage value Now Depreciable cost Divided by Remaining life in years Revised annual depreciation Dec. 31 40 E68 E7_P1 P9-6A 6Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started